Gladstone Commercial Corporation Provides a Business Update

June 15 2020 - 4:30PM

Gladstone Commercial Corporation (Nasdaq: GOOD) (“we” or “Gladstone

Commercial”) is providing the following business update regarding

portfolio performance during this time of market volatility related

to the global COVID-19 pandemic.

- We have continued to exhibit

strength in rent collections: Approximately 98% of June cash base

rent has been paid and collected. June rental collections remain

consistent with 98% of May and April cash base rent that was paid

and collected. The remaining 2% of cash base rents are associated

with the previously agreed upon deferral agreements. All deferred

amounts are to be paid back by the respective tenants commencing in

July 2020 and ending in March 2021.

- Our portfolio continues to provide

stable cash flow to our investors: Portfolio occupancy remains at

approximately 97%, as of June 15, 2020.

- Our leasing initiatives have been

successful in the COVID-19 environment: On May 27th we announced a

lease amendment with Morgan Stanley Smith Barney Financing for

16,689 square feet at our Easton Commons Ohio office building.

Morgan Stanley now leases 100% of the building through December of

2025 and intends to invest significant capital to renovate the

common areas of the building while completing tenant improvements

on the expansion space. The space was previously occupied by

Congressional Bank, which vacated in October 2019. The lease

expansion resulted in a 51% increase in GAAP rent over the previous

tenant’s rent.

- We have continued to raise

additional capital to fund acquisitions and operating needs: Since

January 1, 2020, we have issued 1.3 million shares of common stock

for net proceeds of $28.2 million and 45,600 shares of Series E

perpetual preferred stock for net proceeds of $1.0 million.

- We continue to have ample liquidity

and a strong capital structure: As of June 15th, our currently

available liquidity is in excess of $30 million via our revolving

credit facility availability and cash on hand. We have continued to

reduce our net book leverage to 46% as of March 31, 2020.

- We have maintained an active

investor outreach program: The Company presented at the virtual

2020 REITWeek and met with numerous investors, analysts, and

investment banks. Discussion subjects included portfolio

performance, market conditions, capital strategy and our

predominantly industrial-focused acquisition program. The positive

recent and long-term performance on rent collection, the

significant industrial acquisition volume since January 2019, the

recast of the credit facility at more favorable terms in tandem

with the addition of two Tier 1 banks to the syndicate, and

favorable equity issuance were well-received by the audience.

We may receive additional rent relief requests

in the near term. Gladstone Commercial’s acquisitions and asset

management teams intend to predominantly seek near term rent

deferral repayment, extended lease term, increased rent, and other

favorable lease modifications as consideration for granting relief

for certain tenants that have been materially and adversely

impacted by the ongoing COVID-19 pandemic, as assessed by us.

However, we are unable to quantify the outcomes of future

negotiation of relief packages, the success of any tenant’s

financial prospects or the amount of relief requests that we will

ultimately receive or grant.

About Gladstone Commercial (Nasdaq:

GOOD)

Gladstone Commercial is a real estate investment

trust focused on acquiring, owning and operating net leased

industrial and office properties across the United States. As

of March 31, 2020, Gladstone Commercial’s real estate

portfolio consisted of 122 properties located in 28 states,

totaling approximately 15.1 million square feet. For additional

information please visit www.gladstonecommercial.com

For Broker Submittals:

| South

Central: |

Midwest/Northeast: |

| Buzz Cooper |

Matt Tucker |

| Senior Managing Director |

Senior Managing Director |

| (703) 287-5815 |

(703) 287-5830 |

|

Buzz.Cooper@gladstonecompanies.com |

Matt.Tucker@gladstonecompanies.com |

| |

|

| Southeast /

West: |

|

| Brandon

Flickinger |

|

| Managing Director |

|

| (703) 287-5819 |

|

|

Brandon.Flickinger@gladstonecompanies.com |

|

| |

|

Investor or Media Inquiries:

| Bob Cutlip |

|

| President – Gladstone

Commercial Corporation |

| (703) 287-5878 |

|

|

Bob.Cutlip@gladstonecompanies.com |

|

All statements contained in this press release, other than

historical facts, may constitute “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as “anticipates,” “expects,” “intends,”

“plans,” “believes,” “seeks,” “estimates” and variations of these

words and similar expressions are intended to identify

forward-looking statements. Readers should not rely upon

forward-looking statements because the matters they describe are

subject to known and unknown risks and uncertainties that could

cause the Gladstone Commercial’s business, financial condition,

liquidity, results of operations, funds from operations or

prospects to differ materially from those expressed in or implied

by such statements. Such risks and uncertainties are disclosed

under the caption “Risk Factors” of the company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2019, as filed

with the SEC on February 12, 2020 and certain other filings we make

with the SEC. Gladstone Commercial cautions readers not to place

undue reliance on any such forward-looking statements which speak

only as of the date made. The company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

For Investor Relations inquiries related to any of the monthly

dividend paying Gladstone funds, please visit

www.gladstonecompanies.com.

SOURCE: Gladstone Commercial Corporation

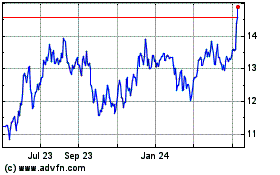

Gladstone Commercial (NASDAQ:GOOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

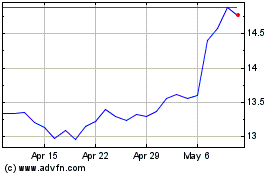

Gladstone Commercial (NASDAQ:GOOD)

Historical Stock Chart

From Apr 2023 to Apr 2024