Current Report Filing (8-k)

June 10 2020 - 7:31AM

Edgar (US Regulatory)

DANAHER CORP /DE/ DC false 0000313616 0000313616 2020-06-05 2020-06-05 0000313616 us-gaap:CommonStockMember 2020-06-05 2020-06-05 0000313616 us-gaap:SeriesAPreferredStockMember 2020-06-05 2020-06-05 0000313616 us-gaap:SeriesBPreferredStockMember 2020-06-05 2020-06-05 0000313616 dhr:FloatingRateSeniorNotesDue2022Member 2020-06-05 2020-06-05 0000313616 dhr:A1.7SeniorNotesDue2022Member 2020-06-05 2020-06-05 0000313616 dhr:A1.7SeniorNotesDue2024Member 2020-06-05 2020-06-05 0000313616 dhr:A2.5SeniorNotesDue2025Member 2020-06-05 2020-06-05 0000313616 dhr:M0.200SeniorNotesDue20262Member 2020-06-05 2020-06-05 0000313616 dhr:M2.100SeniorNotesDue20261Member 2020-06-05 2020-06-05 0000313616 dhr:A1.2SeniorNotesDue2027Member 2020-06-05 2020-06-05 0000313616 dhr:A0.45SeniorNotesDue2028Member 2020-06-05 2020-06-05 0000313616 dhr:A2.5SeniorNotesDue2030Member 2020-06-05 2020-06-05 0000313616 dhr:A0.75SeniorNotesDue2031Member 2020-06-05 2020-06-05 0000313616 dhr:A1.35SeniorNotesDue2039Member 2020-06-05 2020-06-05 0000313616 dhr:A1.8SeniorNotesDue2049Member 2020-06-05 2020-06-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 5, 2020

DANAHER CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

001-08089

|

|

59-1995548

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

2200 Pennsylvania Avenue, NW,

Suite 800W,

Washington, D.C.

|

|

20037-1701

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

202-828-0850

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

|

|

|

|

|

|

Common stock, $0.01 par value

|

|

DHR

|

|

New York Stock Exchange

|

|

4.75% Mandatory Convertible Preferred Stock, Series A, without par value

|

|

DHR.PRA

|

|

New York Stock Exchange

|

|

5.00% Mandatory Convertible Preferred Stock, Series B, without par value

|

|

DHR.PRB

|

|

New York Stock Exchange

|

|

Floating Rate Senior Notes due 2022

|

|

DHR F 06/30/22

|

|

New York Stock Exchange

|

|

1.700% Senior Notes due 2022

|

|

DHR 1.7 01/04/22

|

|

New York Stock Exchange

|

|

1.700% Senior Notes due 2024

|

|

DHR 1.7 03/30/24

|

|

New York Stock Exchange

|

|

2.500% Senior Notes due 2025

|

|

DHR 2.5 07/08/25

|

|

New York Stock Exchange

|

|

0.200% Senior Notes due 2026

|

|

DHR 0.2 03/18/26

|

|

New York Stock Exchange

|

|

2.100% Senior Notes due 2026

|

|

DHR 2.1 09/30/26

|

|

New York Stock Exchange

|

|

1.200% Senior Notes due 2027

|

|

DHR 1.2 06/30/27

|

|

New York Stock Exchange

|

|

0.450% Senior Notes due 2028

|

|

DHR 0.45 03/18/28

|

|

New York Stock Exchange

|

|

2.500% Senior Notes due 2030

|

|

DHR 2.5 03/30/30

|

|

New York Stock Exchange

|

|

0.750% Senior Notes due 2031

|

|

DHR 0.75 09/18/31

|

|

New York Stock Exchange

|

|

1.350% Senior Notes due 2039

|

|

DHR 1.35 09/18/39

|

|

New York Stock Exchange

|

|

1.800% Senior Notes due 2049

|

|

DHR 1.8 09/18/49

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

364-Day Revolving Credit Facility

On June 5, 2020, Danaher entered into a new $2.5 billion 364-day revolving credit facility (the “Credit Facility”) with Bank of America, N.A., as Administrative Agent, and a syndicate of lenders from time to time party thereto, which replaces the existing $5.0 billion 364-day revolving credit facility entered into on August 27, 2019 (the “2019 364-Day Credit Facility”) with Bank of America, N.A., as Administrative Agent, and a syndicate of lenders party thereto. There were no amounts outstanding under the 2019 364-Day Credit Facility at the time it was replaced by the Credit Facility. The Credit Facility expires on June 5, 2021 (the “Scheduled Termination Date”). Danaher may elect, upon the payment of a fee equal to 0.75% of the principal amount of the loans then outstanding and upon the satisfaction of certain conditions, to convert any loans outstanding on the Scheduled Termination Date into term loans that are due and payable one year following the Scheduled Termination Date. The description of the Credit Agreement with respect to the Credit Facility (the “Credit Agreement”) set forth herein is qualified in its entirety by reference to the full text of the Credit Agreement, a copy of which is attached as Exhibit 10.1 hereto and is incorporated by reference herein.

Borrowings under the Credit Facility bear interest as follows: (1) Eurodollar Rate Loans (as defined in the Credit Agreement) bear interest at a variable rate per annum equal to the London inter-bank offered rate plus a margin of between 90.0 and 127.5 basis points, depending on Danaher’s long-term debt credit rating; and (2) Base Rate Loans (as defined in the Credit Agreement) bear interest at a variable rate per annum equal to the highest of (a) the Federal funds rate (as published by the Federal Reserve Bank of New York from time to time) plus 1/2 of 1%, (b) Bank of America’s “prime rate” as publicly announced from time to time and (c) the Eurodollar Rate (as defined in the Credit Agreement) plus 1.0%, plus in each case a margin of between 0.0 and 27.5 basis points depending on Danaher’s long-term debt credit rating. In addition, Danaher is required to pay a per annum facility fee of between 10 and 22.5 basis points (depending on Danaher’s long-term debt credit rating) based on the aggregate commitments under the Credit Facility, regardless of usage.

The Credit Facility requires Danaher to maintain a Consolidated Leverage Ratio (as defined in the respective Credit Agreement) of 0.65 to 1.00 or less. Borrowings under the Credit Facility are prepayable at Danaher’s option at any time in whole or in part without premium or penalty.

Danaher’s obligations under the Credit Facility are unsecured. Danaher has unconditionally and irrevocably guaranteed the obligations of each of its subsidiaries in the event a subsidiary is named a borrower under the Credit Facility. The Credit Agreement contains customary representations, warranties, conditions precedent, events of default, indemnities and affirmative and negative covenants, including covenants that, among other things, restrict the ability of Danaher and certain of its subsidiaries to: incur liens; sell or otherwise dispose of all or substantially all of Danaher’s or any subsidiary borrower’s assets; enter into certain mergers or consolidations; and use proceeds of borrowings under the Credit Facility for other than permitted uses. These covenants are subject to a number of important exceptions and qualifications. Certain changes of control with respect to Danaher would constitute an event of default under the Credit Facility. Upon the occurrence and during the continuance of an event of default, the lenders may declare the outstanding advances and all other obligations under the Credit Agreement immediately due and payable.

Danaher intends to use the Credit Facility for liquidity support for Danaher’s U.S. and Euro commercial paper programs and for general corporate purposes.

|

Item 1.02

|

Termination of a Material Definitive Agreement.

|

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

The following exhibits are filed herewith:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

DANAHER CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 10, 2020

|

|

|

By:

|

|

|

/s/ James F. O’Reilly

|

|

|

|

|

|

|

Name:

|

|

|

James F. O’Reilly

|

|

|

|

|

|

|

Title:

|

|

|

Vice President, Secretary and Associate General Counsel

|

|

|

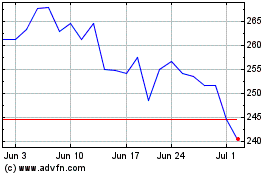

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024