Mammoth Energy Announces Filing of Rand Corporation Report Findings

June 09 2020 - 8:00AM

Mammoth Energy Services, Inc. (“Mammoth” or the “Company”)

(NASDAQ:TUSK) today announced that it has filed with the Securities

and Exchange Commission a detailed independent reasonableness

analysis of the October 19, 2017 emergency Master Services

Agreement (the “MSA”) between Cobra Acquisitions LLC (“Cobra”) and

the Puerto Rico Electric Power Authority (“PREPA”). The report adds

further validation to a December 23, 2017 letter from the Federal

Emergency Management Agency (“FEMA”) to the Government of Puerto

Rico that the costs under the MSA were reasonable and the MSA was

awarded in compliance with applicable procurement provisions.

The Rand Report

After over a year of requests under the Freedom of Information

Act, Mammoth received a copy of a detailed independent assessment

of the reasonableness of the emergency MSA dated October 19, 2017

between the Company’s subsidiary Cobra and PREPA for repairs to

PREPA’s electrical grid as a result of Hurricane Maria. This

report, titled “Reasonableness Analysis of Cobra Acquisitions, LLC

Emergency Contract – Cost Validation Report” dated March 28, 2019

(the “Rand Report”), was prepared at the request of FEMA by the

Homeland Security Operational and Analysis Center (“HSOAC”), a

federally funded research and development center operated by the

Rand Corporation for the U.S. Department of Homeland Security.

FEMA’s request for the Rand Report followed a December 22, 2017

Determination Memorandum produced by FEMA that found the MSA to be

reasonable.

The 77-page Rand Report's comprehensive analysis and findings

are significant and contain, among others, the following

conclusions:

Selection of Cobra was reasonable

“Having examined [the foregoing] aspects regarding the

reasonableness of PREPA’s emergency procurement process, HSOAC

finds that selecting Cobra for the MSA was reasonable considering

FEMA policy on emergency situations and existing regulations

regarding contracting.” (page 14)

PREPA adhered to procurement statutes and policies in

awarding the contract to Cobra

“PREPA adhered to Puerto Rican legal statutes regarding

emergency situations and remained consistent with their own

internal policies.” (page 14)

“Thus, according to this evaluation of the procurement process

HSOAC concludes that PREPA engaged in a reasonable procurement

process given the circumstances following Hurricane Maria.” (page

14)

Cobra’s rates were reasonable

“We conclude that Cobra’s blended rates fall within

representative ranges for high voltage emergency repair work. This

conclusion is delivered from analytical investigation which

combined knowledge of work conditions, assumptions into wage

burdens, evaluation of the equipment quantities and workforce

structures, different assumptions about fuel costs, and inclusion

of the best benchmark data and current adjustment factors available

at this time.” (page 48)

“Cobra’s blended rates fall within estimated ranges in all

scenarios we considered.” (page 47)

Other key findings:

“Cobra was uniquely positioned for rapid response to the crisis,

deploying heavy equipment to seaports to barge transports on the

day after contract signature (10/20/17). Transmission work on the

island began on 10/31/17, two weeks after Cobra was awarded the

contract. Furthermore, a fully equipped crew of 463 lineman and 200

support staff arrived on the island within 3 weeks of contract

signing (11/13/17). This fully equipped crew was composed of

quantities of linemen and security which greatly exceeded the

levels proposed in the MSA. This timely delivery of quantities of

work and support labor, in excess of the levels initially proposed

quickly (three weeks after the MSA was signed), clearly reflects

responsiveness to requirements for both immediate availability and

contract flexibility.” (page 22)

“Overall, we concluded that work crew headcounts and equipment

quantities offered by Cobra were sufficiently large to complete

required electricity work and thus, HSOAC deemed quantities

presented in Cobra’s bid document to be reasonable.” (page 27)

“Results show that Cobra’s average hourly labor rate lay between

low and high benchmarks and did not exceed any individual labor

category except for groundman. By comparison, MasTec and

PowerSecure’s crew weighted hourly rates were higher than Cobra’s

and exceed benchmark ranges for most individual labor categories

and overall. These results indicate that Cobra’s labor rates were

competitive relative to others who submitted proposals for the

MSA.” (page 36)

“PREPA’s requested solution delineated four critical

requirements for emergency work – transmission repair capabilities,

aircraft assets for installation in mountainous terrain,

self-logistics resources, and ability to perform with minimal

upfront payment. PREPA stated that Cobra was selected as the only

company with experience in installation of transmission equipment

and towers in mountainous terrain environments. Cobra had five

helicopters, which could be deployed as emergency repair assets.

Additionally, Cobra was able to provide its own logistical support

– including supplies, equipment, fuel, food, water, housing, etc.,

and had crews and equipment ready to deploy.” (page 13)

The foregoing description of the Rand Report does not purport to

be complete and is qualified in its entirety by reference to the

full text of the Rand Report which is included as Exhibit 99.1 to a

Current Report on Form 8-K filed by Mammoth with the Security and

Exchange Commission (the “SEC”) on June 9, 2020, and can be found

on the SEC’s EDGAR website.

About Mammoth Energy Services,

Inc.

Mammoth is an integrated, growth-oriented energy service company

serving companies engaged in the exploration and development of

North American onshore unconventional oil and natural gas reserves

and private utilities, public investor-owned utilities and

co-operative utilities through its energy infrastructure services.

Mammoth’s suite of services and products include: pressure pumping

services, infrastructure services, natural sand and proppant

services, contract land and directional drilling services and other

services.

Investor Contact: Don Crist – Director,

Investor Relationsdcrist@mammothenergy.com(405) 608-6048

Media Contact:Peter

Mirijanianpeter@pmpadc.com(202) 464-8803

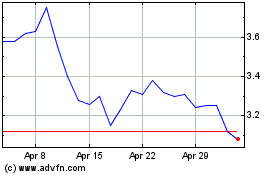

Mammoth Energy Services (NASDAQ:TUSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

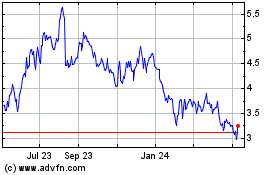

Mammoth Energy Services (NASDAQ:TUSK)

Historical Stock Chart

From Apr 2023 to Apr 2024