The information in this preliminary pricing supplement is not complete and may be changed. We may not sell these securities until the pricing supplement, the accompanying product supplement and the accompanying prospectus (collectively, the "Offering Documents") are delivered in final form. The Offering Documents are not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

|

Subject to Completion

|

|

June 2020

Preliminary Pricing Supplement dated June

2, 2020

Registration Statement No. 333-225551

Filed pursuant to Rule 424(b)(2)

(To Prospectus dated October 31, 2018 and

Product Supplement dated October 31, 2018)

|

Structured Investments

Opportunities in U.S. Equities

Buffered Income Auto-Callable Securities with Downside

Leverage due on or about June 8, 2021

$• Based

on the Performance of the Common Stock of Amazon.com, Inc.

Principal at risk securities

Buffered Income Auto-Callable Securities

with Downside Leverage (the “securities”) offer the opportunity for investors to earn an interest payment on each interest

payment date on which the securities are outstanding in exchange for potentially receiving shares of the underlying equity at maturity,

the value of which is expected to be worth less than the stated principal amount of the securities. If the closing price of the

underlying equity is equal to or greater than the call threshold level on any determination date (other than the final determination

date), on the corresponding interest payment date the securities will be redeemed early for an amount per security equal to the

stated principal amount plus the interest payment with respect to such interest payment date. If the closing price of the underlying

equity is less than the call threshold level on any determination date (other than the final determination date), on the corresponding

interest payment date the securities will not be redeemed early and investors will receive the interest payment per security. If

the securities are not redeemed early and the closing price of the underlying equity on the final determination date (the “final

price”) is equal to or greater than the downside threshold level, on the maturity date investors will receive an amount per

security equal to the stated principal amount plus the interest payment with respect to the maturity date. If, however, the securities

are not redeemed early and the final price is less than the downside threshold level, in addition to the interest payment with

respect to the maturity date, investors will receive per security a number of shares of the underlying equity equal to the quotient,

observed to 4 decimal places, of the stated principal amount divided by the downside threshold level (the “exchange

ratio”), the value of which is expected to be worth less than the stated principal amount and, in extreme situations, investors

could lose all of their initial investment. Any fractional share included in the exchange ratio will be paid in cash at an amount

equal to the product of the fractional share multiplied by the final price. Accordingly, the securities do not

guarantee any return of principal at maturity. Investors will not participate in any appreciation of the underlying equity and

must be willing to accept the risk of receiving shares of the underlying equity, the value of which is expected to be worth less

than the stated principal amount, and in extreme situations, investors could lose all of their initial investment. The securities

are unsubordinated, unsecured debt obligations issued by UBS AG, and all payments or deliveries on the securities are subject to

the credit risk of UBS AG.

|

SUMMARY TERMS

|

|

|

Issuer:

|

UBS AG London Branch

|

|

Underlying equity:

|

Common stock of Amazon.com, Inc. (Bloomberg Ticker: “AMZN UW”)

|

|

Aggregate principal amount:

|

$•

|

|

Stated principal amount:

|

$10,000.00 per security

|

|

Issue price:

|

$10,000.00 per security (see “Commissions and issue price” below)

|

|

Strike date:

|

Expected to be June 2, 2020

|

|

Pricing date:

|

Expected to be June 3, 2020

|

|

Original issue date:

|

Expected to be June 8, 2020 (3 business days after the pricing date). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days (T+2), unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the securities in the secondary market on any date prior to two business days before delivery of the securities will be required, by virtue of the fact that each security initially will settle in three business days (T+3), to specify alternative settlement arrangements to prevent a failed settlement of the secondary market trade.

|

|

Maturity date:

|

Expected to be June 8, 2021, subject to postponement for certain market disruption events and as described under “General Terms of the Securities — Market Disruption Events” and “— Payment Dates — Maturity Date” in the accompanying product supplement.

|

|

Early redemption:

|

If, on any determination date (other

than the final determination date), the closing price of the underlying equity is equal to or greater than the call

threshold level, the securities will be redeemed early and we will pay the early redemption amount on the first interest payment

date immediately following the related determination date. No further payments will be made on the securities once they

have been redeemed.

|

|

Early redemption amount:

|

The early redemption amount will be an amount equal to (i) the stated principal amount plus (ii) the interest payment with respect to the related interest payment date.

|

|

Interest payment:

|

On each interest payment date, we will pay an interest payment of $67.50 (equivalent to 8.10% per annum of the stated principal amount) per security on the related interest payment date, unless the securities were previously redeemed early.

|

|

Determination dates:

|

Expected to be July 6, 2020, August 3, 2020, September 3, 2020, October 5, 2020, November 3, 2020, December 3, 2020, January 4, 2021, February 3, 2021, March 3, 2021, April 5, 2021, May 3, 2021 and June 3, 2021, subject to postponement for non-trading days and certain market disruption events (as described under “General Terms of the Securities — Valuation Dates”, “— Final Valuation Date” and “— Market Disruption Events” in the accompanying product supplement). We also refer to June 3, 2021 as the final determination date. In the event that we make any change to the expected strike date, pricing date and original issue date, the calculation agent may adjust the determination dates, as well as the final determination date and maturity date, to ensure that the stated term of the securities remains the same. References in the accompanying product supplement to one or more “valuation dates” shall mean the determination dates for purposes of the market disruption event provisions in the accompanying product supplement.

|

|

Interest payment dates:

|

With respect to each determination date other than the final determination date, the third business day after the related determination date. With respect to the final determination date, the maturity date.

|

|

Payment at maturity:

|

§

|

If the final price is equal to or greater than the downside threshold level:

|

(i) the stated principal amount plus (ii) the interest payment with respect to the maturity date

|

|

|

§

|

If the final price is less than the downside threshold level:

|

(i) a number of shares of the underlying equity equal to the exchange ratio, and the cash value in lieu of any fractional shares included in the exchange ratio plus (ii) the interest payment with respect to the maturity date

|

|

|

If the securities are not redeemed early and the final price is less than the downside threshold level, you will receive per security a number of shares of the underlying equity equal to the exchange ratio (and cash in lieu of any fractional shares), the value of which is expected to be worth less than the stated principal amount and, in extreme situations, you could lose all of your initial investment. If the exchange ratio is less than 1, your payment at maturity for each security will be the cash value of the fractional share.

|

|

Exchange ratio:

|

A number of shares of the underlying equity per security equal to the quotient of the stated principal amount divided by the downside threshold level, observed to 4 decimal places (as may be adjusted in the case of certain adjustment events as described with respect to the “share delivery amount” under “General Terms of the Securities — Antidilution Adjustments for Securities Linked to an Underlying Equity or Equity Basket Asset” and “— Reorganization Events for Securities Linked to an Underlying Equity or Equity Basket Asset” in the accompanying product supplement). We will pay cash in lieu of delivering any fractional shares in an amount equal to the product of that fraction multiplied by the final price, each as determined by the calculation agent.

|

|

Cash value:

|

An amount in cash per security equal to the product of the exchange ratio multiplied by the final price. For the avoidance of doubt, we will pay the cash value if the exchange ratio is less than 1.0000 and may pay the cash value following certain adjustment events as described with respect to the “share delivery amount” under “General Terms of the Securities — Antidilution Adjustments for Securities Linked to an Underlying Equity or Equity Basket Asset” and “— Reorganization Events for Securities Linked to an Underlying Equity or Equity Basket Asset” in the accompanying product supplement.

|

|

Call threshold level:

|

$[•], which is equal to 100.00% of the initial price (as may be adjusted in the case of certain adjustment events as described under “General Terms of the Securities — Antidilution Adjustments for Securities Linked to an Underlying Equity or Equity Basket Asset” and “— Reorganization Events for Securities Linked to an Underlying Equity or Equity Basket Asset” in the accompanying product supplement).

|

|

Downside threshold level:

|

$[•], which is equal to 80.00% of the initial price (as may be adjusted in the case of certain adjustment events as described under “General Terms of the Securities — Antidilution Adjustments for Securities Linked to an Underlying Equity or Equity Basket Asset” and “— Reorganization Events for Securities Linked to an Underlying Equity or Equity Basket Asset” in the accompanying product supplement).

|

|

Initial price:

|

$[•], which is equal to the closing price of the underlying equity on the strike date and not the closing price on the pricing date (as may be adjusted in the case of certain adjustment events as described under “General Terms of the Securities — Antidilution Adjustments for Securities Linked to an Underlying Equity or Equity Basket Asset” and “— Reorganization Events for Securities Linked to an Underlying Equity or Equity Basket Asset” in the accompanying product supplement).

|

|

Final price:

|

The closing price of the underlying equity on the final determination date.

|

|

CUSIP / ISIN:

|

90276BDH3 / US90276BDH33

|

|

Listing:

|

The securities will not be listed or displayed on any securities exchange or any electronic communications network.

|

|

Calculation Agent:

|

UBS Securities LLC

|

|

Commissions and issue price:

|

|

Price to Public(1)

|

Fees and Commissions(1)

|

Proceeds to Issuer

|

|

Per security

|

|

100.00%

|

0.10%(a)

|

99.80%

|

|

|

|

|

+ 0.10%(b)

|

|

|

|

|

|

0.20%

|

|

|

Total

|

|

$•

|

$•

|

$•

|

|

|

|

|

|

|

|

|

|

(1)

|

UBS Securities LLC will purchase from UBS AG the securities at the price to public less a fee of $20.00 per $10,000.00 stated principal amount of securities. UBS Securities LLC will agree to resell all of the securities to Morgan Stanley Smith Barney LLC (“Morgan Stanley Smith Wealth Management”) at an underwriting discount which reflects:

|

|

|

(a)

|

a fixed sales commission of $10.00 per $10,000.00 stated principal amount of securities that Morgan Stanley Wealth Management sells and

|

|

|

(b)

|

a fixed structuring fee of $10.00 per $10,000.00 stated principal amount of securities that Morgan Stanley Wealth Management sells,

|

|

|

each payable to Morgan Stanley Wealth Management. See “Supplemental information regarding plan of distribution (conflicts of interest); secondary markets (if any)”.

|

The estimated initial value of the securities

as of the pricing date is expected to be between $9,641.00 and $9,941.00. The range of the estimated initial value of the securities

was determined on the date hereof by reference to UBS’ internal pricing models, inclusive of the internal funding rate. For

more information about secondary market offers and the estimated initial value of the securities, see “Risk Factors —

Fair value considerations” and “— Limited or no secondary market and secondary market price considerations”

beginning on page 11 of this document. The securities involve risks not associated with an investment in ordinary debt securities.

See “Risk Factors” beginning on page 10.

Neither the Securities and Exchange

Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this document, the accompanying product supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

The securities are not bank deposits

and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency. You should read this document

together with the accompanying product supplement and the accompanying prospectus, each of which can be accessed via the hyperlinks

below, before you decide to invest.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

Additional Information about UBS and the Securities

UBS AG (“UBS”) has filed a

registration statement (including a prospectus as supplemented by a product supplement) with the Securities and Exchange Commission

(the “SEC”) for the securities to which this document relates. Before you invest, you should read these documents and

any other documents relating to this offering that UBS has filed with the SEC for more complete information about UBS and this

offering. You may obtain these documents for free from the SEC website at www.sec.gov. Our Central Index Key, or CIK, on the SEC

web site is 0001114446.

You may access these documents on the SEC website at www.sec.gov

as follows:

References to “UBS,” “we,”

“our” and “us” refer only to UBS AG and not to its consolidated subsidiaries. In this document, the “securities”

refers to the Buffered Income Auto-Callable Securities with Downside Leverage that are offered hereby. Also, references to the

“accompanying prospectus” mean the UBS prospectus titled “Debt Securities and Warrants,” dated October

31, 2018, and references to the “accompanying product supplement” mean the UBS product supplement titled “Market-Linked

Securities Product Supplement”, dated October 31, 2018.

You should rely only on the information

incorporated by reference or provided in this document, the accompanying product supplement or the accompanying prospectus. We

have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state

where the offer is not permitted. You should not assume that the information in this document, the accompanying product supplement

or the accompanying prospectus is accurate as of any date other than the date on the front of the document.

UBS reserves the right to change the terms

of, or reject any offer to purchase, the securities prior to their issuance. In the event of any changes to the terms of the securities,

UBS will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject

such changes in which case UBS may reject your offer to purchase.

In the event of any discrepancies between

this document, the accompanying product supplement and the accompanying prospectus, the following hierarchy will govern: first,

this document; second, the accompanying product supplement; and finally, the accompanying prospectus.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

Investment Summary

The Buffered Income Auto-Callable Securities

with Downside Leverage due on or about June 8, 2021 based on the performance of the common stock of Amazon.com, Inc., which we

refer to as the securities, provide an opportunity for investors to earn an interest payment, which is an amount equal to $67.50

(equivalent to 8.10% per annum of the stated principal amount) per security, on each interest payment date on which the securities

are outstanding. If the securities have not been previously redeemed, the interest payment will be payable on the relevant interest

payment date, which is the third business day after the related determination date, except that the interest payment date for the

final determination date will be the maturity date.

If the closing price of the underlying

equity is equal to or greater than the call threshold level on any of the determination dates other than the final determination

date, the securities will be automatically redeemed for an early redemption amount equal to (i) the stated principal amount plus

(ii) the interest payment with respect to the related interest payment date. If the securities have not previously been redeemed

early and the final price is equal to or greater than 80.00% of the initial price, which we refer to as the downside threshold

level, the payment at maturity will be the sum of (i) the stated principal amount and (ii) the interest payment with respect to

the maturity date. If, however, the securities are not redeemed early and the final price is less than the downside threshold

level, investors will receive per security (i) a number of shares of the underlying equity equal to the exchange ratio, which

will be equal to the quotient, observed to 4 decimal places, of (a) the stated principal amount divided by (b) downside threshold

level, the value of which is expected to be worth less than the stated principal amount and could be zero and (ii) the interest

payment with respect to the maturity date. Any fractional share included in the exchange ratio will be paid in cash at an amount

equal to the product of the fractional share and the final price. Investors in the securities must be willing to accept the

risk of receiving shares of the underlying equity that are expected to be worth less than the principal amount, and in extreme

situations, investors could lose all of their initial investment. In addition, investors will not participate in any appreciation

of the underlying equity.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

Key Investment Rationale

The securities offer the opportunity for

investors to earn an interest payment equal to $67.50 (equivalent to 8.10% per annum of the stated principal amount) per security

on each interest payment date on which the securities are outstanding. Payments or deliveries on the securities will vary depending

on the closing price or final price of the underlying equity on each determination date and/or the final determination date, respectively,

relative to the initial price and the downside threshold level, as follows:

|

Scenario 1

|

|

On any determination date other than the final determination date, the closing price is equal to or greater than the call threshold level.

|

|

|

|

§

|

The securities will be automatically redeemed early for an early redemption amount equal to (i) the stated principal amount plus (ii) the interest payment with respect to the related interest payment date.

|

|

§

|

Investors will not participate in any appreciation of the underlying equity from the initial price.

|

|

|

|

|

|

Scenario 2

|

|

The securities are not automatically redeemed early and the final price is equal to or greater than the downside threshold level.

|

|

|

|

§

|

The payment due at maturity will be (i) the stated principal amount plus (ii) the interest payment with respect to the maturity date.

|

|

§

|

Investors will not participate in any appreciation of the underlying equity from the initial price.

|

|

|

|

|

|

Scenario 3

|

|

The securities are not automatically redeemed early and the final price is less than the downside threshold level.

|

|

|

|

§

|

At maturity, investors will receive per security (i) a number of shares of the underlying equity equal to the exchange ratio, which will be equal to the quotient of (a) the stated principal amount divided by (b) the downside threshold level and (ii) the interest payment with respect to the maturity date. Any fractional share included in the exchange ratio will be paid in cash at an amount equal to the product of the fractional share multiplied by the final price.

|

|

§

|

Investors will receive shares of the underlying equity that are expected to be worth less than the stated principal amount and may lose all of their initial investment in this scenario.

|

Investing in the securities involves

significant risks. The securities differ from ordinary debt securities in that UBS is not necessarily obligated to repay the full

amount of your initial investment. In exchange for receiving an interest payment on each interest payment date on which the securities

are outstanding, you are accepting the risk of receiving at maturity a number of shares of the underlying equity. If the securities

are not automatically redeemed early and the final price is less than the downside threshold level, you will receive per security

a number of shares of the underlying equity, the value of which is expected to be worth less than the stated principal amount and,

in extreme situations, you could lose all of your initial investment.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

Investor Suitability

The securities may be suitable for you if:

|

|

§

|

You fully understand the risks of an investment in the securities, including the risk of loss of

all of your initial investment.

|

|

|

§

|

You can tolerate a loss of some or all of your initial investment and are willing to make an investment

that may have the full downside market risk of an investment in the underlying equity.

|

|

|

§

|

You believe that the final price of the underlying equity will be equal to or greater than the

downside threshold level.

|

|

|

§

|

You can tolerate receiving a number of shares of the underlying equity equal to the exchange ratio at maturity, the value of

which is expected to be worth less than your stated principal amount and, in extreme situations, losing all of your initial investment.

|

|

|

§

|

You understand and accept that you will not participate in any appreciation in the price of the

underlying equity and that any positive return is limited to the interest payments received, which will depend on the number of

interest payment dates on which the securities remain outstanding.

|

|

|

§

|

You can tolerate fluctuations in the price of the securities prior to maturity that may be similar

to or exceed the downside price fluctuations of the underlying equity.

|

|

|

§

|

You are willing to invest in the securities based on the interest payment, the downside threshold

level and the call threshold level indicated on the cover hereof.

|

|

|

§

|

You are willing to forgo any dividends paid on the underlying equity.

|

|

|

§

|

You are willing to invest in securities that may be redeemed prior to the maturity date and you

are otherwise willing to hold such securities to maturity, a term of approximately 12 months, and accept that there may be little

or no secondary market.

|

|

|

§

|

You are willing to assume the credit risk of UBS for all payments or deliveries under the securities,

and understand that if UBS defaults on its obligations you may not receive any amounts due to you including any repayment of principal.

|

|

|

§

|

You understand that the estimated initial value of the securities determined by our internal pricing

models is lower than the issue price and that should UBS Securities LLC or any affiliate make secondary markets for the securities,

the price (not including their customary bid-ask spreads) will temporarily exceed the internal pricing model price.

|

The securities may not be suitable

for you if:

|

|

§

|

You do not fully understand the risks of an investment in the securities, including the risk of

loss of all of your initial investment.

|

|

|

§

|

You require an investment designed to provide a full return of principal at maturity.

|

|

|

§

|

You cannot tolerate a loss of some or all of your initial investment, or you are not willing to

make an investment that may have the full downside market risk of an investment in the underlying equity.

|

|

|

§

|

You believe that the final price of the underlying equity is likely to be less than the downside

threshold level.

|

|

|

§

|

You cannot tolerate receiving a number of shares of the underlying equity equal to the exchange ratio at maturity, the value

of which is expected to be worth less than your stated principal amount and could be zero.

|

|

|

§

|

You seek an investment that participates in the appreciation in the price of the underlying equity

or that has unlimited return potential.

|

|

|

§

|

You cannot tolerate fluctuations in the price of the securities prior to maturity that may be similar

to or exceed the downside price fluctuations of the underlying equity.

|

|

|

§

|

You are unwilling to invest in the securities based on the interest payment, the downside threshold

level or the call threshold level indicated on the cover hereof.

|

|

|

§

|

You prefer to receive any dividends paid on the underlying equity.

|

|

|

§

|

You are unable or unwilling to hold securities that may be redeemed prior to the maturity date,

or you are otherwise unable or unwilling to hold such securities to maturity, a term of approximately 12 months, or you seek an

investment for which there will be an active secondary market.

|

|

|

§

|

You are not willing to assume the credit risk of UBS for all payments or deliveries under the securities,

including any repayment of principal.

|

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

How the Securities Work

The following diagrams illustrate the potential outcomes for

the securities depending on (1) the closing price and (2) the final price, relative to the initial price and the downside threshold

level.

Diagram #1: Determination

Dates Other Than the Final Determination Date

Diagram #2: Payment at Maturity if No Early

Redemption Occurs

For more information about the payout

upon an early redemption or at maturity in different hypothetical scenarios, see “Hypothetical Examples” beginning

on the following page.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

Hypothetical Examples

The below examples are based on the following

terms and are purely hypothetical (the actual terms of your security will be determined on the strike date and will be specified

in the final pricing supplement; amounts may have been rounded for ease of analysis):

|

Hypothetical Initial Price:

|

$2,300.00

|

|

Hypothetical Call Threshold Level:

|

$2,300.00, which is equal to 100.00% of the hypothetical initial price

|

|

Hypothetical Downside Threshold Level:

|

$1,840.00, which is 80.00% of the hypothetical initial price

|

|

Hypothetical Exchange Ratio*:

|

5.4348 shares per security*

|

|

Hypothetical Interest Payment:

|

$67.50 (equivalent to approximately 8.10% per annum of the stated principal amount) per security

|

|

Stated Principal Amount:

|

$10,000.00 per security

|

|

*

|

Equal to the quotient, observed to 4 decimal places, of (i) the stated principal amount

divided by (ii) the hypothetical downside threshold level. If you receive the exchange ratio at maturity, any fractional

share included in the exchange ratio will be paid in cash at an amount equal to the product of the fractional share and the final

price.

|

In Examples 1 and 2 the closing price of

the underlying equity fluctuates over the term of the securities and the closing price of the underlying equity is equal to or

greater than the hypothetical call threshold level on one of the determination dates (other than the final determination date).

Because the closing price is equal to or greater than the call threshold level on one of the determination dates (other than the

final determination date), the securities are redeemed early on the interest payment date corresponding to the relevant determination

date. In Examples 3 and 4, the closing price on each of the determination dates (other than the final determination date) is less

than the call threshold level, and, consequently, the securities are not redeemed early and remain outstanding until maturity.

|

|

Example 1

|

Example 2

|

Determination

Dates

|

Hypothetical

Closing Price

|

Interest

Payment

|

Early

Redemption Amount*

|

Hypothetical

Closing Price

|

Interest

Payment

|

Early

Redemption

Amount

|

|

#1

|

$2,310.00

|

—*

|

$10,067.50

|

$2,090.00

|

$67.50

|

N/A

|

|

#2

|

N/A

|

N/A

|

N/A

|

$2,175.80

|

$67.50

|

N/A

|

|

#3

|

N/A

|

N/A

|

N/A

|

$2,760.00

|

—*

|

$10,067.50

|

|

#4

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#5

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#6

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#7

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#8

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#9

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#10

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

|

#11

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Final

Determination

Date

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Payment at

Maturity

|

N/A

|

N/A

|

|

|

*

|

The early redemption amount includes the unpaid interest payment with respect to the interest payment

date corresponding to the determination date on which the closing price is equal to or greater than the call threshold level and

the securities are redeemed early as a result.

|

|

▪

|

In Example 1, the securities are redeemed early on the interest payment date corresponding to the first determination

date because the closing price on such determination date is equal to or greater than the call threshold level. You receive the

early redemption amount on such interest payment date, calculated as follows:

|

Stated Principal Amount + Interest Payment

= $10,000.00 + $67.50 = $10,067.50

In this example, the early redemption

feature limits the term of your investment to approximately 1 month and you may not be able to reinvest at comparable terms or

returns. If the securities are redeemed early, you will stop receiving interest payments. Your total return per security in this

example is $10,067.50 (a 0.675% total return on the securities).

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

|

▪

|

In Example 2, the securities are redeemed early on the interest payment date corresponding to the third determination

date as the closing price on such determination date is equal to or greater than the call threshold level. You receive the early

redemption amount on such interest payment date, calculated as follows:

|

Stated Principal Amount + Interest Payment

= $10,000.00 + $67.50 = $10,067.50

In this example, the early redemption

feature limits the term of your investment to approximately 3 months and you may not be able to reinvest at comparable terms or

returns. If the securities are redeemed early, you will stop receiving interest payments. Further, although the underlying equity

has appreciated by 20% from its initial price on the third determination date, you will receive only $10,067.50 per security and

do not benefit from such appreciation. When added to the interest payments of $135.00 received in respect of the prior interest

payment dates, UBS will have paid you a total of $10,202.50 per security for a 2.025% total return on the securities.

|

|

Example 3

|

Example 4

|

Determination

Dates

|

Hypothetical

Closing Price

|

Interest

Payment

|

Early

Redemption

Amount

|

Hypothetical

Closing Price

|

Interest

Payment

|

Early

Redemption

Amount

|

|

#1

|

$2,200.00

|

$67.50

|

N/A

|

$2,190.00

|

$67.50

|

N/A

|

|

#2

|

$2,150.00

|

$67.50

|

N/A

|

$2,160.00

|

$67.50

|

N/A

|

|

#3

|

$2,250.00

|

$67.50

|

N/A

|

$2,240.00

|

$67.50

|

N/A

|

|

#4

|

$2,050.00

|

$67.50

|

N/A

|

$2,060.00

|

$67.50

|

N/A

|

|

#5

|

$2,275.00

|

$67.50

|

N/A

|

$2,265.00

|

$67.50

|

N/A

|

|

#6

|

$2,175.00

|

$67.50

|

N/A

|

$2,185.00

|

$67.50

|

N/A

|

|

#7

|

$2,140.00

|

$67.50

|

N/A

|

$2,130.00

|

$67.50

|

N/A

|

|

#8

|

$2,210.00

|

$67.50

|

N/A

|

$2,220.00

|

$67.50

|

N/A

|

|

#9

|

$1,980.00

|

$67.50

|

N/A

|

$1,970.00

|

$67.50

|

N/A

|

|

#10

|

$1,945.00

|

$67.50

|

N/A

|

$1,955.00

|

$67.50

|

N/A

|

|

#11

|

$1,900.00

|

$67.50

|

N/A

|

$1,890.00

|

$67.50

|

N/A

|

Final

Determination

Date

|

$1,472.00

|

—*

|

N/A

|

$2,070.00

|

—*

|

N/A

|

Payment at

Maturity

|

$8,067.53**

|

$10,067.50

|

|

|

*

|

The final interest payment will be paid at maturity.

|

|

|

**

|

Represents (i) the approximate cash value of the exchange ratio as of the final determination date, plus (ii) the interest payment with

respect to the maturity date. Because the securities are physically settled, the actual value of the shares received and the total

return on the securities at maturity depends on the price of the underlying equity on the maturity date.

|

Examples 3 and 4 illustrate the payment

at maturity per security based on the final price.

|

▪

|

In Example 3, the closing price of the underlying equity remains less than the call threshold level on each determination

date, including the final determination date. As a result, the securities remain outstanding until maturity and, because the final

price is less than the downside threshold level, at maturity, in addition to the interest payment with respect to the maturity

date, investors will receive shares of the underlying equity, and an amount in cash equal to the product of the fractional share

and the final price, calculated as follows:

|

Exchange Ratio = $8,000.03* = $1,472.00

x 5.4348 shares

Payment at Maturity = Exchange Ratio + Interest

Payment

Payment at Maturity = $8,000.03* + $67.50

= $8,067.53

|

|

*

|

Represents the approximate cash value of

the exchange ratio as of the final determination date. Because the securities are physically settled, the actual value of the shares

received and the total return on the securities at maturity depends on the price of the underlying equity on the maturity date.

|

If the exchange ratio is less than 1, your

payment at maturity for each security will be the cash value of the fractional share.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

In this example, your payment at maturity

is significantly less than the stated principal amount. As represented by the exchange ratio, on the maturity date you will receive

shares of the underlying equity and an amount in cash equal to the product of the fractional share and the final price. The value

of the shares as of the final determination date plus the interest payment with respect to the maturity date equals $8,067.53 per

security. When added to the interest payments per security of $742.50 received in respect to the prior interest payment dates,

UBS will have paid you a total of $8,810.03 (an 11.8997% loss on the securities). The value of the shares received as of the maturity

date and the total return on the securities at that time will depend on the closing price of the underlying equity on the maturity

date.

|

▪

|

In Example 4, the closing price of the underlying equity is less than the call threshold level on each determination

date prior to the final determination date and, as a result, the securities remain outstanding until maturity. On the final determination

date, although the final price is less than the initial price, the final price is equal to or greater than the downside threshold

level and therefore you receive the stated principal amount plus the interest payment with respect to the maturity date. Your payment

at maturity is calculated as follows:

|

$10,000.00 + $67.50 = $10,067.50

In this example, although the final

price represents a 10.00% decline from the initial price, the final price is equal to or greater than the downside threshold level

and therefore you receive at maturity the stated principal amount per security plus the interest payment with respect to the maturity

date, equal to $10,067.50 per security. When added to the interest payments of $742.50 received in respect to the prior interest

payment dates, UBS will have paid you a total of $10,810.00 (an 8.10% total return on the securities).

Investing in the securities involves

significant risks. The securities differ from ordinary debt securities in that UBS is not necessarily obligated to repay the full

amount of your initial investment. In exchange for receiving an interest payment on each interest payment date on which the securities

are outstanding, you are accepting the risk that the securities may have downside market risk similar to the underlying equity.

If the securities are not automatically redeemed early and the final price is less than the downside threshold level, you will

receive per security a number of shares of the underlying equity, the value of which is expected to be worth less than the stated

principal amount and, in extreme situations, you could lose all of your initial investment.

Any payment or delivery to be made

on the securities, including any repayment of principal, depends on the ability of UBS to satisfy its obligations as they come

due. If UBS were to default on its obligations under the securities, you could lose all of your initial investment.

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

Risk Factors

The following is a non-exhaustive list

of certain key risk factors for investors in the securities. For further discussion of these and other risks, you should read the

section entitled “Risk Factors” in the accompanying product supplement. We urge to consult your investment, legal,

tax, accounting and other advisors before you invest in the securities.

|

|

§

|

The securities do not guarantee the return of any principal and your investment in the securities

may result in a loss. The terms of the securities differ from those of ordinary debt securities in that the securities do not

guarantee the return of any of the stated principal amount at maturity. Instead, if the securities have not been redeemed early

and if the final price is less than the downside threshold level, you will receive a number of shares of the underlying equity

for each security that you own equal to the exchange ratio, the value of which is expected to be worth less than the stated principal

amount and could be worthless. If you receive the exchange ratio, as of the final determination date the percentage decline in

the value of the exchange ratio will be at a proportionately higher percentage relative to any percentage decline in the price

of the underlying equity below the downside threshold level from the initial price to the final price. Therefore, the further the

final price has declined from the downside threshold level, the closer your loss of principal will be to the decline of the underlying

equity from the initial price and, in extreme situations, you could lose all of your initial investment. For example, if the downside

threshold level is 80.00% of the initial price and the final price is 70.00% of the initial price, you will lose 12.50% of your

initial investment (based on the value of the exchange ratio on the final determination date), which is greater than the 10.00%

additional decline of the underlying equity from the downside threshold level, but less than the 30.00% decline from the initial

price.

|

|

|

|

Additionally,

in the event that the securities are not redeemed early and the final price is less than the downside threshold level, any decline

in the price of the underlying equity during the period between the final determination date and the maturity date will result

in a return on the securities at maturity that is less than the return you would have received had UBS instead paid you an amount

in cash at maturity equal to the exchange ratio.

|

|

§

|

The contingent repayment of principal applies only if you hold the securities to maturity.

You should be willing to hold your securities to maturity. If you are able to sell your securities prior to an early redemption

or maturity in the secondary market, you may have to sell them at a loss relative to your initial investment even if the price

of the underlying equity at such time is equal to or greater than the downside threshold level.

|

|

|

§

|

Higher interest payments are generally associated with a greater risk of loss. Greater expected

volatility with respect to the underlying equity reflects a higher expectation as of the strike date that the closing price of

such stock may be less than the downside threshold level on the final determination date of the securities. This greater expected

risk will generally be reflected in a higher interest payment rate for that security. “Volatility” refers to the frequency

and magnitude of changes in the price of the underlying equity. However, while the amount of each applicable interest payment is

set on the strike date, a stock’s volatility can change significantly over the term of the securities. The closing price

of the underlying equity for your securities could fall sharply, which could result in the receipt of shares of the underlying

equity at maturity and, in extreme situations, the loss of all of your initial investment.

|

|

|

§

|

Investors will not participate in any appreciation in the price of the underlying equity and

will not have the same rights during the term of the securities as holders of the underlying equity. Investors will not participate

in any appreciation in the price of the underlying equity from the initial price and the return on the securities will be limited

to the interest payments received, which will depend on the number of interest payment dates on which the securities remain outstanding.

It is possible that the securities could be subject to an early redemption so that you will receive few interest payments. If you

do not earn sufficient interest payments on the securities, the overall return on the securities may be less than the amount that

would be paid on a conventional debt security of the issuer of comparable maturity. Further, investors in the securities will not

have voting rights or rights to receive dividends or other distributions or any other rights during the term of the securities

with respect to the underlying equity, and any such dividends or distributions will not be factored into the calculation of the

payment at maturity.

|

|

|

§

|

Early redemption risk. The term of your investment in the securities may be limited to the

first interest payment date on which the securities may be redeemed early. If the securities are redeemed early, you will receive

no more interest payments and may be forced to invest in a lower interest rate environment and may not be able to reinvest the

proceeds from an investment in the securities at a comparable return for a similar level of risk.

|

|

|

§

|

The securities are subject to the credit risk of UBS AG, and any actual or anticipated changes

to our credit ratings or credit spreads may adversely affect the market value of the securities. Investors are dependent on

UBS AG’s ability to pay all amounts due on the securities, and therefore investors are subject to our credit risk and to

changes in the market’s view of our creditworthiness. Any actual or anticipated decline in our credit ratings or increase

in the credit spreads charged by the market for taking our credit risk is likely to affect adversely the market value of the securities.

If we were to default on our obligations under the securities, you could lose a significant portion or all of your initial investment.

|

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

|

|

§

|

Single equity risk. The closing price of the underlying equity can rise or fall sharply

due to factors specific to that underlying equity and the issuer of such underlying equity (the “underlying equity issuer”),

such as stock price volatility, earnings, financial conditions, corporate, industry and regulatory developments, management changes

and decisions and other events, as well as general market factors, such as general stock market volatility and levels, interest

rates and economic and political conditions. Recently, the coronavirus infection has caused volatility in the global financial

markets and a slowdown in the global economy. Coronavirus or any other communicable disease or infection may adversely affect the

underlying equity issuer. You, as an investor in the securities, should make your own investigation into the underlying equity

issuer and the underlying equity for your securities. For additional information regarding the underlying equity, please see “Information

about the Underlying Equity” below and the underlying equity issuer’s SEC filings referred to in this section. We

urge you to review financial and other information filed periodically by the underlying equity issuer with the SEC.

|

|

|

§

|

Fair value considerations.

|

|

|

o

|

The issue price you pay for the securities will exceed their estimated initial value. The

issue price you pay for the securities will exceed their estimated initial value as of the pricing date due to the inclusion in

the issue price of the underwriting discount, hedging costs, issuance costs and projected profits. As of the close of the relevant

markets on the pricing date, we will determine the estimated initial value of the securities by reference to our internal pricing

models and the estimated initial value of the securities will be set forth in the final pricing supplement. The pricing models

used to determine the estimated initial value of the securities incorporate certain variables, including the price, volatility

and any dividends paid on the underlying equity, prevailing interest rates, the term of the securities and our internal funding

rate. Our internal funding rate is typically lower than the rate we would pay to issue conventional fixed or floating rate debt

securities of a similar term. The underwriting discount, hedging costs, issuance and other costs, projected profits and the difference

in rates will reduce the economic value of the securities to you. Due to these factors, the estimated initial value of the securities

as of the pricing date will be less than the issue price you pay for the securities.

|

|

|

o

|

The estimated initial value is a theoretical price and the actual price that you may be able

to sell your securities in any secondary market (if any) at any time after the pricing date may differ from the estimated initial

value. The value of your securities at any time will vary based on many factors, including the factors described above and

in “—Single equity risk” above and is impossible to predict. Furthermore, the pricing models that we use are

proprietary and rely in part on certain assumptions about future events, which may prove to be incorrect. As a result, after the

pricing date, if you attempt to sell the securities in the secondary market, the actual value you would receive may differ, perhaps

materially, from the estimated initial value of the securities determined by reference to our internal pricing models. The estimated

initial value of the securities does not represent a minimum or maximum price at which we or any of our affiliates would be willing

to purchase your securities in any secondary market at any time.

|

|

|

o

|

Our actual profits may be greater or less than the differential between the estimated initial

value and the issue price of the securities as of the pricing date. We may determine the economic terms of the securities,

as well as hedge our obligations, at least in part, prior to the pricing date. In addition, there may be ongoing costs to us to

maintain and/or adjust any hedges and such hedges are often imperfect. Therefore, our actual profits (or potentially, losses) in

issuing the securities cannot be determined as of the pricing date and any such differential between the estimated initial value

and the issue price of the securities as of the pricing date does not reflect our actual profits. Ultimately, our actual profits

will be known only at the maturity of the securities.

|

|

|

§

|

Limited or no secondary market and secondary market price considerations.

|

|

|

o

|

There may be little or no secondary market for the securities. The securities will not be

listed or displayed on any securities exchange or any electronic communications network. UBS Securities LLC and its affiliates

intend, but are not required to make a market for the securities and may stop making a market at any time. If you are able to sell

your securities prior to maturity, you may have to sell them at a substantial loss. Furthermore, there can be no assurance that

a secondary market for the securities will develop. The estimated initial value of the securities does not represent a minimum

or maximum price at which we or any of our affiliates would be willing to purchase your securities in any secondary market at any

time.

|

|

|

o

|

The price at which UBS Securities LLC and its affiliates may offer to buy the securities in

the secondary market (if any) may be greater than UBS’ valuation of the securities at that time, greater than any other secondary

market prices provided by unaffiliated dealers (if any) and, depending on your broker, greater than the valuation provided on your

customer account statements. For a limited period of time following the issuance of the securities, UBS Securities LLC or its

affiliates may offer to buy or sell such securities at a price that exceeds (i) our valuation of the securities at that time based

on our internal pricing models, (ii) any secondary market prices provided by unaffiliated dealers (if any) and (iii) depending

on your broker, the valuation provided on customer account statements. The price that UBS Securities LLC may initially offer to

buy such securities following issuance will exceed the valuations indicated by our internal pricing models due to the inclusion

for a limited period of time of the aggregate value of the underwriting discount, hedging costs, issuance costs and theoretical

projected trading profit. The portion of such amounts included in our price will decline to zero on a straight line basis over

a period ending no later than the date specified under “Supplemental information regarding plan of distribution (conflicts

of interest); secondary markets (if any).” Thereafter, if UBS Securities LLC or an affiliate makes secondary markets in the

securities, it will do so at prices that reflect our estimated value determined by reference to our internal pricing models at

that time. The temporary positive differential relative to our internal pricing

|

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

|

|

|

models arises from requests from and arrangements

made by UBS Securities LLC with the selling agents of structured debt securities such as the securities. As described above, UBS

Securities LLC and its affiliates are not required to make a market for the securities and may stop making a market at any time.

The price at which UBS Securities LLC or an affiliate may make secondary markets at any time (if at all) will also reflect its

then current bid-ask spread for similar sized trades of structured debt securities. UBS Securities LLC reflects this temporary

positive differential on its customer statements. Investors should inquire as to the valuation provided on customer account statements

provided by unaffiliated dealers.

|

|

|

o

|

Price of securities prior to maturity. The market price of the securities will be influenced

by many unpredictable and interrelated factors, including the price of the underlying equity; the volatility of the underlying

equity; the dividend rate paid on the underlying equity; the time remaining to the maturity of the securities; interest rates in

the markets; geopolitical conditions and economic, financial, political, force majeure and regulatory or judicial events; the creditworthiness

of UBS and the then current bid-ask spread for the securities.

|

|

|

o

|

Impact of fees and the use of internal funding rates rather than secondary market credit spreads

on secondary market prices. All other things being equal, the use of the internal funding rates described above under “—Fair

value considerations” as well as the inclusion in the issue price of the underwriting discount, hedging costs, issuance costs

and any projected profits are, subject to the temporary mitigating effect of UBS Securities LLC’s and its affiliates’

market making premium, expected to reduce the price at which you may be able to sell the securities in any secondary market.

|

|

|

§

|

There can be no assurance that the investment view implicit in the securities will be successful.

It is impossible to predict whether the price of the underlying equity will rise or fall. The price of the underlying equity will

be influenced by complex and interrelated political, economic, financial and other factors that affect the underlying equity. You

should be willing to accept the downside risks of owning equities in general and the underlying equity in particular, and to assume

the risk that, if the securities are not redeemed early, you may lose some or all of your initial investment.

|

|

|

§

|

Potential conflicts of interest. We and our affiliates may engage in business related to

the underlying equity, which may present a conflict between our obligations as issuer and you, as a holder of the securities. There

are also potential conflicts of interest between you and the calculation agent, which will be an affiliate of UBS. The calculation

agent will determine the initial price, the final price and whether the closing price of the underlying equity on any determination

date is equal to or greater than the call threshold level (other than on the final determination date) or is less than the downside

threshold level on the final determination date. Determinations made by the calculation agent, including with respect to the occurrence

or non-occurrence of market disruption events, may affect the payout to you at maturity or whether the securities are redeemed

early. As UBS determines the economic terms of the securities, including the interest payment, call threshold level and downside

threshold level, and such terms include the underwriting discount, hedging costs, issuance and other costs and projected profits,

the securities represent a package of economic terms. There are other potential conflicts of interest insofar as an investor could

potentially get better economic terms if that investor entered into exchange-traded and/or OTC derivatives or other instruments

with third parties, assuming that such instruments were available and the investor had the ability to assemble and enter into such

instruments. Furthermore, given that UBS Securities LLC and its affiliates temporarily maintain a market making premium, it may

have the effect of discouraging UBS Securities LLC and its affiliates from recommending sale of your securities in the secondary

market.

|

|

|

|

In addition, we

or one of our affiliates may enter into swap agreements or related hedging activities with the dealer or its affiliates in connection

with the securities, which could cause the economic interests of UBS, the dealer or our or their respective affiliates to be adverse

to your interests as an investor in the securities. If the dealer or any of its affiliates conduct hedging activities for us or

our affiliate in connection with the securities and earns profits in connection with such hedging activities, such profit will

be in addition to the underwriting compensation it receives for the sale of the securities to you. You should be aware that the

potential to receive compensation both for hedging activities and sales may create a further incentive for the dealer to sell the

securities to you.

|

|

|

§

|

No affiliation with the underlying equity issuer. The underlying equity issuer is not an

affiliate of ours, is not involved with the offering in any way, and has no obligation to consider your interests in taking any

corporate actions that might affect the value of the securities. We have not made any due diligence inquiry with respect to the

underlying equity in connection with the offering.

|

|

|

§

|

We may engage in business with or involving the underlying equity issuer without regard to your

interests. We or our affiliates may presently or from time to time engage in business with the underlying equity issuer without

regard to your interests and thus may acquire non-public information about the underlying equity. Neither we nor any of our affiliates

undertakes to disclose any such information to you. In addition, we or our affiliates from time to time have published and in the

future may publish research reports with respect to the underlying equity, which may or may not recommend that investors buy or

hold the underlying equity.

|

|

|

§

|

Potential UBS impact on an underlying equity. Trading or transactions by UBS or its affiliates

in the underlying equity, listed and/or over the counter options, futures, exchange-traded funds or other instruments with return

linked to the performance of the underlying equity, may adversely affect the market price(s) or level(s) of the underlying equity

on the pricing date, any determination date or on the final determination date and, therefore, the market value of the securities

and any payout to you on the securities.

|

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

|

|

§

|

The antidilution protection of the underlying equity is limited and may be discretionary.

The calculation agent may make adjustments to the initial price, exchange ratio, downside threshold level, call threshold level,

the final price and/or any other term of the securities, for certain corporate events affecting the underlying equity. However,

the calculation agent will not make an adjustment in response to all events that could affect the underlying equity. If an event

occurs that does not require the calculation agent to make an adjustment, the value of, and the amount payable on, the securities

may be materially and adversely affected. You should also be aware that the calculation agent may make adjustments in response

to events that are not described in the accompanying product supplement to account for any diluting or concentrative effect, but

the calculation agent is under no obligation to do so or to consider your interests as a holder of the securities in making these

determinations.

|

|

|

§

|

Hedging and trading activities by the calculation agent and its affiliates could potentially

affect the value of, and the amount payable on, the securities. The hedging or trading activities of the issuer’s affiliates

and of any other hedging counterparty with respect to the securities on or prior to the strike date and prior to maturity could

adversely affect the value of, and the amount payable on, the securities. These hedging or trading activities on or prior to the

strike date could potentially affect the initial price and, as a result, could adversely affect the downside threshold level and

exchange ratio. Additionally, these hedging or trading activities during the term of the securities could potentially affect the

price of the underlying equity on the determination dates and, accordingly, whether the securities are redeemed early and, if the

securities are not called prior to maturity, the payout to you at maturity. It is possible that these hedging or trading activities

could result in substantial returns for us or our affiliates while the value of the securities declines.

|

|

|

§

|

The securities are not bank deposits. An investment in the securities carries risks which

are very different from the risk profile of a bank deposit placed with UBS or its affiliates. The securities have different yield

and/or return, liquidity and risk profiles and would not benefit from any protection provided to deposits.

|

|

|

§

|

If UBS experiences financial difficulties, FINMA has the power to open restructuring or liquidation

proceedings in respect of, and/or impose protective measures in relation to, UBS, which proceedings or measures may have a material

adverse effect on the terms and market value of the securities and/or the ability of UBS to make payments thereunder. The Swiss

Financial Market Supervisory Authority (“FINMA”) has broad statutory powers to take measures and actions in relation

to UBS if (i) it concludes that there is justified concern that UBS is over-indebted or has serious liquidity problems or (ii)

UBS fails to fulfill the applicable capital adequacy requirements (whether on a standalone or consolidated basis) after expiry

of a deadline set by FINMA. If one of these pre-requisites is met, FINMA is authorized to open restructuring proceedings or liquidation

(bankruptcy) proceedings in respect of, and/or impose protective measures in relation to, UBS. The Swiss Banking Act grants significant

discretion to FINMA in connection with the aforementioned proceedings and measures. In particular, a broad variety of protective

measures may be imposed by FINMA, including a bank moratorium or a maturity postponement, which measures may be ordered by FINMA

either on a stand-alone basis or in connection with restructuring or liquidation proceedings. The resolution regime of the Swiss

Banking Act is further detailed in the FINMA Banking Insolvency Ordinance (“BIO-FINMA”). In a restructuring proceeding,

FINMA, as resolution authority, is competent to approve the resolution plan. The resolution plan may, among other things, provide

for (a) the transfer of all or a portion of UBS’ assets, debts, other liabilities and contracts (which may or may not include

the contractual relationship between UBS and the holders of securities) to another entity, (b) a stay (for a maximum of two business

days) on the termination of contracts to which UBS is a party, and/or the exercise of (w) rights to terminate, (x) netting rights,

(y) rights to enforce or dispose of collateral or (z) rights to transfer claims, liabilities or collateral under contracts to which

UBS is a party, (c) the conversion of UBS’ debt and/or other obligations, including its obligations under the securities,

into equity (a “debt-to-equity” swap), and/or (d) the partial or full write-off of obligations owed by UBS (a “write-off”),

including its obligations under the securities. The BIO-FINMA provides that a debt-to-equity swap and/or a write-off of debt and

other obligations (including the securities) may only take place after (i) all debt instruments issued by UBS qualifying as additional

tier 1 capital or tier 2 capital have been converted into equity or written-off, as applicable, and (ii) the existing equity of

UBS has been fully cancelled. While the BIO-FINMA does not expressly address the order in which a write-off of debt instruments

other than debt instruments qualifying as additional tier 1 capital or tier 2 capital should occur, it states that debt-to-equity

swaps should occur in the following order: first, all subordinated claims not qualifying as regulatory capital; second, all other

claims not excluded by law from a debt-to-equity swap (other than deposits); and third, deposits (in excess of the amount privileged

by law). However, given the broad discretion granted to FINMA as the resolution authority, any restructuring plan in respect of

UBS could provide that the claims under or in connection with the securities will be partially or fully converted into equity or

written-off, while preserving other obligations of UBS that rank pari passu with, or even junior to, UBS’ obligations under

the securities. Consequently, holders of securities may lose all or some of their investment in the securities. In the case of

restructuring proceedings with respect to a systemically important Swiss bank (such as UBS), the creditors whose claims are affected

by the restructuring plan will not have a right to vote on, reject, or seek the suspension of the restructuring plan. In addition,

if a restructuring plan has been approved by FINMA, the rights of a creditor to seek judicial review of the restructuring plan

(e.g., on the grounds that the plan would unduly prejudice the rights of holders of securities or otherwise be in violation of

the Swiss Banking Act) are very limited. In particular, a court may not suspend the implementation of the restructuring plan. Furthermore,

even if a creditor successfully challenges the restructuring plan, the court can only require the relevant creditor to be compensated

ex post and there is currently no guidance as to on what basis such compensation would be calculated or how it would be funded.

|

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

|

|

§

|

Uncertain tax treatment. Significant aspects of the tax treatment of the securities are

uncertain. You should consult your tax advisor about your tax situation. See “Tax Considerations” herein and “Material

U.S. Federal Income Tax Consequences”, including the section “— Securities Treated as Investment Units Containing

a Debt Instrument and a Put Option Contract”, in the accompanying product supplement.

|

|

|

Buffered Income Auto-Callable Securities with Downside Leverage due on or about June 8, 2021

|

|

$n Based on the Performance of the Common Stock of Amazon.com, Inc.

Principal at Risk Securities

|

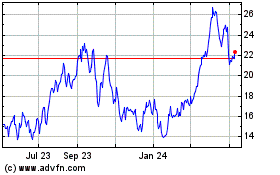

Information about the Underlying Equity

Amazon.com, Inc.

According to publicly available information,

Amazon.com, Inc. (“Amazon”) is an online retail company offering a variety of products sold by Amazon and third parties.

Amazon also manufactures and sells electronic devices, including Kindle e-readers, Fire tablets, Fire TVs and Echo. Information

filed by Amazon with the SEC can be located by reference to its SEC file number: 000-22513, or its CIK Code: 0001018724. Amazon’s

common stock is listed on the Nasdaq Global Select Market under the ticker symbol “AMZN.”

Information from outside sources is not

incorporated by reference in, and should not be considered part of, this document or any document incorporated herein by reference.

UBS has not conducted any independent review or due diligence of any publicly available information with respect to any underlying

equity.

Information as of market close on June 1, 2020:

|

Bloomberg Ticker Symbol:

|

AMZN UW <Equity>

|

52 Week High (on May 20, 2020):

|

$2,497.94

|

|

Current Stock Price:

|

$2,471.04

|

52 Week Low (on March 12, 2020):

|

$1,676.61

|

|

52 Weeks Ago (on May 31, 2019):

|

$1,775.07

|

|

|

All disclosures contained in this document

regarding the underlying equity are derived from publicly available information. UBS has not conducted any independent review or

due diligence of any publicly available information with respect to the underlying equity. You should make your own investigation

into the underlying equity.

The underlying equity is registered under