Current Report Filing (8-k)

June 02 2020 - 4:16PM

Edgar (US Regulatory)

0001657853

false

0000047129

false

8-K

2019-05-19

false

false

false

false

false

8501 Williams Road

Estero

Florida

301-7000

0001657853

2020-05-26

2020-05-27

0001657853

htz:TheHertzCorprationMember

2020-05-26

2020-05-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

|

Co-Registrant CIK

|

0000047129

|

|

Co-Registrant Amendment Flag

|

false

|

|

Co-Registrant Form Type

|

8-K

|

|

Co-Registrant DocumentPeriodEndDate

|

2019-05-19

|

|

Co-Registrant Written Communications

|

false

|

|

Co-Registrant Solicitating Materials

|

false

|

|

Co-Registrant PreCommencement Tender Offer

|

false

|

|

Co-Registrant PreCommencement Issuer Tender Offer

|

false

|

|

Co-Registrant Emerging Growth Company

|

false

|

|

|

8501 Williams Road

|

|

|

Estero

|

|

|

Florida 33928

|

|

|

239 301-7000

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 27, 2020

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant

as specified in its charter)

|

Delaware

|

|

001-37665

|

|

61-1770902

|

|

Delaware

|

|

001-07541

|

|

13-1938568

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

8501 Williams Road

Estero,

Florida 33928

239 301-7000

(Address, including Zip Code, and

telephone number, including area code,

of registrant's principal executive offices)

Not Applicable

Not Applicable

(Former name, former address and

former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange on which

Registered

|

|

Hertz Global Holdings, Inc.

|

|

Common Stock par value $0.01 per share

|

|

HTZ

|

|

New York Stock Exchange

|

|

The Hertz Corporation

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

ITEM 7.01

REGULATION FD DISCLOSURE.

On May 22, 2020, Hertz Global Holdings, Inc. (“Hertz Global”),

The Hertz Corporation (“THC,” and collectively with Hertz Global, “Hertz” or the “Company”)

and certain of their direct and indirect subsidiaries in the United States and Canada (but excluding, without limitation, (i) Hertz

International Limited, Hertz Holdings Netherlands BV (“Hertz Netherlands”) and the direct and indirect subsidiary companies

located outside of the United States and Canada (the “International Subsidiaries”) and (ii) Hertz Vehicle Financing

LLC, Hertz Vehicle Financing II LP, Hertz Fleet Lease Funding LP and certain other vehicle financing subsidiaries) (collectively,

the “Debtors”) filed voluntary petitions for relief (collectively, the “Petitions”) under chapter 11 of

title 11 (“Chapter 11”) of the United States Code in the United States Bankruptcy Court for the District of Delaware

(the “Bankruptcy Court”), thereby commencing Chapter 11 cases for the Debtors.

In connection

with the commencement of their Chapter 11 cases, the Debtors filed a number of motions with the Bankruptcy Court. Among these was

a motion to establish certain procedures to protect any potential value of the Company’s net operating loss carryforwards

and other tax attributes (the “NOLs,” and such motion, the “NOL Motion”). On May 27, 2020, the Bankruptcy

Court entered an interim order approving the NOL Motion (the “NOL Order”) and directing the Debtors, to, among other

things, provide notice of the NOL Order by annexing an approved notice thereof (the “Notice of NOL Order”) to a filing

on Form 8-K.

The NOL Order

establishes certain procedures (the “Procedures”) with respect to direct and indirect trading and transfers of stock

of the Company in order to protect any potential value of the Company’s NOLs for use in connection with the reorganization.

As approved on an interim basis, the Procedures restrict transactions involving, and require notices of the holdings of and proposed

transactions by, any person or group of persons that is or, as a result of such a transaction, would become, a Substantial Shareholder

of the common stock issued by the Company (the “Common Stock”). For purposes of the Procedures, a “Substantial

Shareholder” is any person or, in certain cases, group of persons that beneficially own, directly or indirectly (and/or owns

options to acquire) at least approximately 6.4 million shares of Common Stock (representing approximately 4.5% of all issued and

outstanding shares of Common Stock). Any prohibited transfer of Common Stock would be null and void from the beginning and may

lead to contempt, compensatory damages, punitive damages, or sanctions being imposed by the Bankruptcy Court. In addition, the

NOL Order establishes May 22, 2020 as the “Record Date” applicable to certain claims trading activity that may be governed

by additional procedures that the Debtors requested by the NOL Motion be established by a final order. These additional procedures

not yet approved by the Bankruptcy Court would (i) establish certain future circumstances under which any person, group of persons,

or entity holding, or which as a result of a proposed transaction may hold, a substantial amount of certain claims against the

Debtors may be required to file notice of its holdings of such claims and of proposed transactions involving such claims, which

transactions may be restricted, and (ii) describe certain limited circumstances thereafter under which such person(s) may be required

to sell, by a specified date, all or a portion of any such claims acquired during the Chapter 11 cases.

The Notice of

NOL Order setting forth the Procedures is furnished as Exhibit 99.1 to this current report and is

hereby incorporated by reference into this Item 7.01.

This same information

may also be found at https://restructuring.primeclerk.com/hertz/, the third party website maintained by Prime Clerk, the Debtors’

claims and noticing agent. A direct link to the Notice of NOL Order is as follows: https://restructuring.primeclerk.com/hertz/Home-DownloadPDF?id1=NDA1NTg5&id2=0

The

information contained in this Item 7.01 and Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference

into any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific

reference in such filing.

ITEM 8.01

OTHER EVENTS.

As previously disclosed, on May 22, 2020, Hertz Netherlands

and certain other International Subsidiaries entered into a limited waiver agreement in respect of the Issuer Facility Agreement,

dated as of September 25, 2018, between, among others, International Fleet Financing No.2 B.V. as issuer, Hertz Europe Limited

as issuer administrator, Credit Agricole Corporate and Investment Bank as administrative agent and BNP Paribas Trust Corporation

UK Limited as issuer security trustee, as amended, restated or otherwise modified from time to time (the “European ABS Waiver”)

pursuant to which the Waiving Parties (as defined therein) agreed to waive any default or event of default that could have resulted

from the Chapter 11 cases. The European ABS Waiver will expire on September 30, 2020 or, if sooner, the date on which Hertz Netherlands

or certain other International Subsidiaries that are party to the European ABS Waiver fail to comply with certain agreements contained

in the European ABS Waiver. The European ABS Waiver was conditioned on (i) the

waiver on similar terms of the VFN Issuance Facility Agreement, dated as of December 7, 2010,

(as amended and restated from time to time) by and among HA Fleet Pty Limited, as

issuer, Hertz Australia Pty Limited, as administrator, Westpac Banking Corporation as administrative agent, certain committed note

purchasers, certain conduit investors, certain funding agents for the investor groups and P.T. Limited, as security trustee, which

has been obtained and is in effect, (ii) the waiver on similar terms of the Vehicle Funding Facilities Agreement dated February

7, 2013 (as amended and restated from time to time) between Hertz (U.K.) Limited, Hertz Vehicle Financing U.K. Limited and Lombard

North Central Plc, which was obtained on May 27, 2020 and is in effect, and (iii) the waiver on similar terms of the €225,000,000

aggregate principal amount outstanding of 4.125% Senior Notes due 2021 and the €500,000,000 aggregate principal amount outstanding

of 5.500% Senior Notes due 2023, which was obtained on May 27, 2020 and is in effect. The conditions to the effectiveness of the

European ABS Waiver have been satisfied and Hertz Netherlands and the International Subsidiaries are not included in the Chapter

11 cases.

ITEM 9.01 EXHIBITS

(d) Exhibits

|

Exhibit

Number

|

|

Title

|

|

|

|

|

|

99.1

|

|

Notice of NOL Order

|

|

|

|

|

|

101.1

|

|

Pursuant to Rule 406 of Regulation S-T, the cover page to this Current Report on Form 8-K is formatted in Inline XBRL

|

|

|

|

|

|

104.1

|

|

Cover Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit 101.1)

|

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Current Report on form 8-K contains “forward-looking statements” within the meaning of federal securities laws. Words

such as “expect” and “intend” and similar expressions identify forward-looking statements, which include

but are not limited to statements related to our liquidity, the expected effects on our business, financial condition and results

of operations due to the spread of the COVID-19 virus, the bankruptcy process, the Company’s ability to obtain approval from

the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter

11 cases, the effects of the Chapter 11 cases, including increased professional costs, on the Company’s liquidity, results

of operations and business, the Company’s ability to comply with the continued listing criteria of the New York Stock Exchange

(the “NYSE”) and risks arising from the potential suspension of trading of the Company’s common stock on, or

delisting from, the NYSE, the effects of Chapter 11 on the interests of various constituents and the ability to negotiate, develop,

confirm and consummate a plan of reorganization. We caution you that these statements are not guarantees of future performance

and are subject to numerous evolving risks and uncertainties that we may not be able to accurately predict or assess, including

those in our risk factors that we identify in our most recent annual report on Form 10-K for the year ended December 31, 2019,

as filed with the Securities and Exchange Commission on February 25, 2020, and quarterly reports on Form 10-Q filed subsequent

thereto. We caution you not to place undue reliance on our forward-looking statements, which speak only as of the date of this

filing, and we undertake no obligation to update this information.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(each, a Registrant)

|

|

|

|

|

|

Dated: June 2, 2020

|

|

By:

|

|

/s/ JAMERE JACKSON

|

|

|

|

Name:

|

|

Jamere Jackson

|

|

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Title

|

|

|

|

|

|

99.1

|

|

Notice of NOL Order

|

|

|

|

|

|

101.1

|

|

Pursuant to Rule 406 of Regulation S-T, the cover page to this Current Report on Form 8-K is formatted in Inline XBRL

|

|

|

|

|

|

104.1

|

|

Cover Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit 101.1)

|

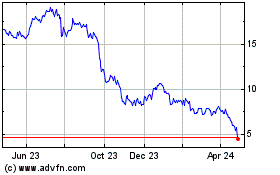

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

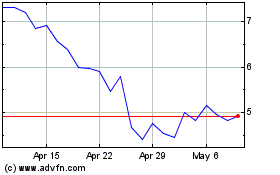

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024