By Tim Higgins

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 19, 2020).

Elon Musk's success last week restarting production at Tesla

Inc.'s lone U.S. factory ends one drama but sets up another with a

big question: Can the car maker park itself in the S&P 500?

Joining the index would bring the prestige of belonging to the

benchmark gauge of U.S. equities and drive index funds to race to

include the company's shares in their holdings.

Inclusion in the S&P 500 requires an accumulated profit over

four consecutive quarters. With Tesla's profit over its past three

quarters -- its longest run of profitability -- it may be able to

join the influential index if it can defy Wall Street's expectation

and eke out another this period.

The connection could help explain why Mr. Musk was so determined

to reopen the plant, which had been idled since March 23 by local

authorities trying to stem the spread of Covid-19, the disease

caused by the new coronavirus.

Analysts and other observers have puzzled over why Mr. Musk

pushed so aggressively to restart the Fremont, Calif., factory a

week earlier than local authorities anticipated -- including filing

a suit in federal court against the local authority that ordered

Tesla not to ramp up and daring authorities to arrest him (they

didn't). Mr. Musk has complained that competing car makers in other

states were being allowed to reopen when he wasn't.

"I don't think reopening a week or two later than the Detroit

three or transplants matters much in the long run, but it will

matter for [second-quarter] results," said David Whiston, an

analyst for Morningstar Research Services.

The local county on Monday cleared manufacturers to resume

production if Covid-19-related safety requirements are met. The

local police department that has inspected Tesla's U.S. plant said

"they were meeting or exceeding the specific safety protocols we

were asked to look at."

Mr. Musk didn't respond to a request for comment. Earlier this

month he surprised investors by saying he thought the company's

stock was too high, sending shares sharply lower only for them to

rebound in the following days. He didn't explain why he felt shares

were overvalued.

On its face, generating a profit in the April-to-June period

might seem improbable, given Tesla's lone U.S. car plant was idled

for about half that time. Analysts surveyed by FactSet predict

Tesla will report a loss of $387 million after deliveries fall 31%

from the first quarter to 67,000.

Tesla got close to meeting the S&P 500 profit requirement

already with its first-quarter results, but it fell short of a

cumulative four-quarter profit by about $144 million, with a $16

million profit that wasn't enough to offset losses in the second

quarter a year earlier. Its most recent quarter also must be

profitable, along with other requirements, for the S&P 500 to

consider adding the company. A spokesman for the index declined to

comment on an individual company.

Investor Gary Black, who has been long on Tesla since 2019 and

is the former chief executive of Aegon Asset Management, says

reopening the plant could help Tesla eke out a $2 million profit

for the second quarter. That is based on his estimates for delivery

of 80,000 vehicles helped by results in China and a backlog of

inventory that didn't make it customers at the end of the first

quarter, when the pandemic shut down much of the U.S. and

Europe.

A profit, he bets, will trigger Tesla's inclusion in the S&P

500. "I think it's 75% likely Tesla generates a GAAP profit of at

least $1 in 2Q, and if that happens, it's 100% likely S&P would

add Tesla to the S&P 500," he said in an email.

Inclusion in the S&P typically brings a rally for a

company's stock, though the gains don't necessarily last long.

Stock performance for companies added to the index between 1973 and

2018 usually fell behind the S&P a year after inclusion,

according to Ned Davis Research.

Tesla's stock price more than doubled in 2020 through Feb. 19,

when it closed at $917.42 a share -- giving it a market value of

more than $170 billion -- before falling as the coronavirus

pandemic hit the U.S. and roiled markets globally. After Tesla

posted a surprise first-quarter profit in late April, its shares

rallied. It again hit a $150 billion market value on May 8 -- the

day Mr. Musk said he was recalling workers to the Fremont factory.

Tesla shares finished trading Friday at $799.17, giving the company

a value of $148.1 billion.

Mr. Musk has a history of surprising Wall Street, sometimes by

triggering accounting levers not linked directly to car sales.

Tesla's surprise profit in the first quarter, when analysts

expected a loss, was aided by a surge in the sale of tax credits

that helped offset the drag on vehicle sales from the coronavirus

pandemic.

This quarter, Tesla has been pushing landlords for rent breaks

that could bolster its bottom line. It also furloughed workers

without pay, while also temporarily cutting salaries of others.

With work at Fremont now resuming, Tesla could enjoy about seven

weeks of production as long as suppliers -- some with their own

plants shut by local restrictions -- can deliver parts in time.

Tesla's only other assembly plant, in China, has been churning out

cars for much of the quarter after a brief Covid-19-linked pause

earlier this year. Any results are contingent on customers wanting

cars, which isn't a certainty amid fears of an extended

recession.

Tesla's China performance, where its local plant started

delivering Model 3 cars in December, could be pivotal to its

financial performance this quarter. Tesla sales rose strongly in

the market even as rival car makers were hard hit.

Tesla has orders in hand for future car deliveries, the

company's head of investor relations, Martin Viecha, told Deutsche

Bank, according to Deutsche analyst Emmanuel Rosner. "Tesla's

record backlog of orders should provide a strong pipeline of

deliveries regardless of near-term conditions," Mr. Rosner wrote to

investors last week.

Barclays PLC analyst Brian Johnson doubts Tesla can stay in the

black this quarter. He estimates the China factory probably will

make 39,000 vehicles in the period and Fremont will produce an

estimated 24,000 Model 3s during the period, as it will take

several weeks for the factory to return to a more normal rate of

building vehicles. The one extra week Mr. Musk pushed for is "not

enough to swing" a profit, he said.

Even if that happens, Mr. Musk may not have to wait long to

knock on the S&P's door. If Tesla posts a loss in the second

quarter, a rapid rebound in the third could still propel the car

maker to its cumulative goal. Analysts expect profitable third and

fourth quarters to bring Tesla a total annual profit of $190

million.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

May 19, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

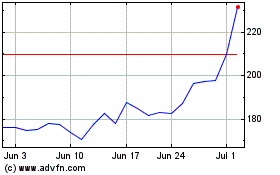

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024