UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2020

Commission File Number: 001-31995

MEDICURE

INC.

(Translation of registrant's name into English)

2-1250 Waverley Street

Winnipeg, MB Canada R3T 6C6

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F o

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes o

No x

If “Yes” is marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 8a72____.

EXHIBIT

LIST

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Medicure Inc. |

| |

(Registrant) |

| |

|

| |

|

|

| Date: May 12, 2020 |

By: |

/s/ Dr. Albert D. Friesen |

| |

Dr. Albert D. Friesen |

| |

Title: CEO |

Exhibit 99.1

Medicure Reports Financial Results for

Quarter Ended March 31, 2020

WINNIPEG, May 12, 2020 /CNW/ - Medicure Inc.

("Medicure" or the "Company") (TSXV:MPH, OTC:MCUJF), a cardiovascular pharmaceutical company,

today reported its results from operations for the quarter ended March 31, 2020.

Quarter Ended March 31, 2020 Highlights:

- Recorded

total net revenue from the sale of products of $3.0 million during the quarter ended March 31, 2020 compared to $4.9 million for

the quarter ended March 31, 2019;

- Recorded

total net revenue from the sale of AGGRASTAT® of $2.7 million during the quarter ended March 31, 2020 compared

to $4.8 million for the quarter ended March 31, 2019;

- Adjusted

earnings before interest, taxes, depreciation and amortization (EBITDA1) for the quarter ended March 31, 2020 was negative

$1.3 million compared to adjusted EBITDA of negative $1.7 million for the quarter ended March 31, 2019; and

- Net loss for the quarter

ended March 31, 2020 was $1.5 million compared to net loss of $2.8 million for the quarter ended March 31, 2019.

Financial Results

Net revenues for the three months ended March

31, 2020 were $3.0 million compared to $4.9 million for the three months ended March 31, 2019. Net revenues from AGGRASTAT®

for the three months ended March 31, 2020 were $2.7 million compared to $4.8 million for the three months ended March 31, 2019.

ZYPITAMAGTM and SNP contributed $163,000 and $31,000, respectively during the three months ended March 31, 2020. Additionally,

ReDSTM contributed net revenue of $89,000 for the three months ended March 31, 2020 compared to $103,000 for the three

months ended March 31, 2019.

The Company continues to show strong patient

market share with AGGRASTAT®, however, the market share is offset by increased price competition caused by enhanced

generic Integrilin competition, which resulted in lower discounted prices for AGGRASTAT® into the first quarter

of 2020. There was also decreases in the volume of the product sold compared to 2019. The Company is beginning to see an increase

in demand for ZYPITAMAGTM and expects growth in ZYPITAMAGTM revenues going forward.

Adjusted EBITDA for the three months ended

March 31, 2020 was negative $1.3 million compared to negative $1.7 million for the three months ended March 31, 2019. The change

in adjusted EBITDA for the three months ended March 31, 2020 is the result of lower selling, general and administration and research

and development expenses, partially offset by lower revenues during the three months ended March 31, 2020 when compared to the

same period in 2019.

Net loss for the three months ended March 31,

2020 was $1.5 million or $0.14 per share compared to net loss of $2.8 million or $0.18 per share for the three months ended March

31, 2019. The change in the net loss for the three months ended March 31, 2020 is the result of lower selling, general and administration

and research and development expenses and a gain on foreign exchange, partially offset by lower revenues experienced during

the three months ended March 31, 2020 when compared to the three months ended March 31, 2019.

At March 31, 2020, the Company had unrestricted

cash totaling $12.7 million consistent with the $13.0 million of unrestricted cash held as of December 31, 2019. Cash flows used

in operating activities for the three months ended March 31, 2020 totaled $822,000 compared to $1.9 million for the three months

ended March 31, 2019.

All amounts referenced herein are in Canadian

dollars unless otherwise noted.

Notes

(1) The Company defines EBITDA

as "earnings before interest, taxes, depreciation, amortization and other income or expense" and Adjusted EBITDA as "EBITDA

adjusted for non-cash and non-recurring items". The terms "EBITDA" and "Adjusted EBITDA", as it relates

to the three months ended March 31, 2020 and 2019 results prepared using IFRS, do not have any standardized meaning according to

IFRS. It is therefore unlikely to be comparable to similar measures presented by other companies.

Conference Call Info:

Topic: Medicure's Q1 2020 Results

Call date: Wednesday, May 13, 2020

Time: 7:30 AM Central Time (8:30 AM Eastern

Time)

Canada toll: 1 (416) 764-8659

North American toll-free: 1 (888) 664-6392

Passcode: not required

Webcast: This conference call will be

webcast live over the internet and can be accessed from the Medicure investor relations page at the following link: http://www.medicure.com/investors

You may request international country-specific

access information by e-mailing the Company in advance. Management will accept and answer questions related to the financial results

and operations during the question-and-answer period at the end of the conference call. A recording of the call will be available

following the event at the Company's website.

About Medicure Inc.

Medicure is a pharmaceutical company focused on the development and commercialization of therapies for the U.S. cardiovascular

market. The present focus of the Company is the marketing and distribution of AGGRASTAT® (tirofiban hydrochloride)

injection, ZYPITAMAGTM (pitavastatin) tablets and the ReDS™ device in the United States, where they are sold through

the Company's U.S. subsidiary, Medicure Pharma Inc. For more information on Medicure please visit www.medicure.com.

To be added to Medicure's e-mail list, please

visit: http://medicure.mediaroom.com/alerts

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy

or accuracy of this release.

Forward Looking Information: Statements

contained in this press release that are not statements of historical fact, including, without limitation, statements containing

the words "believes", "may", "plans", "will", "estimates", "continues",

"anticipates", "intends", "expects" and similar expressions, may constitute "forward-looking

information" within the meaning of applicable Canadian and U.S. federal securities laws (such forward-looking information

and forward-looking statements are hereinafter collectively referred to as "forward-looking statements"). Forward-looking

statements, include estimates, analysis and opinions of management of the Company made in light of its experience and its perception

of trends, current conditions and expected developments, as well as other factors which the Company believes to be relevant and

reasonable in the circumstances. Inherent in forward-looking statements are known and unknown risks, uncertainties and other factors

beyond the Company's ability to predict or control that may cause the actual results, events or developments to be materially different

from any future results, events or developments expressed or implied by such forward-looking statements, and as such, readers are

cautioned not to place undue reliance on forward-looking statements. Such risk factors include, among others, the Company's future

product revenues, expected future growth in revenues, stage of development, additional capital requirements, risks associated with

the completion and timing of clinical trials and obtaining regulatory approval to market the Company's products, the ability to

protect its intellectual property, dependence upon collaborative partners, changes in government regulation or regulatory approval

processes, and rapid technological change in the industry. Such statements are based on a number of assumptions which may prove

to be incorrect, including, but not limited to, assumptions about: general business and economic conditions; the impact of changes

in Canadian-US dollar and other foreign exchange rates on the Company's revenues, costs and results; the timing of the receipt

of regulatory and governmental approvals for the Company's research and development projects; the availability of financing for

the Company's commercial operations and/or research and development projects, or the availability of financing on reasonable terms;

results of current and future clinical trials; the uncertainties associated with the acceptance and demand for new products and

market competition. The foregoing list of important factors and assumptions is not exhaustive. The Company undertakes no obligation

to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, other than as may be required

by applicable legislation. Additional discussion regarding the risks and uncertainties relating to the Company and its business

can be found in the Company's other filings with the applicable Canadian securities regulatory authorities or the US Securities

and Exchange Commission, and in the "Risk Factors" section of its Form 20F for the year ended December 31, 2019.

AGGRASTAT® (tirofiban hydrochloride)

is a registered trademark of Medicure International Inc.

Condensed Consolidated Interim Statements

of Financial Position

(expressed in thousands of Canadian dollars, except per share amounts)

(unaudited)

| |

|

|

| |

March 31, 2020 |

December 31, 2019 |

| Assets |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ |

12,688 |

$ |

12,965 |

| Accounts receivable |

9,700 |

10,216 |

| Inventories |

8,020 |

6,328 |

| Prepaid expenses |

1,965 |

1,855 |

| Total current assets |

32,373 |

31,364 |

| Non-current assets: |

|

|

| Property, plant and equipment |

1,207 |

1,282 |

| Intangible assets |

9,844 |

9,599 |

| Other assets |

39 |

39 |

| Total non-current assets |

11,090 |

10,920 |

| Total assets |

$ |

43,463 |

$ |

42,284 |

| |

|

|

| Liabilities and Equity |

|

|

| Current liabilities: |

|

|

| Accounts payable and accrued liabilities |

$ |

10,064 |

$ |

9,384 |

| Current portion of royalty obligation |

1,010 |

872 |

| Current portion of acquisition payable |

709 |

649 |

| Income taxes payable |

564 |

517 |

| Current portion of lease obligation |

249 |

240 |

| Total current liabilities |

12,596 |

11,662 |

| Non-current liabilities |

|

|

| Royalty obligation |

1,176 |

1,176 |

| Acquisition payable |

1,852 |

1,655 |

| Lease obligation |

793 |

849 |

| Total non-current liabilities |

3,821 |

3,680 |

| Total liabilities |

16,417 |

15,342 |

| Equity: |

|

|

| Share capital |

85,364 |

85,364 |

| Warrants |

1,949 |

1,949 |

| Contributed surplus |

8,105 |

8,028 |

| Accumulated other comprehensive income |

(4,260) |

(5,751) |

| Deficit |

(64,112) |

(62,648) |

| Total Equity |

27,046 |

26,942 |

| Total liabilities and equity |

$ |

43,463 |

$ |

42,284 |

Condensed Consolidated Interim Statements

of Net Loss and Comprehensive Income (Loss)

(expressed in thousands of Canadian dollars, except per share amounts)

(unaudited)

| |

|

|

| For the three months ended March 31 |

2020 |

2019 |

| |

|

|

| Revenue, net |

$ |

3,010 |

$ |

4,880 |

| Cost of goods sold |

1,542 |

1,038 |

| Gross profit |

1,468 |

3,842 |

| |

|

|

| Expenses |

|

|

| Selling |

2,069 |

4,128 |

| General and administrative |

800 |

935 |

| Research and development |

858 |

921 |

| |

3,727 |

5,984 |

| |

|

|

| Finance (income) costs: |

|

|

| Finance expense (income), net |

73 |

(190) |

| Foreign exchange (gain) loss, net |

(868) |

881 |

| |

(795) |

691 |

| Net loss before income taxes |

$ |

(1,464) |

$ |

(2,833) |

| |

|

|

| Income tax recovery |

|

|

| Current |

- |

(77) |

| |

- |

(77) |

| Net loss |

$ |

(1,464) |

$ |

(2,756) |

| |

|

|

| Other comprehensive income (loss): |

|

|

| Item that may be reclassified to profit or loss |

|

|

Exchange differences on translation

of foreign subsidiaries |

1,491 |

(834) |

| |

|

|

| Item that will not be reclassified to profit or loss: |

|

|

| Revaluation of investment in Sensible Medical at FVOCI |

- |

117 |

| Other comprehensive income (loss), net of tax |

1,491 |

(717) |

| Comprehensive income (loss) |

$ |

27 |

$ |

(3,473) |

| |

|

|

| Loss per share |

|

|

| Basic |

$ |

(0.14) |

$ |

(0.18) |

| Diluted |

$ |

(0.14) |

$ |

(0.18) |

Condensed Consolidated Interim Statements

of Cash Flows

(expressed in thousands of Canadian dollars, except per share amounts)

(unaudited)

| |

|

|

| For the three months ended March 31 |

2020 |

2019 |

| Cash (used in) provided by: |

|

|

| Operating activities: |

|

|

| Net loss for the period |

$ |

(1,464) |

$ |

(2,756) |

| Adjustments for: |

|

|

| Current income tax recovery |

- |

(77) |

| Amortization of property, plant and equipment |

75 |

122 |

| Amortization of intangible assets |

608 |

183 |

| Share-based compensation |

77 |

122 |

| Write-down of inventories |

207 |

|

| Finance expense (income), net |

73 |

(190) |

| Unrealized foreign exchange loss |

401 |

867 |

| Change in the following: |

|

|

| Accounts receivable |

516 |

2,752 |

| Inventories |

(1,899) |

(36) |

| Prepaid expenses |

(110) |

(341) |

| Accounts payable and accrued liabilities |

680 |

(3,046) |

| Interest received, net |

14 |

969 |

| Royalties paid |

- |

(462) |

| Cash flows used in operating activities |

(822) |

(1,893) |

| Investing activities: |

|

|

| Investment in Sensible Medical |

- |

(6,337) |

| Redemptions of short-term investments |

- |

2,313 |

| Acquisition of property, plant and equipment |

- |

(164) |

| Acquisition of intangible assets |

- |

(7,038) |

| Cash flows used in investing activities |

- |

(11,226) |

| Financing activities: |

|

|

| Purchase of common shares under normal course issuer bid |

- |

(899) |

| Cash flows used in financing activities |

- |

(899) |

| Foreign exchange gain (loss) on cash held in foreign currency |

545 |

(14) |

| Decrease in cash and cash equivalents |

(277) |

(14,032) |

| Cash and cash equivalents, beginning of period |

12,965 |

24,139 |

| Cash and cash equivalents, end of period |

$ |

12,688 |

$ |

10,107 |

View

original content:http://www.prnewswire.com/news-releases/medicure-reports-financial-results-for-quarter-ended-march-31-2020-301057838.html

View

original content:http://www.prnewswire.com/news-releases/medicure-reports-financial-results-for-quarter-ended-march-31-2020-301057838.html

SOURCE Medicure Inc.

View

original content: http://www.newswire.ca/en/releases/archive/May2020/12/c8428.html

View

original content: http://www.newswire.ca/en/releases/archive/May2020/12/c8428.html

%CIK: 0001133519

For further information: James Kinley, Chief Financial Officer,

Tel. 888-435-2220, Fax 204-488-9823, E-mail: info@medicure.com, www.medicure.com

CO: Medicure Inc.

CNW 17:30e 12-MAY-20

This regulatory filing also includes additional resources:

ex991.pdf

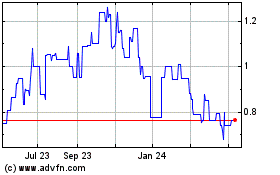

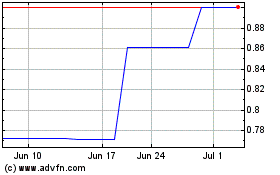

Medicure (PK) (USOTC:MCUJF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Medicure (PK) (USOTC:MCUJF)

Historical Stock Chart

From Apr 2023 to Apr 2024