Current Report Filing (8-k)

May 11 2020 - 4:03PM

Edgar (US Regulatory)

0001289460

false

0001289460

2020-05-10

2020-05-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

May 11, 2020

TEXAS ROADHOUSE, INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

000-50972

|

|

20-1083890

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

6040 Dutchmans Lane, Louisville, KY

|

|

40205

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code (502) 426-9984

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant

to Section 12(b) of the Act:

|

Title of each Class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

TXRH

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

As previously disclosed, Texas Roadhouse,

Inc. and certain of its subsidiaries are parties to that certain Amended and Restated Credit Agreement dated August 7, 2017 (the

“Amended Credit Agreement”). The Amended Credit Agreement is a revolving credit agreement under which we can borrow

up to $200.0 million with the option to increase the credit facility by an additional $200.0 million (subject to certain limitations

set forth in the Amended Credit Agreement). The material terms of the Amended Credit Agreement are described under “Note

5 – Long-term Debt” of the Notes to Consolidated Financial Statements for Texas Roadhouse, Inc. and its subsidiaries,

which Note 5 is included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Securities

and Exchange Commission on February 28, 2020, and which description is incorporated herein by reference.

As further disclosed, we previously borrowed

a total of $190.0 million under our Amended Credit Agreement in two separate transactions during March. Following the receipt of

such transactions, we had a total of $198.2 million outstanding (including $8.2 million of outstanding letters of credit) under

the Amended Credit Agreement. The current interest for such borrowings under the Amended Credit Agreement is a blended rate of

approximately 2.27%.

On May 11, 2020 and as a precautionary measure,

we entered into that certain Amendment No. 1 to Amended and Restated Credit Agreement (the “Amendment”) amending the

terms and conditions of the Amended Credit Agreement with a syndicate of commercial lenders led by JPMorgan Chase Bank, N.A., PNC

Bank, National Association, Wells Fargo Bank, National Association, U.S. Bank National Association, and Old National Bank. The

Amendment provides for a senior 364-day incremental revolving credit facility under the Amended Credit Agreement in the aggregate

principal amount of up to $82.5 million. These amounts are applied against the additional $200.0 million that was otherwise available

under the Amended Credit Agreement so that we have the ability to increase the credit facility under the Amended Credit Agreement,

as amended by the Amendment, by an additional $117.5 million following the execution of the Amendment (subject to certain limitations

described in the Amended Credit Agreement). The maturity date for such incremental revolving credit facility is May 10, 2021; however,

the maturity date for all other borrowings under the Amended Credit Agreement remains August 5, 2022.

Under the Amendment,

with respect to any borrowing other than the incremental revolving credit facility described in the Amendment, we are required

to pay interest on any outstanding borrowing at LIBOR plus 1.50% and to pay a commitment fee of 0.25% per year for any unused portion

of the credit facility through the end of the first quarter of our 2021 fiscal year. Subsequent to the first quarter of our 2021

fiscal year, we are required to pay interest on our outstanding borrowing at LIBOR plus 0.875% to 2.250% and to pay a commitment

fee of 0.125% to 0.400% per year for any unused portion of the credit facility, in each case depending on our leverage ratio. With

respect to the incremental revolving credit facility described in the Amendment, we are required to pay interest on any outstanding

borrowing at LIBOR plus 2.250% and to pay a commitment fee of 0.500% per year for any unused portion of the incremental revolving

credit facility. The Amendment also provides an Alternate Base Rate that may be substituted for LIBOR for any borrowings outstanding.

The Amendment also

modifies the financial covenants contained in the Amended Credit Agreement. The Amended Credit Agreement, as amended by the Amendment,

imposes the financial covenants of maintaining a fixed charge coverage ratio to be less than the following: (i) 1.00 to 1.00 for

the second, third and fourth fiscal quarters for our 2020 fiscal year and the first fiscal quarter for our 2021 fiscal year; and

(ii) 2.00 to 1.00 for each fiscal quarter thereafter. Additionally, the Amended Credit Agreement, as amended by the Amendment,

imposes the financial covenants of maintaining a maximum leverage ratio to be less than the following: (a) 3.50 to 1:00 for the

second fiscal quarter for our 2020 fiscal year; (b) 4.50 per 1.00 for the third and fourth fiscal quarters for our 2020 fiscal

year; (c) 3.75 to 1.00 for the first fiscal quarter for our 2021 fiscal year; and (d) 3.00 to 1.00 for each fiscal quarter thereafter.

The lenders’ obligations to extend credit under the Amended Credit Agreement, as amended by the Amendment, will depend upon

our compliance with these covenants.

Fees and expenses incurred

in connection with the Amendment were paid from cash on hand.

The Obligations

pursuant to the Amended Credit Agreement, as amended by the Amendment, can be accelerated upon an Event of Default, as such

terms are defined in the Amended Credit Agreement. The description of the Amended Credit Agreement, before execution of the

Amendment, is qualified in its entirety by the copy thereof which is attached as Exhibit 10.1 to our Current Report on Form

8-K dated August 7, 2017 and incorporated herein by reference. The description of the Amendment is qualified in its entirety by the copy thereof which is attached hereto as Exhibit 10.1

and incorporated herein by reference.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

Concurrently with the execution of the

Amendment and as a precautionary measure, we provided notice to the lenders under the Amendment of our desire to exercise our

right to borrow on the senior 364-day incremental revolving credit facility under the Amended Credit Agreement in the

aggregate principal amount of up to $50.0 million so that a total of $248.2 million will be outstanding (including $8.2

million of outstanding letters of credit) following receipt of such additional $50.0 million draw down. As of the date of

this Current Report on Form 8-K, we still remain in compliance with all financial covenants set forth in the

Amended Credit Agreement, as amended by the Amendment.

In light of the continued uncertainty in

the global markets resulting from the COVID-19 outbreak, we increased our borrowing as a precautionary measure in order to bolster

our cash position and further enhance financial flexibility. The proceeds from these borrowings are being held on our balance sheet

and may in the future be used for general corporate purposes, including, without limitation, working capital, capital expenditures

in the ordinary course of business, or other lawful corporate purposes, all in accordance with and subject to the terms and conditions

of the Amended Credit Agreement.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

Forward-looking Statements

This

Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section

21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to

the continued potential impact of the COVID-19 outbreak and other non-historical statements. Such statements are based upon

the current beliefs and expectations of the management of Texas Roadhouse. Actual results may vary materially from those contained

in forward-looking statements based on a number of factors including, without limitation, conditions beyond our control such as

weather, natural disasters, disease outbreaks, epidemics or pandemics impacting our customers or food supplies; food safety and

food-borne illness concerns; and other factors disclosed from time to time in our filings with the U.S. Securities and Exchange

Commission. Accordingly, there are or will be important factors that could cause actual outcomes

or results to differ materially from those indicated in these statements. These factors include but are not limited to those described

under “Part I—Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31,

2019 and other subsequent filings on Form 10-Q and Form 8-K. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary

statements that are included in this Current Report on Form 8-K and in our other filings with the Securities and Exchange Commission.

Investors should take such risks into account when making investment decisions. Shareholders and other readers are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake

no obligation to update any forward-looking statements, except as required by applicable law.

INDEX TO EXHIBITS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

TEXAS ROADHOUSE, INC.

|

|

|

|

|

|

|

|

|

|

Date: May 11, 2020

|

By:

|

/s/ Tonya Robinson

|

|

|

|

Tonya Robinson

|

|

|

|

Chief Financial Officer

|

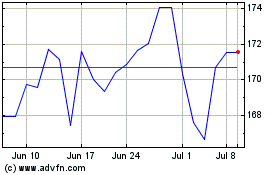

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Mar 2024 to Apr 2024

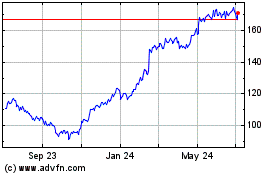

Texas Roadhouse (NASDAQ:TXRH)

Historical Stock Chart

From Apr 2023 to Apr 2024