U.K. Telecom Units Join In Rare Megamerger Amid Global Pandemic -- WSJ

May 08 2020 - 3:02AM

Dow Jones News

By Julie Steinberg and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 8, 2020).

John Malone's Liberty Global PLC agreed to combine its U.K.

telecommunications business with that of Spain's Telefónica SA,

creating a telecom giant worth nearly $39 billion in the biggest

deal since the global coronavirus shutdown started.

The timing is unusual. Global deal-making across many sectors

has been sidelined, with companies shelving plans for potentially

risky tie-ups until the impact of the crisis on their businesses

and the global economy is clearer.

Under the deal, Liberty's Virgin Media would merge with

Telefónica's O2, pooling the two companies' 46 million video,

broadband and mobile subscribers, the companies said Thursday. The

units generated GBP11 billion ($13.6 billion) in combined annual

revenue in 2019.

The deal values Virgin Media at GBP18.7 billion, including debt,

and O2 at GBP12.7 billion.

The pandemic is underscoring the need for telecom companies to

offer packages of cable, internet, wireless and landline-phone

services on a single bill -- so-called quad-play packages.

Providing these services can help retain customers, a key

consideration as consumers look to cut costs and providers seek to

make their existing services stickier, some bankers say.

Another consideration is the skyrocketing use of internet

services as customers work from home, a boon for telecom companies.

This makes it easier for them to pursue a deal at a time when

companies from sectors suffering more adverse effects from the

crisis would be unable or unwilling to.

The companies began talking in earnest around December,

according to people close to the deal, and face-to-face meetings

between executives stopped after March 11, Telefónica Chief

Operating Officer Angel Vilá said at a news conference

Thursday.

Teams in Denver, London, Madrid and Amsterdam made hundreds of

video calls to crunch the numbers, hammer out regulatory matters

and negotiate the terms of the deal, the people close to the

situation said. The calls necessarily involved barking dogs and

screaming children, they said.

Like many working from home, executives' attire ranged from

athletic gear to jeans to nicer shirts. One person said he was

gently ribbed about too many boxes cluttering up his background,

but that he made sure a picture that was also visible was a nice

one.

Typically, deals require site visits as part of due diligence,

which couldn't happen under the lockdown, but people familiar with

the deal said the companies were already familiar with each other's

assets.

Mr. Malone earned the nickname the "Cable Cowboy" for knitting

together a cable empire in the U.S. More recently, he has tried to

do the same thing overseas, focused on internet delivery, with

Liberty Global, a U.K.-incorporated media giant run out of

Denver.

The efforts come amid the fitful global emergence of 5G,

networks that promise faster downloads that can handle what

industry experts say will be an explosion of video content

consumption. The new technology also promises to usher in more

connected devices, at home and across businesses.

The deal promises savings of GBP6.2 billion, the companies said.

As part of the terms of the merger, which the companies said

includes recapitalization financings, Telefónica will receive

GBP5.7 billion in cash. That includes an equalization payment to

Telefónica of GBP2.5 billion to account for the difference in value

and debt of the two units. Liberty will get GBP1.4 billion of

proceeds in the transaction, stemming from the recapitalization

financings, the companies said.

One person close to the deal said its structure wasn't

contingent on either company's individual valuations, and the

pandemic didn't play a meaningful role because the companies aren't

overly relying on the stock or bond markets to get it done.

The deal doesn't include Virgin Media's Ireland business, which

Liberty Global will keep.

Liberty Global said the deal would marry Virgin Media's strong

position in broadband and entertainment offerings in the U.K. with

O2's reliable telecom network. "We're committed to this market,"

said Liberty Global Chief Executive Mike Fries.

Global deal-making during the pandemic has slowed, bankers and

corporate executives say. Some $700 billion worth of mergers and

acquisitions have been announced since the beginning of the year,

down from $1.2 trillion a year earlier, according to Dealogic.

--Mauro Orru contributed to this article.

Write to Julie Steinberg at julie.steinberg@wsj.com and Ben

Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

May 08, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

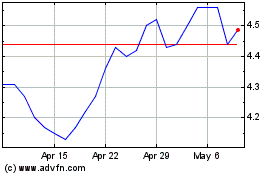

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

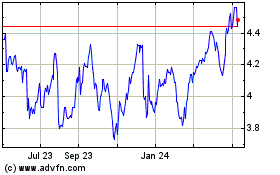

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024