Profound Medical Corp. (NASDAQ:PROF; TSX:PRN) (“Profound” or the

“Company”), the only company to provide customizable, incision-free

therapies which combine real-time Magnetic Resonance Imaging

(“MRI”), thermal ultrasound and closed-loop temperature feedback

control for the radiation-free ablation of diseased tissue, today

reported financial results for the first quarter ended March 31,

2020, and provided an update on its operations.

Recent Corporate Highlights

- On January 10, 2020, Profound

announced its first-ever U.S. multi-site imaging center agreement

for TULSA-PRO® with RadNet, Inc. (NASDAQ:RDNT), a national leader

in providing high-quality, cost-effective, fixed-site outpatient

diagnostic imaging services through a network of 340 owned and/or

operated outpatient imaging centers.

- On January 10, 2020, Profound also

announced that it had submitted its application for a Healthcare

Common Procedure Coding System C-Code from the Centers for Medicare

& Medicaid Services for the TULSA-PRO® procedure.

- On January 27, 2020, the Company closed an underwritten

offering of common shares, including the full exercise of the

over-allotment option, for gross proceeds of

US$39,522,625.

- On February 4, 2020, Profound announced that it had retired its

$12.5 million in principal amount loan with Canadian Imperial Bank

of Commerce approximately 30 months ahead of schedule, thereby

extinguishing all of its long-term debt.

- On March 4, 2020, Profound

presented at Cowen and Company’s 40th Annual Health Care

Conference.

- On March 18, 2020, Profound

participated in a series of one-on-one virtual meetings with

institutional investors in lieu of the in-person BTIG Annual

Healthcare Conference originally scheduled to take place in

Snowbird, UT.

- On April 3, 2020, Profound launched

a TULSA procedure website, www.tulsaprocedure.com, as a resource

for patients with prostate disease.

“During the first quarter of 2020, we made

important progress on our U.S. TULSA-PRO® commercialization

strategy by executing a multi-site imaging center agreement with

RadNet, as well as supporting TULSA-PRO® installations at Vituro

Health’s center in Sarasota, FL and the Busch Center in Alpharetta,

GA, both of which are now treating patients,” said Arun Menawat,

Profound’s CEO. “Importantly, patients can now find up-to-date

information on where the TULSA Procedure is available, both within

the U.S. and internationally, on our recently launched TULSA

procedure website, which features an enhanced TULSA Center Locator

Page and contact forms to reach out to each center directly. As a

growing resource for prostate patients, the website will provide

regular updates, blog posts and patient testimonials to provide

every visitor with clear and accurate information.”

Summary First Quarter 2020

Results

All amounts, unless specified otherwise, are

expressed in Canadian dollars and are presented in accordance with

International Financial Reporting Standards as issued by the

International Accounting Standards Board, applicable to the

preparation of interim financial statements, including IAS 34,

Interim Financial Reporting.

For the first quarter ended March 31, 2020, the

Company recorded revenue of $1,560,218, with $1,357,539 from the

sale of product, $41,085 from lease of medical device revenue and

$161,594 from installation and training services. First quarter

2020 revenue increased approximately 6% from $1,475,788 in the same

three-month period a year ago.

The Company recorded a net loss for the three

months ended March 31, 2020 of $3,607,693, or $0.25 per common

share, compared to a net loss of $2,962,686 or $0.27 per common

share, for the three months ended March 31, 2019. The increase in

net loss was primarily attributed to an increase in research and

development (“R&D”) expense of $161,471, an increase in general

and administration (“G&A”) expenses of $1,539,114, an increase

in selling and distribution expenses of $1,783,674 and a decrease

in gross profits of $347,822. This was offset by a decrease in net

finance costs of $3,241,009.

Expenditures for R&D for the three months

ended March 31, 2020 were higher by $161,471 compared to the three

months ended March 31, 2019. Materials, consulting fees and share

based compensation increased by $173,407, $89,615, and $120,377,

respectively. These increases were due to increased spending and

testing for R&D projects and additional system applications,

reimbursement of consultants and options awarded to employees.

Offsetting these amounts were reductions in salaries and benefits,

software and other expenses which decreased by $156,735, $38,947

and $30,624, respectively, resulting from decreased R&D

personnel, lower software and hardware costs and an overall

decrease in the general R&D expenditures.

G&A expenses for the three months ended

March 31, 2020 increased by $1,539,114 compared to the three months

ended March 31, 2019. Salaries and benefits, consulting fees, share

based compensation, insurance, software and other expenses

increased by $591,560, $230,059, $213,956, $409,517, $59,964 and

$58,415, respectively, due to salary increases and bonuses awarded

to management, increased costs associated with being Nasdaq listed,

options vesting during the period, increased insurance costs

associated with being Nasdaq listed, increased software costs for

cybersecurity and overall increase in general costs. Depreciation

expenses decreased by $20,781 due to certain assets being fully

depreciated.

Liquidity and Outstanding Share

Capital

As at March 31, 2020, the Company had cash of

$61,900,725.

As at May 7, 2020, Profound had an unlimited

number of authorized common shares with 16,082,577 common shares

issued and outstanding.

For complete financial results, please see our

filings at www.sedar.com and our website at

www.profoundmedical.com.

Conference Call Details

Profound Medical is pleased to invite all

interested parties to participate in a conference call today, May

7, 2020, at 4:30 pm ET during which time the results will be

discussed.

|

Live Call: |

|

1-877-407-9210 (Canada and the United States) |

|

| |

|

1-201-689-8049

(International) |

|

| |

|

|

|

| Replay: |

|

1-919-882-2331 |

|

| Replay ID: |

|

34270 |

|

The call will also be broadcast live and

archived on the Company's website at www.profoundmedical.com under

"Webcasts" in the Investors section.

About Profound Medical

Corp.

Profound is a commercial-stage medical device

company that develops and markets customizable, incision-free

therapies for the ablation of diseased tissue.

Profound is commercializing TULSA-PRO®, a

technology that combines real-time MRI, robotically-driven

transurethral ultrasound and closed-loop temperature feedback

control. TULSA-PRO® is designed to provide customizable and

predictable radiation-free ablation of a surgeon-defined prostate

volume while actively protecting the urethra and rectum to help

preserve the patient’s natural functional abilities.

TULSA-PRO® has the potential to be a flexible technology in

customizable prostate ablation, including intermediate stage

cancer, localized radio-recurrent cancer, retention and hematuria

palliation in locally advanced prostate cancer, and the transition

zone in large volume benign prostatic hyperplasia (BPH). TULSA-PRO®

is CE marked, Health Canada approved, and 510(k) cleared by the

U.S. Food and Drug Administration.

Profound is also commercializing Sonalleve®, an

innovative therapeutic platform that is CE marked for the treatment

of uterine fibroids and palliative pain treatment of bone

metastases. Sonalleve® has also been approved by the China

National Medical Products Administration for the non-invasive

treatment of uterine fibroids. The Company is in the early stages

of exploring additional potential treatment markets for

Sonalleve® where the technology has been shown to have

clinical application, such as non-invasive ablation of abdominal

cancers and hyperthermia for cancer therapy.

Forward-Looking Statements

This release includes forward-looking statements

regarding Profound and its business which may include, but is not

limited to, the expectations regarding the efficacy of Profound’s

technology in the treatment of prostate cancer, uterine fibroids

and palliative pain treatment. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "is expected", "expects", "scheduled", "intends",

"contemplates", "anticipates", "believes", "proposes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Such

statements are based on the current expectations of the management

of Profound. The forward-looking events and circumstances discussed

in this release, may not occur by certain specified dates or at all

and could differ materially as a result of known and unknown risk

factors and uncertainties affecting the company, including risks

regarding the pharmaceutical industry, economic factors, the equity

markets generally and risks associated with growth and competition.

Although Profound has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be

other factors that cause actions, events or results to differ from

those anticipated, estimated or intended. Except as required by

applicable securities laws, forward-looking statements speak only

as of the date on which they are made and Profound undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events,

or otherwise, other than as required by law.

COVID-19

The COVID-19 outbreak has been declared a

pandemic by the World Health Organization. It is too soon to gauge

the impacts of the current outbreak, given the many unknowns

related to COVID-19 including the duration and severity of the

outbreak. COVID-19 is altering business and consumer activity in

affected areas and beyond. The global response to the COVID-19

outbreak has resulted in, among other things, border closures,

severe travel restrictions, the temporary shut-down of

non-essential services and extreme fluctuations in financial and

commodity markets. Additional measures may be implemented by one or

more governments in jurisdictions where the Company operates. These

measures have caused material disruption to businesses globally,

resulting in an economic slowdown. The extent to which COVID-19 and

any other pandemic or public health crisis impacts the Company’s

business, affairs, operations, financial condition, liquidity,

availability of credit and results of operations will depend on

future developments that are highly uncertain and cannot be

predicted with any meaningful precision, including new information

which may emerge concerning the severity of the COVID-19 virus and

the actions required to contain the COVID-19 virus or remedy its

impact, among others.

The actual and threatened spread of COVID-19

globally could also have a material adverse effect on the regional

economies in which the Company operates, could continue to

negatively impact stock markets, including the trading price of

Profound’s Common Shares, could adversely impact the Company’s

ability to raise capital, and could cause continued interest rate

volatility and movements that could make obtaining financing more

challenging or more expensive.

For further information, please contact:

Stephen KilmerInvestor Relationsskilmer@profoundmedical.com T:

647.872.4849

Profound Medical Corp.Interim Condensed

Consolidated Balance Sheets(Unaudited)

|

|

|

March

31,2020$ |

|

December 31,2019$ |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash |

|

61,900,725 |

|

|

19,222,195 |

|

|

Trade and other receivables |

|

4,471,213 |

|

|

4,058,136 |

|

|

Investment tax credits receivable |

|

240,000 |

|

|

240,000 |

|

|

Inventory |

|

5,818,643 |

|

|

4,764,458 |

|

|

Prepaid expenses and deposits |

|

1,062,788 |

|

|

1,335,620 |

|

|

Total current assets |

|

73,493,369 |

|

|

29,620,409 |

|

|

|

|

|

|

|

|

Property and equipment |

|

803,593 |

|

|

684,718 |

|

|

Intangible assets |

|

2,840,409 |

|

|

3,128,820 |

|

|

Right-of-use assets |

|

2,121,039 |

|

|

2,199,381 |

|

|

Goodwill |

|

3,409,165 |

|

|

3,409,165 |

|

|

|

|

|

|

|

|

Total assets |

|

82,667,575 |

|

|

39,042,493 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

2,848,789 |

|

|

3,933,114 |

|

|

Deferred revenue |

|

739,327 |

|

|

654,763 |

|

|

Long-term debt |

|

- |

|

|

5,144,461 |

|

|

Provisions |

|

141,071 |

|

|

134,956 |

|

|

Other liabilities |

|

213,430 |

|

|

286,858 |

|

|

Derivative financial instrument |

|

222,122 |

|

|

254,769 |

|

|

Lease liabilities |

|

307,185 |

|

|

258,685 |

|

|

Income taxes payable |

|

5,446 |

|

|

15,763 |

|

|

Total current liabilities |

|

4,477,370 |

|

|

10,683,369 |

|

|

|

|

|

|

|

|

Long-term debt |

|

- |

|

|

6,719,924 |

|

|

Deferred revenue |

|

940,458 |

|

|

829,784 |

|

|

Provisions |

|

29,029 |

|

|

19,005 |

|

|

Lease liabilities |

|

2,036,407 |

|

|

2,125,873 |

|

|

|

|

|

|

|

|

Total liabilities |

|

7,483,264 |

|

|

20,377,955 |

|

|

|

|

|

|

|

|

Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

Share capital |

|

193,917,357 |

|

|

130,266,880 |

|

|

Contributed surplus |

|

15,872,210 |

|

|

19,580,338 |

|

|

Accumulated other comprehensive loss |

|

67,929 |

|

|

(117,188 |

) |

|

Deficit |

|

(134,673,185 |

) |

|

(131,065,492 |

) |

|

|

|

|

|

|

|

Total Shareholders’ Equity |

|

75,184,311 |

|

|

18,664,538 |

|

|

|

|

|

|

|

|

Total Liabilities and Shareholders’ Equity |

|

82,667,575 |

|

|

39,042,493 |

|

Profound Medical Corp.Interim Condensed

Consolidated Statements of Cash Flows(Unaudited)

|

|

|

Three months ended March 31,

2020$ |

Three months ended March 31,

2019$ |

|

|

|

|

|

|

Revenue |

|

|

|

|

Products |

|

1,357,539 |

|

1,347,781 |

|

|

Services |

|

161,594 |

|

128,007 |

|

|

Lease of medical devices |

|

41,085 |

|

- |

|

|

|

|

1,560,218 |

|

1,475,788 |

|

|

Cost of sales |

|

965,608 |

|

533,356 |

|

|

Gross profit |

|

594,610 |

|

942,432 |

|

|

|

|

|

|

|

Operating expenses (recovery) |

|

|

|

|

Research and development |

|

2,839,217 |

|

2,677,746 |

|

|

General and administrative |

|

3,053,227 |

|

1,514,113 |

|

|

Selling and distribution |

|

1,254,329 |

|

(529,345 |

) |

|

Total operating expenses |

|

7,146,773 |

|

3,662,514 |

|

|

|

|

|

|

|

Operating Loss |

|

6,552,163 |

|

2,720,082 |

|

|

|

|

|

|

|

Net finance (income)/costs |

|

(3,068,205 |

) |

172,804 |

|

|

|

|

|

|

|

Loss before taxes |

|

3,483,958 |

|

2,892,886 |

|

|

|

|

|

|

|

Income taxes |

|

123,735 |

|

33,800 |

|

|

|

|

|

|

|

Net loss attributed to shareholders for the

period |

|

3,607,693 |

|

2,926,686 |

|

|

|

|

|

|

|

Other comprehensive loss (income) |

|

|

|

|

Item that may be reclassified to profit or loss |

|

|

|

|

Foreign currency translation adjustment - net of tax of $nil (2019

- $nil) |

|

185,117 |

|

(46,389 |

) |

|

|

|

|

|

|

Net loss and comprehensive loss for the

period |

|

3,792,810 |

|

2,880,297 |

|

|

|

|

|

|

|

Loss per share |

|

|

|

|

Basic and diluted loss per common share |

|

0.25 |

|

0.27 |

|

Profound Medical Corp.Interim Condensed

Consolidated Statements of Cash Flows(Unaudited)

|

|

Three months ended March

31,2020$ |

Three months ended March

31,2019$ |

|

|

|

|

|

Operating activities |

|

|

|

Net loss for the period |

(3,607,693 |

) |

(2,926,686 |

) |

|

Adjustments to reconcile net loss to net cash flows from operating

activities: |

|

|

|

Depreciation of property and equipment |

118,582 |

|

129,325 |

|

|

Amortization of intangible assets |

288,411 |

|

282,110 |

|

|

Depreciation of right-of-use assets |

101,173 |

|

102,224 |

|

|

Share-based compensation |

611,124 |

|

72,638 |

|

|

Interest and accretion expense |

665,315 |

|

342,012 |

|

|

Deferred revenue |

195,238 |

|

438,306 |

|

|

Change in fair value of derivative financial instrument |

(32,647 |

) |

57,471 |

|

|

Change in fair value of contingent consideration |

14,624 |

|

(72,876 |

) |

|

Foreign exchange on cash |

(3,290,028 |

) |

- |

|

|

Changes in non-cash working capital balances |

|

|

|

Trade and other receivables |

(413,077 |

) |

(360,565 |

) |

|

Prepaid expenses and deposits |

272,832 |

|

41,650 |

|

|

Inventory |

(1,242,998 |

) |

217,613 |

|

|

Accounts payable and accrued liabilities |

(961,929 |

) |

(347,454 |

) |

|

Provisions |

16,139 |

|

(1,206,383 |

) |

|

Income taxes payable |

(10,317 |

) |

12,573 |

|

|

Net cash flow used in operating activities |

(7,275,251 |

) |

(3,218,042 |

) |

|

|

|

|

|

Financing activities |

|

|

|

Issuance of common shares |

52,098,723 |

|

- |

|

|

Transaction costs paid |

(4,152,072 |

) |

- |

|

|

Payment of other liabilities |

(88,052 |

) |

- |

|

|

Payment of long-term debt and interest |

(12,497,993 |

) |

(8,545 |

) |

|

Proceeds from share options exercised |

1,480,555 |

|

(331,490 |

) |

|

Proceeds from warrants exercised |

9,904,019 |

|

- |

|

|

Payment of lease liabilities |

(81,427 |

) |

(80,269 |

) |

|

Total cash from financing activities |

46,663,753 |

|

(420,304 |

) |

|

|

|

|

|

Net change in cash during the period |

39,388,502 |

|

(3,638,346 |

) |

|

Foreign exchange on cash |

3,290,028 |

|

- |

|

|

Cash – Beginning of period |

19,222,195 |

|

30,687,183 |

|

|

Cash – End of

period |

61,900,725 |

|

27,048,837 |

|

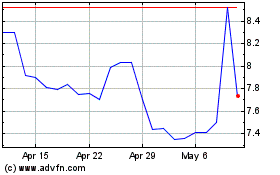

Profound Medical (NASDAQ:PROF)

Historical Stock Chart

From Mar 2024 to Apr 2024

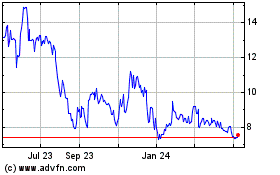

Profound Medical (NASDAQ:PROF)

Historical Stock Chart

From Apr 2023 to Apr 2024