Plug Power Inc. (NASDAQ: PLUG), a leading provider of hydrogen

engines and fueling solutions enabling e-mobility, and Generate

Capital have agreed to increase its term loan facility and reduce

the interest rate. The term facility will be increased by $100M and

the interest rate will be reduced to 9.5% from 12% for the entire

facility. Plug Power has drawn an incremental $50M, and an

additional $50M of borrowing capacity is available to be drawn

based on mutual agreement. The maturity of the loan has been

extended to October 2025 from October 2022. The proceeds will be

used to help fund the Company’s hydrogen expansion strategies as

well as overall working capital given the growing pipeline of

opportunities.

“We are pleased to continue to work and expand this facility

with our longstanding partner, Generate Capital,” said Andy Marsh,

CEO for Plug Power. “In addition, we are pleased with the reduction

in the interest rate as Plug Power has continued to deliver revenue

and EBITDA growth. We believe the continued reduction in our cost

of capital is important to propel our growth and the growth of this

industry. Plug Power and Generate Capital share a similar vision on

building the hydrogen economy providing both economic and

sustainable solutions.”

“Generate’s singular goal is to partner with the best companies

rebuilding the world with the most affordable, reliable, resilient

energy and resource solutions” said Jigar Shah, president and

co-founder of Generate Capital. “Plug Power’s hydrogen fuel cells

deliver proven productivity benefits to customers, in addition to

helping its customers meet their sustainability objectives. That

has made them a key player in the emerging global hydrogen

economy.”

About Plug Power Plug Power is building the

hydrogen economy as the leading provider of comprehensive hydrogen

fuel cell turnkey solutions. The company’s innovative technology

powers electric motors with hydrogen fuel cells amid an ongoing

paradigm shift in the power, energy, and transportation industries

to address climate change and energy security, while meeting

sustainability goals.

Plug Power created the first commercially viable

market for hydrogen fuel cell (HFC) technology. As a result, the

company has deployed over 32,000 fuel cell systems for e-mobility,

more than anyone else in the world, and has become the largest

buyer of liquid hydrogen, having built and operated a hydrogen

highway across North America. Plug Power has built more hydrogen

refueling stations than anyone in the world. Customers have

performed more than 27.7 million fills, dispensing more than 27

Tons of hydrogen daily. These numbers remain unmatched by any other

company in our industry.

Plug Power delivers a significant value proposition to

end-customers, including meaningful environmental benefits,

efficiency gains, fast fueling, and lower operational costs.

Plug Power’s vertically-integrated GenKey solution ties together

all critical elements to power, fuel, and provide service to

customers such as Amazon, BMW, The Southern Company, Carrefour, and

Walmart. The company is now leveraging its know-how, modular

product architecture and foundational customers to rapidly expand

into other key markets including zero-emission on-road vehicles,

robotics, and data centers.

About Generate Capital Founded in 2014,

Generate builds, owns, operates, and finances sustainable

infrastructure to deliver affordable and reliable resource

solutions for companies, governments and communities. Generate

currently has more than 25 technology and project development

partners and serves more than 400 companies, universities, school

districts, cities and non-profits across North

America. www.generatecapital.com

Plug Power Safe Harbor Statement This

communication contains statements that are not historical facts and

are considered forward-looking within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

include, but are not limited to, our expectations regarding use of

loan proceeds and revenue and EBITDA growth. These forward-looking

statements contain projections of our future results of operations

or of our financial position or state other forward-looking

information. In some cases you can identify these statements by

forward-looking words such as "anticipate," "believe," "could,"

"continue," "estimate," "expect," "intend," "may," "should,"

"will," "would," "plan," "projected" or the negative of such words

or other similar words or phrases, which are predictions of or

indicate future events or trends and which do not relate solely to

historical matters. We believe that it is important to communicate

our future expectations to our investors. However, forward-looking

statements involve numerous risks and uncertainties and depend on

assumptions, data or methods which may be incorrect or imprecise.

There may be events in the future that we are not able to

accurately predict or control and that may cause our actual results

to differ materially from the expectations we describe in our

forward-looking statements. Investors are cautioned not to unduly

rely on forward-looking statements. Actual results may differ

materially from those discussed as a result of various factors,

including, but not limited to: the risk that we continue to incur

losses and might never achieve or maintain profitability; the risk

that we will need to raise additional capital to fund our

operations and such capital may not be available to us; the risk of

dilution to our stockholders and/or stock price should we need to

raise additional capital; the risk that our lack of extensive

experience in manufacturing and marketing products may impact our

ability to manufacture and market products on a profitable and

large-scale commercial basis; the risk that unit orders may not

ship, be installed and/or converted to revenue, in whole or in

part; the risk that a loss of one or more of our major customers,

or if one of our major customers delays payment of or is unable to

pay its receivables, a material adverse effect could result on our

financial condition; the risk that a sale of a significant number

of shares of stock could depress the market price of our common

stock; the risk that our convertible senior notes, if settled in

cash, could have a material effect on our financial results; the

risk that our convertible note hedges may affect the value of our

convertible senior notes and our common stock; the risk that

negative publicity related to our business or stock could result in

a negative impact on our stock value and profitability; the risk of

potential losses related to any product liability claims or

contract disputes; the risk of loss related to an inability to

maintain an effective system of internal controls; our ability to

attract and maintain key personnel; the risks related to the use of

flammable fuels in our products; the risk that pending orders may

not convert to purchase orders, in whole or in part; the cost and

timing of developing, marketing and selling our products; the risks

of delays in or not completing our product development goals; our

ability to obtain financing arrangements to support the sale or

leasing of our products and services to customers; our ability to

achieve the forecasted gross margin on the sale of our products;

the cost and availability of fuel and fueling infrastructures for

our products; the risks, liabilities, and costs related to

environmental, health and safety matters; the risk of elimination

of government subsidies and economic incentives for alternative

energy products; market acceptance of our products and services,

including GenDrive, GenSure and GenKey systems; our ability to

establish and maintain relationships with third parties with

respect to product development, manufacturing, distribution and

servicing, and the supply of key product components; the cost and

availability of components and parts for our products; general

global economic and political conditions that harm the worldwide

economy, disrupt our supply chain, increase material costs or

reduce demand for our component products (including changes in the

level of gross domestic product in various regions of the world,

natural disasters, terrorist act, global conflicts and public

health crises such as the coronavirus); the risk that possible new

tariffs could have a material adverse effect on our business; our

ability to develop commercially viable products; our ability to

reduce product and manufacturing costs; our ability to successfully

market, distribute and service our products and services

internationally; our ability to improve system reliability for our

products; competitive factors, such as price competition and

competition from other traditional and alternative energy

companies; our ability to protect our intellectual property; the

risk of dependency on information technology on our operations and

the failure of such technology; the cost of complying with current

and future federal, state and international governmental

regulations; our subjectivity to legal proceedings and legal

compliance; the risks associated with past and potential future

acquisitions; and the volatility of our stock price. The risks and

uncertainties included here are not exhaustive, and additional

factors could adversely affect our business and financial

performance, including factors and risks referenced under "Risk

Factors" of this prospectus supplement and in the accompanying

prospectus or any free writing prospectus provided in connection

with this offering and any documents incorporated by reference

herein or therein, including our Annual Report on Form 10-K for the

year ended December 31, 2019 as well as any amendment or update to

our risk factors reflected in subsequent filings with the SEC. We

operate in a very competitive and rapidly changing environment. New

risk factors emerge from time to time and it is not possible for

management to predict all such risk factors, nor can we assess the

impact of all such risk factors on our business or the extent to

which any factor, or combination of factors, may cause actual

results to differ materially from these contained in any

forward-looking statements. While forward-looking statements

reflect our good faith beliefs, they are not guarantees of future

performance. These forward-looking statements speak only as of the

date on which the statements were made. Except as may be required

by applicable law, we do not undertake or intend to update any

forward-looking statements after the date of this

communication.

SOURCE: PLUG POWER

Media Contact Ian MartoranaThe Bulleit

Group(415) 237-3681plugpower@bulleitgroup.com

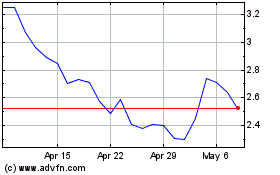

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

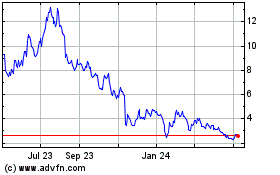

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024