Current Report Filing (8-k)

May 06 2020 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) May 4, 2020

electroCore, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38538

|

|

20-3454976

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

150 Allen Road, Suite 201

Basking Ridge, NJ 07920

(Address of principal executive offices and zip code)

(973) 290-0097

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, Par Value $0.001 Per Share

|

|

ECOR

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

Item 1.01. Entry into a Material Definitive Agreement.

On May 4, 2020, electroCore, Inc. (the “Company”) entered into a promissory note (the “Note”) with Citibank, N.A. (the

“Lender”), evidencing an unsecured loan (the “Loan”) in the amount of $1,409,300 made to the Company under the Paycheck Protection Program (the “PPP”). The PPP is a program of the U.S. Small Business Administration (the

“SBA”) established under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). Under the PPP, the proceeds of the Loan may be used to pay payroll and make certain covered interest payments, lease payments and

utility payments (“Qualifying Expenses”). The Company intends to use the entire Loan amount for Qualifying Expenses under the PPP.

The interest

rate on the Loan is 1.0% per annum. The Note matures on May 2, 2022. On December 2, 2020 (the “First Payment Date”), the Company is required to pay all accrued interest under the Loan that is not forgiven in accordance with

the terms of the PPP. Additionally, on the First Payment Date and on the second day of each month thereafter until May 2, 2022, the Company must make equal monthly payments of the amount of principal under the Loan that is not forgiven in

accordance with the terms of the PPP and related accrued interest thereon. The Note contains events of default and other conditions customary for a Note of this type.

Under the terms of the CARES Act, PPP loan recipients can be granted forgiveness for all or a portion of the loan granted under the PPP, with such forgiveness

to be determined, subject to limitations, based on the use of the loan proceeds for payment of Qualifying Expenses and the Company maintaining its payroll levels over certain required thresholds under the PPP. The terms of any forgiveness also may

be subject to further requirements in any regulations and guidelines the SBA may adopt. No assurance can be provided that the Company will obtain forgiveness of the Note in whole or in part.

The foregoing is a description of the material terms and conditions of the Note and is not a complete discussion of the Note. Accordingly, the foregoing is

qualified in its entirety by reference to the full text of the Note, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated

by reference into this Item 2.03.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 that involve risks and uncertainties. Such forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted or expected results. The inclusion of

forward-looking statements should not be regarded as a representation by the Company that any of these results will be achieved. Actual results may differ from those contemplated by forward-looking statements in this Current Report on Form 8-K, such as statements regarding the Company’s use of proceeds from the Loan, the amount of the loan to the Company that will be eligible to be forgiven, any actual forgiveness of some or all of the amount of

the Loan evidenced by the Note, the ability and legality of the Company retaining the proceeds from the Loan in light of regulatory requirements, related guidance and public opinion and sentiment and other risks inherent in the Company’s

business including those described in the Company’s periodic filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on forward-looking statements, which are based on the Company’s current

expectations and assumptions and speak only as of the date of this Current Report on Form 8-K. The Company does not intend to revise or update any forward-looking statement in this Current Report on Form 8-K to reflect events or circumstances arising after the date hereof, except as may be required by law. All forward-looking statements are qualified in their entirety by this cautionary statement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

electroCore, Inc.

|

|

|

|

|

|

|

May 6, 2020

|

|

|

|

|

|

/s/ Brian Posner

|

|

|

|

|

|

|

|

Brian Posner

|

|

|

|

|

|

|

|

Chief Financial Officer

|

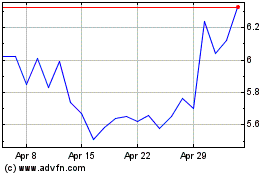

electroCore (NASDAQ:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

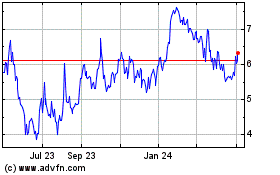

electroCore (NASDAQ:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024