Beyond Meat Swings to Profit as Consumers Stock Up Amid Pandemic

May 05 2020 - 6:12PM

Dow Jones News

By Kimberly Chin

Beyond Meat Inc. said sales more than doubled in the latest

quarter, boosted by increased demand from its partners and

retailers stocking up on the alternative meats as food supply

chains faced disruptions because of the coronavirus pandemic.

The maker of plant-based meat said sales for the first quarter

rose to $97.1 million from $40.2 million a year earlier, as it sold

more because of expanded distribution in the U.S. and other

countries.

Beyond has established partnerships with clients like Starbucks

Corp. and Yum China Holdings Inc.'s KFC, which has helped increase

its distribution while many parts of the world are following social

distancing measures.

The company made its debut in China in April, taking advantage

of the country's reopening, offering products such as lasagna,

pasta and a tortilla wrap containing Beyond Beef, at more than

3,300 Starbucks locations. KFC said in April that it would also

start selling Beyond's plant-based fried "chicken" nuggets in some

Chinese cities. Meanwhile, McDonald's Corp. in January broadened a

test in Canada of a sandwich made with a Beyond patty.

The company has also benefited from plant closings by several

meat companies due to cases of Covid-19, the illness caused by the

novel coronavirus, that have led to concerns about potential meat

shortages. Tyson Foods Inc., the top U.S. meat supplier by sales,

said Monday that the coronavirus pandemic would disrupt business

for months to come, reducing its meat production and threatening

supplies to consumers.

Retail sales helped offset weakness elsewhere in the business,

as temporary closures due to the Covid-19 crisis led to muted

demand.

The company also faces increased competition from big food

companies, including Nestlé SA, Smithfield Foods Inc., Cargill Inc.

and food distributor Sysco Corp., that have entered the field with

plans to introduce their own meat-free patties, sometimes at lower

prices than those charged by upstarts like Impossible Foods

Inc.

The California-based Beyond swung to a profit of $1.8 million in

the three-month period ended March 28, or 3 cents a share, compared

with a loss of $6.6 million, or 95 cents a share, in last year's

first quarter.

Analysts surveyed by FactSet anticipated a per-share loss of 7

cents on sales of $88.8 million.

Beyond's shares surged in the months following its initial

public offering at $25 a share last May, trading as high as $239.71

on optimism for continued growth in restaurants and supermarkets.

Shares sagged later in the year as more Beyond shares were freed up

to trade and as competition mounted.

Beyond's shares currently stand at $100.16 as of Tuesday's

close, and rose 4% in after-hours trading. The stock has gained 32%

in the past 12 months.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

May 05, 2020 17:57 ET (21:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

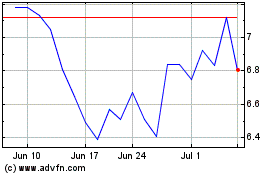

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2023 to Apr 2024