Cerus Corporation (Nasdaq: CERS) today announced financial

results for the first quarter ended March 31, 2020.

Recent developments and highlights include:

- Total first quarter 2020 revenue of $24.6 million

- Quarterly product revenue of $18.6 million, a 6% increase

compared to the prior year quarter

- Global demand for INTERCEPT kits grew during the first quarter

with the calculated number of treatable platelet doses up 14%

compared to the same period in 2019

- Government contract revenue of $6.0 million

- Reaffirming 2020 full year product revenue guidance range of

$89 million to $93 million representing an approximately 20% to 25%

increase over 2019 reported product revenue.

- Strengthened balance sheet with a $63.3 million public offering

of common stock. At March 31, 2020, the Company had cash, cash

equivalents and short-term investments of $133.1 million.

- Announced strategic organizational changes to align teams

around key commercial growth and product portfolio pipeline

development targets.

- Formed a collaborative research group with the aim of

optimizing the characteristics and dosing of convalescent plasma as

a potential therapy for COVID-19 patients.

- Further strengthened the Company’s collaboration with the

Biomedical Advanced Research and Development Authority (BARDA) with

an incremental $14 million available under the contract.

“First quarter product revenue of $18.6 million exceeded our

internal expectations despite the tumultuous macro environment

created by the global COVID-19 pandemic. The emergence of

SARS-CoV-2 has highlighted the need for comprehensive preparedness

planning for healthcare systems and the corresponding obligation to

safeguard the blood supply chain. The INTERCEPT Blood System has

played a critical role for many blood centers by reducing the risk

of transfusion transmitted infections,” said William ‘Obi’

Greenman, Cerus’ president and chief executive officer. “In the

face of this crisis, I am proud of the actions taken by the Cerus

employees designed to make sure that the blood centers and

hospitals have access to INTERCEPT Blood System, even in the

regions hardest hit by the pandemic.”

“It is unclear as to the extent and duration that the COVID-19

impact will have on the global transfusion medicine industry and on

healthcare in general, but given the critical need for blood and

blood components, we are cautiously optimistic about the health of

our business and our ability to further our mission to make

INTERCEPT the standard of care,” continued Greenman.

Revenue

Product revenue during the first quarter of 2020 was $18.6

million, compared to $17.5 million during the same period in 2019.

Revenue growth during the quarter benefited from increased demand

for INTERCEPT platelet kit sales in the U.S., offset partially by

the year-over-year product mix shift in France and a decrease in

kit sales in the Middle East due to the timing of distributor

orders.

Government contract revenue from the Company’s BARDA agreement

was $6.0 million during the first quarter of 2020, compared to $4.5

million during the same period in 2019, as a result of increasing

INTERCEPT red blood cell development activities. With the recently

announced amendment, the total potential value of the current BARDA

agreement is now $214 million with $50 million recognized as

revenue to date.

BARDA is part of the Office of the Assistant Secretary for

Preparedness and Response within the U.S. Department of Health and

Human Services. The development of the INTERCEPT red blood cell

program has been funded in whole or in part with federal funds from

the Department of Health and Human Services; Office of the

Assistant Secretary for Preparedness and Response; Biomedical

Advanced Research and Development Authority, under Contract No.

HHSO100201600009C.

Gross Margins

Gross margins on product revenue during the first quarter of

2020 were 55%, compared to 52% for the first quarter of 2019. Gross

margins during the quarter benefited from continued economies of

scale and resulting lower per unit costs, driven by increased

manufacturing production to meet existing and expected future

growth in demand for INTERCEPT.

Operating Expenses

Total operating expenses for the first quarter 2020 were $31.7

million compared to $29.6 million for the same period the prior

year.

Selling, general, and administrative (SG&A) expenses for the

first quarter of 2020 totaled $15.9 million, compared to $16.2

million for the first quarter of 2019. The year-over-year decline

was primarily due to lower marketing and travel related expenses,

both driven in part by the COVID-19 pandemic.

Research and development (R&D) expenses for the first

quarter of 2020 were $15.8 million, compared to $13.4 million for

the first quarter of 2019. The increase in year-over-year R&D

expenses were primarily due to increased costs associated with

initiatives for expanded INTERCEPT platelet label claims and costs

for our red blood cell program, namely activities under our BARDA

agreement.

Net Loss

Net loss for the first quarter of 2020 was $16.5 million, or

$0.10 per diluted share, compared to a net loss of $18.8 million,

or $0.14 per diluted share, for the first quarter of 2019.

Cash, Cash Equivalents and Investments

At March 31, 2020, the Company had cash, cash equivalents and

short-term investments of $133.1 million, compared to $85.7 million

at December 31, 2019.

At March 31, 2020, the Company had approximately $39.5 million

in outstanding term loan debt compared to $39.4 million at December

31, 2019.

2020 Product Revenue Guidance

The Company expects 2020 product revenue to be in the range of

$89 million to $93 million, unchanged from the prior guidance

originally provided on January 13, 2020. The guidance range

represents approximately 20% to 25% growth compared to 2019

reported product revenue.

QUARTERLY CONFERENCE CALL

The Company will host a conference call and webcast at 4:30 P.M.

EDT this afternoon, during which management will discuss the

Company’s financial results and provide a general business overview

and outlook. To access the live webcast, please visit the Investor

Relations page of the Cerus website at http://www.cerus.com/ir.

Alternatively, you may access the live conference call by dialing

(866) 235-9006 (U.S.) or (631) 291-4549 (international).

A replay will be available on the Company’s website, or by

dialing (855) 859-2056 (U.S.) or (404) 537-3406 (international) and

entering conference ID number 8484403. The replay will be available

approximately three hours after the call through May 19, 2020.

ABOUT CERUS

Cerus Corporation is dedicated solely to safeguarding the

world’s blood supply and aims to become the preeminent global blood

products company. Based in Concord, California, our employees are

dedicated to deploying and supplying vital technologies and

pathogen-protected blood components for blood centers, hospitals

and ultimately patients who rely on safe blood. With the INTERCEPT

Blood System, we are focused on protecting patients by delivering

the full complement of reliable products and expertise for

transfusion medicine. Cerus develops and markets the INTERCEPT

Blood System and remains the only company in the blood transfusion

space to earn both CE Mark and FDA approval for pathogen reduction

of both platelet and plasma components. Cerus currently markets and

sells the INTERCEPT Blood System in the United States, Europe, the

Commonwealth of Independent States, the Middle East and selected

countries in other regions around the world. The INTERCEPT Red

Blood Cell system is in clinical development. For more information

about Cerus, visit www.cerus.com and follow us on LinkedIn.

INTERCEPT and the INTERCEPT Blood System are trademarks of Cerus

Corporation.

Forward Looking Statements

Except for the historical statements contained herein, this

press release contains forward-looking statements concerning Cerus’

products, prospects and expected results, including statements

relating to Cerus’ 2020 annual product revenue guidance; the

therapeutic potential of convalescent plasma for COVID-19 patients;

the total potential value of Cerus’ agreement with BARDA; actions

taken by the Cerus’ employees designed to make sure that the blood

centers and hospitals have access to INTERCEPT Blood System; Cerus’

cautious optimism about the health of its business and its ability

to further its mission to make INTERCEPT the standard of care; and

other statements that are not historical facts. Actual results

could differ materially from these forward-looking statements as a

result of certain factors, including, without limitation: risks

associated with the commercialization and market acceptance of, and

customer demand for, the INTERCEPT Blood System, including the

risks that Cerus may not (a) meet its 2020 annual product revenue

guidance, (b) grow sales globally, including in its U.S. and

European markets, and/or realize expected revenue contribution

resulting from its U.S. and European market agreements, (c) realize

meaningful and/or increasing revenue contributions from U.S.

customers in the near term or at all, particularly since Cerus

cannot guarantee the volume or timing of commercial purchases, if

any, that its U.S. customers may make under Cerus’ commercial

agreements with these customers, and/or (d) realize any revenue

contribution from its pipeline product candidates, whether due to

Cerus’ inability to obtain regulatory approval of its pipeline

product candidates, or otherwise; risks associated with the scale,

duration and evolving effects of the COVID-19 pandemic and

resulting global economic and financial disruptions, and the

current and potential future negative impacts to Cerus’ business

operations and financial results; risks associated with Cerus’ lack

of commercialization experience in the United States and its

ability to develop and maintain an effective and qualified

U.S.-based commercial organization, as well as the resulting

uncertainty of its ability to achieve market acceptance of and

otherwise successfully commercialize the INTERCEPT Blood System for

platelets and plasma in the United States, including as a result of

licensure requirements that must be satisfied by U.S. customers

prior to their engaging in interstate transport of blood components

processed using the INTERCEPT Blood System; risks related to

Fresenius Kabi’s efforts to assure an uninterrupted supply of

platelet additive solution (PAS); risks related to how any future

PAS supply disruption could affect INTERCEPT’s acceptance in the

marketplace; risks related to how any future PAS supply disruption

might affect current commercial contracts; risks related to Cerus’

ability to demonstrate to the transfusion medicine community and

other health care constituencies that pathogen reduction and the

INTERCEPT Blood System is safe, effective and economical; risks

related to the uncertain and time-consuming development and

regulatory process, including the risks (a) that the INTERCEPT

Blood System does not have approved label claims for SARS-CoV-2

inactivation and may not successfully inactivate SARS-CoV-2; (b)

that convalescent plasma therapies are unproven in treating, and

may be ineffective in treating, patients with COVID-19, (c) that

Cerus will continue to experience delays in successfully

initiating, conducting or completing clinical trials as a result of

the COVID-19 pandemic, (d) that Cerus may be unable to comply with

the FDA’s post-approval requirements for the INTERCEPT platelet and

plasma systems, including by successfully completing required

post-approval studies, which could result in a loss of U.S.

marketing approval for the INTERCEPT platelet and/or plasma

systems, (e) related to Cerus’ ability to expand the label claims

and product configurations for the INTERCEPT platelet and plasma

systems in the United States, including for pathogen-reduced

cryoprecipitate, which will require additional regulatory

approvals, (f) that Cerus may be unable to submit its planned PMA

supplement to the FDA for pathogen-reduced cryoprecipitate in a

timely manner or at all, and even if submitted, such planned PMA

supplement may not be accepted or approved in a timely manner or at

all, (g) that applicable regulatory authorities may disagree with

Cerus‘ interpretations of the data from its clinical studies and/or

may otherwise determine not to approve Cerus’ regulatory

submissions, including Cerus’ planned PMA supplement submission for

pathogen-reduced cryoprecipitate, in a timely manner or at all, and

(h) that even if Cerus’ regulatory submissions are approved, Cerus

may not receive label claims for all requested indications or for

indications with the highest unmet need or market acceptance; risks

associated with Cerus’ lack of experience in marketing products

directly to hospitals and expertise complying with regulations

governing finished biologics; risks associated with the uncertain

nature of BARDA’s funding over which Cerus has no control as well

as actions of Congress and governmental agencies that may adversely

affect the availability of funding under Cerus’ BARDA agreement

and/or BARDA’s exercise of any potential subsequent option periods,

including in connection with the general economic environment and

uncertainty associated with the COVID-19 pandemic, such that the

anticipated activities that Cerus expects to conduct with the funds

available from BARDA may be delayed or halted and that Cerus may

not otherwise realize the total potential value under its agreement

with BARDA; risks related to product safety, including the risk

that the septic platelet transfusions may not be avoidable with the

INTERCEPT Blood System; risks related to adverse market and

economic conditions, including continued or more severe adverse

fluctuations in foreign exchange rates and/or continued or more

severe weakening in economic conditions resulting from the evolving

effects of the COVID-19 pandemic or otherwise in the markets where

Cerus currently sells and is anticipated to sell its products;

Cerus’ reliance on third parties to market, sell, distribute and

maintain its products; Cerus’ ability to maintain an effective,

secure manufacturing supply chain, including the risks that (a)

Cerus’ supply chain could be negative impacted as a result of the

evolving effects of the COVID-19 pandemic, (b) Cerus’ manufacturers

could be unable to comply with extensive FDA and foreign regulatory

agency requirements, and (c) Cerus may be unable to maintain its

primary kit manufacturing agreement and its other supply agreements

with its third party suppliers; Cerus’ ability to identify and

obtain additional partners to manufacture pathogen-reduced

cryoprecipitate; risks associated with Cerus’ ability to meet its

debt service obligations and its need for additional funding; the

impact of legislative or regulatory healthcare reforms that may

make it more difficult and costly for Cerus to produce, market and

distribute its products; risks related to future opportunities and

plans, including the uncertainty of Cerus’ future capital

requirements and its future revenues and other financial

performance and results, as well as other risks detailed in Cerus’

filings with the Securities and Exchange Commission, including

Cerus’ Annual Report on Form 10-K for the year ended December 31,

2019, filed with the SEC on February 21, 2020. In addition, to the

extent that the COVID-19 pandemic adversely affects Cerus’ business

and financial results, it may also have the effect of heightening

many of the other risks and uncertainties described above. Cerus

disclaims any obligation or undertaking to update or revise any

forward-looking statements contained in this press release.

CERUS CORPORATION

REVENUE BY REGION

(in thousands, except

percentages)

Three Months Ended

March 31,

Change

2020

2019

$

%

Europe, Middle East and Africa

$

12,220

$

12,653

$

(433

)

-3

%

North America

6,077

4,551

1,526

34

%

Other

314

300

14

5

%

Total product revenue

$

18,611

$

17,504

$

1,107

6

%

CERUS CORPORATION

CONDENSED CONSOLIDATED

UNAUDITED STATEMENTS OF OPERATIONS

(in thousands, except per

share information)

Three Months Ended

March 31,

2020

2019

Product revenue

$

18,611

$

17,504

Cost of product revenue

8,320

8,432

Gross profit on product revenue

10,291

9,072

Government contract revenue

6,030

4,461

Operating expenses:

Research and development

15,810

13,440

Selling, general and administrative

15,913

16,161

Total operating expenses

31,723

29,601

Loss from operations

(15,402

)

(16,068

)

Non-operating expense, net:

(1,007

)

(2,664

)

Loss before income taxes

(16,409

)

(18,732

)

Provision for income taxes

57

60

Net loss

$

(16,466

)

$

(18,792

)

Net loss per share:

Basic and diluted

$

(0.10

)

$

(0.14

)

Weighted average shares used for

calculating net loss per share:

Basic and diluted

157,405

137,108

CERUS CORPORATION

CONDENSED CONSOLIDATED

UNAUDITED BALANCE SHEETS

(in thousands)

March 31,

December 31,

2020

2019

ASSETS

Current assets:

Cash and cash equivalents

$

33,679

$

34,986

Short-term investments

99,426

50,732

Accounts receivable

18,165

16,882

Inventories

21,684

19,490

Prepaid and other current assets

5,365

6,018

Total current assets

178,319

128,108

Non-current assets:

Property and equipment, net

14,654

14,898

Goodwill and intangible assets, net

1,398

1,448

Operating lease right-of-use assets

14,080

14,122

Restricted cash and other assets

6,912

6,959

Total assets

$

215,363

$

165,535

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable and accrued

liabilities

$

37,383

$

43,136

Debt – current

4,813

5,017

Operating lease liabilities – current

1,751

1,613

Deferred product revenue – current

1,142

570

Total current liabilities

45,089

50,336

Non-current liabilities:

Debt – non-current

39,458

39,414

Operating lease liabilities –

non-current

18,005

18,406

Other non-current liabilities

403

327

Total liabilities

102,955

108,483

Stockholders' equity

112,408

57,052

Total liabilities and stockholders'

equity

$

215,363

$

165,535

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200505005911/en/

Tim Lee – Investor Relations Director Cerus Corporation

925-288-6137

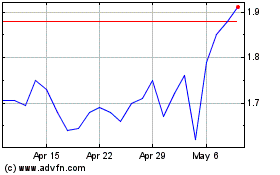

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cerus (NASDAQ:CERS)

Historical Stock Chart

From Apr 2023 to Apr 2024