Standard Chartered's 1Q Profit Fell as Impairments Surged

April 29 2020 - 1:32AM

Dow Jones News

By Yifan Wang

Standard Chartered PLC's first-quarter pretax underlying profit

fell despite higher income, as credit impairments rose

significantly due to the rapid spread of the coronavirus

pandemic.

Pretax underlying profit fell 12% to $1.22 billion, the

Asia-focused bank said Wednesday.

The decline was in part due to a sharp increase in credit

impairments, which jumped more than ten times from a year earlier

to $962 million.

Operating income rose 13% to $4.33 billion, primarily driven by

strong performance in the lender's financial markets business.

Net interest income, however, dropped 4.2% to $1.84 billion due

to margin compression. Net interest margin fell 0.14 percentage

point to 1.52%.

Standard Chartered said it expects large-scale benchmark rate

cuts by the U.S. Federal Reserve and other central banks to hurt

its income by a further $600 million in 2020.

The bank had earlier canceled its final dividend for 2019 and

said it would not consider an interim dividend this year in order

to conserve capital during the pandemic.

Standard Chartered also warned that the public health crisis and

resulting economic slowdown could derail its previous target to

achieve at least 10% return on tangible equity by 2021.

Write to Yifan Wang at yifan.wang@wsj.com

(END) Dow Jones Newswires

April 29, 2020 01:17 ET (05:17 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

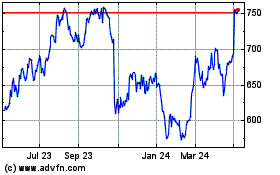

Standard Chartered (LSE:STAN)

Historical Stock Chart

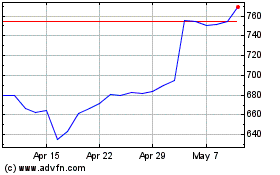

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024