Current Report Filing (8-k)

April 23 2020 - 4:19PM

Edgar (US Regulatory)

Noble Corp plc false 0001458891 0001458891 2020-04-17 2020-04-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): April 17, 2020

NOBLE CORPORATION plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

England and Wales

|

|

001-36211

|

|

98-0619597

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. employer

identification number)

|

|

|

|

|

|

10 Brook Street

London, England

|

|

W1S 1BG

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: +44 20 3300 2300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Shares, Nominal Value $0.01 per Share

|

|

NE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On April 17, 2020, Noble Corporation plc, a public limited company incorporated under the laws of England and Wales (the “Company”), agreed with the lender that financed its purchases of the Noble Joe Knight and Noble Johnny Whitstine rigs to pay off the related seller loans (the “Seller Loans”) in exchange for a discount to the outstanding loan balance. The Company made a payment in the amount of 85% of the outstanding principal amount of the Seller Loans plus accrued and unpaid interest, and upon the lender’s receipt of such payment, the remaining principal balance under each Seller Loan was reduced to $1.00, interest ceased accruing, and the financial covenants ceased to apply. As long as certain events specified in the related deed of release do not occur within the 90-day period following the payment date, then the Seller Loans will be terminated, and all security will be released. Following the close of the transaction, the Company borrowed $100 million on its 2017 Credit Facility, increasing pro forma borrowings outstanding to $545 million, with the ability to borrow up to an additional $297 million.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NOBLE CORPORATION plc

|

|

|

|

|

|

|

|

|

|

Date: April 23, 2020

|

|

|

|

By:

|

|

/s/ William E. Turcotte

|

|

|

|

|

|

|

|

William E. Turcotte

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

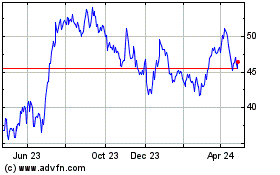

Noble (NYSE:NE)

Historical Stock Chart

From Mar 2024 to Apr 2024

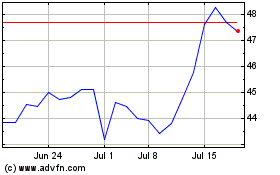

Noble (NYSE:NE)

Historical Stock Chart

From Apr 2023 to Apr 2024