0001124140

false

0001124140

2020-04-20

2020-04-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): April 21, 2020

EXACT SCIENCES CORPORATION

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

|

001-35092

|

|

02-0478229

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

441 Charmany Drive

Madison, WI 53719

(Address of Principal Executive Offices)(Zip

Code)

Registrant’s telephone number, including

area code: (608) 284-5700

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common

Stock, $0.01 par value per share

|

EXAS

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

2.02

|

Results of Operations and Financial Condition.

|

The information included in Item 7.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 2.02.

|

|

7.01

|

Regulation FD Disclosure.

|

Preliminary, Unaudited First Quarter 2020 Financial Results

Exact Sciences Corporation (the “Company”) expects

to report the following financial results for the three-month period ended March 31, 2020, as compared to the same period of 2019

(where applicable):

|

|

·

|

Total revenue of approximately $348M, compared to $162M

|

|

|

|

|

|

|

·

|

Screening revenue of approximately $219M, an increase of 35%

|

|

|

|

|

|

|

·

|

Precision Oncology revenue of approximately $128M, an increase of 18% from pro forma 2019

|

|

|

|

|

|

|

·

|

Cash, cash equivalents and marketable securities of $1.2B at the end of the quarter

|

The financial data presented herein for the first quarter of

2020 are preliminary, have not been subject to final review or other procedures by the Company’s independent auditor, and

are thus inherently uncertain and subject to change. There can be no assurance that the Company’s final results for this

period will not differ from these estimates. During the course of the preparation and review of the Company’s consolidated

financial statements and related notes as of and for the quarter ended March 31, 2020, the Company or its independent auditor may

identify items that could cause the Company’s final reported results to be materially different from the preliminary financial

estimates presented herein.

COVID-19 Business Update

The COVID-19 environment is rapidly evolving, and there are

continued uncertainties surrounding its impact. Despite these uncertainties, the Company’s testing labs have been operating

throughout the COVID-19 pandemic and remain operational at this time. Business continuity plans are in place at all sites to help

sustain operations and ensure continuity of service for patients. The Company’s labs are also providing COVID-19 testing

on a limited basis. In April 2020, the Company received $24 million of funding under the CARES Act, subject to the Company’s

agreement to comply with the Department of Health & Human Services’ standard terms and conditions.

Due to social distancing, stay-at-home orders, and other actions

taken in response to COVID-19, there has been a significant and widespread decline in standard wellness visits and preventive services.

That decline has negatively impacted Cologuard test orders in our Screening business, notwithstanding the availability of alternative

ordering channels such as telehealth. Through the end of February, Cologuard revenue was tracking consistent with our original

first quarter guidance range of $230 million to $235 million, provided on February 11, 2020. Cologuard test order volume and patient

compliance have been negatively impacted by COVID-19. From March 15 through March 31 and during the first 20 days of April, Cologuard

test orders decreased 36% and 63% year-over-year, respectively. During April, we have seen what appears to be a stabilization in

the year-over-year decline of Cologuard test orders.

After delivering strong results in the first quarter, the Precision

Oncology business is also starting to see weakening underlying conditions because of COVID-19, more notably in the U.S. prostate

business and in certain international geographies. We expect the widespread decrease in preventive services, such as mammograms

and prostate cancer screenings, to negatively impact Precision Oncology test volumes in the coming months due to the typical lag

between cancer screening and genomic test ordering.

The Company has initiated proactive measures to address the

order weakness experienced thus far and anticipated for the balance of 2020, due to the COVID-19 pandemic. The Company expects

to achieve cost savings through, among other things:

|

|

(i)

|

reduction of the CEO’s base salary to effectively zero (excluding amounts to cover benefits and taxes),

|

|

|

(ii)

|

elimination of the Board of Directors annual cash retainer,

|

|

|

(iii)

|

reduction of base salaries for our executive team and employees at or above the director level,

|

|

|

(iv)

|

reduction in the annual corporate bonus and quarterly sales commissions,

|

|

|

(v)

|

implementation of a voluntary furlough program,

|

|

|

(vi)

|

implementation of a workforce reduction, involuntary furloughs, and work schedule reductions,

|

|

|

(vii)

|

reduction of investments in marketing and other promotional activities,

|

|

|

(viii)

|

reduction in costs of goods sold consistent with the expected decrease in revenue,

|

|

|

(ix)

|

pause in certain clinical trial activities,

|

|

|

(x)

|

reduction of travel and professional services fees, and

|

|

|

(xi)

|

delay or termination of certain capital projects.

|

The Company estimates that these items will contribute over

$400 million of cost savings in 2020. The Company believes that its cost savings, coupled with its strong cash position, will enable

the Company to continue serving patients who rely on its screening and diagnostic products and services through the remainder of

the COVID-19 pandemic and thereafter. These estimates of potential cost savings, and the timing thereof, are subject to a number

of assumptions and actual results may differ.

As announced on March 19, 2020, the Company has withdrawn its

annual guidance for 2020. The Company intends to provide an updated outlook when it reports full and final first quarter financial

results on May 6, 2020, to the extent practicable, based on information available at the time.

The information furnished in this Current Report on Form 8-K

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any

filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended, that are intended to be covered by the "safe harbor" created by those sections. Forward-looking

statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be

identified by the use of forward-looking terms such as "believe," "expect," "may," "will,"

"should," "would," "could," "seek," "intend," "plan," "goal,"

"project," "estimate," "anticipate" or other comparable terms. All statements other than statements

of historical facts included in this Current Report on Form 8-K regarding our strategies, prospects, financial condition, operations,

costs, plans, and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements

we make regarding expected future operating results, expectations for achieving cost-savings, anticipated results of our sales

and marketing efforts, expectations concerning payer reimbursement, and the anticipated results of our product development efforts.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on current

beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the

following: uncertainties associated with the coronavirus (COVID-19) pandemic, including its possible effects on our operations

and the demand for our products and services; our ability to efficiently and flexibly manage our business and achieve cost-savings

amid uncertainties related to COVID-19; our ability to successfully and profitably market our products and services; the acceptance

of our products and services by patients and healthcare providers; our ability to meet demand for our products and services; the

success of our efforts to facilitate patient access to Cologuard via telehealth; the willingness of health insurance companies

and other payers to cover our products and services and adequately reimburse us for such products and services; the amount and

nature of competition for our products and services; the effects of the adoption, modification or repeal of any law, rule, order,

interpretation or policy relating to the healthcare system, including without limitation as a result of any judicial, executive

or legislative action; the effects of changes in pricing, coverage and reimbursement for our products and services, including without

limitation as a result of the Protecting Access to Medicare Act of 2014; recommendations, guidelines and quality metrics issued

by various organizations such as the U.S. Preventive Services Task Force, the American Society of Clinical Oncology, the American

Cancer Society, and the National Committee for Quality Assurance regarding cancer screening or our products and services; our ability

to successfully develop new products and services and assess potential market opportunities; our ability to effectively enter into

and utilize strategic partnerships, such as through our Promotion Agreement with Pfizer, Inc., and acquisitions; our success establishing

and maintaining collaborative, licensing and supplier arrangements; our ability to maintain regulatory approvals and comply with

applicable regulations; our ability to manage an international business and our expectations regarding our international expansion

and opportunities; the potential effects of foreign currency exchange rate fluctuations and our efforts to hedge such effects;

the possibility that the anticipated benefits from our combination with Genomic Health cannot be realized in full or at all or

may take longer to realize than expected; the possibility that costs or difficulties related to the integration of Genomic Health’s

operations will be greater than expected and the possibility of disruptions to our business during integration efforts and strain

on management time and resources; the outcome of any litigation, government investigations, enforcement actions or other legal

proceedings; and the other risks and uncertainties described in the Risk Factors and in Management's Discussion and Analysis of

Financial Condition and Results of Operations sections of our most recently filed Annual Report on Form 10-K and our subsequently

filed Quarterly Reports on Form 10-Q. We undertake no obligation to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EXACT SCIENCES CORPORATION

|

|

|

|

|

Date: April 21, 2020

|

By:

|

/s/ Jeffrey T. Elliott

|

|

|

|

Jeffrey T. Elliott

|

|

|

|

Chief Financial Officer

|

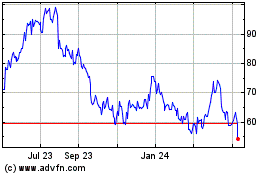

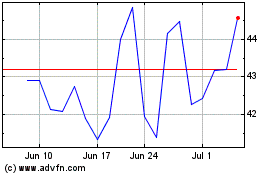

EXACT Sciences (NASDAQ:EXAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

EXACT Sciences (NASDAQ:EXAS)

Historical Stock Chart

From Apr 2023 to Apr 2024