UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Amendment No. 1

Information Statement Pursuant to Section

14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

☑

Preliminary Information Sheet

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

☐

Definitive Information Statement

ITEM 9 LABS CORP.

(Exact name of registrant as specified in its

Charter)

Payment of Filing Fee (Check the appropriate

box):

☑

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

☐

Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously

Paid:

2) Form Schedule

or Registration Statement No.:

3) Filing Party:

4) Date Filed:

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Regulation 14C

of the Securities Exchange Act of 1934 as

amended

Item 9 Labs Corp.

2727 N 3rd Street, Suite 201,

Phoenix AZ 85004

Tel. 1-833-867-6337

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A

PROXY

This Information Statement

(the “Information Statement”) is being furnished to the holders (the “Stockholders”) of shares of common

stock, par value $0.001 per share (the “Common Stock”), of Item 9 Labs Corp., a Delaware Corporation (the “Company”)

in connection with the reverse triangular merger in which the Company shall acquire OCG,

Inc., a Colorado corporation (“OCG”).

Notice is hereby given to

you that all members of the Company’s Board of Directors (“Board”) and

the holders of a majority of the outstanding shares of our common stock (the “Majority

Stockholders”) have, by written consent in lieu of a stockholders’ meeting, approved and authorized the Company

to: (1) enter into the Agreement and Plan of Merger, dated as of February 27, 2020, by and among the Company, a wholly owned subsidiary

of the Company (“Merger Sub”), and OCG, and perform the transactions contemplated thereby; (2) file the necessary certificates

of merger to effectuate the transactions contemplated by the Agreement and Plan of Merger (collectively, corporate actions).

This Information Statement

is being furnished to Stockholders for informational purposes only, pursuant to Section 14(c) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder. As described in this Information

Statement, on March 5, 2020, the Majority Stockholders, collectively owning 42,606,712 shares of Common Stock, representing approximately

69% of the 61,410,645 total issued and outstanding shares of Common Stock of the Company as of March 5, 2020 (the “Consent

Date”), approved the Corporate Actions by written consent in lieu of a meeting of Stockholders. Our Board of Directors

approved the foregoing Corporate Actions by written consent on February 27, 2020.

Our Board of Directors is

not soliciting your proxy or consent in connection with the Corporate Actions. You are urged to read this Information Statement

carefully and in its entirety for a description of the Corporate Actions taken by the Majority Stockholders. Stockholders who were

not afforded an opportunity to consent or otherwise vote with respect to the Corporate Actions taken have no right under Delaware

corporate law or the Company’s Articles of Incorporation or Bylaws to dissent or require a vote of all Stockholders.

The Corporate Actions will

not become effective before a date which is twenty (20) calendar days after this Information Statement is made available to or

otherwise delivered to Stockholders. The Information Statement is being given on or about [•], 2020 (“Record

Date”) to Stockholders of record on the Record Date. The entire cost of furnishing this Information Statement will be

borne by the Company.

THIS IS NOT A

NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS, AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS

INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED HEREIN

PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C.

WE ARE NOT ASKING YOU

FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

By order of the Board of Directors

of ITEM 9 LABS CORP.

Date: [•], 2020

/s/ Andrew Bowden

By: Andrew Bowden

Chief Executive Officer and

Director

NOTICE OF ACTION TO BE TAKEN PURSUANT TO THE

WRITTEN CONSENT OF STOCKHOLDERS

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY

To the Stockholders of ITEM 9 LABS CORP.:

Item 9 Labs Corp., a Delaware corporation (the

“Company,” “we,” “our,” or “us”), is making this Information Statement available

on or about [•], 2020 to all the Company’s stockholders of record as of [•], 2020

(the “Record Date”). As of March 5, 2020, 61,410,645 shares of our common stock were issued and

outstanding. Each outstanding share of our common stock is entitled to one vote per share. On March 5, 2020 (the “Consent

Date”). Holders of approximately 69% of the outstanding shares of our common stock prior to the transactions referenced

herein have, by written consent in lieu of a stockholders’ meeting (the “Written Consent”), approved and authorized

the Company to: (1) enter into the Agreement and Plan of Merger, dated as of February 27, 2020, by and among the Company, an unnamed

Colorado corporation (“Merger Sub”) and a wholly owned subsidiary of the Company, and OCG, Inc. (“OCG”),

a Colorado corporation (the “Merger Agreement”), and perform the transactions contemplated thereby, and (2) file the

necessary certificates of merger to effectuate the transactions contemplated by the Agreement and Plan of Merger (collectively,

corporate actions).

This Information Statement is being made available

pursuant to the requirements of Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), to inform holders of our common stock who were entitled to consent to the matters authorized by the Written Consent.

This Information Statement also constitutes notice of the actions that have been approved pursuant to the Written Consent for purposes

of Section 228 of the General Corporation Law of the State of Delaware (the “DGCL”).

Because the Written Consent was executed by

holders representing approximately 69% of the outstanding shares of our common stock, no vote or consent of any other stockholder

is being, or will be, solicited in connection with the authorization of the matters set forth in the Written Consent. Under the

DGCL and our Bylaws, the votes represented by the holders signing the Written Consent are sufficient in number to authorize the

matters set forth in the Written Consent, without the vote or consent of any other stockholder of the Company. The DGCL

provides that any action that is required to be taken, or that may be taken, at any annual or special meeting of stockholders of

a Delaware corporation may be taken, without a meeting, without prior notice and without a vote, if a written consent, setting

forth the action taken, is signed by the holders of outstanding capital stock having not less than the minimum number of votes

necessary to authorize such action.

Based on the foregoing, our board of directors

(our “Board”) has determined not to call a meeting of stockholders to approve the transactions contemplated by the

Written Consent.

NO VOTE OR OTHER CONSENT OF OUR STOCKHOLDERS

IS SOLICITED IN CONNECTION WITHTHIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY.

FORWARD LOOKING STATEMENTS

This Information Statement

and other reports that the Company files with the SEC contain forward-looking statements about the Company’s business containing

the words “believes,” “anticipates,” “expects” and words of similar import. These forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to be

materially different from the results or performance anticipated or implied by such forward-looking statements. Given these uncertainties,

stockholders are cautioned not to place undue reliance on forward-looking statements. Except as specified in SEC regulations, the

Company has no duty to publicly release information that updates the forward-looking statements contained in this Information Statement.

An investment in the Company involves numerous risks and uncertainties, including those described elsewhere in this Information

Statement. Additional risks will be disclosed from time-to-time in future SEC filings.

SUMMARY

TERM SHEET

This

Summary Term Sheet and the section titled “Questions and Answers About the Acquisition” summarize certain information

contained in this Information Statement, but do not contain all of the information that is important to you. The description and

summaries of the documents and agreements below do not purport to be complete and are qualified in their entirety by reference

to the actual documents and agreements. You should carefully read this entire Information Statement, including the attached Appendices.

On

February 27, 2020, the Company, an unnamed Colorado corporation (“Merger Sub”) and a wholly owned subsidiary of the

Company, and OCG, Inc. (“OCG”), a Colorado corporation entered into an Agreement and Plan of Merger (the “Merger

Agreement”) pursuant to which the Company by and through Merge Sub, will acquire 100% of the outstanding interest in OCG

in exchange for 30,000,000 restricted shares of the Company’s common stock (the “Acquisition” or “Merger”).

Questions

and Answers About the Acquisition

Q: Why

am I receiving this Information Statement?

A:

The Company will acquire OCG in accordance with the terms of the Merger Agreement as described in this Information Statement.

We are providing this Information Statement to our holders of record as of the close of business on [•], 2020, the dates

on which the respective consents received approval of a majority in voting power of our Common Stock. This Information Statement

is being provided to you for your information to comply with the Exchange Act requirements. You are urged to read this Information

Statement carefully in its entirety. However, no action is required on your part in connection with this document. We are

not asking you for a proxy and you are requested not to send us a proxy.

Q: When

and where is the stockholder meeting?

A:

No stockholder meeting will be held in connection with this Information Statement.

Q: What

is the record date for Stockholders entitled to receive this Information Statement?

A:

The record dates is [•], 2020, which was the date on which the Company received approval from a majority in voting power

of our Common Stock.

Q: Why

is the Company acquiring OCG?

A:

OCG is a Colorado corporation focused on the business of franchising cannabis dispensaries through the United States, with agreements

for up to thirty-one franchise units across seven states. The Acquisition of OCG accelerates the Company’s strategy to expand

more swiftly its base in new states and new product offerings, which will accelerate and increase revenue growth and operating

margins, respectively.

Q: What

was the merger consideration paid by the Company to acquire 100% of the outstanding stock of OCG?

A:

In the Acquisition, the Company acquired 100% of the outstanding stock of OCG from the OCG Shareholders for 30,000,000 restricted

shares of Common Stock issued pursuant to Rule 506(b) of Regulation D.

Q:

What is the ownership of the Company following the Acquisition?

A:

Following Closing of the Acquisition, the Company stockholders immediately after the Closing will own approximately 67.2% of the

outstanding Company Common Stock and the OCG Shareholders will own approximately 32.8% of the outstanding Company Common Stock.

Q:

Who manages the Company after the Closing?

A:

The Company continues to be overseen by the Board of Directors, and its existing management team. At the Closing, OCG may nominate,

and the Company has agreed to appoint, two persons designated by OCG to the Company’s Board of Directors. Additionally,

while the senior management of the Company remains the same now, it is likely that certain officers of OCG may become management

level employees of the Company in the future, however, no determination regarding these matters has been made as of the date of

this Information Statement

Q: Who

Can Help Answer Your Questions

A:

If you have more questions about the Acquisition the related financing, and the other transactions provided for in the Merger

Agreement and described in this Information Statement, you should contact: Andrew Bowden, CEO of Item 9 Labs.

INFORMATION ON CONSENTING STOCKHOLDER

Pursuant to our Bylaws and the DGCL, a vote

by the holders of at least a majority of our outstanding shares of common stock was required to approve the corporate actions

set forth in the Written Consent. Our Certificate of Incorporation, as amended, does not authorize cumulative voting. As of the

Consent Date, 61,410,645 shares of our common stock were issued and outstanding, of which 30,705,323 shares were required

to pass any stockholder resolutions. The consenting stockholders that were the record and/or beneficial owners of an aggregate

42,606,712 of the outstanding shares of our common stock outstanding on the Consent Date, which was prior to the transactions

contemplated by the Merger Agreement. Accordingly, the Consenting Stockholders represented approximately 69% of the issued and

outstanding shares of our common stock as of such date. Pursuant to Section 228 of the DGCL, the Consenting Stockholders voted

in favor of the actions described herein in a written consent, dated March 5, 2020. No consideration was paid for any stockholder’s

consent.

PROPOSED TRANSACTION

The transactions contemplated by the Merger

Agreement include the following:

|

•

|

|

Pursuant to the Merger Agreement, Merger Sub will merge with and into OCG, with OCG continuing as the surviving corporation.

|

|

•

|

|

Upon completion of the transactions contemplated by the Merger Agreement, each issued and outstanding share of OCG common stock will be exchanged for shares of our common stock, each share of Merger Sub will be converted and exchanged for one share of common stock of OCG.

|

The foregoing does not purport to fully describe

the transactions contemplated by the Merger Agreement. See the section entitled “Merger Agreement”, and a copy of which

is attached as Exhibit A, hereto.

VOTING SECURITIES

Voting Securities of the Company

Our authorized capital stock consists of 2,000,000,000

shares of common stock, $0.0001 par value per share. As of March 5, 2020, there were 61,410,645 shares of our common stock issued

and outstanding.

We anticipate that there will be 91,410,645

shares of our common stock issued and outstanding as of the date that all transactions contemplated by the Merger Agreement have

been consummated (such date being hereinafter referred to as, the “Post-Transaction Date”).

Authorization or Issuance of Securities

Otherwise than for Exchange

Common Stock As Consideration For Merger

Upon the consummation of the transactions

contemplated by the Merger Agreement, we shall issue 30,000,000 restricted shares of common stock as consideration for

the transactions contemplated thereby (“Shares”). The Shares are restricted securities and are being issued pursuant

to Rule 506(b) of Regulation D as a safe harbor to Section 4(a)(2) of the Securities Act. As a result of the issuance of common

stock as consideration for the transactions contemplated by the Merger Agreement, OCG’s former stockholders will own approximately

33% of our common stock with a corresponding dilution to our current stockholders.

Common Stock

The following description is a summary of the

material terms of our common stock. Because it is only a summary, it does not contain all the information that may be important

to you. For a more thorough understanding of the terms of our common stock, you should refer to our Amended and Restated Articles

of Incorporation, as amended.

The holders of our common stock are entitled

to dividends as our board of directors may declare, from time to time, from funds legally available therefor, subject to any contractual

limitations on our ability to declare and pay dividends. The holders of our common stock are entitled to one vote per share on

any matter to be voted upon by stockholders. Our Articles of Incorporation, as amended, do not provide for cumulative voting in

connection with the election of directors. Our bylaws provide that all director elections shall be determined by a plurality of

the votes cast, and except as required by law, our Articles of Incorporation, as amended, or our bylaws, all other matters shall

be determined by a majority vote. At any meeting of the stockholders, holders of a majority in voting power of the shares issued

and outstanding and entitled to vote at such meeting of stockholders will constitute a quorum at such meeting of the stockholders

for the transaction of business. No holder of our common stock has any preemptive right to subscribe for any shares of our common

stock issued in the future.

Upon any voluntary or involuntary liquidation,

dissolution, or winding up of our affairs, the holders of our common stock are entitled to share ratably in all assets available

for distribution after payment of creditors.

Security Ownership of Certain Beneficial

Owners of More than Five Percent of our Common Stock

The following table sets forth information

regarding each stockholder who will beneficially own more than five percent of our common stock as of the Post-Transaction Date.

Except as otherwise indicated, we believe, based on information furnished by such persons, that each person listed below has sole

voting and investment power over the voting securities shown as beneficially owned, subject to community property laws, where applicable.

Beneficial ownership is determined under the rules of the Securities and Exchange Commission (“SEC”) and includes any

shares which the person has the right to acquire within 60 days after the Post-Transaction Date through the exercise of any stock

option, warrant or other right.

Security Ownership of Certain Beneficial

Owners & Management

|

Name and Address of Beneficial Owner

|

Amount and Nature of Beneficial Ownership

|

Percentage of Beneficial Ownership (1)

|

|

|

Directors and Officers: (1)

|

|

|

|

|

Andrew Bowden (2)

|

2,200,000

|

2.40%

|

|

|

|

|

Robert Mikkelsen (3)

|

0

|

0.00%

|

|

|

Ronald L. Miller, Jr. (4)

|

32,501

|

0.04%

|

|

|

Bryce Skalla (5)(9)

|

5,217,036

|

5.71%

|

|

|

|

|

Jeffrey Rassas (6)

|

1,833,349

|

2.01%

|

|

|

|

|

Christopher Wolven (7)

|

278,845

|

0.31%

|

|

|

Doug Bowden (8)

|

3,100,000

|

3.38%

|

|

|

All directors and officers as a group (7 people)**

|

12,661,731

|

13.85%

|

|

|

|

|

|

|

|

Beneficial Shareholders greater than 5%

|

|

|

|

|

Stockbridge Enterprises LP (9)

|

|

|

|

|

7377 E Doubletree Ranch Rd, Suite 200

|

4,884,048

|

5.34%

|

|

|

Scottsdale, AZ 85258

|

|

|

|

|

Sean Dugan (10)

|

8,144,712

|

8.91%

|

|

|

|

|

Mark Murro III (10)

|

6,227,044

|

6.81%

|

|

|

|

|

Andrew Poirier (10)

|

7,618,045

|

8.33%

|

|

|

|

|

|

|

|

|

**We anticipate that all of our

officers, directors and 5% plus shareholders as a group will beneficially own approximately 43% of our issued and outstanding common

stock as of the Post-Transaction Date.

(1) The percentages are based on 91,410,645

shares of our common stock outstanding as of the Post-Transaction Date, plus shares of common stock that may be acquired by the

beneficial owner within 60 days after the Post-Transaction Date, by exercise of stock conversions and/or warrants. Our common stock

is our only issued and outstanding class of securities eligible to vote. Unless otherwise stated, all shareholders can be reached

at mailing address 2727 North 3rd Street, Suite 201 Phoenix, Arizona 85004

(2) Andrew Bowden has been Chief Executive

Officer since November 18, 2019 and a Director of the Company since September 11, 2018. Mr. Bowden’s beneficial ownership

consists of 200,000 shares purchased via private placement in March 2018 by EBAB, LLC, which is controlled by Mr. Bowden. Mr. Bowden

owns approximately 40% of Viridis Group I9 Capital LLC, an entity which owns an aggregate 5,000,000 shares purchased pursuant to

the Purchase Agreement dated October 17, 2018.

(3) Robert Mikkelsen is the Company’s

CFO, Secretary and Treasurer. His beneficial ownership includes 0 shares of restricted common stock.

(4) Ronald L. Miller, Jr. is a Director of

the Company and Chairman of the Board. Mr. Miller’s beneficial ownership includes 30,000 shares issuable upon exercise of

stock options which have vested as of the day of this report and 2,501 total shares purchased in May 2014, some of which were purchased

by Windsor Westfield Management, LLC and some by Chickamauga Enterprises, L.P. Both companies are indirectly controlled by Mr.

Miller. The remaining 376 shares are held directly by Mr. Miller.

(5) Bryce Skalla is the Company’s President

and Director. Mr. Skalla’s beneficial ownership consists of 4,717,036 shares of restricted common stock held in his name

and 500,000 shares held by a minor.

(6) Jeffrey Rassas is Chief Strategy Officer

and Director. The shares are held by Hayjour Family Limited Partnership, an entity controlled by Mr. Rassas, as such Mr. Rassas’

beneficial ownership includes: 1,788,903 shares of restricted common stock and 44,446 shares issuable upon the exercise of stock

options which have vested as of the date of this report.

(7) Christopher Wolven is Chief Operating Officer

and his beneficial ownership consists of 278,845 shares of common stock.

(8) Doug Bowden has been a Director of the

Company since February 2020. Mr. Bowden’s beneficial ownership consists of 100,000 shares purchased via private placement

in March 2018 and Mr. Bowden also owns approximately 60% of Viridis Group I9 Capital LLC, an entity which owns an aggregate 5,000,000

shares purchased pursuant to the Purchase Agreement dated October 17, 2018.

(9) Stockbridge Enterprises LP is an Arizona

limited partnership controlled by Mitchell A. Saltz, Chairman and Managing Partner.

(10) Skalla, Dugan, Murro, and Poirier were

members of BSSD. On March 20, 2018, the Company closed on an Agreement and Plan of Exchange to acquire all of the membership interests

of BSSD in exchange for newly issued restricted shares of the Company’s common which were distributed pro-rata to the BSSD

members.

Change of Control

Pursuant to the terms of the Merger Agreement,

and upon the effectiveness of the transactions contemplated thereby, OCG will become our wholly-owned subsidiary. In exchange for

100% of the common stock of OCG, OCG’s former shareholders will collectively own approximately 33% of our common stock on

a fully-diluted basis. Among OCG’s former shareholders, none will own 5% of more of our common stock upon completion of the

Merger Agreement transaction.

Pursuant to the terms of the Merger Agreement

and upon the effectiveness of the transactions contemplated thereby OCG’s management and majority shareholders may nominate

two new members to our Board, potentially bringing our Board to a total of seven (7) members. Because of the issuance of securities

pursuant by the Merger Agreement, there may be a change of control of the Company upon the effectiveness of the transactions contemplated

by the Merger Agreement.

Consummation of the transactions contemplated

by the Merger Agreement is also conditioned upon, among other things, preparation, filing and distribution to our stockholders

of this Information Statement. There can be no assurance that the transactions contemplated by the Merger Agreement will be completed.

OVERVIEW OF BUSINESS

ITEM 9 LABS CORP.

Corporate history

Item 9 Labs Corp. (“Item 9 Labs”

or the “Company”), was incorporated under the laws of the State of Delaware on June 15, 2010 as Crown Dynamics Corp.

On October 26, 2012, the Company changed its name to Airware Labs Corp. On April 2, 2018, the Company changed its name to Item

9 Labs Corp. to better reflect its business following the acquisition of BSSD, as discussed below.

On March 20, 2018, the Company closed on an

Agreement and Plan of Exchange to acquire all of the membership interests of BSSD Group, LLC (“BSSD”), an Arizona limited

liability company formed on May 2, 2017, in exchange for newly issued restricted shares of the Company’s common stock (the

“Shares”), which represent approximately 75% of the issued and outstanding shares of the Company’s common stock

on a fully-diluted basis. The 40,355,771 shares were distributed pro-rata to the BSSD members.

Effective October 18, 2018, the Company completed

a 1-for-20 reverse split of its issued and outstanding common stock.

On November 26, 2018, the company’s wholly

owned subsidiary AZ DP Holdings, LLC (“AZ DP”) closed on an asset acquisition of the majority of the assets of Arizona

DP Consulting, LLC, a consulting firm specializing in obtaining marijuana dispensary permits and developing cannabis related business

plans. The purchase price was $1,500,000 in cash and 3,000,000 shares of restricted common stock having an aggregate value of $7,770,000

or $2.59 per share based on current market price of the Company shares at time asset purchase agreement was executed. On November

15, 2019, the Company received 2,300,000 shares of the Company’s common stock into treasury previously issued pursuant to

the November 26, 2018 asset acquisition in exchange for a reduction in time of the former CEO’s non-competition agreement.

On September

12, 2018, the Company executed a $1,500,000 promissory note (see Note 8) which was used to make a capital contribution into Strive

Management, LLC, a Nevada limited liability company (“Strive Management”). In exchange for the contribution, the Company

received a 20% membership interest in Strive Management.

In February 2020, the Company executed an agreement

with the other members of Strive Management, LLC to purchase the remaining 80% of Strive Management, LLC, as well as the Nevada

licenses its members held in another entity. The Company agreed to pay $500,000 in cash, $1,000,000 in an unsecured note payable

and 3,250,000 shares of the Company’s restricted common stock. In order to close the transaction, the Company borrowed $500,000

from Stockbridge Enterprises, a related party. The Company is to repay the loan by April 15, 2020.

Overview

Item 9 Labs creates comfortable cannabis

health solutions for the modern consumer. The Company is bringing best of industry practices to markets from coast to coast through

cultivation and production, distinctive retail environments, licensing services, and diverse product suites catering to different

medical and adult use cannabis demographics. Item 9 Labs is headquartered in Phoenix, Arizona, with medical cannabis operations

in multiple U.S. markets.

Item 9 Labs’ asset portfolio includes

Dispensary Permits, Dispensary Templates, and Strive Life. These assets provide services specific to different stakeholder groups.

Dispensary Permits is the Company’s consulting firm specializing in strategic license application and compliance. Dispensary

Templates, a subdivision of the firm, is a technology platform with an extensive digital library of licensing and business planning

resources. Strive Life is a turnkey dispensary model for the retail sector, elevating the patient experience with consistent and

superior service, high-end design, and precision-tested products. It is currently being implemented in North Dakota.

In addition, Item 9 Labs is advancing

the industry with its dynamic product suites. The Company has created complementary brands Item 9 Labs and Strive Wellness to channel

consumer diversity. Propriety delivery platforms include the Apollo Vape and Pod system, as well as a pioneering intra-nasal device.

The Company has received multiple accolades for its medical-grade flower and concentrates.

Item 9 Labs anticipates it will be

managing cultivation, processing, distribution, and dispensary operations in up to seven U.S. markets by the end of 2020. Current

facilities include Cultivation, Processing and Distribution for Strive Wellness of Nevada, as well as dispensary Strive Life North

Dakota.

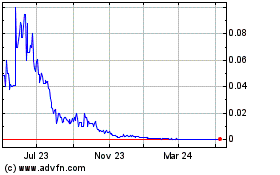

Market Information

Our common stock is currently quoted on the

OTC Bulletin Board. Our common stock has been quoted on the OTC Bulletin Board since November 3, 2011 under the symbol “CDYY.OB.”

On November 9, 2012, our symbol was changed to “AIRW.OB” to reflect the Company’s name change. On December 21,

2016 we filed a Form 15-12G and down listed to the OTC Pink sheets. On April 27, 2018, the Company’s ticker symbol was changed

to “INLB”. Because we are quoted on the OTC Markets, our common stock may be less liquid, receive less coverage by

security analysts and news media, and generate lower prices than might otherwise be obtained if it were listed on a national securities

exchange.

The following table sets forth the high and

low bid prices for our Common Stock per quarter as reported by the OTC Bulletin Board for the quarterly periods indicated below

based on our fiscal year end September 30. Our common stock began trading in 2012. These prices represent quotations between dealers

without adjustment for retail mark-up, markdown or commission and may not represent actual transactions.

|

Fiscal Quarter

|

|

|

High

|

|

|

|

Low

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter (Oct. 1, 2017 – Dec. 31, 2017)

|

|

$

|

3.40

|

|

|

$

|

0.252

|

|

|

Second Quarter (Jan. 1, 2018 – Mar. 31, 2018)

|

|

|

2.80

|

|

|

|

1.80

|

|

|

Third Quarter (Apr. 1, 2018 – Jun. 30, 2018)

|

|

|

4.20

|

|

|

|

2.20

|

|

|

Fourth Quarter (Jul. 1, 2018 – Sept. 30, 2018)

|

|

|

3.00

|

|

|

|

1.65

|

|

|

First Quarter (Oct. 1, 2018 – Dec. 31, 2018)

|

|

$

|

7.00

|

|

|

$

|

1.50

|

|

|

Second Quarter (Jan. 1, 2019 – Mar. 31, 2019)

|

|

$

|

6.00

|

|

|

$

|

3.50

|

|

|

Third Quarter (Apr. 1, 2019 – Jun. 30, 2019)

|

|

|

7.10

|

|

|

|

2.02

|

|

|

Fourth Quarter (Jul. 1, 2019 – Sept. 30, 2019)

|

|

|

4.99

|

|

|

|

2.15

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter (Oct. 1, 2019 – Dec. 31, 2019)

|

|

$

|

2.73

|

|

|

$

|

0.75

|

|

Record Holders

As of March 5, 2020, there were 61,410,645

common shares issued and outstanding, which were held by 313 stockholders of record.

Dividends

We have never declared or paid any cash dividends

on our common stock nor do we anticipate paying any in the foreseeable future. Furthermore, we expect to retain any future earnings

to finance our operations and expansion. The payment of cash dividends in the future will be at the discretion of our Board of

Directors and will depend upon our earnings levels, capital requirements, any restrictive loan covenants and other factors the

Board considers relevant.

Securities Authorized for Issuance under

Equity Compensation Plans

On June 21, 2019, our shareholders voted to

approve the 2019 Equity Incentive Plan (the “2019 Plan”). Pursuant to the 2019 Plan, the maximum aggregate number of

Shares available under the Plan through awards is the lesser of: (i) 6,000,000 shares, increased each anniversary date of the adoption

of the plan by 2 percent of the then-outstanding shares, or (b) 10,000,000 shares. We have 6,000,000 shares available for issuance

under the 2019 Plan.

Stock Transfer

Agent

Our transfer agent is Nevada Agency and Transfer

Company, Inc., 50 West Liberty Street, Suite 880 Reno Nevada 89501.

Employees and Independent Contractors

As of March 5, 2020, we had sixty-five full

time employees, including our executive officers, one full-time consultant, and two part-time employees. We plan to hire additional

employees and engage consultants on an as-needed basis. Our employees are not represented by any unions and we consider our relationship

with our employees to be great. We also have relationships with several independent contractors who provide services on a regular

basis to us.

Research and Development

Going forward, we intend to continue focusing

adequate resources on research and development. Allocation of research and development funds may be dependent on the perceived

likelihood of legalization or a significant change in the treatment of cannabis in a given geographic market. Funds may also be

used for both product and market development in the hemp and cannabis industries. Given the emergent nature of these industries,

we recognize the needs of today may not be the needs of the future and some capital investment will be necessary to meet changing

demands.

Intellectual Property

We generally rely upon copyright, trademark

and trade secret laws to protect and maintain our proprietary rights for our technology, brands, and products. We currently

hold several trademarks including various goods and services of “Item 9 Labs” (serial numbers 87940264, 87940227,

87940254 and 87940239), “Delta 8” (serial numbers 88004775,

88004789, 88004799, 88004812) and Strive Life (88/144,717), as well as several domains, including but not limited to, arizonadispensarypermits.com,

dispernsarytemplates.com, and wegrowstore.com.

We maintain a policy requiring our employees,

consultants and other third parties to enter into confidentiality and proprietary rights agreements and to control access to software,

documentation and other proprietary information.

Notwithstanding the steps we have taken to

protect our intellectual property rights, third parties may infringe or misappropriate our proprietary rights. Competitors may

also independently develop products and models that are substantially equivalent or superior to our products and services.

Properties

Currently the Company leases approximately

4,202 square feet of office space in Phoenix, Arizona, at a monthly rent of $6,480. The lease includes all utilities, was effective

September 1, 2019, with a 5-year term.

The Company owns approximately 50 acres in

Southern Arizona that is zoned to grow and cultivate medical marijuana flower. The Company is currently utilizing 5 acres which

was acquired in May 2017 which includes a 10,000 square foot, state-of-the-art indoor manufacturing facility with 10,000 square

feet of additional capacity which passed inspections to operate June 4, 2019 and is currently in production. The facility now totals

20,000 square-feet consisting of 8 flower rooms, just over 1,000 square-feet of nursery space, an upgraded extraction laboratory,

for increased manufacturing capabilities. On April 20, 2018, the Company entered into an agreement for the purchase of approximately

44 acres of land from an affiliate of a founding member of BSSD, its now wholly owned subsidiary. The purchase price of the property

was $3,000,000, payable as follows; (i) $200,000 deposited with escrow agent as an initial earnest money deposit in April 2018,

(ii) on or before February 1, 2019, the Company will deposit an additional $800,000 into escrow as additional earnest money deposit

and (iii) the balance of the purchase price shall be paid via a promissory note. The earnest money amounts are non-refundable.

The Company has negotiated an amendment to this agreement that will spread the $800,000 payment over the course of time. As of

September 30, 2019, the Company had paid a total of $600,000 which was deposited in escrow and classified as a long-term asset

on the consolidated balance sheet as of September 30, 2019. As of the date of these financial statements, a total of $600,000 has

been deposited in escrow.

Legal Proceedings

From time to time, we may become subject to various legal proceedings that are incidental to the ordinary conduct of its business.

Although we cannot accurately predict the amount of any liability that may ultimately arise with respect to any of these matters,

it makes provision for potential liabilities when it deems them probable and reasonably estimable. These provisions are based on

current information and may be adjusted from time to time according to developments. Other than the foregoing we are not aware

of any material litigation:

On February 26, 2020, the Company’s subsidiary

Item 9 Properties, LLC was served with a foreclosure of mechanics lien in Nye County, Nevada against itself and Solera General

Contracting alleging among other things breach of contract and covenant of good faith and fair dealing against Solera, unjust enrichment

against Item 9 Properties. The Company has engaged counsel to defend the action. The Company has engaged legal counsel to answer

the complaint.

Competition

We compete in markets where cannabis has been

legalized and regulated, which includes various states within the United States. We expect that the quantity and composition of

our competitive environment will continue to evolve as the industry matures. Additionally, increased competition is possible to

the extent that new states and geographies enter the marketplace as a result of continued enactment of regulatory and legislative

changes that de-criminalize and regulate cannabis products. We believe that by diligently establishing and expanding our brands,

product offerings and services in new and existing locations, we will become established in the industry. Additionally, we expect

that establishing our product offerings in new and existing locations are factors that mitigate the risk associated with operating

in a developing competitive environment. Additionally, the contemporaneous growth of the industry as a whole will result in new

customers entering the marketplace, thereby further mitigating the impact of competition on our operations and results.

In our opinion, we are currently competing

with cannabis cultivators, manufacturers, and retailers in our local jurisdictions as well as international enterprises as set

forth below, among many others. Many of our competitors are substantially larger than us and have significantly greater name recognition,

sales and marketing, financial, technical, customer support and other resources. These competitors also may have more established

distribution channels and stronger relationships with local, long distance and Internet service providers. These competitors may

be able to respond more rapidly to new or emerging technologies and changes in customer requirements or to devote greater resources

to the development, promotion and sale of their products.

These competitors may enter our existing or

future markets with products that may be less expensive, that may provide higher performance or additional features or that may

be introduced more quickly than our products.

We do not expect to face significant competition

with respect to our branded apparel, however, other corporations may sell apparel that incorporates other logos or trademarks associated

with the cannabis industry.

We believe that we compete favorably with our

competitors on the basis of these factors. However, if we are unable to compete successfully against our current and future competitors,

it will be difficult to acquire and retain customers, and we may experience revenue declines, thereby resulting in reduced operating

margins, loss of market share and diminished value in our services.

Government Regulation of Cannabis

Cannabis is currently a Schedule I controlled

substance under the Controlled Substances Act (21 U.S.C. § 811) (“CSA”) and is, therefore, illegal under federal

law. Even in those states in which the use of cannabis has been legalized pursuant to state law, its use, possession or cultivation

remains a violation of federal law. A Schedule I controlled substance is defined as one that has no currently accepted medical

use in the United States, a lack of safety for use under medical supervision and a high potential for abuse. The U.S. Department

of Justice (the “DOJ”) defines Schedule I controlled substances as “the most dangerous drugs of all the drug

schedules with potentially severe psychological or physical dependence.” If the federal government decides to enforce the

CSA, persons that are charged with distributing, possessing with intent to distribute or growing cannabis could be subject to fines

and/or terms of imprisonment, the maximum being life imprisonment and a $50 million fine, even though these persons are in compliance

with state law.

In light of such conflict between federal laws

and state laws regarding cannabis, the previous administration under President Obama had effectively stated that it was not an

efficient use of resources to direct federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws

allowing the use and distribution of medical cannabis. The new administration under President Trump has indicated that he will

strongly enforce the federal laws applicable to cannabis. Any such change in the federal government’s enforcement of current

federal laws could cause significant financial damage to us. As we currently directly harvest, distribute and/or sell cannabis,

we may be irreparably harmed by a change in enforcement policies of the federal government.

The Company and our licensed products will

also be subject to a number of other federal, state and local laws, rules and regulations. We anticipate that our vendors and us

will be required to manufacture our products in accordance with the Good Manufacturing Practices guidelines and will be subject

to regulations relating to employee safety, working conditions, protection of the environment, and other items. The current administration

has indicated that it will closely scrutinize the cannabis industry, in particular, recreational marijuana. Changes in laws, rules

and regulations or the recall of any product by a regulatory authority, could have a material adverse effect on our business and

financial condition.

The United States

federal government regulates drugs through the Controlled Substances Act (21 U.S.C. § 811), which places controlled substances,

including cannabis, in a schedule. Currently, cannabis and CBD (0.3 percent THC or more) are

classified as Schedule I drugs, which are viewed as highly addictive and having no medical value and is illegal to distribute and

use. The United States Federal Drug Administration has not approved the sale of marijuana or CBD (0.3

percent THC or more) for any medical application. Doctors may not prescribe cannabis or CBD (0.3

percent THC or more) for medical use under federal law, however they can recommend its use under the First Amendment.

In 2010, the United States Veterans Affairs Department clarified that veterans using medicinal cannabis or CBD (0.3

percent THC or more) will not be denied services or other medications that are denied to those using illegal drugs.

Currently, forty-seven

States and the District of Columbia have laws legalizing marijuana and CBD in some form. In November 2016, California, Massachusetts,

Maine and Nevada all passed measures legalizing recreational marijuana. California’s Prop. 64 measure allows adults 21 and

older to possess up to one ounce of marijuana and grow up to six plants in their homes. Other tax and licensing provisions of the

law didn’t take effect until January 2018.

These noted state

laws, both proposed and enacted, are in direct conflict with the federal Controlled Substances Act, which makes cannabis use and

possession illegal on a national level. However, on August 29, 2013, the U.S. Department of Justice issued a memorandum providing

that where states and local governments enact laws authorizing cannabis-related use, and implement strong and effective regulatory

and enforcement systems, the federal government will rely upon states and local enforcement agencies to address cannabis activity

through the enforcement of their own state and local narcotics laws. The memorandum further stated that the U.S Justice Department’s

limited investigative and prosecutorial resources will be focused on eight priorities to prevent unintended consequences of the

state laws, including distribution of cannabis to minors, preventing the distribution of cannabis from states where it is legal

to states where it is not, and preventing money laundering, violence and impaired driving.

On December 11, 2014,

the U.S. Department of Justice issued another memorandum with regard to its position and enforcement protocol with regard to Indian

Country, stating that the eight priorities in the previous federal memo would guide the United States Attorneys' cannabis enforcement

efforts in Indian Country. On December 16, 2014, as a component of the federal spending bill, the Obama administration enacted

regulations that prohibit the Department of Justice from using funds to prosecute state-based legal medical cannabis programs.

On January 4, 2018, The Department of Justice

lead by Jeff Sessions issued a memo on federal marijuana enforcement policy announcing a return to the rule of law and the rescission

of previous guidance documents. Since the passage of the Controlled Substances Act (CSA) in 1970, Congress has generally prohibited

the cultivation, distribution, and possession of marijuana.

However, on January 18, 2019, the new Attorney

General, William Barr, stated in front of the Senate Judiciary Committee that he does not plan on using federal resources to "go

after" companies if they are complying with state law. That would be a reversal from the approach taken by his predecessor,

former Attorney General Jeff Sessions, who vowed to pursue federal violations more aggressively. According to Erik Altieri, executive

director of the National Organization for the Reform of Marijuana Laws (NORML), Barr's stance is a good sign for advocates, but

it remains to be seen if his actions will follow through on his pledge. Our business could terminate and investors could lose their

total investment in the company if there is no reversal in Sessions’ approach.

On June 20, 2019, the United States House of

Representatives passed a historic bipartisan amendment to the fiscal year 2020 Commerce-Justice-Science spending bill. By a vote

of 267-165, the House approved the Blumenauer-McClintock-Norton Amendment which would protect state-legal cannabis programs from

interference by the United States Department of Justice (DOJ). The amendment is named after the three individuals who submitted

it for consideration: Representative Earl Bluemenauer, a Democrat from Oregon, Tom McClintock, a Republican from California, and

Eleanor Norton, a delegate from Washington D.C.

Currently, the spending

bill does provide protection for state-legal medical cannabis programs from DOJ interference – but this amendment would protect

both medical and recreational cannabis programs that are legal at the state level. The amendment would prohibit the DOJ from using

funds to prevent any American state, territory, and Washington D.C. from approving and implementing laws authorizing marijuana

use, distribution, possession, and cultivation. What remains uncertain is whether the current Republican-controlled Senate will

support the amendment. Further, if the amendment makes it into the final spending bill approved by Congress, it will only remain

in effect for one year. If the amendment does not garner approval from the Senate, then the DOJ will maintain the right to use

its funding to prevent the approval and implementation of laws regarding recreational cannabis use at the state level, which could

affect our business, and could impact our investors’ investment in the Company.

OCG, INC.

Corporate Overview

OCG, Inc. (“OCG”),

a Colorado corporation, was formed on March 6, 2018. OCG’s principal business address is 100 Garfield Street, Suite 400,

Denver, Colorado 80206.

OCG sells medical and adult-use cannabis

dispensary franchises under the brand “Unity Rd.” OCG’s franchising business offers existing and potential operators

in the cannabis industry the benefit of OCG’s operational experience, marketing, partnerships and branding while allowing

franchisees to own their own business. To date, OCG has sold one five (5) unit package in December 2018. OCG has also entered into

services agreements with applicants seeking licenses to operate twenty-six (26) dispensaries across seven (7) states. These agreements

require conversion into franchise agreements upon issuance of the licenses. Subject to local franchise regulations, OCG intends

to offer franchises in all states that have regulated medical or adult-use cannabis.

OCG’s franchise model is intended

to enable OCG to expand its brand more quickly than existing multi-state cannabis operators (“MSOs”) across all cannabis

markets with very little capital investment. OCG believes it is one of the first companies to offer franchise opportunities to

participants in the cannabis industry, which will provide OCG an early mover advantage over newer franchisors or existing MSOs.

OCG franchise program is intended to guide its franchisees in building industry experience, improving operational quality, innovating

and maximizing operating results. OCG’s franchisees will assume much of the day-to-day responsibilities that otherwise would

be performed by a typical owner-operator. This reduction of duties at the corporate level allows OCG’s franchise support

team to scale across multiple units. Franchisees provide OCG a one-time upfront payment as well as ongoing royalties based on their

gross revenues. Therefore, OCG will benefit directly from the growth in their business.

OCG believes its model will assist its

franchisees in delivering high quality cannabis products and locally relevant customer experiences. Franchising enables an individual

to be his or her own employer and maintain control over all employment-related matters, and marketing and pricing decisions, while

also benefiting from OCG’s brand and operating system. While OCG intends for units operating under its brand to be primarily

franchised, OCG also intends to own and operate cannabis dispensaries and currently owns a cultivation facility, which has generated

virtually all its revenue to date.

OCG’s franchising business model

is designed to assist franchisees through every step of owning and operating a dispensary. OCG’s franchise package includes

product sourcing, technology, regulatory compliance, licensing, standard operating procedures, employee training and ongoing support.

OCG intends for its franchisees to leverage its years of cannabis operating experience and standardized procedures to operate their

own dispensaries and be part of OCG’s brand as it grows.

As a cannabis dispensary franchisor,

OCG offers both single-unit and multi-unit franchise packages to potential business operators. OCG seeks to sell primarily multi-unit

packages in regulated markets across the U.S. to well capitalized individuals and organizations that meet OCG’s franchisee

requirements. The primary franchise fees include an initial franchise fee and ongoing fees based on a percentage of revenues of

the franchisee. A summary of OCG’s current franchising fees is provided below:

Initial Franchise Fees

|

Number of Franchises

|

Initial Franchise Fee Per Unit

|

|

1-2

|

$100,000

|

|

3 or more

|

$83,333

|

Recurring Fees

|

Fee Type

|

Fee Amount

|

Payment Frequency

|

|

Support Fee

|

5% of Gross Revenues

|

Weekly

|

|

Marketing Fund Contribution

|

2% of Gross Revenues

|

Weekly

|

The initial fee and the support fee are intended

to generate revenue for OCG and to support its efforts to provide services to its franchisees. In OCG’s franchise agreements,

OCG is required to segregate the marketing fund contributions and use those funds to advertise locally, regionally, and/or nationally,

in printed materials, on radio, on television, and/or on the Internet in support of OCG’s franchisees and its brand. The

actual fee arrangements are subject to negotiation undertaken by OCG’s management.

OCG’s franchise operations cover

a wide scope of services to provide value to its franchisees. For new entrants to the cannabis industry, OCG has an application

writing and support team well-versed in the cannabis licensing process for different cities and states across the country. OCG

works with its franchisees’ advisors and facilitate relationships to help franchisees in obtaining a license. OCG’s

franchisee prospects also may choose to acquire existing operators rather than new unlicensed locations and OCG has a mergers and

acquisitions team with experience in valuing and finding acquisition candidates.

Whether buying or building, OCG assists

franchisees in selecting real estate in optimal areas that suit the zoning restrictions and limitations for cannabis dispensaries.

OCG is also seeking to partner with real estate investors to provide real estate capital and leasing to its franchisees. During

the building and/or retrofit stage of a franchisee’s dispensary, OCG intends to utilize our long-standing relationships with

architects and contractors who have experience working with cannabis industry participants. OCG also plans to provide franchisees

with strategic sourcing and partnerships through its preferred suppliers in various locations. OCG plans to utilize existing relationships

to assist franchisee product purchasing at more competitive pricing than if they were operating as a non-franchised dispensary.

Additionally, OCG works with franchisees to develop and execute a plan with respect to various marketing programs, including the

grand opening of each franchise location, local advertising and cooperative marketing to support its franchisees in establishing

and growing their business. OCG believes its franchisees will receive the benefit of scale as OCG’s brand grows and the marketing

pool and locations develop alongside OCG. Finally, prior to a franchisee beginning operations, OCG provides a classroom training

program that lasts approximately 45 hours. OCG’s staff is well versed in cannabis dispensary operational procedures and with

training new employees and managers.

Pre-Franchise Service Agreements

For prospective franchisees that have

not yet obtained a license, OCG enters into service agreements that require conversion into franchise agreements upon issuance

of the licenses. In connection with these agreements, OCG assists the prospective franchisees with site selection, license procurement,

dispensary design and other pre-operational services. Upon signing of the service agreement, the prospective franchisee typically

pays OCG an amount that is credited towards their initial franchise fee in consideration for the services to be provided prior

to obtaining the license. OCG believes these service agreements allow them to assist its prospective franchisees in obtaining licenses,

while it also provides OCG with a binding commitment from the prospective franchisee to enter into a franchise agreement upon issuance

of a license.

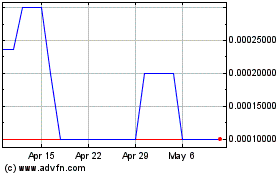

Market For Common Equity, Related Stockholder

Matters And Issuer Purchases of Equity Securities

Market Information

OCG's common stock is not currently traded

on any exchange.

Dividends

OCG has not paid cash dividends on its stock

since inception and has no intention to do so in the foreseeable future.

Equity Compensation Plans

OCG does not currently have an equity compensation

plan.

OCG’s Market

Our Competition

The cannabis industry is highly regulated,

fragmented and contains a patchwork of larger and small operators with a range of experience. OCG views its competition as both

large-scale MSOs and other franchising companies such as Spirit Leaf and TGS National.

OCG’s Competitive Strengths

OCG believes the competitive strength of its

franchise model relates to our ability to leverage operational experience to help new entrants and existing operators run better

businesses. OCG is one of the first movers in cannabis franchising and believes the cannabis industry provides for significant

opportunity in franchising. The cannabis industry currently suffers from a lack of regulated cannabis operational expertise, inconsistent

customer experiences, a limited number of multi-state or national retail brands, license ownership limitations and large capital

investment requirements. OCG’s franchise model is designed to overcome these issues in the following manner:

Industry and Franchise Expertise

- OCG believes that its operational know-how and support system for franchisees increases the likelihood of success for new

operators and provides greater comfort to regulators that compliance standards are met. Members of OCG’s senior management

team have over a decade of experience in the regulated cannabis industry and have utilized that experience to build standard operating

procedures and partner relationships to create what it believes is a franchise-ready brand. Additionally, members of OCG’s

senior management team have many years of experience in franchising and franchise law. OCG believes the combination of these two

disciplines provides OCG with a significant advantage in the marketplace by leveraging cannabis and franchising industry experience

to support the goal of franchisee owner-operators to operate successful cannabis businesses.

Customer Experience and National

Branding – OCG’s franchise system allows it to set, maintain and monitor standards and procedures intended to result

in consistent, positive customer experiences across all of OCG’s franchisees’ and company-owned dispensaries.

Reduced License Limitations -

Many jurisdictions limit the number of licenses for a single entity and through OCG’s franchise model, OCG believes it can

expand its brand and receive high margin revenues from operations, while allowing individuals to own their own stores in the growing

cannabis industry.

Limited Capital Expenditure -

An additional competitive strength of OCG’s business model is the capital efficient nature of franchising. OCG is not reliant

on the capital markets to continue to grow and are able to expand its brand while limiting our deployment of capital.

Growth Strategies

OCG believes that it has multiple potential

pathways for growth in the U.S. and internationally with the goal of being a leading retail brand across all regulated medical

and adult-use cannabis states and countries. Through OCG’s franchise operations, they plan to grow their brand presence and

franchise revenue in existing regulated cannabis markets and also newly state-regulated locations. The financially efficient nature

of their franchising model further enables them to continue to expand and allow franchisees to open new locations without OCG needing

to invest significant additional capital for that purpose.

Alongside OCG’s franchise sales efforts,

they intend to own and operate cannabis facilities both to support franchisees and also to grow their company. In addition to their

plan to continue to seek licenses for company-owned cannabis facilities directly, OCG plans to target strategic acquisitions of

licensed dispensary, cultivation, and/or product manufacturing operations in existing regulated cannabis markets. The OCG management

team believes it has a strong pipeline of strategic acquisitions for various types of cannabis licenses in a variety of locations.

In newly regulated states and countries, OCG will look, as strategically appropriate, to apply for cannabis business licenses or

acquire newly established businesses.

State and Federal Cannabis Regulation

There is significant government regulation

in the legal cannabis industry. We employ an in-house compliance officer who is a member of several state and national lobbying

organizations including National Cannabis Industry Association (NCIA) and Colorado Leads and Accelerate Colorado. Through these

and other organizations we will continue to interact with the multiple levels of government that regulate the cannabis industry.

In the United States, cannabis is illegal

under federal law. Medical and adult use cannabis has been legalized and regulated by individual states. As of the date of

this Memorandum 33 states plus the District of Columbia and certain U.S. territories recognize, in one form or another, medical

use of cannabis, while 11 of those states plus the District of Columbia and certain U.S. territories recognize, in one form or

another, adult use of cannabis. Notwithstanding the regulatory environment with respect to cannabis at the state level, cannabis

continues to be categorized as a Schedule I controlled substance under the CSA and as such violates U.S. federal law. As a result

of this conflict between state and federal law, cannabis businesses in the United States are subject to inconsistent legislation

and regulation. It is presently unclear whether the U.S. federal government intends to enforce U.S. federal laws relating to cannabis

where the conduct at issue is legal under applicable state law.

Employees

As of March 1, 2020, OCG has 44 full time

employees and 0 part time employees.

Intellectual Property

We registered the Unity Rd. trademark on June

25, 2019 with the United State Patent and Trademark Office, with notice published in the Trademark Official Gazette on January

14, 2020.

Description of Property

OCG does not own any real property. OCG’s

corporate headquarters is located at 100 Garfield St. Suite 400, Denver, CO 80206, where they lease 10,090 sq. feet of space. OCG’s

lease on these premises runs through January 31, 2024. The rent is approximately $90,099 per month, subject to yearly increases

of between 4.8% and 15.4% annually pursuant to the lease agreement.

One of OCG’s subsidiaries leases a building

at 21000 East 32nd Parkway, Suite 110, Aurora, CO 80011. The lease on those premises runs through December 31, 2023. The rent is

approximately $18,078 per month, subject to yearly increases of approximately 2.3%.

MERGER AGREEMENT

Pursuant to the Written Consent, a majority

of the stockholders and all members of our Board approved the Merger Agreement and authorized the Company to enter into the Merger

Agreement and perform all the transactions contemplated thereby. On February 27, 2020, the Company entered into the Merger Agreement,

pursuant to which Merger Sub will be merged with and into OCG through a reverse triangular merger transaction upon the terms and

subject to the conditions of the Merger Agreement, and in accordance with the DGCL.

Pursuant to the transactions contemplated

by the Merger Agreement, (i) each share of common stock of OCG will be exchanged for shares of the Company based on a ratio of

0.61475 to one, (ii) the operations of Item 9 Labs shall continue unchanged and OCG shall continue as the surviving corporation

after the transactions contemplated by the Merger Agreement (with and into Merger Sub), and (iii) each share of common

stock of Merger Sub will be converted into and exchanged for one share of common stock of OCG.

The foregoing description of the Merger Agreement

does not purport to be complete and is qualified in its entirety by the terms of the actual Merger Agreement, which is attached

as Exhibit A hereto and incorporated herein by reference.

Item 9 Labs Corp.

The discussion and analysis below should

be read in conjunction with the Company’s audited financial statements and notes thereto for the year ended September 30,

2019 and unaudited financial statements and notes thereto for the period ended December 31, 2019, each filed as Exhibit

B and Exhibit C hereto, respectively.

PRO-FORMA AND OTHER FINANCIAL INFORMATION

The following is the pro-forma financial

information for the Company and OCG as of the quarter ended December 31, 2019. The pro-forma information represents the effect

of the Merger on the Company’s financials as though it took place on October 1, 2019:

UNAUDITED CONDENSED COMBINED PRO FORMA

FINANCIAL STATEMENTS

The Company will acquire all of the issued

and outstanding shares of OCG, Inc. in exchange for 30,000,000 shares of the Company’s Common Stock. The following unaudited

condensed combined pro forma financial statements for the quarter ended December 31, 2019 are based upon the previously filed

unaudited financial statements of the Company for the quarter ended December 31, 2019, a copy of which is attached hereto as Exhibit

C, and the unaudited financial statements of OCG, Inc. as of and for the three-month period ended December 31, 2019. The unaudited

Pro Forma Condensed Combined Statement of Operations for the quarter ended December 31, 2019 give effect to these transactions

as if they had occurred on October 1, 2019. Additionally, a copy of the Company’s audited financial statements and notes

thereto for the year ended September 30, 2019 and unaudited financial statements and notes thereto for the period ended December

31, 2019, are each filed as Exhibit B and Exhibit C hereto, respectively

The historical information contained in

the unaudited condensed combined pro forma financial statements has been adjusted where events are directly attributable to the

acquisition, or are likely to have a continuing effect on the consolidated financial statements of Item 9 Labs Corp. The unaudited

condensed combined pro forma financial statements should only be read in conjunction with the notes to the unaudited condensed

combined pro forma financial statements appearing below and with reference to historical financial statements on file for Item

9 Labs Corp.

The unaudited condensed combined pro forma

financial statements are based on estimates and assumptions and are presented for illustrative purposes only and are not necessarily

indicative of what the consolidated company’s results of operations actually would have been had the acquisition been completed

as of the dates indicated. Additionally, the unaudited pro forma condensed consolidated financial information are not necessarily

indicative of the condensed consolidated financial position or results of operations in future periods or the results that actually

would have been realized if the acquisition had been completed as of the dates indicated. The actual financial position and results

of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors.

The combined pro forma financial information

does not reflect the realization of any expected cost savings or other synergies from the acquisition of OCG, Inc. as a result

of restructuring activities and other planned cost savings initiatives following the completion of the business combination.

|

ITEM 9 LABS CORP. AND SUBSIDIARIES

|

|

(FORMERLY AIRWARE LABS CORP.)

|

|

UNAUDITED PROFORMA CONDENSED CONSOLIDATED

CONDENSED BALANCE SHEETS

|

|

As of December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

9 Labs

|

|

|

|

(unaudited)

|

|

|

|

Proforma

|

|

|

|

|

|

|

|

Proforma

|

|

|

|

|

|

Corp

|

|

|

|

OCG

Inc.

|

|

|

|

Adjustments

|

|

|

|

Notes

|

|

|

|

Combined

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

46,680

|

|

|

$

|

(6,650

|

)

|

|

$

|

2,000,000

|

|

|

|

a

|

|

|

$

|

2,040,030

|

|

|

Restricted cash and cash equivalents

|

|

|

517,664

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

517,664

|

|

|

Accounts receivable, net of reserves

of $22,460 and $0 at December 31, 2019 and September 30, 2019, respectively

|

|

|

366,658

|

|

|

|

103,271

|

|

|

|

|

|

|

|

|

|

|

|

469,929

|

|

|

Due from related parties

|

|

|

|

|

|

|

243,631

|

|

|

|

|

|

|

|

|

|

|

|

243,631

|

|

|

Deferred costs

|

|

|

2,004,235

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

2,004,235

|

|

|

Inventory

|

|

|

—

|

|

|

|

642,352

|

|

|

|

|

|

|

|

|

|

|

|

642,352

|

|

|

Prepaid expenses

and other current assets

|

|

|

75,293

|

|

|

|

325,949

|

|

|

|

|

|

|

|

|

|

|

|

401,242

|

|

|

Total current assets

|

|

|

3,010,530

|

|

|

|

1,308,553

|

|

|

|

2,000,000

|

|

|

|

|

|

|

|

6,319,083

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

7,180,662

|

|

|

|

355,638

|

|

|

|

|

|

|

|

|

|

|

|

7,536,300

|

|

|

Right of use asset

|

|

|

243,027

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

243,027

|

|

|

Investment in Health Defense, LLC

|

|

|

100,000

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

100,000

|

|

|

Deposits on acquisitions

|

|

|

600,000

|

|

|

|

802,046

|

|

|

|

|

|

|

|

|

|

|

|

1,402,046

|

|

|

Security deposits

|

|

|

|

|

|

|

245,500

|

|

|

|

|

|

|

|

|

|

|

|

245,500

|

|

|

Receivable for sale of Airware assets,

net of reserves and unamortized discount of $307,430

|

|

|

474,715

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

474,715

|

|

|

Notes and interest receivable, net

of reserves of $69,000

|

|

|

180,000

|

|