Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed pursuant to Rule 424(b)(5)

Registration No. 333-235328

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to Be Registered

|

|

Maximum Aggregate

Offering Price

|

|

Amount of

Registration Fee(1)

|

|

|

|

Common Stock, $0.01 par value per share

|

|

$75,000,000

|

|

$9,735

|

|

|

-

(1)

-

This

filing fee is calculated in accordance with Rule 457(o) of the Securities Act of 1933, as amended (the "Securities Act"), based on the proposed maximum

offering price, and Rule 457(r) under the Securities Act. This "Calculation of Registration Fee" table shall be deemed to update the "Calculation of Registration Fee" table in the registrant's

Registration Statement on Form S-3 (File No. 333-235328) in accordance with Rules 456(b) and 457(r) under the Securities Act.

Table of Contents

PROSPECTUS SUPPLEMENT

(to Prospectus dated December 2, 2019)

$75,000,000

Common Stock

We have entered into an At Market Issuance Sales Agreement, or the sales agreement, with B. Riley FBR, Inc., or B. Riley FBR,

relating to the sale of shares of our common stock offered by this prospectus supplement and the accompanying prospectus. We may offer and sell shares of our common stock having an aggregate offering

price of up to $75,000,000, from time to time through or to B. Riley FBR as sales agent or principal.

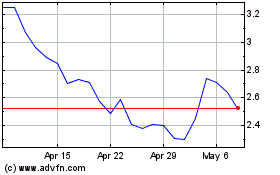

Our

common stock is listed on The NASDAQ Capital Market under the symbol "PLUG." On April 9, 2020, the last reported sale price of our common stock on The NASDAQ Capital Market

was $3.82 per share.

Sales

of our common stock, if any, under this prospectus supplement and the accompanying prospectus will be made by any method that is deemed an "at the market offering" as defined in

Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. B. Riley FBR is not required to sell a certain number of shares or dollar amount of our common stock.

Rather, B. Riley FBR will act as our sales agent on a commercially reasonable efforts basis consistent with its normal trading and sales practices. There is no arrangement for funds to be received in

any escrow, trust or similar arrangement.

B.

Riley FBR will be entitled to a commission in an amount up to 3.0% of the gross sales price per share sold under the sales agreement with B. Riley FBR. In connection with the sale of

the common stock on our behalf, B. Riley FBR may be deemed to be an "underwriter" within the meaning of the Securities Act, and the compensation of B. Riley FBR may be deemed to be underwriting

commissions or discounts. We have also agreed to provide indemnification and contribution to B. Riley FBR with respect to certain liabilities, including liabilities under the Securities Act.

Investing in our securities involves a high degree of risk. See "Risk Factors" beginning on page S-5 of this prospectus supplement

and in the other documents that are incorporated by reference in this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

B. Riley FBR

The date of this prospectus supplement is April 13, 2020.

Table of Contents

TABLE OF CONTENTS

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is part of the registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a "shelf"

registration process and consists of two parts. The first part is this prospectus supplement, including the documents incorporated by reference, which describes the specific terms of this offering.

The second part, the accompanying prospectus, including the documents incorporated by reference, gives more general information, some of which may not apply to this offering. Generally, when we refer

only to the "prospectus," we are referring to both parts combined. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by

reference into this prospectus supplement or the accompanying prospectus.

If

information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference that was filed with the SEC before the date

of this prospectus supplement, you should rely on this prospectus supplement. This prospectus supplement, the

accompanying prospectus and the documents incorporated by reference herein and therein include important information about us, the securities being offered and other information you should know before

investing in our securities. You should read the entire prospectus supplement and the accompanying prospectus carefully, including "Risk Factors" contained in this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference herein and therein and the financial statements incorporated by reference in this prospectus supplement and the accompanying

prospectus, before making an investment decision. You should also read and consider information in the documents we have referred you to in the section of this prospectus supplement and the

accompanying prospectus entitled "Where You Can Find Additional Information" and "Incorporation of Certain Information by Reference" as well as any free writing prospectus provided in connection with

this offering.

You

should rely only on this prospectus supplement, the accompanying prospectus, and any free writing prospectus provided in connection with this offering and the information

incorporated or deemed to be incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the sales agent has not, authorized anyone to provide you with

information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus, and any free writing prospectus provided in

connection with this offering. If anyone provides you with different or inconsistent information, you should not rely on it. We and the sales agent take no responsibility for, and can provide no

assurance as to the reliability of, any other information that others may give you. We and the sales agent are not offering to sell these securities in any jurisdiction where the offer or sale is not

permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in

connection with this offering is accurate as of any date other than as of the date of this prospectus supplement, the accompanying prospectus, or such free writing prospectus, as the case may be, or

in the case of the documents incorporated by reference, the date of such documents, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our

securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

All

references in this prospectus supplement or the accompanying prospectus to "Plug Power," the "Company," "we," "us," or "our" mean Plug Power Inc. and our subsidiaries, unless

we state otherwise or the context otherwise requires.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the securities or possession or distribution of this

prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in connection with this offering in that jurisdiction. Persons who come into possession of this prospectus

supplement, the accompanying

S-i

Table of Contents

prospectus, or any free writing prospectus provided in connection with this offering in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions

as to this offering and the distribution of this prospectus supplement, the accompanying prospectus, or any free writing prospectus provided in connection with this offering applicable to that

jurisdiction.

The

industry and market data contained or incorporated by reference in this prospectus supplement are based either on our management's own estimates or on independent industry

publications, reports by market research firms or other published independent sources. Although we believe these sources are reliable, we have not independently verified the information and cannot

guarantee its accuracy and completeness, as industry and market data are subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of

raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. Accordingly, you should be aware that the

industry and market data contained or incorporated by reference in this prospectus supplement, and estimates and beliefs based on such data, may not be reliable. Unless otherwise indicated, all

information contained or incorporated by reference in this prospectus supplement concerning our industry in general or any segment thereof, including information regarding our general expectations and

market opportunity, is based on management's estimates using internal data, data from industry related publications, consumer research and marketing studies and other externally obtained data.

This

prospectus supplement and the information incorporated herein by reference includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service

marks and trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective

owners.

S-ii

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about us and this offering and does not contain all of the information that

you should consider in making your investment decision. You should carefully read this entire prospectus supplement and the accompanying prospectus, including the risks and uncertainties discussed

under the heading "Risk Factors" beginning on page S-5 of this prospectus supplement, and the information incorporated by reference in this prospectus supplement and the accompanying

prospectus, including our consolidated financial statements, before making an investment decision. If you invest in our securities, you are assuming a high degree of risk.

Overview

As a leading provider of comprehensive hydrogen fuel cell turnkey solutions, we are seeking to build a green hydrogen economy. We are focused on

hydrogen and fuel cell systems that are used to power electric motors primarily in the electric mobility and stationary power markets, given the ongoing paradigm shift in the power, energy, and

transportation industries to address climate change, energy security, and meet sustainability goals. Plug Power created the first commercially viable market for hydrogen fuel cell, or the HFC

technology. As a result, we have deployed over 30,000 fuel cell systems, and have become the largest buyer of liquid hydrogen, having built and operated a hydrogen network across North America.

We

are focused on proton exchange membrane, or PEM, fuel cell and fuel processing technologies, fuel cell/battery hybrid technologies, and associated hydrogen storage and dispensing

infrastructure from which multiple products are available. A fuel cell is an electrochemical device that combines hydrogen and oxygen to produce electricity and heat without combustion. Hydrogen is

derived from hydrocarbon fuels such as liquid petroleum gas, or LPG, natural gas, propane, methanol, ethanol, gasoline or biofuels. Plug Power develops complete hydrogen generation, delivery,

storage and refueling solutions for customer locations. Currently, we obtain the majority of our hydrogen by purchasing it from fuel suppliers for resale to customers.

We

provide and continue to develop commercially-viable hydrogen and fuel cell solutions for industrial mobility applications (including electric forklifts and electric industrial

vehicles) at multi-shift high volume manufacturing and high throughput distribution sites where we believe our products and services provide a unique combination of productivity, flexibility and

environmental benefits. Additionally, we manufacture and sell fuel cell products to replace batteries and diesel generators in stationary backup power applications. These products have proven valuable

with telecommunications, transportation and utility customers as robust, reliable and sustainable power solutions.

In

our core business, we provide and continue to develop commercially-viable hydrogen and fuel cell product solutions to replace lead-acid batteries in electric material handling

vehicles and industrial trucks for some of the world's largest retail-distribution and manufacturing businesses. We are focusing our efforts on industrial mobility applications, including electric

forklifts and electric industrial vehicles, at multi-shift high volume manufacturing and high throughput distribution sites where we believe our products and services provide a unique combination of

productivity, flexibility and environmental benefits. Additionally, we manufacture and sell fuel cell products to replace batteries and diesel generators in stationary backup power applications. These

products have proven valuable with telecommunications, transportation and utility customers as robust, reliable and sustainable power solutions.

Our

current products and services include:

GenDrive: GenDrive

is our hydrogen fueled PEM fuel cell system providing power to material handling electric vehicles, including class 1, 2, 3 and 6 electric

forklifts and ground support equipment;

GenFuel: GenFuel

is our hydrogen fueling delivery, generation, storage and dispensing system;

S-1

Table of Contents

GenCare: GenCare

is our ongoing 'internet of things'-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel

hydrogen storage and dispensing products and ProGen fuel cell engines;

GenSure: GenSure

is our stationary fuel cell solution providing scalable, modular PEM fuel cell power to support the backup and grid-support power requirements of the

telecommunications, transportation, and utility sectors;

GenKey: GenKey

is our vertically integrated "turn-key" solution combining either GenDrive or GenSure fuel cell power with GenFuel fuel and GenCare aftermarket service,

offering complete simplicity to customers transitioning to fuel cell power; and

ProGen: ProGen

is our fuel cell stack and engine technology currently used globally in mobility and stationary fuel cell systems, and as engines in electric delivery vans.

We

provide our products worldwide through our direct product sales force, and by leveraging relationships with original equipment manufacturers, and their dealer networks. We manufacture

our commercially-viable products in Latham, NY and Spokane, WA.

To

promote fuel cell adoption and maintain post-sale customer satisfaction, we offer a range of service and support options through extended maintenance contracts. Additionally,

customers may waive our service option, and choose to service their systems independently. Substantially all of our fuel cells sold in recent years were bundled with maintenance contracts.

We

were organized in the State of Delaware on June 27, 1997.

Our

principal executive offices are located at 968 Albany-Shaker Road, Latham, New York, 12110, and our telephone number is (518) 782-7700. Our corporate website address is

www.plugpower.com. The information on our website is not part of this prospectus supplement or the accompanying prospectus.

S-2

Table of Contents

THE OFFERING

|

|

|

|

|

Issuer

|

|

Plug Power Inc.

|

|

Common stock offered by us pursuant to this prospectus supplement

|

|

Shares of our common stock having an aggregate offering price of up to $75,000,000.

|

|

Common stock to be outstanding after this offering

|

|

Up to 337,409,928 shares, after giving effect to the sale of 19,633,507 shares of our common stock in this offering at an

offering price of $3.82 per share, which was the last reported sale price of our common stock on The NASDAQ Capital Market on April 9, 2020. The actual number of shares issued will vary depending on the price at which shares may be sold from

time to time under this offering.

|

|

Manner of offering

|

|

"At the market offering" that may be made from time to time through or to B. Riley FBR, as sales agent or principal. See

"Plan of Distribution" on page S-13 of this prospectus supplement.

|

|

Use of Proceeds

|

|

We currently intend to use the net proceeds primarily for general corporate purposes. As of the date of this prospectus

supplement, we cannot specify with certainty all of the particular uses of the proceeds. As a result, our management will retain broad discretion in the allocation and use of the net proceeds. See "Use of Proceeds" on page S-10 of this

prospectus supplement.

|

|

Risk Factors

|

|

An investment in our common stock involves a high degree of risk. See the information contained in or incorporated by

reference under "Risk Factors" on page S-5 of this prospectus supplement, page 9 of our Annual Report on Form 10-K for the year ended

December 31, 2019 and under similar headings in the other documents that are incorporated by reference herein, as well as the other information included in or incorporated by reference in this prospectus supplement.

|

|

NASDAQ Capital Market Symbol

|

|

"PLUG".

|

The

number of shares of our common stock to be outstanding after this offering is based on 317,776,421 shares of common stock outstanding as of December 31, 2019. Unless

specifically stated otherwise, the information in this prospectus supplement is as of December 31, 2019 and excludes:

-

•

-

23,013,590 shares of common stock issuable upon the exercise of stock options, at a weighted average exercise price of $2.48 per share;

-

•

-

4,608,560 shares of common stock issuable upon the vesting of restricted stock units;

-

•

-

110,573,392 shares of common stock issuable upon the exercise of warrants;

-

•

-

2,782,076 shares of common stock issuable upon conversion of our Series C Redeemable Convertible Preferred Stock at a conversion price

of $0.2343 per share;

-

•

-

216,452 shares of common stock issuable upon conversion of our Series E Redeemable Preferred Stock at a conversion price of $2.31 per

share;

S-3

Table of Contents

-

•

-

43,630,020 shares of common stock issuance upon conversion of our 5.5% Convertible Senior Notes due March 15, 2023 at a conversion rate

of 436.3002 shares;

-

•

-

15,503,876 shares of common stock issuable upon conversion of our 7.5% Convertible Senior Note due January 2023 at a conversion rate of

387.5969 shares;

-

•

-

861,139 shares of common stock in treasury; and

-

•

-

8,377,891 shares of our common stock reserved for future issuance under our equity incentive plans.

On

January 22, 2020, all outstanding shares of Series E Redeemable Preferred Stock were redeemed.

Unless

otherwise stated, all information contained in this prospectus supplement reflects an assumed public offering price of $3.82 per share, which was the last reported sale price of

our common stock on The NASDAQ Capital Market on April 9, 2020.

S-4

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before investing in our common stock, you should carefully

consider the risks described below, together with all of the other information contained in this prospectus supplement, and accompanying prospectus and incorporated by reference herein and therein,

including from our most recent Annual Report on Form 10-K as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. Some of these factors relate

principally to our business and the industry in which we operate. Other factors relate principally to your investment in our securities. The risks and uncertainties described below are not the only

risks facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business and operations. If any of the

matters included in the following risks were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially and adversely affected. In such case, you

may lose all or part of your investment.

Risks Related to this Offering and Our Common Stock

Our stock price and stock trading volume have been and could remain volatile.

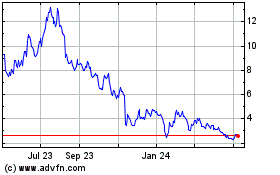

The market price of our common stock has historically experienced and may continue to experience significant volatility. From January 1,

2019 through April 9, 2020, the last reported sales prices of our common stock fluctuated from a high of $5.72 per share to a low of $1.26 per share. Our progress in developing and

commercializing our products, our quarterly operating results, announcements of new products by us or our competitors, our perceived prospects, changes in securities analysts' recommendations or

earnings estimates, changes in general conditions in the economy or the financial markets, adverse events related to our strategic relationships, significant sales of our common stock by existing

stockholders, including one or more of our strategic partners, and other developments affecting us or our competitors could cause the market price of our common stock to fluctuate substantially. In

addition, in recent years, the stock market has experienced significant price and volume fluctuations. This volatility has affected the market prices of securities issued by many companies for reasons

unrelated to their operating performance and may adversely affect the price of our common stock. Such market price volatility could adversely affect our ability to raise additional capital. In

addition, we may be subject to securities class action litigation as a result of volatility in the price of our common stock, which could result in substantial costs and diversion of management's

attention and resources and could harm our stock price, business, prospects, results of operations and financial condition.

The Series C Redeemable Convertible Preferred Stock are senior obligations of ours and rank senior to

our common stock with respect to dividends, distributions and payments upon liquidation.

The Series C Redeemable Convertible Preferred Stock ranks, with respect to dividend rights and rights upon our liquidation, dissolution

or winding up, senior to our common stock. The holders of the Series C Redeemable Convertible Preferred Stock are entitled to receive dividends at a rate of 8% per annum, based upon the

original issue price, payable in equal quarterly installments, in preference to our common stock and other junior securities, in cash or in shares of common stock, at our option. In the event of our

liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of

our debts and other liabilities, subject to the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock, including Series C Redeemable

Convertible Preferred Stock.

S-5

Table of Contents

The actual number of shares we may issue under the sales agreement, at any one time or in total, is

uncertain.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a sales notice to B.

Riley FBR at any time throughout the term of the sales agreement. The number of shares that are sold by B. Riley FBR after delivering a sales notice, if any, will fluctuate based on the market price

of the common stock during the sales period and limits we set with B. Riley FBR. Because the price per share of each share sold will fluctuate based on the market price of our common stock during the

sales period, it is not possible at this stage to predict the number of shares that will be ultimately issued.

You may experience immediate and substantial dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this

offering. Assuming that an aggregate of 19,633,507 shares of our common stock are sold during the term of the sales agreement with B. Riley FBR at a price of $3.82 per share, the last reported sale

price of our common stock on The NASDAQ Capital Market on April 9, 2020, for aggregate gross proceeds of $74,999,996.74, and after deducting commissions and estimated aggregate offering

expenses payable by us, you will experience immediate dilution of $3.24 per share, representing the difference between our as adjusted net tangible book value per share as of December 31, 2019,

after giving effect to this offering and the assumed offering price. In addition, we have a significant number of outstanding convertible notes, convertible preferred stock, warrants and stock

options. The conversion of the notes or preferred stock or the exercise of outstanding stock options and warrants may result in further dilution of your investment. See the section entitled "Dilution"

below for a more detailed illustration of the dilution you would incur if you participate in this offering. Because the sales of the shares offered hereby will be made by any method that is deemed an

"at the market offering" as defined in Rule 415 under the Securities Act, the prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we

sell, as well as our existing stockholders, will experience significant dilution if we sell shares at prices significantly below the price at which they invested.

We have broad discretion in the use of the proceeds of this offering and may apply the proceeds in ways with

which you do not agree.

Substantially all of our net proceeds from this offering will be used, as determined by management in its sole discretion, for general corporate

purposes. Our management will have broad discretion over the use and investment of the net proceeds of this offering. The failure of our management to apply these funds effectively could harm our

business. You will not have the opportunity, as part of your investment decision, to assess whether our proceeds are being used appropriately. Pending application of our proceeds, they may be placed

in investments that do not produce income or that lose value.

Future sales of a significant number of shares of our common stock or other dilution of our equity could

depress the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public market, or the perception that such sales could occur at any time, may

materially affect the market price of our common stock. As of the date hereof, we had a significant number of outstanding convertible notes, convertible preferred stock, warrants and stock options. As

of the date hereof, we had 43,630,020 shares of common stock issuable upon conversion of the 5.5% Convertible Senior Notes due March 2023 at a conversion price of $2.29 per share, 15,503,876 shares of

common stock issuable upon conversion of the 7.5% Convertible Senior Note due January 2023 at a conversion price of $2.58 per share, and 2,782,076 shares of common stock issuable upon conversion of

the Series C Preferred Stock at a conversion price of $0.2343 per share. In addition, as of the date hereof, we had outstanding

S-6

Table of Contents

options

exercisable for an aggregate of 19,803,872 shares of common stock at a weighted average exercise price of $2.57 per share and 110,573,392 shares of common stock issuable upon the exercise of

warrants. Moreover, we may choose to raise additional capital due to market conditions or strategic considerations, including the issuance of securities to fund a strategic transaction. The market

price of our common stock could decline as a result of resales of any of these shares of common stock or sales of such other securities made after this offering, or the perception that such sales

could occur.

A pandemic, epidemic or outbreak of an infectious disease, such as COVID-19, or coronavirus, may materially

and adversely impact our business, our operations and our financial results.

The recent outbreak of COVID-19, which surfaced in Wuhan, China, in December 2019, has since been declared a pandemic and has spread to multiple

global regions, including the United States and Europe. To date, multiple state and national governments—including those in New York and Washington, where our manufacturing facilities are

located—have issued orders requiring businesses that do not conduct essential services to temporarily close their physical workplaces to employees and customers. We are currently deemed an

essential business and, as a result, are exempt from these state orders, in their current form. In March 2020, we put in place a number of protective measures in response to the COVID-19 outbreak.

These measures include the canceling of all commercial air travel and all but other critical travel, requesting that employees limit non-essential personal travel, eliminating all but essential

third-party access to our facilities, enhancing our facilities' janitorial and sanitary procedures, encouraging employees to work from home to the extent their job function enables them to do so,

encouraging the use of virtual employee meetings, and providing staggered shifts and social distancing measures for those employees associated with manufacturing and service operations.

We

cannot predict at this time the full extent to which COVID-19 will impact our business, results and financial condition, which will depend on many factors. We are staying in close

communication with our manufacturing facilities, employees, customers, suppliers and partners, and acting to mitigate the impact of this dynamic and evolving situation, but there is no guarantee that

we will be able to do so. Although as of the date hereof, we have not observed any material impacts to our supply of components, the situation is fluid. Supply chain disruptions could reduce the

availability of key components, increase prices or both. In addition, future changes in applicable government orders or regulations, or changes in the interpretation of existing orders or regulations,

could result in further disruptions to our business that may materially and adversely affect our financial condition and results of operations.

S-7

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus contain and/or incorporate by reference statements that are not historical facts and

are considered forward-looking

within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements contain

projections of our future results of operations or of our financial position or state other forward-looking information. In some cases you can identify these statements by forward-looking words such

as "anticipate," "believe," "could," "continue," "estimate," "expect," "intend," "may," "should," "will," "would," "plan," "projected" or the negative of such words or other similar words or phrases,

which are predictions of or indicate future events or trends and which do not relate solely to historical matters. We believe that it is important to communicate our future expectations to our

investors. However, forward-looking statements involve numerous risks and uncertainties and depend on assumptions, data or methods which may be incorrect or imprecise. There may be events in the

future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Investors

are cautioned not to unduly rely on forward-looking statements. Actual results may differ materially from those discussed as a result of various factors, including, but not limited to: the risk that

we continue to incur losses and might never achieve or maintain profitability; the risk that we will need to raise additional capital to fund our operations and such capital may not be available to

us; the risk of dilution to our stockholders and/or stock price should we need to raise additional capital; the risk that our lack of extensive experience in manufacturing and marketing products may

impact our ability to manufacture and market products on a profitable and large-scale commercial basis; the risk that unit orders may not ship, be installed and/or converted to revenue, in whole or in

part; the risk that a loss of one or more of our major customers, or if one of our major customers delays payment of or is unable to pay its receivables, a material adverse effect could result on our

financial condition; the risk that a sale of a significant number of shares of stock could depress the market price of our common stock; the risk that our convertible senior notes, if settled in cash,

could have a material effect on our financial results; the risk that our convertible note hedges may affect the value of our convertible senior notes and our common stock; the risk that negative

publicity related to our business or stock could result in a negative impact on our stock value and profitability; the risk of potential losses related to any product liability claims or contract

disputes; the risk of loss related to an inability to maintain an effective system of internal controls; our ability to attract and maintain key personnel; the risks related to the use of flammable

fuels in our products; the risk that pending orders may not convert to purchase orders, in whole or in part; the cost and timing of developing, marketing and selling our products; the risks of delays

in or not completing our product development goals; our ability to obtain financing arrangements to support the sale or leasing of our products and services to customers; our ability to achieve the

forecasted gross margin on the sale of our products; the cost and availability of fuel and fueling infrastructures for our products; the risks, liabilities, and costs related to environmental, health

and safety matters; the risk of elimination of government subsidies and economic incentives for alternative energy products; market acceptance of our products and services, including GenDrive, GenSure

and GenKey systems; our ability to establish and maintain relationships with third parties with respect to product development, manufacturing, distribution and servicing, and the supply of key product

components; the cost and availability of components and parts for our products; general global economic and political conditions that harm the worldwide economy, disrupt our supply chain, increase

material costs or reduce demand for our component products (including changes in the level of gross domestic product in various regions of the world, natural disasters, terrorist act, global conflicts

and public health crises such as the coronavirus); the risk that possible new tariffs could have a material adverse effect on our business; our ability to develop commercially viable products; our

ability to reduce product and manufacturing costs; our ability to successfully market, distribute and service our products and services internationally; our ability to improve system reliability for

our products; competitive factors, such as price competition and

S-8

Table of Contents

competition

from other traditional and alternative energy companies; our ability to protect our intellectual property; the risk of dependency on information technology on our operations and the

failure of such technology; the cost of complying with current and future federal, state and international governmental regulations; our subjectivity to legal proceedings and legal compliance; the

risks associated with past and potential future acquisitions; and the volatility of our stock price. The risks and uncertainties included here are not exhaustive, and additional factors could

adversely affect our business and financial performance, including factors and risks referenced under "Risk Factors" of this prospectus supplement and in the accompanying prospectus or any free

writing prospectus provided in connection with this offering and any documents incorporated by reference herein or therein, including our Annual Report on Form 10-K for the year ended

December 31, 2019 as well as any amendment or update to our risk factors reflected in subsequent filings with the SEC. We operate in a very competitive and rapidly changing environment. New

risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to

which any factor, or combination of factors, may cause actual results to differ materially from these contained in any forward-looking statements. While forward-looking statements reflect our good

faith beliefs, they are not guarantees of future performance. These forward-looking statements speak only as of the date on which the statements were made. Except as may be required by applicable law,

we do not undertake or intend to update any forward-looking statements after the date of this prospectus supplement or the respective dates of documents incorporated herein or therein or any free

writing prospectus provided in connection with this offering that include forward-looking statements.

S-9

Table of Contents

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $75.0 million from time to time. Because there

is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There

can be no assurance that we will sell any shares under or fully utilize the sales agreement with B. Riley FBR as a source of financing.

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Except as described in any related free writing prospectus that we may

authorize to be provided

to you, we currently intend to use the net proceeds from the sale of the securities offered hereby for general corporate purposes. We may also use a portion of the net proceeds to acquire or invest in

businesses, products and technologies that are complementary to our own. Pending these uses, we intend to invest the net proceeds primarily in government securities and short-term, interest-bearing

securities.

S-10

Table of Contents

DILUTION

If you invest in our common stock, your ownership interest will be diluted by the difference between the assumed public offering price per share

of our common stock and the net tangible book value per share of our common stock immediately after this offering.

Our

net tangible book value as of December 31, 2019 was approximately $121.4 million, or $0.38 per share of common stock. Net tangible book value per share is determined by

dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of December 31, 2019. Dilution in net tangible book value per share

represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after

this offering. Dilution per share to new investors represents the difference between the amount per share paid by purchasers for our common stock in this offering and the net tangible book value per

share of our common stock immediately following the completion of this offering.

After

giving effect to the sale of shares of common stock offered by the prospectus at an assumed public offering price of $3.82 per share of common stock (the last reported sale price

of our common stock on The NASDAQ Capital Market on April 9, 2020), and after deducting the commissions and estimated aggregate offering expenses payable by us, our as adjusted net tangible

book value as of December 31, 2019 would have been approximately $194.7 million, or $0.58 per share of common stock. This represents an immediate increase in the as adjusted net tangible

book value of $0.20 per share to our existing stockholders and an immediate dilution of $3.24 per share of common stock issued to the new investors purchasing securities in this offering.

The

following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

Assumed public offering price per share of common stock

|

|

|

|

|

$

|

3.82

|

|

|

Net tangible book value per share as of December 31, 2019

|

|

$

|

0.38

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

0.20

|

|

|

|

|

|

As adjusted net tangible book value per share after giving effect to this offering

|

|

|

|

|

$

|

0.58

|

|

|

|

|

|

|

|

|

|

|

|

Dilution in net tangible book value per share to new investors

|

|

|

|

|

$

|

3.24

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

table above assumes for illustrative purposes that an aggregate of 19,633,507 shares of our common stock are sold at a price of $3.82 per share, the last reported sale price of our

common stock on The NASDAQ Capital Market on April 9, 2020, for aggregate net proceeds of $73.3 million. The shares sold in this offering, if any, will be sold from time to time at

various prices. An increase of $0.50 per share in the price at which the shares are sold from the assumed offering price of $3.82 per share shown in the table above, assuming all of our common stock

in the aggregate amount of $75,000,000 is

sold at that price, would result in net tangible book value per share after the offering of $0.58 per share and would result in dilution in adjusted net tangible book value per share to new investors

in this offering of $3.24 per share, after deducting commissions and estimated aggregate offering expenses payable by us. A decrease of $0.50 per share in the price at which the shares are sold from

the assumed offering price of $3.82 per share shown in the table above, assuming all of our common stock in the aggregate amount of $75,000,000 is sold at that price, would result in adjusted net

tangible book value per share after the offering to $0.57 per share and would result in dilution in net tangible book value per share to new investors in this offering to $3.25 per share, after

deducting commissions and estimated aggregate offering expenses payable by us. The information discussed above is illustrative only and will adjust based on the actual public offering price and other

terms of this offering determined at pricing.

S-11

Table of Contents

The

above table is based on 317,776,421 shares of common stock outstanding as of December 31, 2019. Unless specifically stated otherwise, the information in this prospectus

supplement is as of December 31, 2019 and excludes:

-

•

-

23,013,590 shares of common stock issuable upon the exercise of stock options, at a weighted average exercise price of $2.48 per share;

-

•

-

4,608,560 shares of common stock issuable upon the vesting of restricted stock units;

-

•

-

110,573,392 shares of common stock issuable upon the exercise of warrants;

-

•

-

2,782,076 shares of common stock issuable upon conversion of our Series C Redeemable Convertible Preferred Stock at a conversion price

of $0.2343 per share;

-

•

-

216,452 shares of common stock issuable upon conversion of our Series E Redeemable Preferred Stock at a conversion price of $2.31 per

share;

-

•

-

43,630,020 shares of common stock issuance upon conversion of our 5.5% Convertible Senior Notes due March 15, 2023 at a conversion rate

of 436.3002 shares;

-

•

-

15,503,876 shares of common stock issuable upon conversion of our 7.5% Convertible Senior Note due January 2023 at a conversion rate of

387.5969 shares;

-

•

-

861,139 shares of common stock in treasury; and

-

•

-

8,377,891 shares of our common stock reserved for future issuance under our equity incentive plans.

On

January 22, 2020, all outstanding shares of Series E Redeemable Preferred Stock were redeemed.

To

the extent that options or warrants outstanding as of December 31, 2019 are exercised or outstanding securities are converted or restricted stock units vest, you may experience

further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations, including the issuance of securities to fund a strategic transaction,

even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale or issuance of equity or convertible debt

securities, the issuance of these securities could result in further dilution to our stockholders.

S-12

Table of Contents

PLAN OF DISTRIBUTION

We have entered into an At Market Issuance Sales Agreement with B. Riley FBR, dated April 13, 2020. Pursuant to the sales agreement,

under this prospectus we may issue and sell our common stock having aggregate sales proceeds of up to $75,000,000 million from time to time through or to B. Riley FBR, acting as sales agent or

principal, subject to certain limitations. Sales of shares of our common stock, if any, will be made by any method deemed to be an "at the market offering" as defined in Rule 415 promulgated

under the Securities Act.

Each

time we wish to issue and sell common stock under the sales agreement, we will notify B. Riley FBR of the number of shares to be issued, the dates on which such sales are

anticipated to be made, any minimum price below which sales may not be made and other sales parameters as we deem appropriate. B. Riley FBR has agreed that once we have so instructed it, unless B.

Riley FBR declines to accept the terms of the notice, it will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount

specified on such terms.

B.

Riley FBR will be entitled to a commission in an amount up to 3.0% of the gross sales price per share sold under the sales agreement. B. Riley FBR may also receive customary brokerage

commissions from purchasers of the common stock in compliance with FINRA Rule 2121. B. Riley FBR may effect sales to or through dealers, and such dealers may receive compensation in the form of

discounts, concessions or commissions from B. Riley FBR and/or purchasers of shares of common stock for whom they may act as agents or to whom they may sell as principal. In addition, we have agreed

to reimburse legal expenses of B. Riley FBR in an amount not to exceed $20,000. We estimate that the total expenses for the offering, excluding compensation payable to B. Riley FBR under the terms of

the sales agreement, will be approximately $200,000.

Settlement

for sales of common stock will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us and B. Riley

FBR in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The

offering pursuant to the sales agreement will terminate upon the earliest of (a) the sale of all shares of common stock subject to the sales agreement or

(b) termination of the sales agreement as permitted therein.

In

connection with the sales of common stock on our behalf, B. Riley FBR may be deemed an "underwriter" within the meaning of the Securities Act, and the compensation of B. Riley FBR may

be deemed underwriting commissions or discounts. We have agreed to provide indemnification and contribution to B. Riley FBR against certain civil liabilities, including liabilities under the

Securities Act.

B.

Riley FBR and its affiliates may in the future provide various investment banking and other financial services for us and our affiliates, for which services they may in the future

receive customary fees. To the extent required by Regulation M, B. Riley FBR will not engage in any market making activities involving our common stock while the offering is ongoing under this

prospectus supplement.

S-13

Table of Contents

LEGAL MATTERS

The validity of the securities we are offering will be passed upon by Goodwin Procter LLP, Boston, Massachusetts. B. Riley FBR is being

represented in connection with this offering by Duane Morris LLP, New York, New York.

EXPERTS

The consolidated financial statements of Plug Power Inc. and subsidiaries as of December 31, 2019 and 2018, and for each of the

years in the three-year period ended December 31, 2019, and management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2019, have been

incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as

experts in accounting and auditing. The audit report on the consolidated financial statements refers to a change to the accounting for leases as of January 1, 2018, due to the adoption of

Accounting Standards Update 2016-02, Leases (Topic 842), as amended.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 (File No. 333-235328) under the Securities Act, of which this

prospectus supplement and the accompanying prospectus form a part. The rules and regulations of the SEC allow us to omit from this prospectus supplement certain information included in the

registration statement. For further information about us and the securities we are offering under this prospectus supplement, you should refer to the registration statement and the exhibits and

schedules filed with the registration statement. With respect to the statements contained in this prospectus supplement regarding the contents of any agreement or any other document, in each instance,

the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed as an exhibit to the registration statement.

Because

we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the

SEC. Our SEC filings are available to the public over the Internet at the SEC's website at www.sec.gov.

We

make available free of charge on our website our annual, quarterly and current reports, proxy statements and other information, including amendments thereto, as soon as reasonably

practicable after we electronically file such material with, or furnish such material to, the SEC. Please note, however, that we have not incorporated any other information by reference from our

website, other than the documents listed under the heading "Incorporation of Certain Information by Reference" on page S-15 of this prospectus supplement. In addition, you may request copies of

these filings at no cost by writing or telephoning us at the following address or telephone number:

Plug

Power Inc.

968 Albany Road

Latham, New York 12110

Attention: General Counsel

Telephone: (518) 782-7700

S-14

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference certain information that we file with the SEC. Incorporation by reference allows us to disclose

important information to you by referring you to those other documents instead of having to repeat the information in this prospectus supplement. The information incorporated by reference is

considered to be a part of this prospectus supplement and the accompanying prospectus, and information that we file in the future with the SEC will automatically update and supersede this information.

We incorporate by reference into this prospectus supplement and the accompanying prospectus the following documents (except for any document or portion thereof deemed to be "furnished" and not filed

in accordance with SEC rules and regulations):

In

addition, all documents subsequently filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this offering and prior to the termination

of this offering (excluding any portions of such documents that are deemed "furnished" to the SEC pursuant to applicable rules and regulations) are deemed to be incorporated by reference into, and to

be a part of, this prospectus supplement and the accompanying prospectus.

We

maintain a website that contains information about us at www.plugpower.com. The information found on, or otherwise accessible through our website is not incorporated into, and does

not form a part of, this prospectus supplement, the accompanying prospectus or any other report or document we file with or furnish to the SEC. To obtain copies of the filings we make with the

SEC, see "Where You Can Find More Information" on page S-14 of this prospectus.

S-15

Table of Contents

PROSPECTUS

PLUG POWER INC.

Common Stock

Preferred Stock

Warrants

Debt Securities

Units

This prospectus describes securities that may be issued and sold from time to time by us or that may be offered and sold from time to time by

selling securityholders to be identified in the future. We may offer, in one or more series or classes, separately or together, the following securities: (i) shares of common stock, par value

$0.01 per share, (ii) shares of preferred stock, par value $0.01 per share, (iii) warrants to purchase shares of common stock, preferred stock and/or debt securities, (iv) debt

securities and (v) units comprised of one or more of the securities described in this prospectus in any combination. We refer to the common stock, preferred stock, warrants, debt securities and

units registered hereunder collectively as the "securities" in this prospectus.

The

specific terms of each series or class of the securities will be set forth in the applicable prospectus supplement. The securities may be offered directly by us, through agents

designated from time to time by us, or to or through underwriters or dealers. These securities also may be offered by securityholders, if so provided in a prospectus supplement hereto. We will provide

specific information about any selling securityholders in one or more supplements to this prospectus. If any agents, dealers or underwriters are involved in the sale of any of the securities, their

names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable

prospectus supplement. See the sections entitled "About this Prospectus" and the "Plan of Distribution" for more information. No securities may be sold without delivery of this prospectus and the

applicable prospectus supplement describing the method and terms of the offering of such series of securities.

Our

common stock is listed on the NASDAQ Capital Market under the symbol "PLUG." On November 29, 2019, the last reported sale price of our common stock on the NASDAQ Capital

Market was $3.90. The applicable prospectus supplement will contain information, where applicable, as to any other listing, if any, on the NASDAQ Capital Market or any securities market or other

exchange of the securities covered by the applicable prospectus supplement.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties

described under the heading "Risk Factors" contained in this prospectus beginning on page 3 and any applicable prospectus supplement as well as those set forth in the documents incorporated by

reference into this prospectus or any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is December 2, 2019.

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a "shelf"

registration process. Under this process, we may sell any combination of the securities described in this prospectus in one or more offerings, and selling securityholders may from time to time offer

and sell any such security owned by them.

This

prospectus provides you with a general description of the securities we or the selling securityholders may offer. Each time we or any selling securityholder sell securities, we will

provide a prospectus supplement containing specific information about the terms of the applicable offering. A prospectus supplement may include a discussion of any risk factors or other special

considerations applicable to those securities or to us. A prospectus supplement may add, update or change information contained in this prospectus. If there is any inconsistency between the

information in this

prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. Before you buy any of our securities, it is important for you to consider the

information contained in this prospectus and any prospectus supplement together with additional information described under the heading "Where You Can Find More Information."

We

or any selling securityholders may offer the securities directly, through agents, or to or through underwriters. The applicable prospectus supplement will describe the terms of the

plan of distribution and set forth the names of any agents or underwriters involved in the sale of the securities. See "Plan of Distribution" for more information on this topic. No securities may be

sold without delivery of a prospectus supplement describing the method and terms of the offering of those securities.

We

have not authorized anyone to provide you with information in addition to or different from that contained in this prospectus, any applicable prospectus supplement and any related

free writing prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or

any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the

securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information in this prospectus, any applicable prospectus

supplement, any information incorporated or deemed incorporated by reference herein or therein or any related free writing prospectus is accurate as of any date other than the date of such

information. Our business, financial condition, results of operations and prospects and the business may have changed since that date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All

of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as

exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading "Where You Can Find Additional

Information."

Unless

otherwise mentioned or unless the context requires otherwise, all references in this prospectus to "Plug Power," "we," "us," "our," or the "Company" refer to Plug

Power Inc. and its subsidiaries.

This

prospectus and the information incorporated herein by reference includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and

trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective owners.

1

Table of Contents

OUR COMPANY

We are a leading provider of alternative energy technology focused on the design, development, commercialization and manufacture of hydrogen and

fuel cell systems used primarily for the material handling and stationary power markets. As part of the global drive to electrification, we have recently leveraged product proven in the material

handling vehicle space to enter new, adjacent, electric vehicle markets, specifically electric delivery vans.

We

are focused on proton exchange membrane, or PEM, fuel cell and fuel processing technologies, fuel cell/battery hybrid technologies, and associated hydrogen storage and dispensing

infrastructure from which multiple products are available. A fuel cell is an electrochemical device that combines hydrogen and oxygen to produce electricity and heat without combustion. Hydrogen is

derived from hydrocarbon fuels such as liquid petroleum gas, or LPG, natural gas, propane, methanol, ethanol, gasoline or biofuels. We develop complete hydrogen generation, delivery, storage

and refueling solutions for customer locations. Currently, we obtain the majority of our hydrogen by purchasing it from fuel suppliers for resale to customers.

In

our core business, we provide and continue to develop commercially-viable hydrogen and fuel cell product solutions to replace lead-acid batteries in electric material handling

vehicles and industrial trucks for some of the world's largest distribution and manufacturing businesses. We are focusing our efforts on industrial mobility applications (electric forklifts and

electric industrial vehicles) at multi-shift high volume manufacturing and high throughput distribution sites where our products and services provide a unique combination of productivity, flexibility

and environmental benefits. Additionally, we manufacture and sell fuel cell products to replace batteries and diesel generators in stationary backup power applications. These products prove valuable

with telecommunications, transportation and utility customers as robust, reliable and sustainable power solutions.

Our

current products and services include:

GenDrive:

GenDrive is our hydrogen fueled PEM fuel cell system providing power to material handling electric vehicles, including class 1, 2, 3 and 6 electric forklifts and ground support

equipment.

GenFuel:

GenFuel is our hydrogen fueling delivery, generation, storage and dispensing system.

GenCare:

GenCare is our ongoing 'internet of things'-based maintenance and on-site service program for GenDrive fuel cells, GenSure products, GenFuel products and ProGen engines.

GenSure:

GenSure is our stationary fuel cell solution providing scalable, modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications,

transportation, and utility sectors.

GenKey:

GenKey is our turn-key solution combining either GenDrive or GenSure power with GenFuel fuel and GenCare aftermarket service, offering complete simplicity to customers transitioning to fuel

cell power.

ProGen:

ProGen is our fuel cell stack and engine technology currently used globally in mobility and stationary fuel cell systems, and as engines in electric delivery vans.

We

provide our products worldwide through our direct product sales force, and by leveraging relationships with original equipment manufacturers and their dealer networks. We manufacture

our commercially-viable products in Latham, NY.

We

were organized in the State of Delaware on June 27, 1997. Our principal executive offices are located at 968 Albany-Shaker Road, Latham, New York, 12110, and our

telephone number is (518) 782-7700. Our corporate website address is www.plugpower.com. The information found on, or otherwise accessible through, our website is not deemed to be a part

of this prospectus or any applicable prospectus supplement. Our common stock trades on the NASDAQ Capital Market under the symbol "PLUG."

2

Table of Contents

RISK FACTORS

Investment in any securities offered pursuant to this prospectus involves risks. Before acquiring any offered securities pursuant to this

prospectus, you should carefully consider the information contained or incorporated by reference in this prospectus or in any accompanying prospectus supplement, including, without limitation, the

risks and uncertainties set forth under the heading "Risk Factors" in our most recent Annual Report on Form 10-K, and the other information contained or incorporated by reference in this

prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the risk factors and other information contained in the applicable

prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or a part of your investment in the offered securities. Please also

refer to the section below entitled "Cautionary Statement Regarding Forward-Looking Statements."

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that are not historical facts and are considered forward-looking within the meaning of Section 27A of

the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. These forward-looking statements contain projections of our future results of operations or

of our financial position or state other forward-looking information. You can identify forward-looking statements by the use of forward-looking terminology such as "believes," "expects," "may,"

"will," "should," "seeks," "approximately," "intends," "plans," "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases which are predictions of or indicate

future events or trends and discussions which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

These

forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry

results to differ materially from any predictions of future results, performance or achievements that we express or imply in this prospectus or in the information contained in or incorporated by

reference into this prospectus. Some of the risks, uncertainties and other important factors that may affect future results include, among others: the risk that we continue to incur losses and might

never achieve or maintain profitability; the risk that we will need to raise additional capital to fund our operations and such capital may not be available to us; the risk of dilution to our

stockholders and/or stock price should we need to raise additional capital; the risk that our lack of extensive experience in manufacturing and marketing products may impact our ability to manufacture

and market products on a profitable and large-scale commercial basis; the risk that unit orders may not ship, be installed and/or converted to revenue, in whole or in part; the risk that a loss of one

or more of our major customers, or if one of our major customers delays payment of or is unable to pay its receivables, a material adverse effect

could result on our financial condition; the risk that a sale of a significant number of shares of stock could depress the market price of our common stock; the risk that our convertible debt

securities, if settled in cash, could have a material effect on our financial results; the risk that our convertible note hedges may affect the value of our convertible debt securities and our common

stock; the risk that negative publicity related to our business or stock could result in a negative impact on our stock value and profitability; the risk of potential losses related to any product

liability claims or contract disputes; the risk of loss related to an inability to maintain an effective system of internal controls; our ability to attract and maintain key personnel; the risks

related to the use of flammable fuels in our products; the risk that pending orders may not convert to purchase orders, in whole or in part; the cost and timing of developing, marketing and selling

our products; the risks of delays in or not completing our product development goals; our ability to obtain financing arrangements to support the sale or leasing of our products and services to

customers; our ability to achieve the forecasted gross margin on the sale of our products; the cost and availability of fuel and fueling infrastructures for our products; the risk of elimination of

government subsidies and economic incentives for alternative energy products; market

3

Table of Contents

acceptance

of our products and services, including GenDrive, GenSure and GenKey systems; our ability to establish and maintain relationships with third parties with respect to product development,

manufacturing, distribution and servicing and the supply of key product components; the cost and availability of components and parts for our products; the risk that possible new tariffs could have a

material adverse effect on our business; our ability to develop commercially viable products; our ability to reduce product and manufacturing costs; our ability to successfully market, distribute and

service our products and services internationally; our ability to improve system reliability for our products; competitive factors, such as price competition and competition from other traditional and

alternative energy companies; our ability to protect our intellectual property; the risk of dependency on information technology on our operations and the failure of such technology; the cost of

complying with current and future federal, state and international governmental regulations; our subjectivity to legal proceedings and legal compliance; the risks associated with potential future

acquisitions; the volatility of our stock price; and other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in our other reports and other

public filings with the SEC.

Although

we presently believe that the plans, expectations and anticipated results expressed in or suggested by the forward-looking statements contained in or incorporated by reference

into this prospectus are reasonable, all forward-looking statements are inherently subjective, uncertain and subject to change, as they involve substantial risks and uncertainties, including those

beyond our control. New factors emerge from time to time, and it is not possible for us to predict the nature, or assess the potential impact, of each new factor on our business. Given these

uncertainties, we caution you not to place undue reliance on these forward-looking statements. We undertake no obligation to update or revise any of our forward-looking statements for events or

circumstances that arise after the statement is made, except as otherwise may be required by law.

The

above list of risks and uncertainties is only a summary of some of the most important factors and is not intended to be exhaustive. Additional information regarding risk factors that

may affect us is included in our Annual Report on Form 10-K for the year ended December 31, 2018. The risk factors contained in our Annual Report are updated by us from time to time in

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings we make with the SEC.

4

Table of Contents

USE OF PROCEEDS

Unless otherwise indicated in the applicable prospectus supplement, we will use the net proceeds received by us from our sale of the securities

described in this prospectus for our working capital and other general corporate purposes, including capital expenditures. We may temporarily invest the net proceeds in a variety of capital

preservation instruments, including investment grade, interest bearing instruments and U.S. government securities, until they are used for their stated purpose.

Unless

otherwise set forth in the applicable prospectus supplement, we will not receive any proceeds in the event that securities are sold by a selling securityholder.

5

Table of Contents

DESCRIPTION OF COMMON STOCK AND PREFERRED STOCK

The following description of our common stock and preferred stock, together with any additional information we include in any applicable

prospectus supplement or any related free writing prospectus, summarizes the material terms and provisions of our common stock and the preferred stock that we may offer under this prospectus. While

the terms we have summarized below will apply generally to any future common stock or preferred stock that we may offer, we will describe the particular terms of any class or series of these

securities in more detail in the applicable prospectus supplement or free writing prospectus. For the complete terms of our common stock and preferred stock, please refer to our amended and restated

certificate of incorporation (as amended), which we refer to herein as our certificate of incorporation, and our amended and restated bylaws, which we refer to herein as our bylaws, copies of which

are filed with the SEC. The terms of these securities may also be affected by the Delaware General Corporation Law, or the DGCL. The summary below and that contained in any applicable prospectus

supplement or any related free writing prospectus are

qualified in their entirety by reference to our certificate of incorporation and our bylaws. See "Where You Can Find Additional Information."

Authorized Capital