Current Report Filing (8-k)

April 08 2020 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): April 8, 2020

Anika Therapeutics

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

000-21326

|

04-3145961

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

32 Wiggins Avenue, Bedford, Massachusetts 01730

|

|

(Address of Principal Executive Offices) (Zip Code)

|

(781) 457-9000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

ANIK

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

We, as borrower, are party to a credit agreement entered into as of October 24, 2017 with Bank of America, N.A., as administrative agent, swingline lender and issuer of letters of credit, which we refer to as the Credit Agreement and which provides for a $50.0 million senior revolving line of credit, which we refer to as the Credit Facility. A copy of the Credit Agreement was filed as an exhibit to our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017, as filed with the Securities and Exchange Commission on October 27, 2017. Prior to the date of this report, we had no borrowings or commitments outstanding under the Credit Facility.

On April 8, 2020, we submitted a loan notice to drawdown all of the $50.0 million that was available under the Credit Facility, and we expect to receive the funds on April 14, 2020. We are borrowing this amount as a precautionary measure to strengthen our liquidity in light of continuing uncertainty in the global economy and financial capital markets resulting from the COVID-19 pandemic. In accordance with the terms of the Credit Agreement, our proceeds from the borrowing may be used in the future for working capital, general corporate purposes and other purposes permitted under the Credit Agreement.

The Credit Facility matures in October 2022, at which time all outstanding principal and interest must be repaid. The applicable interest rate for the borrowing under the Credit Facility is 2.08%. We may prepay amounts outstanding under the Credit Facility at our sole discretion, without penalty.

Subject to our satisfaction of certain conditions and to approval by the Revolving Lenders referenced in the Credit Agreement, we may request, under an “accordion feature” of the Credit Facility, up to an additional $50.0 million in commitments, for a total of $100.0 million in commitments under the Credit Facility.

The Credit Agreement contains customary representations, warranties, affirmative and negative covenants, including financial covenants, events of default and indemnification provisions in favor of the Lenders referenced in the Credit Agreement. The covenants include restrictions governing our leverage ratio and interest coverage ratio, our incurrence of liens and indebtedness, our entry into certain merger and acquisition transactions or dispositions, and other matters, all subject to certain exceptions. The financial covenants require that we not exceed certain maximum leverage and interest coverage ratios. The Lenders have been granted a first priority lien and security interest in substantially all of our assets, except for certain intangible assets.

On April 8, 2020, we issued a press release announcing our submission of the loan notice to drawdown under the Credit Facility. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Anika Therapeutics

|

|

|

|

|

|

|

|

|

|

Date: April 8, 2020

|

By:

|

/s/ Sylvia Cheung

|

|

|

|

Sylvia Cheung

|

|

|

|

Chief Financial Officer

|

|

|

|

|

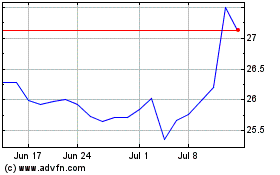

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

From Mar 2024 to Apr 2024

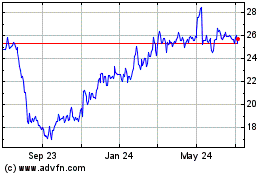

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

From Apr 2023 to Apr 2024