By Konrad Putzier and Peter Grant

A growing number of property investors are preparing for what

they believe could be a once-in-a generation opportunity to buy

distressed real-estate assets at bargain prices.

Investment firms like Blackstone Group Inc., Brookfield Asset

Management and Starwood Capital Group are sitting on billions of

dollars in cash and capital commitments they have raised from

pensions, sovereign-wealth funds and other big institutions in

recent years.

Many of these firms are eyeing hotels, retail properties,

mortgage-backed securities and other assets that have come under

stress in recent weeks as the spread of the coronavirus pandemic

has closed businesses across the country, leaving them unable to

pay rent and their landlords unable to pay their mortgage

bills.

Despite the continuing uncertainty and economic destruction, the

current environment presents the sort of circumstances that

risk-taking property investors say can make a career. And while

investors are in it for the profit, they also say their investments

may help the market bounce back and stabilize property prices.

"There are people that do have dry powder, like us, and that

will recognize this as one of the greatest buying opportunities of

the century," said Daniel Lebensohn, co-founder of the investment

firm BH3, which launched a $100 million distressed-debt fund in

late 2018.

Commercial real-estate prices in the U.S. more than doubled over

the past decade, according to Real Capital Analytics, leading many

investors to conclude that the market had settled near a peak and

so afforded few obvious buying opportunities. Now, many of these

assets could soon hit the market as lenders and desperate landlords

look to raise cash.

It has been mostly a trickle so far because property markets

move slower than bond markets. Mortgage defaults have been few.

Investors expect that to change over the coming weeks and months.

Once a borrower defaults, the lender often chooses to sell the loan

at a discount to avoid the hassle of a lengthy foreclosure

lawsuit.

Some of the first distressed assets to hit the market have been

mortgage-backed securities held by real-estate investment trusts,

which are facing margin calls from their banks. The Royal Bank of

Canada last month sought bids for $600 million in mortgage debt

that it seized from clients.

Distressed hotel debt and properties could be next, even though

"there aren't a lot of deals to talk about yet," said Daniel Peek,

president of the hotel group at brokerage Hodges Ward Elliott. He

gets "20 calls a day" from firms looking to buy distressed

hotels.

Many investors believed in 2008 that the fallout from the sudden

collapse of Lehman Brothers Inc. would make for the best bargain

hunting of their careers. Commercial property prices fell by 35%

between August 2008 and June 2010, according to Real Capital

Analytics, but recovered in the following years.

But some of the same investors expect a worse downturn now and

more immediate distress. The previous crisis started in financial

markets and gradually spread into the real economy. Property owners

had trouble getting new loans from skittish banks, but most tenants

still paid rent, meaning landlords were able to keep paying their

mortgage bills.

This time, the sudden shutdown of vast parts of the U.S. economy

is leaving landlords with less rental income, and many may well

default on their mortgages this month.

Investors concede there is a risk, and they won't be pouring all

their money into distressed assets. Prices could remain depressed

for a long time, and there is always the danger of buying too

early, before the market bottoms out.

Still, there is plenty of money waiting to pounce. In December,

private real-estate funds that focus on opportunistic and

distressed-asset investments held $142 billion in dry powder,

according to Preqin -- up from $94 billion in December 2008.

Greystone & Co., a New York-based real-estate firm, is

raising a fund with up to $400 million to buy distressed debt.

"There's not much liquidity in the market so prices are getting

cheaper and cheaper," said Greystone CEO Stephen Rosenberg.

Directed Capital, a St. Petersburg, Fla.-based investment firm,

bought about 15 loans involving about a dozen different borrowers

from a bank late last month. The loans had a face value of $10

million, but Directed Capital only paid about $7.4 million,

according to CEO Chris Moench.

Other investors had already begun raising money, leaving them

well positioned to bargain hunt now. Blackstone finished raising

the largest commercial real-estate fund ever in September, with

$20.5 billion in commitments. Brookfield Asset Management raised

$15 billion for a fund that closed last year.

Fortress Investment Group, whose real-estate funds have around

$3 billion in cash or cash commitments, was already buying up

defaulted mortgages before the virus spread, according to people

familiar with the matter.

David Schechtman, a broker at Meridian Capital Group, predicts

that bankruptcy auctions in the property market will become a

regular occurrence. He said he is currently marketing a handful of

distressed assets for sale, including an unfinished luxury

condominium in Manhattan.

"Our thoughts and prayers are with all of our fellow Americans

and nobody wants to capitalize on anybody's misfortune," Mr.

Schechtman said. "But I will tell you, real-estate investors --

when you take the emotion out of it -- many of them have been

waiting for this for a decade."

Write to Konrad Putzier at konrad.putzier@wsj.com and Peter

Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

April 07, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

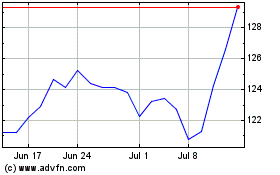

Blackstone (NYSE:BX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

From Apr 2023 to Apr 2024