As filed with the Securities and Exchange Commission on April 6, 2020

Registration No. 333-236596

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1 to Form F-3 on

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BLACKBERRY LIMITED

(Exact Name of Registrant as Specified in Its Charter)

Ontario, Canada

(State or Other Jurisdiction of Incorporation or Organization

Not Applicable

(I.R.S. Employer Identification No.)

2200 University Avenue East

Waterloo, Ontario

Canada, N2K 0A7

Tel: (519) 888-7465(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Randall Cook

Chief Legal Officer

BlackBerry Limited

3001 Bishop Drive, Suite 400

San Ramon, California, USA 10017

(925) 242-5660

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Copies to:

G. Scott Lesmes, Esq.

Morrison & Foerster LLP

2000 Pennsylvania Avenue

Washington, D.C. 20006

(202) 887-1500

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

|

|

|

Accelerated filer

|

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

|

|

|

Smaller reporting company

|

|

|

☐

|

|

|

|

|

|

|

Emerging growth company

|

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financing accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered

|

|

Proposed Maximum

Aggregate

Offering Price

per Share

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

Common Shares, without par value to be offered by the Selling Shareholders

|

|

(1)

|

|

(2)

|

|

(3)

|

|

(4)

|

(1) This post-effective amendment to Form F-3 on Form S-3 relates to the 4,182,189 common shares registered on the Form F-3 registration statement (Registration Statement No. 333-236596) filed on February 24, 2020. Pursuant to Rule 416 under the Securities Act of 1933, the common shares being registered hereunder include such indeterminate amount of shares as may be issuable as a result of stock splits, stock dividends or similar transactions.

(2) The proposed maximum aggregate offering price per share set forth in the Form F-3 registration statement (Registration Statement No. 333-236596) filed on February 24, 2020 was estimated in accordance with Rule 457(c) of the Securities Act of 1933, solely for purposes of calculating the registration fee on the basis of the average of the high and low sales prices of Registrant’s common stock as reported on the New York Stock Exchange on February 19, 2020.

(3) The aggregate maximum offering price of all securities issued by us pursuant to this registration statement, $25,762,284.24, was set forth in the Form F-3 registration statement (Registration Statement No. 333-236596) filed on February 24, 2020.

(4) The registration fee of $3,343.94 was determined in accordance with Section 6(b) of the Securities Act at a rate equal to $129.80 per $1,000,000 of the proposed maximum aggregate offering price or 0.0001298 multiplied by the proposed maximum aggregate offering price. The registration fee was paid upon the filing of the Form F-3 registration statement (Registration Statement No. 333-236596) filed on February 24, 2020.

Explanatory Note

As of February 24, 2020, the date on which BlackBerry Limited (the “Registrant”) filed a registration statement on Form F-3, Registration No. 333-236596 (the “Registration Statement”), to which this post-effective amendment No. 1 on Form S-3 relates, the Registrant was a foreign private issuer within the meaning of Rule 405 under the Securities Act and Rule 12b-2 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). The Registrant has determined that, effective as of March 1, 2020, it is no longer a foreign private issuer and, as a result is subject to the registration and reporting requirements applicable to a United States domestic registrant, including the requirement to file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K and registration statements on Forms S-1, S-3, or S-4. This Registration Statement on Form S-3 serves as a post-effective amendment on Form S-3 to the Registration Statement. This Registration Statement on Form S-3 became effective automatically upon filing with the Securities and Exchange Commission on April 6, 2020.

PROSPECTUS

BLACKBERRY LIMITED

4,182,189 Common Shares

Offered by the Selling Shareholders

This prospectus relates to up to 4,182,189 common shares of BlackBerry Limited (“BlackBerry” or the “Company”) that may be sold by the selling shareholders identified in this prospectus from time to time. The common shares offered under this prospectus by the selling shareholders have been or may be issued to the selling shareholders pursuant to an exchange agreement entered into by BlackBerry and the selling shareholders in connection with an agreement and plan of merger, dated as of November 16, 2018, pursuant to which a wholly-owned subsidiary of BlackBerry acquired Cylance Inc. (“Cylance”). In connection with the acquisition, BlackBerry agreed to file with the Securities and Exchange Commission (the “SEC”) a registration statement covering the resale of the common shares offered under this prospectus. BlackBerry will not receive any of the proceeds from the sale of the common shares hereunder.

The selling shareholders may sell the common shares described in this prospectus in a number of different ways and at varying prices. For more information about how the selling shareholder may sell their common shares, see the section of this prospectus titled “Plan of Distribution.”

BlackBerry common shares trade under the symbol “BB” on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”).

Investing in BlackBerry’s common shares involves risks. See “Risk Factors” on page 3, and under similar headings in other documents that are incorporated by reference into this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED THAT THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is April 6, 2020.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

|

1

|

|

BLACKBERRY LIMITED

|

2

|

|

RISK FACTORS

|

3

|

|

CONSOLIDATED CAPITALIZATION

|

3

|

|

USE OF PROCEEDS

|

3

|

|

DESCRIPTION OF BLACKBERRY SHARE CAPITAL

|

3

|

|

SELLING SHAREHOLDERS

|

4

|

|

PLAN OF DISTRIBUTION

|

5

|

|

LIMITATIONS ON ENFORCEMENT OF U.S. LAWS AGAINST BLACKBERRY LIMITED, ITS MANAGEMENT AND OTHERS

|

7

|

|

LEGAL MATTERS

|

7

|

|

EXPERTS

|

7

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

8

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

8

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that are incorporated by reference contains forward-looking statements within the meaning of certain securities laws, including under the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws, including statements regarding BlackBerry’s:

•the Company’s plans, strategies and objectives, including its intentions to achieve long-term profitable revenue growth and increase and enhance its product and service offerings;

•the Company’s estimates of purchase obligations and other contractual commitments; and

the Company’s expectations with respect to the sufficiency of its financial resources.

The words “expect”, “anticipate”, “estimate”, “may”, “will”, “should”, “could”, “intend”, “believe”, “target”, “plan” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on estimates and assumptions made by BlackBerry in light of its experience, historical trends, current conditions, and expected future developments, as well as other factors that BlackBerry believes are appropriate in the circumstances. Many factors could cause the Company’s actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, risks related to the following factors, which are discussed in greater detail in Part I, Item 1A “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended February 29, 2020 (the “2020 Annual Report”):

•the Company’s ability to enhance, develop, introduce or monetize products and services for the enterprise market in a timely manner with competitive pricing, features and performance;

•the Company’s ability to maintain or expand its customer base for its software and services offerings to grow revenue or achieve sustained profitability;

•the intense competition faced by the Company;

•the occurrence or perception of a breach of the Company’s network cybersecurity measures, or an inappropriate disclosure of confidential or personal information;

•the failure or perceived failure of the Company’s solutions to detect or prevent security vulnerabilities;

•the outbreak of the COVID-19 coronavirus;

•the Company’s continuing ability to attract new personnel, retain existing key personnel and manage its staffing effectively;

•the Company’s dependence on its relationships with resellers and channel partners;

•the Company’s ability to obtain rights to use third-party software and its use of open source software;

•failure to protect the Company’s intellectual property and to earn revenues from intellectual property rights;

•litigation against the Company;

•the substantial asset risk faced by the Company, including the potential for charges related to its long-lived assets and goodwill;

•the Company’s indebtedness;

•acquisitions, divestitures, investments and other business initiatives;

•the Company’s products and services being dependent upon interoperability with rapidly changing systems provided by third parties;

•the Company being found to have infringed on the intellectual property rights of others;

•the use and management of user data and personal information;

•network disruptions or other business interruptions;

•government regulations applicable to the Company’s products and services, including products containing encryption capabilities;

•foreign operations, including fluctuations in foreign currencies;

•the failure of the Company’s suppliers, subcontractors, channel partners and representatives to use acceptable ethical business practices or comply with applicable laws;

•the Company’s ability to generate revenue and profitability through the licensing of security software and services or the BlackBerry brand to device manufacturers;

•the Company’s reliance on third parties to manufacture and repair its hardware products;

•fostering an ecosystem of third-party application developers;

•regulations regarding health and safety, hazardous materials usage and conflict minerals, and to product certification risks;

•tax provision changes, the adoption of new tax legislation, or exposure to additional tax liabilities;

•the fluctuation of the Company’s quarterly revenue and operating results;

•the volatility of the market price of the Company’s common shares; and

•adverse economic and geopolitical conditions.

All of these factors should be considered carefully, and readers should not place undue reliance on BlackBerry’s forward-looking statements. Any statements that are forward-looking statements are intended to enable BlackBerry’s shareholders to view the anticipated performance and prospects of BlackBerry from management’s perspective at the time such statements are made, and they are subject to the risks that are inherent in all forward-looking statements, as described above, as well as difficulties in forecasting BlackBerry’s financial results and performance for future periods, particularly over longer periods, given changes in technology and BlackBerry’s business strategy, evolving industry standards, intense competition and short product life cycles that characterize the industries in which BlackBerry operates. See “Business” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the 2020 Annual Report.

This list above is not an exhaustive of the factors that may affect any of BlackBerry’s forward-looking statements. Additional information about these factors can be found in the “Risk Factors” section of the 2020 Annual Report, which is incorporated by reference in this prospectus. These and other factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. BlackBerry has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

BLACKBERRY LIMITED

The Company provides intelligent security software and services to enterprises and governments around the world. The Company secures more than 500 million endpoints, including 150 million cars. Based in Waterloo, Ontario, the Company leverages artificial intelligence and machine learning to deliver innovative solutions in the areas of cybersecurity, safety and data privacy solutions, and is a leader in the areas of endpoint security management, encryption, and embedded systems. The Company’s common shares trade under the ticker symbol “BB” on the New York Stock Exchange and the Toronto Stock Exchange. The Company was incorporated under the Business Corporations Act (Ontario) (“OBCA”) on March 7, 1984.

Additional information with respect to BlackBerry’s businesses is included in the documents incorporated by reference into this prospectus. See “Documents Incorporated by Reference” in this prospectus.

Background of Transaction and Share Registration

On November 16, 2018, BlackBerry Corporation, a wholly-owned subsidiary of BlackBerry, entered into an agreement and plan of merger pursuant to which it agreed to acquire Cylance (the “Merger”). As a condition to the Merger, Stuart McClure and Ryan Permeh (the “Selling Shareholders”) entered into an exchange agreement with BlackBerry (the “Exchange Agreement”) pursuant to which they agreed to contribute 20% of their shares of Cylance common stock to BlackBerry in exchange for the issuance of shares of BlackBerry common stock over a period of three years from the completion of the Merger. This prospectus covers the sale of up to 4,189,182 shares of BlackBerry common stock (the “Registered Shares”), being all of the shares issued or issuable to the selling shareholders under the Exchange Agreement.

RISK FACTORS

BlackBerry’s business is subject to uncertainties and risks. You should carefully consider and evaluate all of the information included and incorporated by reference in this prospectus, including the risk factors incorporated by reference from the 2020 Annual Report, including the categories of risks identified and discussed in the “Risk Factors” section of the 2020 Annual Report, and from time to time in other filings with the SEC. BlackBerry encourages you to read these risk factors in their entirety. In addition to these risks, other risks and uncertainties not presently known to BlackBerry or that it currently deems immaterial may also adversely affect its business operations and financial condition. Such risks could cause actual results to differ materially from anticipated results. This could cause the trading price of BlackBerry’s common shares to decline, perhaps significantly, and investors may lose part or all of their investment.

CONSOLIDATED CAPITALIZATION

The table below sets forth our unaudited consolidated capitalization as at February 29, 2020. This table should be read in conjunction with our consolidated financial statements and the management’s discussion and analysis of financial condition and results of operations included in the 2020 Annual Report, which is incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

As at February 29, 2020

|

|

(Dollars in thousands, except par value)

|

|

|

Cash, cash equivalents and marketable securities

|

$958,237

|

|

|

|

|

Convertible Debentures

|

605,000

|

|

Financing and capital lease obligations, including current portion

|

1,166

|

|

Total debt, financing, and capital lease obligations

|

606,166

|

|

Shareholders’ equity:

|

|

|

Common shares, authorized unlimited number of voting common shares; 554,199,016 issued and outstanding

|

2,444,112

|

|

Class A Common shares, authorized unlimited number of non-voting, cumulative redeemable and retractable; none issued and outstanding

|

—

|

|

Preferred shares, authorized unlimited number of non-voting, redeemable and retractable; none issued and outstanding

|

—

|

|

Additional paid-in capital

|

315,939

|

|

Deficit

|

(198,422)

|

|

Accumulated other comprehensive loss

|

(32,778)

|

|

|

2,528,851

|

|

Total capitalization

|

$3,135,017

|

USE OF PROCEEDS

All of the common shares being offered hereby are being sold by the Selling Shareholders. While BlackBerry will bear the costs, expenses, and fees in connection with the registration of the common shares, it will not receive any of the proceeds from the sale of the common shares by the Selling Shareholders. See “Selling Shareholders.”

DESCRIPTION OF BLACKBERRY SHARE CAPITAL

BlackBerry’s authorized share capital consists of an unlimited number of voting common shares, an unlimited number of non-voting, redeemable, retractable class A common shares, and an unlimited number of non-voting,

cumulative, redeemable, retractable preferred shares, issuable in series. Only common shares are issued and outstanding, and as of February 29, 2020, 554,199,016 common shares were issued and outstanding.

Common Shares

Each common share is entitled to one vote at meetings of the shareholders and to receive dividends if, as and when declared by the Board of Directors (the “Board”). Dividends which the Board determines to declare and pay shall be declared and paid in equal amounts per share on the common shares and class A common shares at the time outstanding without preference or distinction. Subject to the rights of holders of shares of any class of share ranking prior to the common shares and class A common shares, holders of common shares and class A common shares are entitled to receive BlackBerry’s remaining assets ratably on a per share basis without preference or distinction in the event that it is liquidated, dissolved, or wound-up.

Class A Common Shares

The holders of class A common shares are not entitled to receive notice of, or attend or vote at, any meeting of BlackBerry’s shareholders, except as provided by applicable law. Each such holder is entitled to receive notice of, and to attend, any meetings of shareholders called for the purpose of authorizing the dissolution or the sale, lease, or exchange of all or substantially all of BlackBerry’s property other than in the ordinary course of business and, at any such meeting, shall be entitled to one vote in respect of each class A common share on any resolution to approve such dissolution, sale, lease, or exchange. Dividends are to be declared and paid in equal amounts per share on all the common shares and the class A common shares without preference or distinction. Subject to the rights of holders of any class of share ranking prior to the common shares and class A common shares, in the event that BlackBerry is liquidated, dissolved, or wound-up, holders of common shares and class A common shares are entitled to receive the remaining assets ratably on a per share basis without preference or distinction.

BlackBerry authorized for issuance the class A common shares when BlackBerry was a private company to permit employees to participate in equity ownership. Class A common shares previously issued by BlackBerry to such employees were converted on a one-for-one basis into common shares in December 1996. At this time, BlackBerry has no plans to issue further class A common shares.

Preferred Shares

The holders of preferred shares are not entitled to receive notice of, or to attend or vote at, any meeting of BlackBerry’s shareholders, except as provided by applicable law. Preferred shares may be issued in one or more series and, with respect to the payment of dividends and the distribution of assets in the event that BlackBerry is liquidated, dissolved, or wound-up, rank prior to the common shares and the class A common shares. The Board has the authority to issue series of preferred shares and determine the price, number, designation, rights, privileges, restrictions and conditions, including dividend rights, of each series without any further vote or action by shareholders. The holders of preferred shares do not have pre-emptive rights to subscribe to any issue of BlackBerry’s securities. At this time there are no preferred shares outstanding and BlackBerry has no plans to issue any preferred shares.

SELLING SHAREHOLDERS

This prospectus relates to the offer of the Registered Shares, all of which are being offered for resale by the Selling Shareholders. As described above under “BlackBerry Limited—Background of Transaction and Share Registration,” in connection with the Merger, the Selling Shareholders entered into the Exchange Agreement with BlackBerry pursuant to which they agreed to contribute 20% of their shares of Cylance common stock to BlackBerry in exchange for the issuance of BlackBerry common shares over a period of three years from the completion of the Merger. This prospectus covers up to 4,189,182 BlackBerry common shares, being all of the shares issued or issuable to the Selling Shareholders under the Exchange Agreement. As of the date of this prospectus, BlackBerry has issued 1,030,306 and 349,816 common shares to Messrs. McClure and Permeh, respectively, pursuant to the terms of the Exchange Agreement. BlackBerry may issue up to a total of 3,122,140

and 1,060,049 common shares to Messrs. McClure and Permeh, respectively, pursuant to the terms of the Exchange Agreement.

Because the Selling Shareholders may sell all, some, or none of the common shares they hold, and because the offering contemplated by this prospectus is not currently being underwritten, no estimate can be given as to the number of common shares that will be held by the Selling Shareholders upon termination of the offering. The information set forth in the following table regarding the beneficial ownership after the offering is based upon the hypothetical assumption that the Selling Shareholders will sell all of the common shares owned by them and covered by this prospectus.

Beneficial ownership is determined in accordance with the rules of the SEC, and includes voting or investment power with respect to shares. Unless otherwise indicated below, to BlackBerry’s knowledge, all persons named in the table have sole voting and investment power with respect to their common shares. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for the persons named below. As of February 29, 2020, there were 554,199,016 shares of BlackBerry’s common shares outstanding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Shareholder

|

|

Common

Shares

Owned

Before Offering(1)

|

|

Percentage

of Class

Prior to the

Offering

|

|

Total

Common

Shares

Offered

Hereby(2)

|

|

Common

Shares

Owned

Following

the Offering(2)

|

|

Percentage

of Class

Following

the Offering

|

|

Stuart McClure

2618 San Miguel Drive, #335

Newport Beach, CA 92660

|

|

1,030,306

|

|

*

|

|

3,122,140

|

|

3,122,140

|

|

*

|

|

Ryan Permeh

c/o BlackBerry Limited

2200 University Avenue East

Waterloo, Ontario, Canada N2K 0A7

|

|

349,816

|

|

*

|

|

1,060,049

|

|

1,060,049

|

|

*

|

* Represents beneficial ownership of less than one percent (1%) of BlackBerry’s outstanding common shares.

(1) Includes 1,030,306 and 349,816 common shares issued to Messrs. McClure and Permeh, respectively, pursuant to the terms of the Exchange Agreement as of the date of this prospectus.

(2) Includes all of the 3,122,140 and 1,060,049 common shares that have been or may be issued to Messrs. McClure and Permeh, respectively, pursuant to the terms of the Exchange Agreement.

Messrs. McClure and Permeh were the co-founders of Cylance. Mr. McClure was President of BlackBerry Cylance from the completion of the acquisition of Cylance on February 21, 2019 until his resignation as of September 3, 2019. Mr. Permeh joined BlackBerry upon the completion of the acquisition and is currently its Senior Vice President and Chief Security Architect.

PLAN OF DISTRIBUTION

The Selling Shareholders, which, as used herein, includes donees, pledgees, transferees, or other successors-in-interest selling the common shares offered hereby, or interests in such common shares, received from a selling shareholder as a gift, pledge, partnership distribution, or other transfer, may, from time to time, sell, transfer, or otherwise dispose of any or all of their common shares offered hereby, or interests in such common shares, on any stock exchange, market, or trading facility on which such common shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Shareholders may use any one or more of the following methods when disposing of such common shares, or any interests therein:

•on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

•in the over-the-counter market;

•in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

•broker-dealers may agree with the Selling Shareholders to sell a specified number of such shares at a stipulated price per share;

•a block trade (which may include crosses) in which the broker or dealer so engaged will attempt to sell the common shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker or dealer as principal and resale by such broker or dealer for its account;

•ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•in privately negotiated transactions;

•in short sales;

•through the writing of options on the shares, whether or not the options are listed on an options exchange;

•through distributions of the shares by the Selling Shareholders to its beneficiaries; and

•any other method permitted pursuant to applicable law.

The Selling Shareholders also may sell shares under Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration requirements under the Securities Act, rather than pursuant to this prospectus.

Broker-dealers may receive compensation in the form of commissions and may receive commissions from purchasers of the securities for whom they may act as agents. If any broker-dealer purchases the securities as principal, it may effect resales of the securities from time to time to or through other broker-dealers, and other broker-dealers may receive compensation in the form of concessions or commissions from the purchasers of securities for whom they may act as agents.

In connection with sales of the common shares under this prospectus, the Selling Shareholders may enter into hedging transactions with broker-dealers, who may in turn engage in short sales of the common shares in the course of hedging the positions they assume. The Selling Shareholders also may sell common shares short and deliver them to close out the short positions or loan or pledge the common shares to broker-dealers that in turn may sell them. In addition, from time to time, the Selling Shareholders may pledge, hypothecate, or grant a security interest in some or all of the securities owned by it. In the event of an event of default, upon any foreclosure by pledgees, secured parties, or persons to whom any of the common shares have been hypothecated, the number of the Selling Shareholders’ securities offered under this prospectus will decrease.

The Selling Shareholders and any broker-dealers or agents that are involved in selling the shares covered by this prospectus may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

To BlackBerry’s knowledge, there are currently no plans, arrangements, or understandings between the Selling Shareholders and any broker-dealer or agent regarding the sale of the shares covered by this prospectus by such Selling Shareholders. If the Selling Shareholders notify BlackBerry that a material arrangement has been entered into with a broker-dealer or other agent for the sale of shares through a block trade, special offering, or secondary distribution, BlackBerry may be required to file a prospectus supplement pursuant to applicable SEC rules promulgated under the Securities Act.

There can be no assurance that the Selling Shareholders will sell any or all of the common shares registered pursuant to the registration statement of which this prospectus forms a part.

BlackBerry is required to pay all of the fees and expenses incident to the registration of the common shares covered by this prospectus.

Once sold under the registration statement of which this prospectus forms a part, the common shares will be freely tradable in the hands of persons other than BlackBerry’s affiliates.

LIMITATIONS ON ENFORCEMENT OF U.S. LAWS AGAINST BLACKBERRY LIMITED, ITS MANAGEMENT AND OTHERS

BlackBerry is incorporated under the laws of Ontario, Canada. Many of its directors and executive officers, including many of the persons who signed the Post-Effective Amendment No.1 to Form F-3 on Form S-3, of which this prospectus is a part, and some of the experts named in this document, reside outside the United States, and a significant portion of its assets and the assets of such persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon such persons to enforce against them judgments of the courts of the United States predicated upon, among other things, the civil liability provisions of the federal securities laws of the United States. In addition, it may be difficult for you to enforce, in original actions brought in courts in jurisdictions located outside the United States, among other things, civil liabilities predicated upon such securities laws.

BlackBerry has been advised by its Ontario counsel, Torys LLP, that a judgment of a United States court may be enforceable in Canada if: (a) the United States proceedings such that the United States court properly assumed jurisdiction; (b) the United States judgment is final, conclusive and for a sum certain; (c) the defendant was properly served with originating process from the United States court; and (d) the United States law that led to the judgment is not contrary to Ontario public policy, as that term would be applied by an Ontario court. BlackBerry is advised that in normal circumstances, only civil judgments and not other rights arising from United States securities legislation (for example, penal, or similar awards made by a court in a regulatory prosecution or proceeding) are enforceable in Ontario. The enforceability of a United States judgment in Ontario will be subject to the requirements that: (i) an action to enforce the United States judgment must be commenced in the Ontario Court within any applicable limitation period; (ii) the Ontario Court has discretion to stay or decline to hear an action on the United States judgment if the United States judgment is under appeal or there is another subsisting judgment in any jurisdiction relating to the same cause of action; (iii) the Ontario Court will render judgment only in Canadian dollars; and (iv) an action in the Ontario Court on the United States judgment may be affected by bankruptcy, insolvency, or other laws of general application limiting the enforcement of creditors’ rights generally. The enforceability of a United States judgment in Canada will be subject to the following defenses: (i) the United States judgment was obtained by fraud or in a manner contrary to the principles of natural justice; (ii) the United States judgment is for a claim which under Ontario law would be characterized as based on a foreign revenue, expropriatory, penal, or other public law; (iii) the United States judgment is contrary to Ontario public policy or to an order made by the Attorney General of Canada under the Foreign Extraterritorial Measures Act (Canada) or by the Competition Tribunal under the Competition Act (Canada) in respect of certain judgments referred to in these statutes; and (iv) the United States judgment has been satisfied or is void or voidable under United States law.

LEGAL MATTERS

Unless otherwise specified in the prospectus supplement, certain legal matters in connection with the offering relating to Canadian law will be passed upon on behalf of BlackBerry by Torys LLP. Certain legal matters in connection with the offering relating to United States law will be passed upon on behalf of BlackBerry by Morrison & Foerster LLP. Counsel for any underwriters, dealers, or agents will be named in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of BlackBerry as at February 29, 2020 and February 28, 2019 and for the years ended February 29, 2020 and February 28, 2018 and 2017 incorporated in this prospectus from the 2020 Annual Report and the effectiveness of internal control over financial reporting of BlackBerry as of February 29, 2020, have been audited by Ernst & Young LLP, an independent registered public accounting firm, as stated in their reports which are incorporated by reference. Such consolidated financial statements have been so incorporated herein by reference in reliance upon the reports given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

BlackBerry files annual, quarterly, and current reports, proxy statements, and other information with the SEC under the Exchange Act.

The SEC maintains a website that contains reports, proxy statements and other information, including those filed by BlackBerry, at www.sec.gov. You may also access the SEC filings through the website maintained by BlackBerry at www.blackberry.com. The information contained in those websites is not incorporated by reference in, or in any way part of, this prospectus. All internet addresses provided in this prospectus are for informational purposes only and are not intended to be hyperlinks.

DOCUMENTS INCORPORATED BY REFERENCE

As allowed by SEC rules, this prospectus does not contain all the information you can find in the registration statement and the exhibits to the registration statement. In addition, the SEC allows BlackBerry to “incorporate by reference” information into this prospectus, which means that BlackBerry can disclose important information to you by referring you to other documents filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for any information superseded by information included directly in this prospectus. This prospectus incorporates by reference the documents set forth below that BlackBerry has previously filed with the SEC, in each case to the extent filed and not furnished. These documents contain important information about BlackBerry and its financial condition.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackBerry Filings with the SEC

(File No. 1-38232)

|

|

Period and/or Filing Date

|

|

Annual Report on Form 10-K

|

|

Year ended February 29, 2020, as filed April 6, 2020

|

We also incorporate by reference into this prospectus additional documents that we may file with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of the filing of this prospectus and prior to the completion or withdrawal of any offering hereunder or, if later, the date on which any of BlackBerry’s affiliates ceases offering and selling the securities offered hereby. This incorporation by reference does not include any information deemed furnished and not filed with the SEC.

This prospectus may contain information that updates, modifies, or is contrary to information in one or more of the documents incorporated by reference in this prospectus. You should not assume that the information in this prospectus is accurate as of any date other than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes of this prospectus, to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You can request a copy of the documents referred to above, excluding exhibits that are not specifically incorporated by reference herein, at no cost, by writing or telephoning BlackBerry at BlackBerry Limited, 2200 University Avenue East, Waterloo, Ontario Canada N2K 0A7, Attention: Corporate Secretary, (519) 888-7465.

PART II: INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Expenses of Issuance

The following table sets forth the estimated expenses in connection with the offering described in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount to be Paid

|

|

|

|

|

|

Securities and Exchange Commission filing fee

|

|

$

|

3,344

|

|

|

Legal fees and expenses

|

|

$

|

17,500

|

|

|

Accounting fees and expenses

|

|

$

|

14,306

|

|

|

Total expenses

|

|

$

|

35,150

|

|

BlackBerry will pay all of the above fees and expenses. All expenses are estimated.

Item 15. Indemnification of Directors and Officers.

Under the Business Corporations Act (Ontario) (the “OBCA”), the Registrant may indemnify a director or officer of the Registrant, a former director or officer of the Registrant or another individual who acts or acted at the Registrant’s request as a director or officer or an individual acting in a similar capacity, of another entity:

(a) against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by the individual in respect of any civil, criminal, administrative, investigative or other proceeding in which the individual is involved because of the association with the Registrant or other entity as described above; and

(b) with court approval, against all costs, charges and expenses reasonably incurred by the individual in connection with an action brought by or on behalf of the Registrant or another entity to obtain a judgment in its favor, to which the individual is made a party because of the individual’s association with the Registrant or other entity as described above; provided, in all cases, such individual (i) acted honestly and in good faith with a view to the best interests of the Registrant or, as the case may be, to the best interests of the other entity for which the individual acted as a director or officer or in a similar capacity at the Registrant’s request, and (ii) in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, such individual had reasonable grounds for believing that the individual’s conduct was lawful.

In addition, the Registrant may advance money to a director, officer or other individual for the costs, charges and expenses of a proceeding referred to in (a) above and, with court approval, (b) above but the individual is required to repay the money to the Registrant if the individual did not act honestly and in good faith with a view to the best interests of the Registrant or, as the case may be, to the best interests of the other entity for which the individual acted as a director or officer or in a similar capacity at the Registrant’s request.

Notwithstanding the foregoing, a director or officer of the Registrant, a former director or officer of the Registrant or another individual who acts or acted at the Registrant’s request as a director or officer, or an individual acting in a similar capacity, of another entity, is entitled to be indemnified by the Registrant against all costs, charges and expenses reasonably incurred by the individual in connection with the defence of any civil, criminal, administrative, investigative or other proceeding in which the individual is involved because of the individual’s association with the Registrant or other entity as described above, if the individual seeking the indemnity, (i) was not judged by a court or other competent authority to have committed any fault or omitted to do anything that the individual ought to have done and such individual, (ii) acted honestly and in good faith with a view to the best interests of the Registrant or, as the case may be, to the best interests of the other entity for which the individual acted as a director or officer or in a similar capacity at the Registrant’s request, and (iii) in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, such individual had reasonable grounds for believing that the individual’s conduct was lawful.

Subject to the limitations contained in the OBCA, the By-laws of the Registrant provide that every director or officer of the Registrant, every former director or officer of the Registrant, or a person who acts or acted at the Registrant’s request as a director or officer of a body corporate of which the Registrant is or was a shareholder or creditor, and his or her heirs, executors, administrators and other legal personal representatives shall, from time to time, be indemnified and saved harmless by the Registrant from and against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by him or her in respect of any civil, criminal or administrative action or proceeding to which he or she is made a party by reason of being or having been a director or officer of the Registrant or body corporate of which the Registrant is or was a shareholder or creditor, if (i) he or she acted honestly and in good faith with a view to the best interests of the Registrant, and (ii) in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, such director or officer had reasonable grounds for believing that his or her conduct was lawful.

In addition, as is customary for many public corporations, the Registrant has entered into indemnity agreements (the “Indemnity Agreements”) with its directors and certain senior officers whereby BlackBerry agreed, subject to applicable law, to indemnify those persons against all costs, charges and expenses which they may sustain or incur in third party actions if: such director or officer complied with his or her fiduciary duties; and in the case of a criminal or administrative action or proceeding that is enforced by a monetary penalty, he or she had reasonable grounds for believing that his or her conduct was lawful. The Indemnity Agreements further require the Registrant to pay interim costs and expenses of the director or officer subject to the proviso that the director or officer undertake to repay such costs and expenses if the outcome of any litigation or proceeding establishes that the director or officer was not entitled to indemnification.

The Registrant also maintains insurance for the benefit of its directors and officers against liability in their respective capacities as directors and officers of the Registrant. The directors and officers are not required to pay any premium in respect of the insurance. The policy contains standard industry exclusions.

Reference is made to Item 17 for the undertakings of the Registrant with respect to indemnification of liabilities arising under the Securities Act.

Item 16. Exhibits.

|

|

|

|

|

|

|

|

Exhibit

Number

|

Description of Exhibit

|

|

4.1

|

|

|

4.2

|

|

|

4.3

|

|

|

5.1

|

|

|

23.1

|

|

|

23.2

|

|

|

24.1

|

Power of Attorney (included on the signature page of this Registration Statement)*

|

*Previously filed

**Filed herewith

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

provided, however, that the undertakings set forth in paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) To file a post-effective amendment to the Registration Statement to include any financial statements required by Form 10-K at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act need not be furnished, provided, that the Registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Securities Act or Rule 3-19 of Regulation S-X if such financial statements and information are contained in periodic reports filed with or furnished to the SEC by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(5) That, for the purpose of determining liability under the Securities Act to any purchaser, if the Registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the Registration Statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference

into the Registration Statement or prospectus that is part of the Registration Statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(6) That, for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of the securities, in a primary offering of securities of the Registrant pursuant to this Registration Statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the U.S. Securities Act of 1933, as amended, BlackBerry Limited certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on this Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Ramon, California, United States, on April 6, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BLACKBERRY LIMITED

|

|

|

|

|

|

By:

|

|

/s/ JOHN CHEN

|

|

|

|

|

|

John Chen

|

|

|

|

|

|

Executive Chairman and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints each of Steve Rai and Randall Cook as his or her true and lawful attorney-in-fact and agent, each acting alone, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and any registration statement relating to the offering covered by this Registration Statement and filed pursuant to Rule 462(b) under the U.S. Securities Act of 1933, as amended, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the U.S. Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, each acting alone, full power and authority to do and perform each and every act and thing appropriate or necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE

|

|

CAPACITY

|

|

DATE

|

|

/s/ JOHN CHEN

|

|

Executive Chairman and Chief Executive Officer (Principal Executive Officer)

|

|

April 6, 2020

|

|

John Chen

|

|

|

|

|

|

/s/ STEVE RAI

|

|

Chief Financial Officer (Principal Financial and Accounting Officer)

|

|

April 6, 2020

|

|

Steve Rai

|

|

|

|

|

|

*

|

|

Lead Director

|

|

April 6, 2020

|

|

Prem Watsa

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Michael Daniels

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Timothy Dattels

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Lisa Disbrow

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Richard Lynch

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Laurie Smaldone Alsup

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Barbara Stymiest

|

|

|

|

|

|

*

|

|

Director

|

|

April 6, 2020

|

|

Wayne Wouters

|

|

|

|

|

*By: /s/ RANDALL COOK

Randall Cook

Attorney-in-Fact

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, as amended, the undersigned has signed this Registration Statement, solely in the capacity of the duly authorized representative of BlackBerry Limited in the United States, on April 6, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ RANDALL COOK

|

|

|

|

|

|

Randall Cook

Chief Legal Officer and Corporate Secretary

Authorized Representative in the United States

|

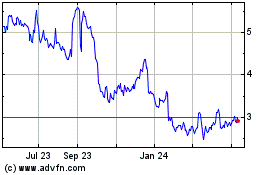

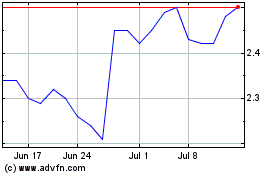

BlackBerry (NYSE:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlackBerry (NYSE:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024