Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-224031

PROSPECTUS SUPPLEMENT

(To Prospectus dated April 6, 2018)

1,713,064 Shares

Common Stock

We are offering 1,713,064 shares of our

common stock, par value $0.0001 per share (the “Common Stock”), at a price of $2.21 pursuant to this prospectus

supplement. In a concurrent private placement, we are also selling warrants to purchase up to a total of 1,713,064 shares of Common

Stock (the “Warrants”). Each Warrant is being sold at a price of $0.125 per underlying warrant share and will

be exercisable at an exercise price of $2.21 per share. The Warrants and the shares of Common Stock issuable upon the exercise

of the Warrants (the “Warrant Shares”) are not being registered under the Securities Act of 1933, as amended

(the “Securities Act”), pursuant to the registration statement of which this prospectus supplement and the accompanying

base prospectus form a part, nor are such Warrants and Warrant Shares being offered pursuant to such prospectus supplement and

base prospectus. The Warrants are being offered pursuant to the exemption provided in Section 4(a)(2) of the Securities Act and

Rule 506(b) promulgated thereunder. The Warrants are not and will not be listed for trading on any national securities exchange.

Each purchaser will be an “accredited investor” as such term is defined in Rule 501(a) under the Securities Act.

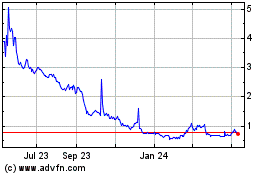

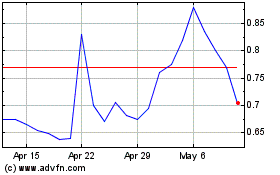

Our Common Stock is listed on The Nasdaq

Capital Market under the symbol “PHIO.” The closing price of our Common Stock on March 30, 2020, as reported by Nasdaq,

was $2.21 per share.

As of March 31, 2020, the aggregate

market value of our outstanding common equity held by non-affiliates was $26,918,250 based on 2,867,851 shares of Common

Stock then outstanding, of which 2,833,500 shares were held by non-affiliates, and a closing sale price on the Nasdaq Capital

Market of $9.50 on February 4, 2020. As of the date of this prospectus supplement, we have sold $2,740,005 of securities pursuant to

General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on, and includes, the date of this

prospectus (but excludes this offering).

We have retained H.C. Wainwright &

Co., LLC to act as our exclusive placement agent in connection with the securities offered by this prospectus supplement and the

accompanying prospectus. The placement agent has agreed to use its reasonable best efforts to sell the securities offered by this

prospectus supplement and the accompanying prospectus. We have agreed to pay the placement agent the placement agent fees set forth

in the table below, which assumes that we sell all of the securities we are offering.

Investing in our securities involves

a high degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties

in the section entitled “Risk Factors” beginning on page S-6 of this prospectus supplement and page 2

of the accompanying prospectus, and in the other documents that are incorporated by reference and any related free writing prospectus.

Neither the Securities and Exchange

Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

2.21000

|

|

|

$

|

3,785,871.44

|

|

|

Placement agent fees(1)

|

|

$

|

0.16575

|

|

|

$

|

283,940.36

|

|

|

Proceeds, before expenses, to us(2)

|

|

$

|

2.04425

|

|

|

$

|

3,501,931.08

|

|

|

(1)

|

We have also agreed to pay the placement agent a management fee of 1%, reimburse the placement agent for certain of its expenses and to grant warrants to purchase shares of common stock to the placement agent as described under the “Plan of Distribution” on page S-9 of this prospectus supplement.

|

|

(2)

|

The amount of the offering proceeds to us presented in this table does not include proceeds from the sale of the warrants in the concurrent private placement or exercise of the warrants in cash, if any.

|

Delivery of the shares of Common Stock

will be made on or about April 2, 2020.

H.C. Wainwright & Co.

The date of this prospectus supplement

is March 31, 2020

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”),

under the Securities Act, using a “shelf” registration or continuous offering process. This document is in two parts.

The first part is this prospectus supplement, which describes the specific terms of this offering and certain other matters and

may add, update or change information in the accompanying prospectus, including the documents incorporated by reference into this

prospectus supplement. The second part is the accompanying prospectus dated April 6, 2018 including the documents incorporated

by reference therein, which provides you with general information about securities we may offer from time to time, some of which

may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined.

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information

contained in the accompanying prospectus, on the other hand, you should rely on the information in this prospectus supplement.

These documents contain important information you should consider when making your investment decision.

You should rely only on the information

provided in this prospectus supplement and the accompanying prospectus, including any information incorporated by reference, and

in any free writing prospectus that we have authorized for use in connection with this offering. We have not, and the placement

agent has not, authorized anyone to provide you with any other information. The information contained in this prospectus supplement

and the accompanying prospectus speaks only as of the date set forth on the cover page and may not reflect subsequent changes in

our business, financial condition, results of operations and prospects.

We are not, and the placement agent is

not, making offers to sell these securities in any jurisdiction in which an offer or solicitation is not authorized or permitted

or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make

such an offer or solicitation. You should read this prospectus supplement, the accompanying prospectus, including any information

incorporated by reference, and any free writing prospectus that we have authorized for use in connection with this offering, in

their entirety before making an investment decision. You should also read and consider the information in the documents to which

we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation of Certain

Information by Reference.”

In this prospectus supplement and accompanying

prospectus, unless otherwise noted, (1) the term “Phio” refers to Phio Pharmaceuticals Corp. and our subsidiary, MirImmune,

LLC and (2) the terms “Company,” “we,” “us” and “our” refer to the ongoing business

operations of Phio and MirImmune, LLC, whether conducted through Phio or MirImmune, LLC.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights certain

information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. This

summary provides an overview of selected information and does not contain all of the information you should consider in making

your investment decision. Therefore, you should read the entire prospectus supplement and the accompanying prospectus, and the

documents incorporated by reference herein carefully before investing in our securities. Investors should carefully consider the

information set forth under “Risk Factors” beginning on page S-6 of this prospectus supplement and the financial statements

and other information incorporated by reference in this prospectus.

Overview

Phio

Pharmaceuticals Corp. is a biotechnology company developing the next generation of immuno-oncology therapeutics based on our

self-delivering RNAi (“INTASYL™”) therapeutic platform. The Company's efforts are focused on

silencing tumor-induced suppression of the immune system through our proprietary INTASYL™ platform with utility in

immune cells and/or the tumor micro-environment. Our goal is to develop powerful

INTASYL™ therapeutic compounds that can weaponize immune effector cells to overcome tumor immune escape, thereby

providing patients a powerful new treatment option that goes beyond current treatment modalities.

Our development efforts are based on our

broadly patented INTASYL™ technology platform. Our INTASYL™ compounds do not require a delivery vehicle to penetrate

into tissues and cells and are designed to “silence” or down-regulate, the expression of a specific gene which is over-expressed

in cancer. We believe that our INTASYL™ platform uniquely positions the Company in the field of immuno-oncology because of

this and the following reasons:

|

|

·

|

Efficient uptake of INTASYL™ to immune cells obviating the need for facilitated delivery (mechanical or formulation);

|

|

|

·

|

Can target multiple genes (i.e. multiple immunosuppression pathways) in a single therapeutic entity;

|

|

|

·

|

Gene silencing by INTASYL™ has been shown to have a sustained,

or long-term, effect in vivo;

|

|

|

·

|

Favorable clinical safety profile of INTASYL™ with local administration;

and

|

|

|

·

|

Can be readily manufactured under current good manufacturing practices.

|

The self-delivering

nature of our compounds makes INTASYL™ ideally suited for use with

adoptive cell transfer (“ACT”) treatments and direct therapeutic use. ACT consists of the infusion of immune

cells with antitumor properties. These cells can be derived from unmodified (i.e. naturally occurring) immune cells, immune cells

isolated from resected tumors, or genetically engineered immune cells recognizing tumor neoantigen/neoepitope cells.

Currently, ACT

therapies for the treatment of solid tumors face several hurdles. Multiple inhibitory mechanisms restrain immune cells used in

ACT from effectively eradicating tumors, including immune checkpoints, reduced cell fitness and cell persistence. Furthermore,

the immunosuppressive tumor micro-environment (the “TME”) can pose a formidable barrier to immune cell infiltration

and function.

Phio has developed

a product platform based on our INTASYL™ technology that allows easy,

precise, rapid, and selective non-genetically modified programming of ACT cells (ex vivo, during manufacturing) and of the

TME (in vivo, by local application), resulting in improved immunotherapy.

Adoptive Cell Transfer

ACT includes a number of different types

of immunotherapy treatments. These treatments use immune cells, that are grown in a lab to large numbers, followed by administering

them to the body to fight the cancer cells. Sometimes, immune cells that naturally recognize a tumor are used, while other times

immune cells are modified or “engineered” to make them recognize and kill the cancer cells. There are several types

of ACT, including: a.) non-engineered cell therapy in which immune cells are grown from the patient’s tumor or blood, such

as tumor infiltrating lymphocytes (“TILs”), or from donor blood or tissue such as natural killer (“NK”)

cells, dendritic cells (“DC”) and macrophages, and b.) engineered immune cells that are genetically modified

to recognize specific tumor proteins and to remain in an activated state (such as T cell receptor technology (“TCRs”),

chimeric antigen receptor (“CAR”) T cells, or CAR-NK cells).

In

ACT, immune cells are isolated from patients, donors or retrieved from allogeneic immune cell banks. The immune cells are then

expanded and modified before being returned and used to treat the patient. We believe our INTASYL™ compounds are ideally

suited to be used in combination with ACT, in order to make these immune cells more effective.

Our approach to

immunotherapy builds on well-established methodologies of ACT and involves the treatment of immune cells with our INTASYL™ compounds

while they are grown in the lab and before administering them to the patient. Because our INTASYL™ compounds

do not require a delivery vehicle to penetrate into the cells, we are able to enhance the function of these cells (for example,

by inhibiting the expression of immune checkpoint genes) by merely adding our INTASYL™ compounds

during the expansion process and without the need for genetic engineering. After enhancing these cells ex vivo, they

are returned to the patient for treatment.

Our method introduces an important step

in the ex vivo processing of immune cells. This step uses our INTASYL™ technology to reduce or eliminate

the expression of genes that make the immune cells less effective. For example, with our INTASYL™ compounds, we can reduce

the expression of immunosuppressive receptors or proteins by the therapeutic immune cells, potentially enabling them to overcome

tumor resistance mechanisms and thus improving their ability to destroy the tumor cells. In

various types of immune cells tested to date, INTASYL™ treatment results in potent silencing while maintaining close to 100%

transfection efficiency and nearly full cell viability.

One of the main issues with ACT is that

the cells are very susceptible to the cancer signals that turn down the immune response and continuous activation of these cells

causes them to become exhausted. These factors, among others, may reduce their efficacy and lifespan. A technology that can reprogram

the immune cells used in ACT, such as with INTASYL™ technology, is of key interest now in the current immuno-oncology world.

In comparison to other technologies available, reprogramming cells with INTASYL™ does not require genetic engineering, its

use is not limited to specific cell types and can be easily integrated with cell manufacturing approaches.

We currently have two product candidates

that are being developed for use in ACT, PH-762 and PH-804. PH-762, our most advanced program and lead pipeline compound, targets

the checkpoint protein PD-1, a checkpoint protein on immune cells. PD-1 normally acts as a type of “off switch” that

helps keep the T cells from attacking other cells in the body. T cells are immune cells that protect the body from cancer cells

and are important for the activation of immune cells to fight infection. Our second pipeline compound, PH-804, targets the suppressive

immune receptor TIGIT, which is a checkpoint protein present on T cells and NK cells.

Data developed in-house and with our collaborators,

which include both leading academic centers and corporate institutions, has shown that PH-762 can elicit PD-1 checkpoint blockade

by silencing PD-1 receptor expression resulting in enhanced T cell activation and tumor cytotoxicity. We have also shown with studies

completed with our collaborators that PH-804 can silence the expression of TIGIT in NK cells and T cells, overcoming their exhaustion

and thereby becoming “weaponized.”

Recent data shown by the Company as well

as with our collaborators, Iovance Biotherapeutics, Inc. and the Karolinska Institutet, at the 2019 Society for Immunotherapy of

Cancer annual meeting further supports the application of INTASYL™ technology in immunotherapy of cancer. PH-762 has shown

to silence the expression of checkpoint molecule PD-1 in target human T cells in a potent and durable manner suitable for both

ACT and intra-tumoral injection, and increases function of patient derived TILs for ACT. The application of INTASYL™ compounds

to novel immuno-oncology targets was shown by the silencing of BRD4, a regulator of gene expression impacting cell differentiation

and function, by a BRD4 targeting INTASYL™ compound in human T cells during expansion for ACT, which has the potential to

confer superior anti-tumor activity.

We expect that

PH-762 can be ready to enter into the clinic with a partner in ACT therapy in the second half of 2020 and we are developing PH-804

with the aim to enter the clinic with a partner in ACT in 2021.

Tumor Micro-Environment

The TME is the environment that surrounds

and feeds a tumor, including normal cells, blood vessels, immune cells and the extracellular matrix. A tumor can change the microenvironment

and the microenvironment can affect how a tumor grows and spreads and can create an immunosuppressive microenvironment that inhibits

the immune system’s natural ability to recognize and destroy tumor cells. This attracts immunosuppressive cells, induces

and activates immune checkpoint expression and excludes and exhausts T cells. Reprogramming different components of the TME may

overcome its resistance to immunotherapy.

Such reprogramming of the TME by INTASYL™

compounds through direct local administration into the tumor, could potentially become an important form of (neo)adjuvant therapy.

We believe that this will also show that our contributions with our INTASYL™ compounds

in immuno-oncology are not limited to use with a cell therapy platform. Additionally, the Company has shown in a clinical setting

that its INTASYL™ compounds are safe and well-tolerated following

local administration.

Our INTASYL™ compounds being developed

for use in ACT, are also being developed for use directly towards the TME, including PH-762 and PH-804. We are also working on

other relevant compounds for TME targets, such as PH-790, an INTASYL™ compound targeting PD-L1. PD-L1 is a protein that keeps

immune cells from attacking nonharmful cells in the body. If cancer cells have large amounts of PD-L1, this “tricks”

the immune system into not recognizing and attacking the tumor. Our approach with PH-790 is to block the PD-L1 protein, which may

prevent cancer cells from inactivating T cells and attack the cancer.

Our collaborative research agreement with

Gustave Roussy, a leading comprehensive cancer center in France, concentrates on determining the feasibility of our INTASYL™ platform

to target the TME via intra-tumoral injection. An in vivo study completed with Gustave Roussy demonstrated that

an INTASYL™ compound delivered via intra-tumoral injection showed

silencing of gene expression with our INTASYL™ compounds with greater

than 90% reduction of the target gene expression in a mouse model of melanoma.

Recent in vivo studies

performed by the Company showed that intra-tumoral injections of a mouse version of PH-804 reduced the tumor growth in colorectal

carcinoma tumor bearing mice, which was shown to be correlated with the silencing of TIGIT messenger RNA (“mRNA”)

expression and an increase in cytotoxic effector T cells in the TME.

The Company expects to move PH-762 for intra-tumoral

injection into the clinical development stage in 2021.

For

additional information about the Company, please refer to other documents we have filed with the Securities and Exchange Commission

and that are incorporated by reference into this prospectus, as listed under the heading “Incorporation of Certain Information

by Reference.”

Corporate Information

We were incorporated

in the state of Delaware in 2011 as RXi Pharmaceuticals Corporation. On November 19, 2018, the Company changed its name to Phio

Pharmaceuticals Corp., to reflect its transition from a platform company to one that is fully committed to developing groundbreaking

immuno-oncology therapeutics. Our executive offices are located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752, and our

telephone number is (508) 767-3861. The Company’s website address is http://www.phiopharma.com. Our website and the

information contained on that site, or connected to that site, is not part of or incorporated by reference into this prospectus.

THE OFFERING

|

|

|

|

|

Common stock offered by this prospectus supplement:

|

|

1,713,064 shares of Common Stock.

|

|

|

|

|

Offering price:

|

|

$2.21 per share of Common Stock.

|

|

|

|

|

Common stock outstanding after this offering:

|

|

2,382,497 shares.1

|

|

|

|

|

Concurrent private placement:

|

|

We are offering 1,713,064 shares of our Common Stock in this

offering pursuant to this prospectus supplement and the accompanying base prospectus and a securities purchase agreement at a

price of $2.21 per share. In a concurrent private placement, we are also selling to investors, at a purchase price of $0.125

per underlying share, Warrants to purchase an additional 100% of the number of shares of Common Stock purchased in this

offering. Each Warrant will be exercisable for one share of Common Stock at an exercise price of $2.21 per share. The

Warrants will be immediately exercisable and expire five and one-half years following the date of issuance. The Warrants and

the shares of Common Stock issuable upon the exercise of the Warrants, or the Warrant Shares, are not being registered under

the Securities Act, pursuant to the registration statement of which this prospectus supplement and the accompanying base

prospectus form a part nor are such Warrants and Warrant Shares being offered pursuant to such prospectus supplement and base

prospectus and are being offered pursuant to an exemption provided in Section 4(a)(2) of the Securities Act and Rule 506(b)

promulgated thereunder. The Warrants are not and will not be listed for trading on any national securities exchange. Each

purchaser will be an “accredited investor” as such term is defined in Rule 501(a) under the Securities Act. See

"Private Placement Transaction and Warrants.”

|

|

|

|

|

Use of proceeds:

|

|

We intend to use the proceeds from this offering to fund the development of the Company’s immuno-oncology program, for other research and development activities and for general working capital needs. See “Use of Proceeds.”

|

|

|

|

|

Risk factors:

|

|

You should read the “Risk Factors” section of this prospectus supplement for a discussion of factors to consider carefully before deciding to invest in shares of our securities.

|

|

|

|

|

Nasdaq Capital Market symbol:

|

|

Our Common Stock is listed on the Nasdaq Capital Market under the symbol “PHIO.”

|

1 The number of shares of Common Stock to be outstanding

after this offering is based on 669,433 shares of Common Stock outstanding as of December 31, 2019 and excludes:

|

|

·

|

197,056 shares of Common issued on February 6, 2020, along with warrants to purchase an additional 197,056 shares of Common

Stock at an exercise price of $8.71 per share;

|

|

|

·

|

993,633 shares of Common Stock and pre-funded warrants to purchase an aggregate of 1,006,367 shares of Common Stock issued

on February 13, 2020, along with warrants to purchase an additional 2,300,000 shares of Common Stock at an exercise price of $4.00

per share;

|

|

|

·

|

2,649 shares of Common Stock issuable upon the exercise of stock options outstanding as of December 31, 2019, having a weighted

average exercise price of $3,298.90 per share;

|

|

|

·

|

14,945 shares of common stock issuable upon the vesting of restricted stock units outstanding as of December 31, 2019;

|

|

|

·

|

480,035 shares of Common Stock issuable upon the exercise of warrants outstanding as of December 31, 2019, having a weighted

average exercise price of $55.58 per share;

|

|

|

·

|

An aggregate of 53,864 shares of Common Stock reserved for future issuance under our 2012 Long-Term Incentive Plan as of December

31, 2019; and

|

|

|

·

|

An aggregate of 8,084 shares of Common Stock reserved for future issuance under our Employee Stock Purchase Plan as of December,

2019.

|

Unless otherwise indicated, all information in this prospectus

supplement assumes no exercise of the Warrants to be issued to the investors in the concurrent private placement and no exercise

of the warrants to be issued as compensation to the placement agent for this offering.

RISK FACTORS

Investing in our securities involves

a high degree of risk. Before investing in our securities, you should carefully consider the risks, uncertainties and assumptions

described below, discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K

for the year ended December 31, 2019, as revised or supplemented by subsequent filings, which are on file with the SEC and are

incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file

with the SEC in the future. Our business, financial condition, results of operations and future growth prospects could be materially

and adversely affected by any of these risks. In these circumstances, the market price of our Common Stock could decline, and you

may lose all or part of your investment.

Risks Related to this Offering

We have broad discretion in how we

use the net proceeds of this offering, and we may not use these proceeds effectively or in ways with which you agree.

Our management will have broad discretion

as to the application of the net proceeds of this offering and could use them for purposes other than those contemplated at the

time of the offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the

net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of

our common stock.

The offering price was set by our Board of Directors and

does not necessarily indicate the actual or market value of our common stock.

Our Board of Directors approved the offering

price and other terms of this offering after considering, among other things: the number of shares authorized in our certificate

of incorporation; the current market price of our common stock; trading prices of our common stock over time; the volatility of

our common stock; our current financial condition and the prospects for our future cash flows; the availability of and likely cost

of capital of other potential sources of capital; and market and economic conditions at the time of the offering. The offering

price is not intended to bear any relationship to the book value of our assets or our past operations, cash flows, losses, financial

condition, net worth or any other established criteria used to value securities. The offering price may not be indicative of the

fair value of the common stock.

You may experience further dilution if we issue additional

equity securities in future fundraising transactions.

To raise additional capital, we may in

the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock

at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other

offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell

additional shares of our Common Stock, or securities convertible or exchangeable into Common Stock, in future transactions may

be higher or lower than the price per share paid by investors in this offering. Further, the exercise of outstanding stock options

and warrants may result in further dilution of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified

by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,”

“expects,” “suggests,” “may,” “would,” “should,” “potential,”

“designed to,” “will,” “ongoing,” “estimate,” “forecast,” “predict,”

“could,” and similar references, although not all forward-looking statements contain these words. Forward-looking statements

are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends,

the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Risks

that could cause actual results to vary from expected results expressed in our forward-looking statements include, but are not

limited to:

|

|

·

|

our business and operations may be materially and adversely affected by the recent coronavirus outbreak;

|

|

|

·

|

our product candidates are in an early stage of development and may fail or experience significant delays or may never advance to the clinic, which may materially and adversely impact our business;

|

|

|

·

|

we are dependent on collaboration partners for the successful development of our adoptive cell therapy product candidates;

|

|

|

·

|

the approach we are taking to discover and develop novel therapeutics using RNAi may never lead to marketable products;

|

|

|

·

|

a number of different factors could prevent us from advancing into clinical development, obtaining regulatory approval, and ultimately commercializing our product candidates on a timely basis, or at all;

|

|

|

·

|

the FDA could impose a unique regulatory regime for our therapeutics;

|

|

|

·

|

we may be unable to protect our intellectual property rights licensed from other parties; our intellectual property rights may be inadequate to prevent third parties from using our technologies or developing competing products; and we may need to license additional intellectual property from others;

|

|

|

·

|

we are subject to significant competition and may not be able to compete successfully;

|

|

|

·

|

if we fail to attract, hire and retain qualified personnel, we may not be able to design, develop, market or sell our products or successfully manage our business;

|

|

|

·

|

future financing may be obtained through, and future development efforts may be paid for by, the issuance of debt or equity, which may have an adverse effect on our stockholders or may otherwise adversely affect our business; and

|

|

|

·

|

the price of our common stock has been and may continue to be volatile.

|

Our actual results and financial condition

may differ materially from those indicated in the forward-looking statements as a result of the foregoing factors, including those

identified in this prospectus under the heading “Risk Factors,” for the reasons described elsewhere in this prospectus

and in other filings the Company periodically makes with the Securities and Exchange Commission. Therefore, you should not rely

unduly on any of these forward-looking statements. Forward-looking statements contained in this prospectus speak as of the date

hereof and Phio does not undertake to update any of these forward-looking statements to reflect a change in its views or events

or circumstances that occur after the date of this report.

USE OF PROCEEDS

We estimate that the net proceeds from

the sale of the shares of Common Stock that we are offering will be approximately $3.3 million, after deducting the placement agent

fees and estimated offering expenses payable by us and excluding any proceeds we may receive upon exercise of the warrants being

offered in the concurrent private placement.

We intend to use the net proceeds from

this offering to fund the development of the Company’s immuno-oncology program, for other research and development activities

and for general working capital needs. We may also use a portion of the net proceeds to acquire or invest in complementary businesses,

products and technologies or to fund the development of any such complementary businesses, products or technologies that we may

acquire in a stock-based acquisition. We have no current plans for any such acquisitions.

PLAN OF DISTRIBUTION

Pursuant to an engagement letter agreement

dated January 31, 2020, we have engaged H.C. Wainwright & Co., LLC, (“Wainwright” or the “placement

agent”) to act as our exclusive placement agent in connection with this offering of our shares of Common Stock pursuant

to this prospectus supplement and accompanying prospectus. Under the terms of the engagement agreement, the placement agent has

agreed to be our exclusive placement agent, on a reasonable best efforts basis, in connection with the issuance and sale by us

of our shares of Common Stock in this takedown from our shelf registration statement. The terms of this offering were subject to

market conditions and negotiations between us, the placement agent and prospective investors. The engagement agreement does not

give rise to any commitment by the placement agent to purchase any of our shares of common stock, and the placement agent will

have no authority to bind us by virtue of the engagement agreement. Further, the placement agent does not guarantee that it will

be able to raise new capital in any prospective offering. The placement agent may engage sub-agents or selected dealers to assist

with the offering.

The placement agent proposes to arrange

for the sale of the shares we are offering pursuant to this prospectus supplement and accompanying prospectus to one or more institutional

or accredited investors through securities purchase agreements directly between the purchasers and us. We will only sell to such

investors who have entered into the securities purchase agreement with us.

We expect to deliver the shares of our

common stock being offered pursuant to this prospectus supplement on or about April 2, 2020.

We have agreed to pay the placement agent

a total cash fee equal to 7.5% of the gross proceeds of this offering. We will also pay the placement agent $90,000 for non-accountable

expenses, a management fee equal to 1.0% of the gross proceeds raised in the offering and $12,900 for clearing fees. We estimate

the total expenses payable by us for this offering will be approximately $470,000, which amount includes the placement agent’s

fees and reimbursable expenses. In addition, we have agreed to issue to the placement agent warrants to purchase up to 7.5% of

the aggregate number of shares of common stock sold in this offering (128,480 shares). The placement agent warrants will have

substantially the same terms as the warrants issued to the investors in this offering, except that the placement agent warrants

will have an exercise price equal to $2.9188, or 125% of the offering price per share and Warrant (combined) and will be exercisable

for five years from the effective date of this offering. Pursuant to FINRA Rule 5110(g), the placement agent warrants and any

shares issued upon exercise of the placement agent warrants shall not be sold, transferred, assigned, pledged, or hypothecated,

or be the subject of any hedging, short sale, derivative, put or call transaction that would result in the effective economic

disposition of the securities by any person for a period of 180 days immediately following the date of effectiveness or commencement

of sales of this offering, except the transfer of any security: (i) by operation of law or by reason of our reorganization; (ii)

to any FINRA member firm participating in the offering and the officers or partners thereof, if all securities so transferred

remain subject to the lock-up restriction set forth above for the remainder of the time period; (iii) if the aggregate amount

of our securities held by the placement agent or related persons do not exceed 1% of the securities being offered; (iv) that is

beneficially owned on a pro-rata basis by all equity owners of an investment fund, provided that no participating member manages

or otherwise directs investments by the fund and the participating members in the aggregate do not own more than 10% of the equity

in the fund; or (v) the exercise or conversion of any security, if all securities remain subject to the lock-up restriction set

forth above for the remainder of the time period.

We have granted the placement agent a twelve-month

right of first refusal to act as our exclusive underwriter or placement agent for any further capital raising transactions undertaken

by us.

We also have granted the placement agent

a tail cash fee equal to 7.5% of the gross proceeds and warrants to purchase shares of common stock equal to 7.5% of the aggregate

number of shares of common stock sold in any offering, within twelve months following the termination of the engagement letter,

to investors whom the placement agent contacted or introduced to us directly or indirectly in connection with this offering.

We have agreed to indemnify the placement

agent and specified other persons against certain liabilities relating to or arising out of the placement agent’s activities

under the placement agency agreement and to contribute to payments that the placement agent may be required to make in respect

of such liabilities.

The placement agent may be deemed to be

an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit

realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions

under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation

M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of common stock and

warrants by the placement agent acting as principal. Under these rules and regulations, the placement agent:

|

|

·

|

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

·

|

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

From time to time, the placement agent

may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course

of business, for which they have received and may continue to receive customary fees and commissions. The placement agent acted

as our exclusive placement agent in connection with the registered direct offering we consummated in February 2020 and our underwriter

in connection with the public offering we consummated in November 2019, for which it received compensation. However, except as

disclosed in this prospectus, we have no present arrangements with the placement agent for any further services.

PRIVATE PLACEMENT TRANSACTION AND WARRANTS

In a concurrent private placement, we are

selling to each of the investors in this offering for consideration of $0.125 per underlying warrant share, a Warrant to purchase

an additional 100% of the number of shares purchased in this offering. The aggregate number of shares of Common Stock exercisable

pursuant to the Warrants is 1,713,064. The Warrants will be exercisable at an exercise price of $2.21 per share, subject to certain

adjustments, will be immediately exercisable and expire five and one-half years following the date of issuance.

The exercise price and number of shares

of common stock issuable upon the exercise of the Warrants will be subject to adjustment in the event of any stock dividend and

split, reverse stock split, recapitalization, reorganization or similar transaction, as described in the Warrants.

The Warrants and the Warrant Shares are

not being registered under the Securities Act pursuant to the registration statement of which this prospectus supplement and the

accompanying base prospectus form a part and are not being offered pursuant to this prospectus supplement and the accompanying

base prospectus. The Warrants and the Warrant Shares are being offered pursuant to the exemption provided in Section 4(a)(2) of

the Securities Act and Rule 506(b) promulgated thereunder.

After the exercise date of the Warrants,

if and only if there is no effective registration statement registering the applicable shares of Common Stock, or no current prospectus

available for such shares, the resale of the shares of Common Stock issuable upon exercise of the Warrants, the purchasers may

exercise the Warrants by means of a “cashless exercise.”

All purchasers are required to be “accredited

investors” as such term is defined in Rule 501(a) under the Securities Act.

LEGAL MATTERS

Certain legal matters relating to the issuance

of the securities offered by this prospectus will be passed upon for us by Gibson, Dunn & Crutcher LLP, San Francisco, California.

EXPERTS

The

consolidated financial statements as of December 31, 2019 and 2018 and for each of the two years in the period ended December 31,

2019 incorporated by reference in this prospectus have been so incorporated in reliance on the report of BDO USA, LLP, an independent

registered public accounting firm, and have been incorporated in this prospectus in reliance upon such report and given on the

authority of said firm as experts in auditing and accounting.

Where

You Can Find More Information

We

are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and

copy any document filed by us at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Our filings

with the SEC are also available to the public at the SEC’s Internet web site at http://www.sec.gov. Copies

of certain information filed by us with the SEC are also available on our website at www.phiopharma.com. Our website is

not a part of this prospectus and is not incorporated by reference in this prospectus, and you should not consider the contents

of our website in making an investment decision with respect to our common stock.

We

have filed a registration statement, of which this prospectus is a part, covering the securities offered hereby. As allowed by

SEC rules, this prospectus does not include all of the information contained in the registration statement and the included exhibits,

financial statements and schedules. You are referred to the registration statement, the included exhibits, financial statements

and schedules for further information. You should review the information and exhibits in the registration statement for

further information about us and our subsidiaries and the securities we are offering. Statements in this prospectus concerning

any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be

comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

INCORPORATION OF CERTAIN INFORMATION

BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we have filed with them, which means that we can disclose important information to you by referring

you to those documents. The information we incorporate by reference is an important part of this prospectus supplement, and information

that we file later with the SEC will automatically update and supersede this information. The documents we are incorporating by

reference are:

|

|

·

|

|

Our Current Reports on Form 8-K, filed with the SEC on January 10, 2020, January 14, 2020, February 6, 2020, February 10, 2020, February 13, 2020 and March 12, 2020; and

|

|

|

·

|

|

The description of our common stock contained in our registration statement on Form 8-A12B filed with the SEC on February 7, 2014, including any amendment or report filed for the purpose of updating such description.

|

All

documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, except as to any portion of

any report or document that is not deemed filed under such provisions, (1) on or after the date of filing of the registration

statement containing this prospectus and prior to the effectiveness of the registration statement and (2) on or after the

date of this prospectus until the earlier of the date on which all of the securities registered hereunder have been sold or the

registration statement of which this prospectus is a part has been withdrawn, shall be deemed incorporated by reference in this

prospectus and to be a part of this prospectus from the date of filing of those documents and will be automatically updated and,

to the extent described above, supersede information contained or incorporated by reference in this prospectus and previously filed

documents that are incorporated by reference in this prospectus.

Nothing in this prospectus shall be deemed

to incorporate information furnished but not filed with the SEC pursuant to Item 2.02, 7.01 or 9.01 of Form 8-K.

Upon written or oral request, we will provide

without charge to each person, including any beneficial owner, to whom a copy of the prospectus is delivered a copy of any or all

of the reports or documents incorporated by reference herein (other than exhibits to such documents, unless such exhibits are specifically

incorporated by reference herein). You may request a copy of these filings, at no cost, by writing or telephoning us at the following

address: Phio Pharmaceuticals Corp., 257 Simarano Drive, Suite 101, Marlborough, Massachusetts 01752 Attention: Investor Relations,

telephone: (508) 767-3861. We maintain a website at www.phiopharma.com. You may access our definitive proxy

statements on Schedule 14A, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K and periodic amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange

Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with,

or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not incorporated by reference

in, and is not part of, this prospectus. We have not authorized any one to provide you with any information that differs from that

contained in this prospectus. Accordingly, you should not rely on any information that is not contained in this prospectus. You

should not assume that the information in this prospectus is accurate as of any date other than the date of the front cover of

this prospectus.

PROSPECTUS

$100,000,000

RXi Pharmaceuticals Corporation

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may offer and sell an indeterminate

number of shares of our common stock and preferred stock, debt securities, warrants and/or units from time to time under this prospectus.

We will describe in a prospectus supplement or sales agreement prospectus the securities we are offering and selling, as well as

the specific terms of the securities.

We may offer these securities in amounts,

at prices and on terms determined at the time of offering. We may sell the securities directly to you, through agents we select,

or through underwriters and dealers we select. If we use agents, underwriters or dealers to sell the securities, we will name them

and describe their compensation in a prospectus supplement or sales agreement prospectus.

Our common stock trades on the NASDAQ Capital

Market under the symbol “RXII”. On March 28, 2018, the closing price for our common stock, as reported on the

NASDAQ Capital Market, was $3.56 per share.

Investing in our securities involves

certain risks. See “Risk Factors” beginning on Page 2 of this prospectus and in the applicable prospectus supplement

or sales agreement prospectus for certain risks you should consider. You should read the entire prospectus carefully before you

make your investment decision.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

April 6, 2018.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a shelf registration process. Under the

shelf registration process, we may offer shares of our common stock and preferred stock, various series of debt securities, warrants

and units to purchase any of such securities with a total value of up to $100,000,000 from time to time under this prospectus at

prices and on terms to be determined by market conditions at the time of offering. This prospectus provides you with a general

description of the securities we may offer. Each time we offer a type or series of securities, we will provide a prospectus supplement

(which term includes, as applicable, the sales agreement prospectus filed with the registration statement of which this prospectus

forms a part) that will describe the specific amounts, prices and other important terms of the securities, including, to the extent

applicable:

|

|

•

|

|

designation or classification;

|

|

|

|

|

|

|

|

•

|

|

aggregate principal amount or aggregate offering price;

|

|

|

|

|

|

|

|

•

|

|

maturity;

|

|

|

|

|

|

|

|

•

|

|

original issue discount, if any;

|

|

|

|

|

|

|

|

•

|

|

rates and times of payment of interest, dividends or other payments, if any;

|

|

|

|

|

|

|

|

•

|

|

redemption, conversion, exchange, settlement or sinking fund terms, if any;

|

|

|

|

|

|

|

|

•

|

|

conversion, exchange or settlement prices or rates, if any, and, if applicable, any provisions for changes to or adjustments in the conversion, exchange or settlement prices or rates and in the securities or other property receivable upon conversion, exchange or settlement;

|

|

|

|

|

|

|

|

•

|

|

ranking;

|

|

|

|

|

|

|

|

•

|

|

restrictive covenants, if any;

|

|

|

|

|

|

|

|

•

|

|

voting or other rights, if any; and

|

|

|

|

|

|

|

|

•

|

|

important federal income tax considerations.

|

A prospectus supplement may include a

discussion of risks or other special considerations applicable to us or the offered securities. A prospectus supplement may also

add, update or change information in this prospectus. If there is any inconsistency between the information in this prospectus

and the applicable prospectus supplement, you must rely on the information in the prospectus supplement. Please carefully read

both this prospectus and the applicable prospectus supplement in their entirety together with additional information described

under the heading “Where You Can Find More Information” in this prospectus. This prospectus may not be used to offer

or sell any securities unless accompanied by a prospectus supplement.

The registration statement containing

this prospectus, including exhibits to the registration statement, provides additional information about us and the securities

offered under this prospectus. The registration statement can be read on the SEC’s website or at the SEC’s public reading

room mentioned under the heading “Where You Can Find More Information” in this prospectus.

We have not authorized any broker-dealer,

salesperson or other person to give any information or to make any representation other than those contained or incorporated by

reference in this prospectus and the accompanying prospectus supplement. You must not rely upon any information or representation

not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. This prospectus and the

accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy securities, nor do

this prospectus and the accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation. The information contained in this

prospectus and the accompanying prospectus supplement speaks only as of the date set forth on the cover page and may not reflect

subsequent changes in our business, financial condition, results of operations and prospects even though this prospectus and any

accompanying prospectus supplement is delivered or securities are sold on a later date.

PROSPECTUS SUMMARY

In this prospectus, unless the context

otherwise requires, (1) the term “RXi” refers to RXi Pharmaceuticals Corporation and our subsidiary, MirImmune,

LLC and (2) the terms “Company,” “we,” “us” and “our” refer to the ongoing

business operations of RXi and MirImmune, LLC, whether conducted through RXi or MirImmune, LLC.

Overview

RXi Pharmaceuticals Corporation is a biotechnology

company focused on discovering and developing immuno-oncology therapeutics to treat cancer based on our self-delivering RNAi, or

sd-rxRNA®, platform. Our sd-rxRNA compounds do not require a delivery

vehicle to penetrate the cell and are designed to “silence,” or down-regulate, the expression of a specific gene that

may be over-expressed in a disease condition. We believe that this provides RXi with a distinct advantage in adoptive cell therapy,

the Company’s initial focus and approach to immuno-oncology.

Prior to the acquisition of MirImmune

Inc., or MirImmune, in January 2017, the Company’s principal activities consisted of the preclinical and clinical development

of our sd-rxRNA compounds and topical immunotherapy agent in the areas of dermatology and ophthalmology. In January 2018, after

a thorough review of its business operations, development programs and financial resources, the Company made a strategic decision

to focus solely on immuno-oncology to accelerate growth and support a potential return on investment for its stockholders. The

Company’s business strategy will focus on the discovery and development of immuno-oncology therapeutics utilizing our proprietary

sd-rxRNA technology. The Company plans to complete its current ongoing clinical trials in dermatology and ophthalmology with RXI-109

and Samcyprone™ and intends to seek a partner and/or out-license these programs

to continue the clinical development and commercialization. The goal of any such transaction would be to allow the Company to monetize

these clinical assets to further fund ongoing and future development work in our immuno-oncology programs and extend our financial

runway.

For additional information about our Company,

please refer to other documents we have filed with the SEC and that are incorporated by reference into this prospectus, as listed

under the heading “Incorporation of Certain Information by Reference.”

Our offices are located at 257 Simarano

Drive, Suite 101, Marlborough, Massachusetts and our telephone number is (508) 767-3861. Additional information about RXi

can be found on our website, at www.rxipharma.com, and in our periodic and current reports filed with the SEC. Copies of

our current and periodic reports filed with the SEC are available at the SEC Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549, and online at www.sec.gov and our website at www.rxipharma.com. No portion of our website is incorporated

by reference into this prospectus.

RISK FACTORS

Before making an investment decision,

you should carefully consider the risks described under “Risk Factors” in the applicable prospectus supplement, together

with all of the other information appearing in this prospectus or incorporated by reference into this prospectus and any applicable

prospectus supplement, in light of your particular investment objectives and financial circumstances. Our business, financial condition

or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could

decline due to any of these risks, and you may lose all or part of your investment. This prospectus and the incorporated documents

also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those

anticipated in these forward-looking statements as a result of certain factors, including the risks mentioned elsewhere in this

prospectus. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors”

included in our most recent Annual Report on Form 10-K, which is on file with the SEC and is incorporated herein by reference,

and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

We are not in compliance with the

Nasdaq continued listing requirements. If we are unable to comply with the continued listing requirements of the Nasdaq Capital

Market, our Common Stock could be delisted, which could affect our Common Sock’s market price and liquidity and reduce our

ability to raise capital.

Our common stock is listed on the Nasdaq

Capital Market. The listing rules of the Nasdaq Capital Market require the Company to meet certain minimum requirements, including

at least $2.5 million of stockholders’ equity. As of December 31, 2017, we failed to meet this required level of stockholders’

equity and, on March 29, 2017, we received a notice from Nasdaq regarding our non-compliance. We believe that if we are able to

execute a successful offering, we will be able to provide sufficient stockholders’ equity to enable us to regain compliance

with the Nasdaq listing rules. However, there can be no assurance that Nasdaq will accept our proposed compliance plan or that

we will not fail to satisfy other Nasdaq listing criteria, such as the minimum bid requirement.

If we fail to comply with the Nasdaq Capital

Market’s continued listing standards, we may be delisted and our common stock will trade, if at all, only on the over-the-counter

market, such as the OTC Bulletin Board or OTCQX market, and then only if one or more registered broker-dealer market makers comply

with quotation requirements. In addition, delisting of our common stock could depress our stock price, substantially limit liquidity

of our common stock and materially adversely affect our ability to raise capital on terms acceptable to us, or at all.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified

by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,”

“expects,” “suggests,” “may,” “should,” “potential,” “designed

to,” “will” and similar references, although not all forward-looking statements contain these words. Forward-looking

statements are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs,

expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events

and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our

control. Risks that could cause actual results to vary from expected results expressed in our forward-looking statements include,

but at not limited to:

|

|

•

|

|

our ability to obtain sufficient financing to develop our product candidates;

|

|

|

•

|

|

expected ongoing significant research and development expenses without a current source of revenue, which may lead to uncertainty as to our ability to continue as a going concern;

|

|

|

•

|

|

dilution that could be caused by future financing transactions or future issuances of capital stock in strategic transactions;

|

|

|

•

|

|

our strategic focus on immuno-oncology;

|

|

|

•

|

|

the novel and unproven approach associated with our RNAi technology;

|

|

|

•

|

|

our limited experience as a company in immuno-oncology;

|

|

|

•

|

|

identifying and developing product candidates, including whether we are able to commence clinical trials in humans or obtain approval for our product candidates;

|

|

|

•

|

|

our dependence on the success of our product candidates, which may not receive regulatory approval or be successfully commercialized;

|

|

|

•

|

|

factors could prevent us from obtaining regulatory approval or commercializing our product candidates on a timely basis, or at all;

|

|

|

•

|

|

FDA regulation of our therapeutics;

|

|

|

•

|

|

our reliance on in-licensed technologies and the potential need for additional intellectual property rights in the future;

|

|

|

•

|

|

our ability protect our intellectual property rights and the adequacy of our intellectual property rights;

|

|

|

•

|

|

competitive risks, including the risks associated with competing against companies in the immuno-oncology space with significantly greater resources;

|

|

|

•

|

|

our reliance on third parties for the manufacture of our clinical product candidates;

|

|

|

•

|

|

potential product liability claims;

|

|

|

•

|

|

pricing regulations, third-party reimbursement practices or healthcare reform initiatives;

|

|

|

•

|

|

our ability to attract, hire and retain qualified personnel;

|

|

|

•

|

|

effectiveness of our internal control over financial reporting; and

|

|

|

•

|

|

volatility of our common stock.

|

Our actual results and financial condition

may differ materially from those indicated in the forward-looking statements as a result of the foregoing factors, as well as those

identified in this prospectus under the heading “Risk Factors” and in other filings the Company periodically makes

with the Securities and Exchange Commission. Therefore, you should not rely on any of these forward-looking statements. Forward-looking

statements contained in this prospectus speak as of the date hereof and the Company does not undertake to update any of these forward-looking

statements to reflect a change in its views or events or circumstances that occur after the date of this report.

DESCRIPTION OF SECURITIES

We may offer shares of our common stock

and preferred stock, various series of debt securities, warrants, and units to purchase any such securities with a total value

of up to $100,000,000 from time to time under this prospectus at prices and on terms to be determined by market conditions at the

time of offering. Each time we offer a type or series of securities, we will provide a prospectus supplement that will describe

the specific amounts, prices and other important terms of the securities.

Common Stock.

We may issue shares of our common stock

from time to time. Holders of our common stock are entitled to one vote per share for the election of directors and on all other

matters that require stockholder approval. Subject to any preferential rights of any outstanding preferred stock, in the event

of our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in the assets remaining

after payment of liabilities and the liquidation preferences of any outstanding preferred stock. Our common stock does not carry

any redemption rights or any preemptive rights enabling a holder to subscribe for, or receive shares of, any class of our common

stock or any other securities convertible into shares of any class of our common stock.

We are authorized to issue 100,000,000

shares of common stock, par value $0.0001 per share, of which 2,699,962 shares were issued and outstanding as of March 28,

2018.

Our common stock is listed on the NASDAQ

Capital Market under the symbol “RXII”. The transfer agent and registrar for our common stock is Computershare Trust

Company, N.A.

Preferred Stock.

We may issue shares of our preferred stock

from time to time, in one or more series. Under our certificate of incorporation, our board of directors has the authority, without

further action by stockholders, to designate up to 10,000,000 shares of preferred stock in one or more series and to fix the rights,

preferences, privileges, qualifications and restrictions granted to or imposed upon the preferred stock, including dividend rights,

conversion rights, voting rights, rights and terms of redemption, liquidation preference and sinking fund terms, any or all of

which may be greater than the rights of the common stock.

If we issue preferred stock, we will fix

the rights, preferences, privileges, qualifications and restrictions of the preferred stock of each series that we sell under this

prospectus and applicable prospectus supplements in the certificate of designations relating to that series. If we issue preferred

stock, we will incorporate by reference into the registration statement of which this prospectus is a part the form of any certificate

of designations that describes the terms of the series of preferred stock we are offering before the issuance of the related series

of preferred stock. We urge you to read the prospectus supplement related to any series of preferred stock we may offer, as well

as the complete certificate of designations that contains the terms of the applicable series of preferred stock.

Debt Securities.

The paragraphs below describe the general

terms and provisions of the debt securities we may issue. When we offer to sell a particular series of debt securities, we will

describe the specific terms of the securities in a supplement to this prospectus, including any additional covenants or changes

to existing covenants relating to such series. The prospectus supplement also will indicate whether the general terms and provisions

described in this prospectus apply to a particular series of debt securities. You should read the actual indenture if you do not

fully understand a term or the way we use it in this prospectus or applicable prospectus supplement.

We may offer senior or subordinated debt

securities. Each series of debt securities may have different terms. The senior debt securities will be issued under one or more

senior indentures, dated as of a date prior to such issuance, between us and a trustee, as amended or supplemented from time to

time. We will refer to any such indenture throughout this prospectus as the “senior indenture.” Any subordinated debt

securities will be issued under one or more separate indentures, dated as of a date prior to such issuance, between us and a trustee,

as amended or supplemented from time to time. We will refer to any such indenture throughout this prospectus as the “subordinated

indenture” and to the trustee under the senior or subordinated indenture as the “trustee.” The senior indenture

and the subordinated indenture are sometimes collectively referred to in this prospectus as the “indentures.” The indentures

will be subject to and governed by the Trust Indenture Act of 1939, as amended. We included copies of the forms of the indentures

as exhibits to our registration statement and they are incorporated into this prospectus by reference.

If we issue debt securities at

a discount from their principal amount, then, for purposes of calculating the aggregate initial offering price of the offered

securities issued under this prospectus, we will include only the initial offering price of the debt securities and not the principal

amount of the debt securities.

We have summarized below the material

provisions of the indentures and the debt securities, or indicated which material provisions will be described in the related prospectus

supplement. The prospectus supplement relating to any particular securities offered will describe the specific terms of the securities,

which may be in addition to or different from the general terms summarized in this prospectus. Because the summary in this prospectus

and in any prospectus supplement does not contain all of the information that you may find useful, you should read the documents

relating to the securities that are described in this prospectus or in any applicable prospectus supplement. Please read “Where

You Can Find More Information” in this prospectus to find out how you can obtain a copy of those documents. Except as otherwise

indicated, the terms of the indentures are identical. As used under this caption, the term “debt securities” includes

the debt securities being offered by this prospectus and all other debt securities issued by us under the indentures.

General

The indentures:

|

|

•

|

|

do not limit the amount of debt securities that we may issue;

|

|

|

•

|

|

allow us to issue debt securities in one or more series;

|

|

|

•

|

|

do not require us to issue all of the debt securities of a series at the same time;

|

|

|

•

|

|

allow us to reopen a series to issue additional debt securities without the consent of the holders of the debt securities of such series; and

|

|

|

•

|

|

provide that the debt securities will be unsecured, except as may be set forth in the applicable prospectus supplement.

|

Unless we give you different information

in the applicable prospectus supplement, the senior debt securities will be unsubordinated obligations and will rank equally with

all of our other unsecured and unsubordinated indebtedness. Payments on the subordinated debt securities will be subordinated to

the prior payment in full of all of our senior indebtedness, as described under “Description of the Debt Securities—Subordination”

and in the applicable prospectus supplement.

Each indenture provides that we may, but

need not, designate more than one trustee under an indenture. Any trustee under an indenture may resign or be removed and a successor

trustee may be appointed to act with respect to the series of debt securities administered by the resigning or removed trustee.

If two or more persons are acting as trustee with respect to different series of debt securities, each trustee shall be a trustee

of a trust under the applicable indenture separate and apart from the trust administered by any other trustee. Except as otherwise

indicated in this prospectus, any action described in this prospectus to be taken by each trustee may be taken by each trustee

with respect to, and only with respect to, the one or more series of debt securities for which it is trustee under the applicable

indenture.

The prospectus supplement for each offering

will provide the following terms, where applicable:

|

|

•

|

|

the title of the debt securities and whether they are senior or subordinated;

|

|

|

•

|

|

the aggregate principal amount of the debt securities being offered, the aggregate principal amount of the debt securities outstanding as of the most recent practicable date and any limit on their aggregate principal amount, including the aggregate principal amount of debt securities authorized;

|

|

|

•

|

|

the price at which the debt securities will be issued, expressed as a percentage of the principal and, if other than the principal amount thereof, the portion of the principal amount thereof payable upon declaration of acceleration of the maturity thereof or, if applicable, the portion of the principal amount of such debt securities that is convertible into common stock or preferred stock or the method by which any such portion shall be determined;

|

|

|

•

|

|

if convertible, the terms on which such debt securities are convertible, including the initial conversion price or rate and the conversion period and any applicable limitations on the ownership or transferability of common stock or preferred stock received on conversion;

|

|

|

•

|

|

the date or dates, or the method for determining the date or dates, on which the principal of the debt securities will be payable;

|

|

|

•

|

|

the fixed or variable interest rate or rates of the debt securities, or the method by which the interest rate or rates is determined;

|

|

|