Appetite for Blue-Chip Corporate Bonds Improves Amid Continued Credit-Market Stress

March 25 2020 - 3:05PM

Dow Jones News

By Sam Goldfarb

Blue-chip U.S. companies are having an easier time issuing new

bonds, a sign of improving conditions in some parts of the credit

markets after a series of extraordinary Federal Reserve

interventions.

Business giants including Nike Inc., McDonald's Corp. and Pfizer

Inc. were among those poised to sell bonds Wednesday, following in

the footsteps of Comcast Corp. and Mastercard Inc. a day earlier.

In a sign of increased demand among investors, the companies were

set to issue the bonds at significantly lower yields than their

initial offers at the start of the day.

Even though companies sold a large amount of investment-grade

bonds last week, they were forced to pay such high interest rates

that it only added to concerns about a breakdown in credit markets,

as investors reeled in response to the spread of the coronavirus

and the aggressive measures taken by public authorities to contain

it. Corporate bond sales had all but ground to a halt earlier in

the month, underscoring how the virus was threatening businesses by

disrupting financial activity.

Improvement in the investment-grade corporate bond market

follows the announcement by the Fed on Monday that it would buy

unlimited amounts of government debt and create new facilities to

buy new and existing corporate bonds that carry investment-grade

ratings.

"With the backstop from the Fed, I think it helps meaningfully,"

said Gene Tannuzzo, deputy global head of fixed income at Columbia

Threadneedle.

Nike on Wednesday was set to sell $1.5 billion of 10-year notes

at yield 2 percentage points above comparable U.S. Treasurys, down

from initial guidance of a 2.5 percentage point spread. McDonald's

was poised to sell $1 billion of 10-year notes at a 2.85 percentage

point spread, down from initial guidance of 3.35 percentage

points.

In recent trading, the yield on the benchmark 10-year U.S.

Treasury note was 0.805%, according to Tradeweb, compared with

0.813% Tuesday. Yields fall when bond prices rise.

In another sign of a healthier market, companies on Tuesday sold

their new investment-grade bonds at an average spread that was just

0.037 percentage point above the spreads on their existing bonds,

according to BofA Global Research. That was down from 0.37

percentage point Monday and roughly 0.5 to 0.8 percentage point

last week.

The cost of protecting corporate bonds against default using

credit derivative indexes has also declined this week. It cost

$105,300 a year to protect $10 million of U.S. investment-grade

bonds against default for five years on IHS Markit's CDX index,

down marginally from Tuesday's close and significantly lower than

Friday's $151,000.

Signs of severe stress in credit markets remain, however.

As of Tuesday, the average investment-grade corporate-bond

spread was 3.53 percentage points, up from 1.07 percentage points a

month ago, according to Bloomberg Barclays data. Fifty-seven

percent of speculative-grade corporate loans are now priced below

80 cents on the dollar, compared with just 4% at the end of last

year, according to LCD, a unit of S&P Global Market

Intelligence.

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

March 25, 2020 14:50 ET (18:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

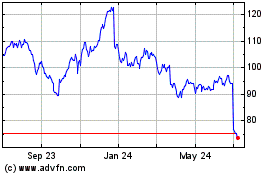

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

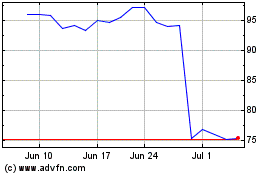

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024