Boeing CEO: No Government Equity Stake for Taxpayer Aid

March 24 2020 - 10:27AM

Dow Jones News

By Andrew Tangel

Boeing Co. Chief Executive David Calhoun suggested he would

decline taxpayer aid if lawmakers require the government to take an

equity stake in the beleaguered aerospace giant.

"I don't have a need for an equity stake," Mr. Calhoun said in a

Tuesday interview on Fox Business Network. "If they forced it, we'd

just look at all the other options, and we have got plenty."

Mr. Calhoun's comments came as Congress was negotiating details

of an aid package of more than $1.6 trillion aimed at blunting the

economic fallout from the worsening novel coronavirus outbreak. The

package could benefit businesses including Boeing and U.S. airlines

and provide support for workers.

The Treasury Department took equity stakes in banks as part of

the Troubled Asset Relief Program during the banking crisis in

2008.

Instead of the government taking an equity stake in Boeing, Mr.

Calhoun expressed support for taking out taxpayer-funded loans and

repaying them with interest.

"I want them to support the credit markets, provide liquidity,

allow us to borrow against our future, which we all believe in very

strongly," Mr. Calhoun said.

To ease its cash crash, Boeing has suspended its dividend and

drawn down a credit line. It is seeking at least $60 billion in

public and private aid for itself, its suppliers and the broader

aerospace industry. On Monday, Boeing said it would halt production

in the Seattle area for two weeks to curb the spread of the

virus.

Mr. Calhoun acknowledged air travel is already virtually

grinding to a halt, but expressed confidence the aviation industry

would recover more quickly than more dire forecasts predict.

Major U.S. airlines are drafting plans for a potential voluntary

shutdown of virtually all passenger flights across the U.S.,

according to industry and federal officials, The Wall Street

Journal reported.

Government agencies also are considering ordering such a move

and the nation's air-traffic control system continues to be ravaged

by the coronavirus contagion. No final decisions have been made by

the carriers or the White House, these officials said

On Tuesday, the International Air Transport Association offered

its latest forecast for global airline traffic, saying it would

fall 38% in 2020 and cost carriers $252 billion in revenue. That is

double its prior estimate of the impact of the coronavirus as it

intensifies efforts to persuade governments to provide financial

support for the industry.

The near-grounding of many airlines' service as demand collapsed

has forced them to park thousands of planes and left many carriers

running out of cash, triggering job cuts as governments continue to

expand travel restrictions.

"We need a full-speed rescue package now," Alexandre de Juniac,

IATA's chief executive said on a call with reporters. Industrywide,

airlines are looking for around $200 billion in support to cover

their fixed costs.

--Doug Cameron contributed to this article.

(END) Dow Jones Newswires

March 24, 2020 10:12 ET (14:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

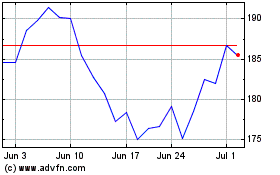

Boeing (NYSE:BA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boeing (NYSE:BA)

Historical Stock Chart

From Apr 2023 to Apr 2024