Pilgrim’s Pride (PPC)

Vote Yes: Proposal #6 –

Provide a report regarding the reduction of

water pollution

Annual Meeting: April 29, 2020

CONTACT: Anna Falkenberg, Socially

Responsible Investment Coalition | afalkenberg@sric-south.org

Mary Minette, Mercy Investment

Services | mminette@Mercyinvestments.org

|

|

·

|

The vast majority of Pilgrim’s Pride Corporation’s (PPC’s) water pollution footprint is associated with

its supply chain. Two of the most significant drivers of nutrient pollution of freshwater ecosystems are runoff from fertilizer

used to grow crops for animal feed, and improperly managed animal waste.

|

|

|

·

|

Supply chain water pollution poses material financial risks to PPC. Potential state and federal regulation of agricultural

practices contributing to water pollution may impose additional costs of compliance. Many of PPC’s largest customers expect

improvements in the management of risks associated with supply chain water pollution. Failing to mitigate water pollution impacts

may therefore harm PPC’s position as a competitive supplier, resulting in reduced market share. Failing to address supply

chain water pollution also threatens PPC’s reputation and brand value.

|

|

|

·

|

PPC lags its competitors in managing risks associated with supply chain water pollution. PPC’s industry peers,

including several of its principal competitors, have either implemented practices to mitigate pollution from fertilizer and manure

runoff or have committed to disclosing relevant information on this topic to investors.

|

|

|

·

|

PPC’s existing disclosures are inadequate to assure investors that it is proactively managing risks associated with

supply chain water pollution. Neither PPC’s disclosures nor its policies specifically address the primary drivers of

its water pollution footprint, including manure from contracted facilities and nutrient runoff from animal fee crops.

|

Shareholders are urged to vote “FOR”

proposal #6.

Shareholders of Pilgrim’s Pride Corporation

(“Pilgrim’s”) request a report assessing if and how the company plans to increase the scale, pace, and rigor

of its efforts to reduce water pollution from its supply chain. This report should omit proprietary information, be prepared at

reasonable cost, and be made available to shareholders by December 1, 2020.

Although we defer to management for the precise contents,

investors believe that meaningful disclosure within the report could include:

|

|

·

|

requirements for manure management practices intended to prevent water pollution

|

|

|

·

|

requirements for leading practices for nutrient management and pollutant limits throughout contract

farms and feed suppliers, with a focus on verifiably reducing nitrate contamination

|

|

|

·

|

plans to verify suppliers’ compliance with Pilgrim’s policies

|

Meat production is the leading source of water pollution

in the U.S., exposing 5.6 million Americans to nitrates in drinking water and many more to toxic algal blooms.1

Proponents are concerned that as the country’s second largest poultry processor,2

PPC’s extensive impacts on water quality pose material regulatory, market and reputational risks to long-term shareholder

value. PPC’s existing disclosures lack sufficient detail to assure investors that it is adequately managing these risks.

The vast majority of PPC’s

water pollution footprint is associated with its supply chain

Our company asserts that its “current

practices and procedures sufficiently address the concerns raised” by this proposal.3

However, while PPC’s existing disclosures focus mainly on its treatment of discharges from its facilities, the vast majority

of PPC’s water pollution footprint is associated with its agricultural supply chain.

Nutrient pollution from

crop and livestock production is a leading cause of water contamination globally.4

Two of the most significant contributors of nitrogen and phosphorus runoff from meat production are:

|

·

|

fields that produce row-crops for animal feed, and

|

|

·

|

manure from animal feeding operations 5 6

|

PPC is the second largest poultry processor

in the United States. The cultivation of feed ingredients (primarily corn and soybeans) for the 45 million7

chickens produced weekly by PPC can be a significant source of water pollution due to nitrates and phosphates, if improperly managed,

washing off fields.

PPC procures livestock from approximately 5,200

poultry farms.8 This supply chain generates large

volumes of animal waste, which may contain nitrates, phosphates, antibiotic-resistant bacteria and pathogens. When these contaminants

pollute waterways, they endanger public health, damage ecosystems and inflict financial harm to downstream industries.9

Supply chain water pollution

poses financially material risks to PPC

The extensive impacts of PPC’s supply chain

on water quality pose material regulatory, market and reputational risks to long-term shareholder value.

Potential state and federal regulation of agricultural

practices contributing to water pollution may impose additional costs of compliance

Public demand for

increased state and federal oversight of the meat industry’s water pollution footprint is growing. PPC notes that its feed

mills are “strategically located in the areas where we have processing operations.”10

Several states where Pilgrim’s has processing operations11

have tightened requirements related to nutrient management plans, manure disposal, field application of manure and groundwater

monitoring for animal agriculture.12

1

https://ehjournal.biomedcentral.com/articles/10.1186/s12940-018-0442-6

2

http://www.wattpoultryusa-digital.com/201903/index.php#/20

3

Statement in opposition of the Board of Directors of the Company to Mercy Investment Services Inc.’s stockholder proposal.

Copy on file with the author.

4

http://www.fao.org/3/CA0146EN/ca0146en.pdf

5

Ibid.

6

https://www.epa.gov/nutrientpollution/sources-and-solutions

7

https://www.pilgrims.com/about-us/

8

http://ir.pilgrims.com/static-files/e3600306-6cfa-4e6e-bae6-30bd760a13c5

9

https://noaa.maps.arcgis.com/apps/Cascade/index.html?appid=9e6fca29791b428e827f7e9ec095a3d7

10

https://www.pilgrimsusa.com/our-chickens/

11

https://www.epa.gov/toxics-release-inventory-tri-program/tri-basic-data-files-calendar-years-1987-2018

12

https://www.opb.org/news/article/washington-dairy-pollution-regs/; https://www.environmentalintegrity.org/wp-content/uploads/2017/02/Shenandoah-Report.pdf;

https://www.jsonline.com/story/news/politics/2017/01/07/state-wants-jump-start-manure-project/96212456; https://www.nytimes.com/2018/07/09/us/algae-blooms-florida-nyt.html;

https://www.flgov.com/wp-content/uploads/2019/01/EO-19-12-.pdf; https://civileats.com/2020/03/03/rural-resistance-builds-in-communities-facing-the-fallout-from-cheap-mea

t-production/

At the federal level, legislation introduced

in December 2019 would place a moratorium on the use of the concentrated animal feeding operations (CAFOs). Many of the growers

supplying PPC rely on the use of CAFOs. The impetus for this legislation came in part from the meat industry’s persistent

contamination of U.S. waterways through fertilizer and manure runoff.13

This legislation was introduced weeks after the American Public Health Association urged federal, state and local governments to

impose a moratorium on all new and expanding CAFOs, citing public health concerns.14

Increased state and/or federal regulation of

nutrient pollution from agricultural supply chains may impose increased costs of compliance on PPC. Reducing the company’s

nutrient load would reduce its exposure to these regulatory risks.

PPC’s largest customers increasingly expect

improvements in the management of risks associated with supply chain water pollution. Failing to address supply chain water pollution

may therefore harm PPC’s position as a competitive supplier, resulting in reduced revenue

Several of PPC’s largest customers have made

public commitments to substantially reduce the greenhouse gas (GHG) emissions of their animal protein supply chains. Just as fertilizer

for animal feed and the storage and field application of manure are significant drivers of water pollution, they are also prominent

sources of GHG emissions. Emissions from these sources comprise approximately 55% of the livestock sector’s total GHG emissions.15

Walmart Inc., PPC’s fourth-largest customer

by percentage of revenue, has introduced detailed supplier expectations on management of water, manure, nutrients and fertilizer.16

Tesco Inc., PPC’s seventh-largest customer

by percentage of revenue17has set a target to reduce

its Scope 3 GHG emissions by 17% by 2030.18 Tesco

notes that emissions from agriculture account for over 60% of its total carbon footprint.19

In discussing its efforts to meet its emissions reduction targets, Tesco notes that “We expect all our largest suppliers

to have their own sustainable agriculture strategies to address their most material farm-level impacts and risks.”20

McDonald’s Corporation and Yum! Brands Inc. have also made commitments to reduce GHG emissions from their meat supply chains.21

Both companies are customers of PPC.22

In light of these commitments and expectations from

several of PPC’s largest customers, failing to address the water and emissions impacts of fertilizer and manure may harm

PPC’s position as a competitive supplier, resulting in reduced market share.

13

https://www.booker.senate.gov/?p=press_release&id=1036

14

https://clf.jhsph.edu/about-us/news/news-2019/nations-leading-public-health-organization-urges-halt-all-new-an

d-expanding?utm_source=FERN+Newsletter+Service&utm_campaign=ff69bc78a4-EMAIL_CAMPAIGN_2019_11_19

_01_41&utm_medium=email&utm_term=0_c95f7f9b8b-ff69bc78a4-120482793

15

http://www.fao.org/3/a-i8276e.pdf

16

https://www.walmartsustainabilityhub.com/project-gigaton/agriculture

17

Revenue ranks from Bloomberg as of March 2, 2020

18

https://sciencebasedtargets.org/case-studies-2/case-study-tesco/

19

https://www.tescoplc.com/sustainability/sourcing/topics/environment/sustainable-agriculture/

20

Ibid.

21

https://corporate.mcdonalds.com/corpmcd/scale-for-good/climate-action.html#goals ; https://www.supplychaindive.com/news/yum-brands-science-based-carbon-emissions-targets/550789/

22

https://www.gainesville.com/news/20170309/pilgrims-pride-sued-over-wastewater-in-river; http://ir.pilgrims.com/static-files/e3600306-6cfa-4e6e-bae6-30bd760a13c5

In addition to McDonald’s and Yum! Brands,

other large PPC customers face growing concerns from their investors regarding the water pollution impacts of their animal protein

supply chains.

In January 2019, more

than 80 investors representing more than $6.5 trillion in combined assets called on fast food chains Chipotle Mexican Grill, Domino’s

Pizza Group, McDonald’s Corporation, Restaurant Brands International, Yum! Brands, and The Wendy’s Company to set policies

and goals to address the water use, water quality, and emissions impacts of their animal protein supply chains. Over the last year,

this coalition of investors nearly doubled in size, and now represents more than $11.4 trillion in combined assets.23

The 75% growth of this coalition demonstrates that investors are increasingly concerned that the environmental impacts of

animal protein production threaten shareholder value.

Supply chain water pollution poses a risk to PPC’s

brand value

In addition to regulatory and market risks, the

poultry industry’s water pollution footprint represents a considerable reputational risk. PPC has been the focus of a public

campaign seeking to hold it accountable for water contamination across the country through its supply chain practices. The campaign

suggests that agricultural runoff from feed crops produced to raise livestock is the leading cause of the growing hypoxic “dead

zone” that forms annually in the Gulf of Mexico. Further, the campaign suggests that as one of the primary sources of demand

for feed crops, meat producers bear responsibility for addressing the water contamination problem.24

PPC lags its competitors in

managing supply chain water pollution

Two of PPC’s principal competitors have

recently disclosed measures intended to address supply chain water pollution. Tyson Foods has committed to support improved fertilizer

practices on two million acres of corn by the end of 2020. This represents enough corn to feed all of Tyson’s annual broiler

chicken production in the United States. Tyson notes that optimizing the application of fertilizer presents a cost-saving opportunity.25

Sanderson Farms has committed to disclose its efforts

to manage environmental risks which the Sustainability Accounting Standards Board (SASB) classifies as financially material for

poultry processors.26 One of the metrics SASB recommends

poultry processors disclose is the amount of poultry litter generated by the company and what percentage of it is managed according

to a nutrient management plan.27

Other industrial meat

processors have taken steps to address water pollution from their supply chains. Pork producer Smithfield Foods exceeded its target

to purchase 75% of its feed grain from farms managed to reduce water pollution. Smithfield noted that optimizing the application

of fertilizer improved farmers’ profits, and “strengthens Smithfield’s relationship with the grain suppliers

that are critical to our business”.28

Perdue Farms has invested $80 million in a poultry litter recycling operation to prevent nutrient pollution.29

Hormel Foods has adopted a sustainable agriculture policy addressing fertilizer and manure management.30

23

https://www.forbes.com/sites/mikescott/2020/02/07/fast-food-companies-need-to-step-up-on-climate-water-action-investors-warn/#287ccae146de

24

http://www.mightyearth.org/as-massive-dead-zone-blooms-in-gulf-hold-industrial-farming-companies-responsible;

http://www.mightyearth.org/wp-content/uploads/2017/08/Meat-Pollution-in-America.pdf

25

https://www.tysonsustainability.com/environment/nutrient-management

26

http://ir.sandersonfarms.com/news-releases/news-release-details/sanderson-farms-inc-holds-annual-meeting-sto

ckholders-6

27

Meat, Poultry, and Dairy Sustainable Accounting Standard – Version 2018-10. Available at https://www.sasb.org/standards-overview/download-current-standards/

28

https://www.smithfieldfoods.com/sustainability/report/2018/environment/supply-chain/grain-production

29

https://corporate.perduefarms.com/pdfs/perdue-farms-responsibility-report.pdf

30

https://www.hormelfoods.com/wp-content/uploads/Responsibility_Sustainable_Agriculture_Policy_07.25.17.pdf

Proponents commend our company’s efforts

to reduce the quantity of water it uses at its facilities, and the recent completion of a water risk assessment of its facilities.31

Proponents acknowledge PPC’s environmental policy requiring “vendors” to comply with all applicable environmental

laws and regulations and encouraging vendors to “use best efforts to meet industry best practices and standards and responsibly

manage the environmental impact of their operations.”32

However, neither our company’s disclosures

nor its policies specifically address the primary drivers of its water pollution footprint, including manure from contracted facilities

and nutrient runoff from animal feed crops. Our company’s existing disclosures therefore lack sufficient detail to assure

investors that it is adequately managing risks associated with water pollution from its supply chain.

We therefore urge shareholders to vote “FOR”

Proposal #6 requesting that PPC issue a report at reasonable cost, omitting proprietary information, assessing if and how it plans

to increase the scale, pace, and rigor of its efforts to reduce water pollution from its supply chain.

THE FOREGOING INFORMATION MAY BE DISSEMINATED

TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED

AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION

TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE

DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

31

https://sustainability.pilgrims.com/chapters/environment/water/

32

https://sustainability.pilgrims.com/stories/supplier-code-of-conduct/

5

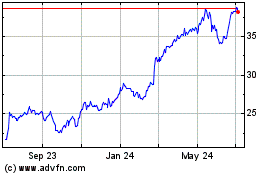

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Apr 2023 to Apr 2024