RPM International Expects Third Quarter Results at the Higher End of Previous Guidance

March 20 2020 - 7:00AM

Business Wire

RPM International Inc. (NYSE:RPM) today announced that it

expects its financial results for its fiscal third quarter, ended

February 29, 2020, to be at the higher end of its guidance provided

on January 8, 2020. At that time, the company said that it expected

revenue for the fiscal third quarter to be up 2.5% to 4%, adjusted

EBIT growth in the 25% to 30% range, and adjusted diluted EPS in

the high-teens to low-20-cent range. The company noted today that

the positive momentum of the 2020 MAP to Growth operating

improvement plan contributed to good earnings leverage in the third

quarter.

“As the impact of the COVID-19 outbreak continues to evolve,

RPM’s top priorities include protecting the health and well-being

of our associates and their family members, supporting our local

communities to control the spread of the virus, and maintaining the

continuity and success of our business operations,” said Frank C.

Sullivan, RPM chairman and chief executive officer. “While the

COVID-19 outbreak continues globally, our supply chain and business

operations remain strong, our March operating results are solid,

and we continue to meet the changing needs of our customers in a

timely manner during this unprecedented period,” stated Sullivan.

“I want to thank all of our associates for their hard work and

dedication as they provide superior service to our customers as we

navigate through these challenging times together.”

The company will report its fiscal third-quarter results on

April 8, 2020, prior to the market open. Management will host a

conference call to discuss the results beginning at 10:00 a.m. EDT

the same day. The call can be accessed by dialing 800-708-4540 or

847-619-6397 for international callers. The call also will be

available both live and for replay, and as a written transcript,

via the RPM website at www.RPMinc.com.

About RPM

RPM International Inc. owns subsidiaries that are world leaders

in specialty coatings, sealants, building materials and related

services. The company operates across four reportable segments:

consumer, construction products, performance coatings and specialty

products. RPM has a diverse portfolio with hundreds of

market-leading brands, including Rust-Oleum, DAP, Zinsser,

Varathane, Day-Glo, Legend Brands, Stonhard, Carboline, Tremco and

Dryvit. From homes and workplaces, to infrastructure and precious

landmarks, RPM’s brands are trusted by consumers and professionals

alike to help build a better world. The company employs

approximately 15,000 individuals worldwide. Visit www.RPMinc.com to

learn more.

For more information, contact Russell L. Gordon, vice president

and chief financial officer, at 330-273-5090 or

rgordon@rpminc.com.

Use of Non-GAAP Financial Information

To supplement the financial information presented in accordance

with Generally Accepted Accounting Principles in the United States

(“GAAP”) in this news release, we use EBIT, adjusted EBIT and

adjusted earnings per share, which are all non-GAAP financial

measures. EBIT is defined as earnings (loss) before interest and

taxes, with adjusted EBIT and adjusted earnings per share provided

for the purpose of adjusting for one-off items impacting revenues

and/or expenses that are not considered by management to be

indicative of ongoing operations. We evaluate the profit

performance of our segments based on income before income taxes,

but also look to EBIT as a performance evaluation measure because

interest expense is essentially related to acquisitions, as opposed

to segment operations. For that reason, we believe EBIT is also

useful to investors as a metric in their investment decisions. EBIT

should not be considered an alternative to, or more meaningful

than, income before income taxes as determined in accordance with

GAAP, since EBIT omits the impact of interest and investment income

or expense in determining operating performance, which represent

items necessary to our continued operations, given our level of

indebtedness. Nonetheless, EBIT is a key measure expected by and

useful to our fixed income investors, rating agencies and the

banking community all of whom believe, and we concur, that this

measure is critical to the capital markets' analysis of our

segments' core operating performance. We also evaluate EBIT because

it is clear that movements in EBIT impact our ability to attract

financing. Our underwriters and bankers consistently require

inclusion of this measure in offering memoranda in conjunction with

any debt underwriting or bank financing. EBIT may not be indicative

of our historical operating results, nor is it meant to be

predictive of potential future results. See the financial statement

section of this earnings release for a reconciliation of EBIT and

adjusted EBIT to income before income taxes, and adjusted earnings

per share to earnings per share. We have not provided a

reconciliation of our fiscal 2020 adjusted EBIT and adjusted

earnings per share guidance, because material terms that impact

such measures are not in our control and/or cannot be reasonably

predicted, and therefore a reconciliation of such measures is not

available without unreasonable effort.

Forward-Looking Statements

This press release contains “forward-looking statements”

relating to our business. These forward-looking statements, or

other statements made by us, are made based on our expectations and

beliefs concerning future events impacting us and are subject to

uncertainties and factors (including those specified below) which

are difficult to predict and, in many instances, are beyond our

control. As a result, our actual results could differ materially

from those expressed in or implied by any such forward-looking

statements. These uncertainties and factors include (a) global

markets and general economic conditions, including uncertainties

surrounding the volatility in financial markets, the availability

of capital and the effect of changes in interest rates, and the

viability of banks and other financial institutions; (b) the

prices, supply and capacity of raw materials, including assorted

pigments, resins, solvents and other natural gas- and oil-based

materials; packaging, including plastic containers; and

transportation services, including fuel surcharges; (c) continued

growth in demand for our products; (d) legal, environmental and

litigation risks inherent in our construction and chemicals

businesses and risks related to the adequacy of our insurance

coverage for such matters; (e) the effect of changes in interest

rates; (f) the effect of fluctuations in currency exchange rates

upon our foreign operations; (g) the effect of non-currency risks

of investing in and conducting operations in foreign countries,

including those relating to domestic and international political,

social, economic and regulatory factors; (h) risks and

uncertainties associated with our ongoing acquisition and

divestiture activities; (i) the timing of and the realization of

anticipated cost savings from restructuring initiatives and the

ability to identify additional cost savings opportunities; (j)

risks related to the adequacy of our contingent liability reserves;

and (k) other risks detailed in our filings with the Securities and

Exchange Commission, including the risk factors set forth in our

Annual Report on Form 10-K for the year ended May 31, 2019, as the

same may be updated from time to time. We do not undertake any

obligation to publicly update or revise any forward-looking

statements to reflect future events, information or circumstances

that arise after the date of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200320005099/en/

Russell L. Gordon, vice president and chief financial officer

330-273-5090 rgordon@rpminc.com

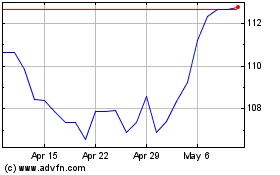

RPM (NYSE:RPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

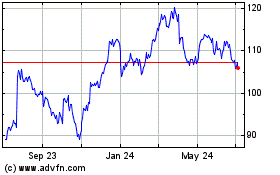

RPM (NYSE:RPM)

Historical Stock Chart

From Apr 2023 to Apr 2024