PE Firms Act to Save Portfolio Companies From Coronavirus Troubles

March 20 2020 - 5:59AM

Dow Jones News

By Ted Bunker

Private-equity firms are taking steps to help their portfolio

companies survive the coronavirus onslaught of forced closures,

scattered workforces and upended markets.

From providing millions of dollars in emergency aid to more

mundane things like phone calls designed to boost managers' morale,

professionals in buyout shops around the U.S. are trying to ensure

the new coronavirus doesn't bring down their investments.

Platinum Equity is "working assertively to keep them all in

business," a person familiar with the matter said, referring to the

firm's portfolio companies.

At buyout shop Apollo Global Management Inc., professionals are

holding conference calls every other day with portfolio company

managers and have created an information-sharing portal online that

can serve as a resource to them all, said a person familiar with

the situation.

KKR & Co. Inc. went so far as to hire an infectious disease

expert to advise the firm's companies on issues related to the

coronavirus pandemic, said a person familiar with what is being

done there. The firm also has connected its medical portfolio

companies and other businesses to help supply guidance on dealing

with situations that arise. Some KKR companies also have donated

supplies such as surgical masks to other portfolio companies in

need.

In one of the biggest efforts so far, executives at Los

Angeles-based Leonard Green & Partners agreed to contribute $10

million of their own money to provide emergency cash to employees

of the firm's portfolio companies that are affected by the

virus.

"We want to support them and share the pain," said Managing

Partner John Danhakl.

Mr. Danhakl said the firm would disperse the money through

emergency relief funds and other initiatives set up by the

portfolio companies to assist employees.

"They should view us as a force multiplier for the things that

they are doing on behalf of impacted employees," he said.

One Leonard Green company, Union Square Hospitality Group, laid

off 80% of its staff after the New York restaurant chain had to

shut down most operations in accordance with government orders. The

company's chief executive, Danny Meyer, set up a relief fund to

assist those who have been affected and said he would divert his

salary into the fund.

In one of the earliest public actions to help battle the

coronavirus outbreak in China, Blackstone Group Inc. in January

pledged $1 million to help local authorities in Wuhan, where the

pandemic began. The firm also is halting evictions from apartments

it owns in New York City, along with other members of the Real

Estate Board of New York that control about 150,000 residential

units.

Carlyle Group Inc. in Washington, D.C., has also stepped up to

assist communities in China, providing 3 million yuan ($422,024) in

cash and medical supplies to front-line medical and support staff

there, according to a person familiar with the matter.

The firm is also bringing together the resources of portfolio

companies that can be used to support operations of those that have

been affected by the virus.

In one example cited by the person, Carlyle's HireVue Inc., a

provider of video interviewing systems, is giving three months of

free access to its technology to other portfolio companies so they

can interview job candidates and hire through the crisis, if

necessary. The move was particularly welcomed by those trying to

recruit for tech and business services jobs and can't conduct

on-campus and in-person spring interviews.

Laura Kreutzer and Preeti Singh contributed to this article.

Write to Ted Bunker at ted.bunker@wsj.com

(END) Dow Jones Newswires

March 20, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

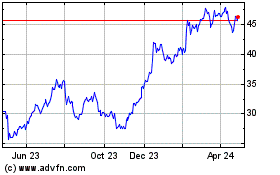

Carlyle (NASDAQ:CG)

Historical Stock Chart

From Mar 2024 to Apr 2024

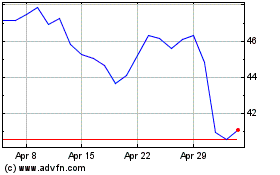

Carlyle (NASDAQ:CG)

Historical Stock Chart

From Apr 2023 to Apr 2024