Hecla Is Protecting Its Stakeholders From COVID-19

March 19 2020 - 6:30AM

Business Wire

Price Protection, Safety System, Supply Levels

and Balance Sheet Strengthen Operations

Hecla Mining Company (NYSE:HL) today provided a summary of the

activities undertaken to protect its business, employees and local

communities from COVID-19. Hecla has corporately and within its

mine sites taken significant measures including:

- Securing contracts that guarantee a $16 per ounce silver price

for the second quarter and $1,450 and $1,650 per ounce gold price

for the second and third quarter, respectively, while maintaining

exposure to the upside, after transaction costs.

- Implemented and followed recommended health and hygiene

protocols.

- Restricted mine site staff to essential personnel and

contractors.

- Stockpiled critical mining supplies (up to six months’ worth in

some cases) to protect against possible future supply

disruptions.

- Completed the $475 million Senior Note refinancing in February,

significantly de-risking the business by extending the maturity to

2028.

- Renewed our $250 million revolving credit facility for the next

three years which could provide working capital needs if

necessary.

“Over the past year, Hecla took steps to de-risk all aspects of

the business, which now puts us in a position to respond to

COVID-19,” said Phillips S. Baker, Jr., President and CEO. “While

Hecla is at risk like any other business, we have not seen any

disruptions with our customers or suppliers, we have bought put

options which should offer us some protection from recent weakness

in the silver and gold prices and our employees are diligently

implementing our safety and hygiene systems. We believe our

129-year culture of preparedness and flexibility is helping us

adjust to this challenge.”

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE:HL) is a leading

low-cost U.S. silver producer with operating mines in Alaska, Idaho

and Mexico, and is a growing gold producer with operating mines in

Quebec, Canada, and Nevada. The Company also has exploration and

pre-development properties in eight world-class silver and gold

mining districts in the U.S., Canada and Mexico.

Cautionary Statements Regarding Forward Looking

Statements

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

which are intended to be covered by the safe harbor created by such

sections and other applicable laws, including Canadian securities

laws. When a forward-looking statement expresses or implies an

expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, such statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the forward-looking statements.

Forward-looking statements often address our expected future

business and financial performance and financial condition; and

often contain words such as “anticipate,” “intend,” “plan,” “will,”

“could,” “would,” “estimate,” “should,” “expect,” “believe,”

“project,” “target,” “indicative,” “preliminary,” “potential” and

similar expressions. Forward-looking statements in this news

release may include, without limitation: (i) our 129-year culture

of preparedness and flexibility is helping us adjust to this

challenge. The material factors or assumptions used to develop such

forward-looking statements or forward-looking information include

that the Company’s plans for development and production will

proceed as expected and will not require revision as a result of

risks or uncertainties, whether known, unknown or unanticipated, to

which the Company’s operations are subject.

Estimates or expectations of future events or results are based

upon certain assumptions, which may prove to be incorrect, which

could cause actual results to differ from forward-looking

statements. Such assumptions, include, but are not limited to: (i)

there being no significant change to current geotechnical,

metallurgical, hydrological and other physical conditions; (ii)

permitting, development, operations and expansion of the Company’s

projects being consistent with current expectations and mine plans;

(iii) political/regulatory developments in any jurisdiction in

which the Company operates being consistent with its current

expectations; (iv) certain price assumptions for gold, silver, lead

and zinc; (v) prices for key supplies being approximately

consistent with current levels; (vi) the accuracy of our current

mineral reserve and mineral resource estimates; (vii) the Company’s

plans for development and production will proceed as expected and

will not require revision as a result of risks or uncertainties,

whether known, unknown or unanticipated; (viii) sufficient

workforce is available and trained to perform assigned tasks; (ix)

factors do not arise that reduce available cash balances, and (x)

there being no material increases in our current requirements to

post or maintain reclamation and performance bonds or collateral

related thereto.

In addition, material risks that could cause actual results to

differ from forward-looking statements include, but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; (vi)

conflict resolution and outcome of projects or oppositions; (vii)

litigation, political, regulatory, labor and environmental risks;

(viii) exploration risks and results, including that mineral

resources are not mineral reserves, they have not demonstrated

economic viability and there is no certainty that they can be

upgraded to mineral reserves through continued exploration; and

(ix)) we are unable to remain in compliance with all terms of the

credit agreement in order to maintain continued access to the

revolver. For a more detailed discussion of such risks and other

factors, see the Company’s 2019 Form 10-K, filed on February 13,

2020, and Form 10-Qs filed on May 9, 2019, August 7, 2019, and

November 7, 2019, with the Securities and Exchange Commission

(SEC), as well as the Company’s other SEC filings. The Company does

not undertake any obligation to release publicly revisions to any

“forward-looking statement,” including, without limitation,

outlook, to reflect events or circumstances after the date of this

presentation, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

Investors should not assume that any lack of update to a previously

issued “forward-looking statement” constitutes a reaffirmation of

that statement. Continued reliance on “forward-looking statements”

is at investors’ own risk.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200319005190/en/

Mike Westerlund Vice President – Investor Relations 800-HECLA91

(800-432-5291) Investor Relations Email: hmc-info@hecla-mining.com

Website: www.hecla-mining.com

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

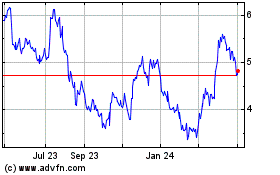

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024