Kelso Technologies Inc. (“Kelso” or the “Company”) (TSX: KLS) (NYSE

American: KIQ) reports that it has released its audited

consolidated financial statements and Management Discussion and

Analysis for the year ended December 31, 2019.

The audited year end financial statements were

prepared in accordance with International Financial Reporting

Standards (“IFRS”) as issued by the International Accounting

Standards Board (“IASB”). All amounts herein are expressed in

United States dollars (the Company’s functional currency) unless

otherwise indicated.

SUMMARY OF FINANCIAL

PERFORMANCE

|

Year ended December 31 |

|

2019 |

|

|

2018 |

|

Change |

|

Revenues |

$ |

20,550,682 |

|

$ |

12,716,596 |

|

+ 62 |

% |

|

Gross profit |

$ |

9,582,879 |

|

$ |

5,287,216 |

|

+ 81 |

% |

|

Gross profit margin |

|

46.5 |

% |

|

41.6 |

% |

+ 12 |

% |

|

EBITDA |

$ |

4,233,339 |

|

$ |

1,002,464 |

|

+ 324 |

% |

|

EBITDA margin |

|

20.6 |

% |

|

7.8 |

% |

+ 165 |

% |

|

Non-cash expenses |

$ |

792,727 |

|

$ |

571,536 |

|

+ 39 |

% |

|

Taxes |

$ |

99,077 |

|

$ |

251,164 |

|

- 139 |

% |

|

Net income |

$ |

3,334,043 |

|

$ |

194,453 |

|

+1,615 |

% |

|

Common shares outstanding |

|

47,170,086 |

|

|

47,170,086 |

|

No dilution |

|

|

Basic earnings per share |

$ |

0.07 |

|

$ |

0.00 |

|

+ 700 |

% |

|

Working capital |

$ |

7,937,873 |

|

$ |

4,469,882 |

|

+ 78 |

% |

|

Cash |

$ |

4,418,236 |

|

$ |

1,246,244 |

|

+ 255 |

% |

|

Interest bearing long-term debt |

|

nil |

|

|

nil |

|

No change |

|

|

Net equity |

$ |

11,845,275 |

|

$ |

8,165,734 |

|

+ 45 |

% |

|

Total assets |

$ |

13,731,571 |

|

$ |

9,944,990 |

|

+ 38 |

% |

LIQUIDITY AND CAPITAL

RESOURCES

At December 31, 2019 the Company had cash on

deposit in the amount of $4,418,236, accounts receivable of

$1,824,563, prepaid expenses of $96,627 and inventory of $3,394,192

compared to cash on deposit in the amount of $1,246,244, accounts

receivable of $1,224,235, prepaid expenses of $110,258 and

inventory of $3,668,401 at December 31, 2018.

The Company has accrued income tax payable of

$71,341 for the year ended December 31, 2019 compared to income tax

payable of $466,739 at December 31, 2018.

The working capital position of the Company at

December 31, 2019 was $7,937,873 compared to $4,469,882 at December

31, 2018. The majority of accounts receivable are collected within

30 days from invoicing shipments giving Kelso $1,824,563 of

additional cash flow plus $4,418,236 of available cash to discharge

accounts payable and accrued liabilities of $1,795,745 on a timely

basis subsequent to December 31, 2019. Income taxes payable are due

mid 2020.

Net assets of the Company improved to

$11,845,275 at December 31, 2019 compared to $8,165,734 at December

31, 2018. The Company has no interest-bearing long-term liabilities

or debt at December 31, 2019.

OUTLOOK

The results for 2019 demonstrated stronger sales

results and earnings growth. Our concentration on products with

proven economic benefits for customers in a highly competitive rail

market increased demand for our valves from rail tank car

manufacturers, retrofitters, repair operations and tank car

owners.

Our business reputation continues as a reliable

supplier of a wide assortment of proprietary rail tank car valves

and other specialized equipment. The key design element for all our

products is the improvement of the quality of public safety

equipment used in the transport of dangerous materials. We focus on

mitigating potential negative impacts on the environment while

providing stakeholders with economic operational rewards.

Since a dismal 2017 Kelso has been able to

refocus its efforts to rebuild its brand through a better “customer

driven” business model. This program has led to co-engineered

product development initiatives with customers and has

significantly increased their support to create a better business

platform to thrive on.

Key to our strategic plan is our dedication to

the improvement of the quality of rail tank car equipment. Our

value proposition for customers is to produce and timely deliver

American precision milled equipment that features quality

craftsmanship and long-term reliable performance. We have

distinguished ourselves from our competition by using only North

American suppliers that allow us to have the shortest delivery and

service lead times in the industry. Our products diminish the

expensive and complex logistics of repairing tank cars in service –

an economic benefit that customers have welcomed and embraced.

In 2019 strong contribution margins from sales

have provided a steady growth of positive cash flows that led to

our improved financial strength. Working capital improved to a

healthy $7,937,873 at December 31, 2019. Our capital management

allows us to finance operations and R&D from the sales of our

products thus avoiding the need for dilutive new equity funding or

interest-bearing long-term debt.

We continue to invest in promising new product

development initiatives to build the next generation of revenue

opportunities even though our R&D projects continue to be

complex, time consuming and expensive. As with all new product

developments the timing of new revenue streams remains

unpredictable and is not guaranteed to develop at all. Our R&D

model has delivered a wide array of promising new products that

include new rail tank car equipment, specialized truck tanker

equipment, no-spill fuel loading systems, first responder emergency

response technologies and our KXI™ suspension system used in rugged

wilderness applications.

Although there are many market challenges and

COVID-19 healthcare concerns around the world our business momentum

appears to be consistent with 2019. Based on our operational

momentum, the introduction of a number of our new products to

market and our healthy debt free financial position it is our

belief that our present business activities will continue to add to

the positive stature of the Company.

About Kelso Technologies

Kelso is a diverse product development company

that specializes in the design, production and distribution of

proprietary service equipment used in transportation applications.

Our reputation has been earned as a designer and reliable supplier

of unique high quality rail tank car valve equipment that provides

for the safe handling and containment of hazardous and

non-hazardous commodities during transport. All Kelso products are

specifically designed to provide economic and operational

advantages to customers while reducing the potential effects of

human error and environmental harm.

For a more complete business and financial

profile of the Company, please view the Company's website at

www.kelsotech.com and public documents posted under the Company’s

profile on www.sedar.com in Canada and on EDGAR at

www.sec.gov in the United States.

On behalf of the Board of

Directors,

James R. Bond, CEO and President

Notice to Reader: References to

EBITDA refer to net earnings from continuing operations before

interest, taxes, amortization, unrealized foreign exchange and non

cash share-based expenses (Black Sholes option pricing model) and

write off of assets. EBITDA is not an earnings measure recognized

by IFRS and does not have a standardized meaning prescribed by

IFRS. Management believes that EBITDA is an alternative measure in

evaluating the Company's business performance. Readers are

cautioned that EBITDA should not be construed as an alternative to

net income as determined under IFRS; nor as an indicator of

financial performance as determined by IFRS; nor a calculation of

cash flow from operating activities as determined under IFRS; nor

as a measure of liquidity and cash flow under IFRS. The Company's

method of calculating EBITDA may differ from methods used by other

issuers and, accordingly, the Company's EBITDA may not be

comparable to similar measures used by any other issuer.

Legal Notice Regarding Forward-Looking

Statements: This news release contains “forward-looking

statements” within the meaning of applicable securities

legislation. Forward-looking statements are indicated expectations

or intentions. Forward-looking statements in this news release

include that we can maintain the shortest delivery and service lead

times in the industry; that our products will continue to diminish

the expensive and complex logistics of repairing tank cars in

service – an economic benefit that customers have welcomed and

embraced; that we can continue to finance operations and R&D

from the sales of our products thus avoiding the need for dilutive

new equity funding or interest-bearing long-term debt; that our

R&D model has delivered a wide array of promising new products

that include new rail tank car equipment, specialized truck tanker

equipment, no-spill fuel loading systems, first responder emergency

response technologies and our KXI™ suspension system used in rugged

wilderness applications and; that it is our belief that our present

business activities will continue to add to the positive stature of

the Company. Although Kelso believes its anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, they can give no assurance

that such expectations will prove to be correct. The reader should

not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Kelso to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information, including without limitation the risk that

regulatory deadlines for compliance may be delayed or cancelled;

the Company’s products may not provide the intended economic or

operational advantages; or reduce the potential effects of human

error and environmental harm during the transport of hazardous

materials; or grow and sustain anticipated revenue streams; our new

products may not receive AAR certification; orders may be cancelled

and competitors may enter the market with new product offerings

which could capture some of our market share; and our new equipment

offerings may not capture market share as well as expected. Except

as required by law, the Company does not intend to update the

forward-looking information and forward-looking statements

contained in this news release.

| |

| For further

information, please contact: |

|

James R. Bond, CEO and President |

Richard Lee, Chief Financial Officer |

Corporate Address: |

| Email: bond@kelsotech.com |

Email: lee@kelsotech.com |

13966 - 18B AvenueSouth Surrey, BC V4A 8J1www.kelsotech.com |

| |

|

|

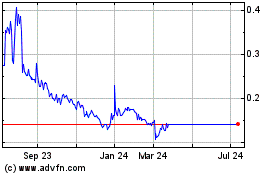

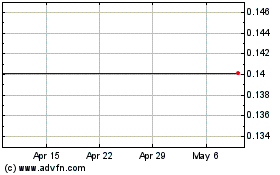

Kelso Technologies (AMEX:KIQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kelso Technologies (AMEX:KIQ)

Historical Stock Chart

From Apr 2023 to Apr 2024