By Alison Sider in Chicago and Ted Mann in Washington

Reeling from the coronavirus crisis, U.S. airlines are seeking

over $50 billion in financial assistance from the government, more

than three times the size of the industry's bailout after the Sept.

11 attacks.

The exact form of the aid -- and the amount -- is under

discussion with Trump administration officials and congressional

leaders. A potential aid package could include government-backed

loans, cash grants and other measures including relief from taxes

and fees, according to an airline trade group and others familiar

with the discussions.

"We're going to back the airlines 100%," President Trump said at

a news conference Monday. "We have to back the airlines. It's not

their fault."

Industry trade group Airlines for America, or A4A, also proposed

$8 billion in grants and guarantees for cargo carriers. U.S.

airports are separately seeking $10 billion in assistance to

counter forecast full-year losses already approaching $9 billion,

according to a person familiar with the request.

Airlines are facing an existential crisis, with United Airlines

Holdings Inc. alone estimating its revenue would be down $1.5

billion in March from a year ago and would post a first-quarter

loss. A4A said all seven of the carriers it represents could run

out of money in the second half of the year or sooner.

"We cannot afford to wait long for assistance," A4A said.

Airlines have been stunned by the rapid plunge in their bookings

as the coronavirus pandemic has spread around the world. As the

worst-case scenarios they envisioned just days or weeks ago have

come to pass, carriers have scrambled to make ever deeper cuts to

their schedules.

Major carriers have warned the administration they could become

insolvent as soon as late May without federal help, a person

familiar with the talks said.

The proposed aid package would require congressional approval,

and some lawmakers in both parties have already begun signaling

opposition to what they called a corporate bailout.

"The Swamp will draft a COVID19 corporate bailout. It will not

be good," Rep. Matt Gaetz (R., Fla.) wrote on Twitter Monday,

referring to the illness caused by the novel coronavirus.

Sunday night on Fox News, Rep. Gaetz said "every lobbyist in

Washington right now is planning for the next big bailout push,

whether it's the airline industry or the cruise industry....We do

not need a massive corporate bailout as a consequence of this

virus. We should be thinking about the workers."

Sen. Edward Markey (D., Mass.) said any assistance to the

airlines should come with new rules prohibiting practices like

charging for flight changes as well as protection for workers.

"Any infusion of money to the airlines must have some major

strings attached," he said in a statement. "I will demand these

conditions be met before supporting any airline bailout."

Treasury Secretary Steven Mnuchin said Sunday that the

administration was considering relief packages for a number of

industries but rejected the idea that they would constitute

bailouts.

"If you're providing liquidity to good businesses that just need

liquidity for three to six months, where you're taking collateral

and you have security, that's not a bailout," he said.

Senior leaders at Boeing Co., meanwhile, have been in talks with

congressional and White House officials about financial assistance

for the plane manufacturer and its suppliers, as part of a broader

aid package for the aviation industry, a company executive said

Monday.

"We can get the aviation sector back on its feet faster if there

is assistance," the executive said. Details of any potential

request for assistance couldn't immediately be learned.

Boeing continues to build wide-body aircraft at its Everett,

Wash., factory near Seattle, while production of the narrow-body

737 MAX remains halted amid a protracted grounding following two

deadly crashes.

United said Sunday night that it would cut its planned flying in

half in April and May and is in talks with its unions about steps

that could include furloughs, pay cuts or other measures to reduce

payroll expenses.

Even then, the carrier expects its remaining planes to fly only

a quarter full.

"When medical experts say that our health and safety depends on

people staying home and practicing social distancing, it's nearly

impossible to run a business whose shared purpose is 'Connecting

people. Uniting the world,'" United CEO Oscar Munoz and President

Scott Kirby wrote in a letter to employees Sunday.

Delta Air Lines Inc. and American Airlines Group Inc. have also

announced severe cuts in flying, hiring freezes, and voluntary

unpaid leave for employees.

A4A issued its proposal for more than $50 billion in aid

publicly Monday after circulating it privately in recent days.

While massive, the aid package falls short of the $80 billion

bailout of the auto industry following the 2008 financial

crisis.

The trade group argued that roughly half of the proposed

assistance -- $25 billion -- should come in the form of direct

grants to airlines. The proposal also outlines a $25 billion

program in which the Federal Reserve would purchase financial

instruments from, or provide interest-free loans or loan guarantees

to, the carriers.

It also includes provisions for rebates of excise taxes --

including those on tickets, cargo and fuel -- that airlines paid in

the first quarter and a repeal of those taxes through at least Dec.

31, 2021.

Some lobbying on behalf of the airlines believe that figure

might not be enough, given the likelihood that the disruption to

air travel will last for months, leaving carriers with huge debt

loads and depressed cash flows.

"They might be shooting too low," one person involved in the

talks said.

The Trump administration is using the post-Sept. 11 bailout

passed by Congress in 2001 as a template for the current talks with

carriers, people involved in the discussions said.

Lawmakers in 2001 made $5 billion in direct payments to airlines

after the terrorist attacks that prompted a three-day closure of

North American airspace. They also earmarked up to $10 billion to

support U.S. airlines through a loan program, though only $1.56

billion in guarantees were authorized, including to carriers that

ended up failing.

Some criticized that package for propping up ailing carriers and

delaying consolidation. The program ended up making money for the

government.

U.S. airlines were profitable for a decade before the virus hit

-- a record stretch -- and airline executives had hoped they had

built up enough of a cushion to make it through the hit from the

virus.

But as governments imposed sweeping new restrictions on

international travel and passengers began canceling flights en

masse, the speed and severity of the drop in demand has been

overwhelming.

Airlines are also arguing that they should be permitted to

retain the 7.5% tax on ticket sales that currently goes to support

airport improvements. That has triggered fights with airport

operators that say they depend on that revenue, this person

said.

Airlines have bolstered liquidity in recent weeks with bond

issues and by drawing down existing credit facilities. Alaska Air

Group Inc. said Monday it was seeking another $500 million, having

drawn down a loan just last week.

Executives have also flagged their access to potentially

billions of dollars more by borrowing against aircraft and other

assets such as frequent-flier programs.

U.S. airline shares have more than halved in value over the past

month and continued their decline on Monday, rising only slightly

after the aid request was disclosed. The NYSE Arca Airline Index

fell 16% to its lowest level in seven years.

United's Mr. Munoz and leaders of unions representing the

airline's flight attendants, pilots, mechanics and flight

dispatchers wrote to Mr. Mnuchin and congressional leaders Monday

asking for financial support, saying that the recent travel

restrictions and shrinking demand were putting jobs at risk.

"The financial impact of this crisis on our industry is much

worse than the stark downturn that we saw in the aftermath of the

9/11 attacks," they wrote in a letter. "Financial support that you

provide would allow United to continue paying our employees as we

weather this crisis -- protecting tens of thousands of people from

imposing a temporary furlough."

--Andrew Tangel, Doug Cameron and Alex Leary contributed to this

article.

Write to Alison Sider at alison.sider@wsj.com and Ted Mann at

ted.mann@wsj.com

(END) Dow Jones Newswires

March 16, 2020 19:43 ET (23:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

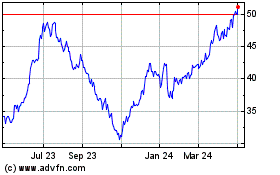

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

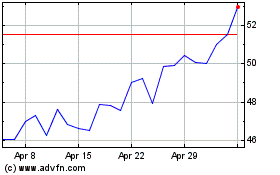

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024