- Revenues of $208.5 million for Q4’19 and $772.7 million for

FY’19, up 36.8% and 23.5%, respectively from Q4’18 and from

FY’18.

- Net income of $4.2 million for Q4’19, up from $0.1

million in Q4’18, driven by growth in our Insurance

operations and improved returns in Tiptree Capital. Net income of

$18.4 million for FY’19, down $5.5 million from prior year driven

by non-recurring gain from sale of Care in 2018, partially offset

by improved performance in Insurance operations and Tiptree

Capital.

- Operating EBITDA(1) of $21.0 million for the quarter and

$63.6 million for the year, an increase of 26.5% and 15.8%,

respectively, from Q4’18 and FY’18, driven by growth in insurance

operations and contributions from our shipping and mortgage

operations within Tiptree Capital.

- Book value per share as of December 31, 2019 was $11.52,

which including dividends paid represents a 8.2%(2) year over year

return.

- Declared a dividend of $0.04 per share to stockholders of

record on March 23, 2020 with a payment date of March 30,

2020.

Tiptree Inc. (NASDAQ:TIPT) (“Tiptree” or the “Company”), a

holding company that combines specialty insurance operations with

investment management, today announced its financial results for

the year ended December 31, 2019.

Summary Consolidated

Statements of Operations

($ in millions, except per share

information)

Three Months Ended December

31,

Year Ended December

31,

GAAP:

2019

2018

2019

2018

Total revenues

$

208.5

$

152.4

$

772.7

$

625.8

Net income attributable to Common

Stockholders

$

4.2

$

0.1

$

18.4

$

23.9

Diluted earnings per share

$

0.11

$

0.01

$

0.50

$

0.69

Cash dividends paid per common share

$

0.040

$

0.035

$

0.155

$

0.135

Non-GAAP:

(1)

Operating EBITDA

$

21.0

$

16.6

$

63.6

$

54.9

Adjusted EBITDA

$

19.3

$

5.6

$

63.0

$

28.8

Book value per share

$

11.52

$

10.79

$

11.52

$

10.79

(1)

For further information relating to the

Company’s Operating EBITDA, Adjusted EBITDA and Book value per

share, including a reconciliation to GAAP financials, see

“—Non-GAAP Reconciliations” below.

(2)

Total return per share as of December 31,

2019 defined as cumulative dividends paid of $0.155 per share plus

growth in book value per share from December 31, 2018.

Earnings Conference Call

Tiptree will host a conference call on Thursday, March 12, 2020

at 9:00 a.m. Eastern Time to discuss its Q4 and full year 2019

financial results. A copy of our investor presentation, to be used

during the conference call, as well as this press release, will be

available in the Investor Relations section of the Company’s

website, located at www.tiptreeinc.com.

The conference call will be available via live or archived

webcast at http://www.investors.tiptreeinc.com. To listen to

a live broadcast, go to the site at least 15 minutes prior to the

scheduled start time in order to register, download and install any

necessary audio software. To participate in the telephone

conference call, please dial 1-877-407-4018 (domestic) or

1-201-689-8471 (international). Please dial in at least five

minutes prior to the start time.

A replay of the call will be available from Thursday, March 12,

2020 at 1:00 p.m. Eastern Time, until midnight Eastern on Thursday,

March 19, 2020. To listen to the replay, please dial 1-844-512-2921

(domestic) or 1-412-317-6671 (international), Passcode:

13697617.

Financial Overview

2019 and early 2020 highlights include:

Overall:

- Delivered total annual return of 8.2%, as measured by growth in

book value per share plus dividends paid.

- In 2019, we purchased and retired 1,472,730 shares of our

Common Stock for $9.1 million.

- Increased our dividends for the third consecutive year to

$0.155 per share, a 14.8% increase over the prior year.

Tiptree Insurance:

- Gross written premiums for 2019 were $1,015 million, up 17.0%

from the prior year. Net written premiums were $537.2 million, up

15.1%, driven by growth in all product lines.

- Our insurance investments earned a total return of 5.4%, up

from 0.3% from the prior year period, driven primarily by improved

mark-to-market on equities and fixed income investments.

- In January 2020, we acquired Smart AutoCare, a growing vehicle

warranty administrator in the United States. The transaction valued

the business at $160 million of enterprise value, inclusive of $50

million of earn out consideration, representing a multiple of 8.3x

modified cash EBITDA (excluding anticipated revenue and expense

synergies).

- As part of our strategy to grow our insurance operations in

Europe, in July 2019, we acquired a majority interest in Defend, an

automotive finance and insurance administrator operating in the

Czech Republic, Poland, Hungary, Slovakia, and the UK.

Tiptree Capital:

- Operating EBITDA grew year over year, driven primarily by the

inclusion of a full year of our maritime transportation operations

and improvements in specialty finance.

- Increased invested capital, primarily due to additional

investments in vessels.

Consolidated Results of Operations

Revenues

For the three months ended December 31, 2019, revenues were

$208.5 million, which increased $56.1 million, or 36.8%, over the

prior year period. For the year ended December 31, 2019, revenues

were $772.7 million, which increased $146.9 million, or 23.5%, over

the prior year period. The increase was primarily driven by growth

in earned premiums, lower unrealized losses on Invesque,

improvements in specialty finance results, the inclusion of revenue

from shipping operations and the gain on sale of our CLO management

business. Earned premiums were $499.1 million for the year ended

December 31, 2019, up $71.3 million, or 16.7%, driven by growth in

net written premiums. The combination of unearned premiums and

deferred revenues on the balance sheet grew by $174.4 million, or

25.8%, from December 31, 2018 to December 31, 2019 as a result of

increased written premiums, primarily in credit protection and

warranty programs.

Net Income Available to Common Stockholders

For the three months ended December 31, 2019, net income

available to Common Stockholders was $4.2 million, an increase of

$4.1 million from the prior year period. The increase was primarily

driven by increased investment gains in the period.

For the year ended December 31, 2019, net income available to

Common Stockholders was $18.4 million, a decrease of $5.5 million.

The decrease was primarily driven by income from discontinued

operations of $43.8 million in 2018, which included the gain on

sale of Care. This non-recurring gain was offset by improved

insurance operating performance, the realized gain on the sale of

our CLO management business, and increased realized and unrealized

gains on investments in 2019.

Income before taxes (from continuing and discontinued

operations)

The table below highlights key drivers impacting our

consolidated results on a pre-tax basis. Many of our investments

are carried at fair value and marked to market through unrealized

gains and losses. As a result, we expect our earnings relating to

these investments to be relatively volatile between periods in

contrast to our fixed income securities, which are marked to market

through AOCI in stockholders’ equity. On February 1, 2018, we sold

our senior living operations to Invesque in exchange for a net of

16.6 million shares of Invesque common stock which resulted in a

pre-tax gain on sale of $56.9 million in 2018.

($ in millions)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Net realized and unrealized gains

(losses)(1)

$

0.6

$

(7.4

)

$

9.8

$

(14.0

)

Net realized and unrealized gains (losses)

- Invesque

$

0.5

$

(10.7

)

$

(1.2

)

$

(20.7

)

Discontinued operations (Care)(2)

$

—

$

10.7

$

—

$

57.5

(1)

Excludes Invesque, Mortgage realized and

unrealized gains and losses and NPLs. The year ended December 31,

2019 includes $7.6 million gain on sale of our CLO business.

(2)

Represents Care for the year ended

December 31, 2018 including a $56.9 million pre-tax gain on

sale.

Non-GAAP

Management uses Operating EBITDA, Adjusted EBITDA and book value

per share as measurements of operating performance which are

non-GAAP measures. Management believes the use of Operating EBITDA

and Adjusted EBITDA provides supplemental information useful to

investors as they are frequently used by the financial community to

analyze financial performance, and to analyze a company’s ability

to service its debt and to facilitate comparison among companies.

Management uses Operating EBITDA as part of its capital allocation

process and to assess comparative returns on invested capital

amongst our businesses and investments. Adjusted EBITDA is also

used in determining incentive compensation for the Company’s

executive officers. Operating EBITDA and Adjusted EBITDA are not

measurements of financial performance or liquidity under GAAP and

should not be considered as an alternative or substitute for GAAP

net income. Management believes the use of book value per share

provides supplemental information useful to investors as it is

frequently used by the financial community to analyze company

growth on a relative per share basis.

Operating EBITDA for the three months ended December 31, 2019

was $21.0 million compared to $16.6 million for the 2018 period, an

increase of $4.4 million, or 26.5%. Operating EBITDA for the year

ended December 31, 2019 was $63.6 million, an increase of $8.7

million, or 15.8%. The increase for both periods were driven

primarily by improved performance in Tiptree Capital.

Total stockholders’ equity was $411.5 million as of December 31,

2019 compared to $399.3 million as of December 31, 2018, primarily

driven by net income, offset by share repurchases and dividends

paid. In 2019, Tiptree returned $14.4 million to shareholders

through share repurchases and dividends paid. Book value per share

for the year ended December 31, 2019 was $11.52, an increase from

book value per share of $10.79 as of December 31, 2018. The key

drivers of the period-over-period impact were earnings per share

and the purchase of 1.5 million shares at an average 40% discount

to book value. Those increases were offset by dividends paid of

$0.155 per share and officer compensation share issuances.

Results by Segment

Tiptree is a holding company that combines insurance operations

with investment management capabilities. Our principal operating

subsidiary is a leading provider of specialty insurance products

and related services. We also allocate capital across a broad

spectrum of businesses, assets and other investments, which we

refer to as Tiptree Capital. As such, we classify our business into

one reportable segment, specialty insurance, with the remainder of

our non-insurance operations aggregated into Tiptree Capital.

Corporate activities include holding company interest expense,

employee compensation and benefits, and other expenses. The

following table presents the components of total pre-tax income

including continuing and discontinued operations.

Pre-tax Income

($ in millions)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Tiptree Insurance

$

12.6

$

2.8

$

41.0

$

18.6

Tiptree Capital

4.8

(6.6

)

21.0

(7.8

)

Corporate

(7.5

)

(9.4

)

(32.9

)

(30.6

)

Pre-tax income (loss) from continuing

operations

$

9.9

$

(13.2

)

$

29.1

$

(19.8

)

Pre-tax income (loss) from discontinued

operations (1)

$

—

$

10.7

$

—

$

57.5

(1)

Represents Care for the year ended

December 31, 2018 which includes $56.9 million pre-tax gain on

sale.

Operating EBITDA - Non-GAAP (1)

The following tables present the

components of Operating EBITDA.

($ in millions)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Tiptree Insurance

$

18.8

$

19.4

$

63.3

$

64.5

Tiptree Capital (2)

7.5

2.3

22.8

13.7

Corporate

(5.3

)

(5.1

)

(22.5

)

(23.3

)

Operating EBITDA

$

21.0

$

16.6

$

63.6

$

54.9

(1)

For further information relating to the

Company’s Operating EBITDA, including a reconciliation to GAAP

pre-tax income, see “—Non-GAAP Reconciliations.”

(2)

Includes discontinued operations related

to Care. As of February 1, 2018, invested capital from Care

discontinued operations is represented by our investment in

Invesque common shares. For more information, see “Note—(3)

Dispositions, Assets Held for Sale and Discontinued Operations” in

our Form 10-K for the year ended December 31, 2019.

About Tiptree

Tiptree Inc. (NASDAQ: TIPT) is a holding company that allocates

capital across a broad spectrum of businesses, assets and other

investments. Our principal operating business, Tiptree Insurance,

along with its subsidiaries, is a leading provider of specialty

insurance, warranty products and related administration services.

We also allocate capital to a diverse group of select investments

that we refer to as Tiptree Capital. For more information, please

visit www.tiptreeinc.com.

Forward-Looking

Statements

This release contains “forward-looking statements” which involve

risks, uncertainties and contingencies, many of which are beyond

the Company’s control, which may cause actual results, performance,

or achievements to differ materially from anticipated results,

performance, or achievements. All statements contained in this

release that are not clearly historical in nature are

forward-looking, and the words “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “project,” “should,”

“target,” “will,” or similar expressions are intended to identify

forward-looking statements. Such forward-looking statements

include, but are not limited to, statements about the Company’s

plans, objectives, expectations and intentions. The forward-looking

statements are not guarantees of future performance and are subject

to risks, uncertainties and other factors, many of which are beyond

our control, are difficult to predict and could cause actual

results to differ materially from those expressed or forecast in

the forward-looking statements. Our actual results could differ

materially from those anticipated in these forward-looking

statements as a result of various factors, including, but not

limited to those described in the section entitled “Risk Factors”

in the Company’s Annual Report on Form 10-K, and as described in

the Company’s other filings with the Securities and Exchange

Commission. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as to the date

of this release. The factors described therein are not necessarily

all of the important factors that could cause actual results or

developments to differ materially from those expressed in any of

our forward-looking statements. Other unknown or unpredictable

factors also could affect our forward-looking statements.

Consequently, our actual performance could be materially different

from the results described or anticipated by our forward-looking

statements. Given these uncertainties, you should not place undue

reliance on these forward-looking statements. Except as required by

the federal securities laws, we undertake no obligation to update

any forward-looking statements.

Tiptree Inc.

Condensed Consolidated Balance

Sheet

($ in thousands, except share data)

As of December 31,

2019

2018

Assets:

Investments:

Available for sale securities, at fair

value

$

335,192

$

283,563

Loans, at fair value

108,894

215,383

Equity securities

155,378

122,979

Other investments

137,472

75,002

Total investments

736,936

696,927

Cash and cash equivalents

133,117

86,003

Restricted cash

11,473

10,521

Notes and accounts receivable, net

286,968

223,105

Reinsurance receivables

539,833

420,351

Deferred acquisition costs

166,493

170,063

Goodwill

99,147

91,562

Intangible assets, net

47,974

52,121

Other assets

68,510

46,034

Assets held for sale

107,835

68,231

Total assets

$

2,198,286

$

1,864,918

Liabilities and Stockholders’

Equity

Liabilities:

Debt, net

$

374,454

$

354,083

Unearned premiums

754,993

599,444

Policy liabilities and unpaid claims

144,384

131,611

Deferred revenue

94,601

75,754

Reinsurance payable

143,869

117,597

Other liabilities and accrued expenses

172,140

124,190

Liabilities held for sale

102,430

62,980

Total liabilities

$

1,786,871

$

1,465,659

Stockholders’ Equity:

Preferred stock: $0.001 par value,

100,000,000 shares authorized, none issued or outstanding

$

—

$

—

Common Stock: $0.001 par value,

200,000,000 shares authorized, 34,562,553 and 35,870,348 shares

issued and outstanding, respectively

35

36

Additional paid-in capital

326,140

331,892

Accumulated other comprehensive income

(loss), net of tax

1,698

(2,058

)

Retained earnings

70,189

57,231

Total Tiptree Inc. stockholders’

equity

398,062

387,101

Non-controlling interests - Other

13,353

12,158

Total stockholders’ equity

411,415

399,259

Total liabilities and stockholders’

equity

$

2,198,286

$

1,864,918

Tiptree Inc.

Condensed Consolidated Statements of

Operations

($ in thousands, except share data)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Revenues:

Earned premiums, net

$

134,396

$

109,995

$

499,108

$

427,837

Service and administrative fees

27,558

26,680

106,239

102,315

Ceding commissions

2,458

2,869

9,608

9,651

Net investment income

3,304

5,237

14,017

19,179

Net realized and unrealized gains

(losses)

25,122

(3,130

)

83,868

28,782

Other revenue

15,730

10,726

59,888

38,062

Total revenues

208,568

152,377

772,728

625,826

Expenses:

Policy and contract benefits

46,425

36,804

170,681

152,095

Commission expense

77,987

68,043

303,057

262,460

Employee compensation and benefits

35,181

29,611

129,479

113,557

Interest expense

6,876

7,078

27,059

27,013

Depreciation and amortization

3,661

3,486

13,569

12,596

Other expenses

28,561

20,547

99,744

77,901

Total expenses

198,691

165,569

743,589

645,622

Income (loss) before taxes from continuing

operations

9,877

(13,192

)

29,139

(19,796

)

Less: provision (benefit) for income

taxes

5,311

(4,431

)

9,017

(5,909

)

Net income (loss) from continuing

operations

4,566

(8,761

)

20,122

(13,887

)

Discontinued operations:

Income (loss) before taxes from

discontinued operations

—

—

—

624

Gain on sale of discontinued

operations

—

10,676

—

56,860

Less: Provision (benefit) for income

taxes

1,387

—

13,714

Net income (loss) from discontinued

operations

—

9,289

—

43,770

Net income (loss) before

non-controlling interests

4,566

528

20,122

29,883

Less: net income (loss) attributable to

non-controlling interests - TFP

—

—

—

5,500

Less: net income (loss) attributable to

non-controlling interests - Other

419

363

1,761

450

Net income (loss) attributable to

Common Stockholders

$

4,147

$

165

$

18,361

$

23,933

Net income (loss) per Common

Share:

Basic, continuing operations, net

$

0.12

$

(0.25

)

$

0.52

$

(0.38

)

Basic, discontinued operations, net

—

0.26

—

1.07

Basic earnings per share

$

0.12

$

0.01

$

0.52

$

0.69

Diluted, continuing operations, net

0.11

(0.25

)

0.50

(0.38

)

Diluted, discontinued operations, net

—

0.26

—

1.07

Diluted earnings per share

$

0.11

$

0.01

$

0.50

$

0.69

Weighted average number of Common

Shares:

Basic

34,562,219

35,921,632

34,578,292

34,715,852

Diluted

34,578,357

35,921,632

34,578,292

34,715,852

Dividends declared per Common Share

$

0.040

$

0.035

$

0.16

$

0.14

Tiptree Inc.

Non-GAAP Reconciliations (Unaudited)

Non-GAAP Financial Measures — Adjusted

EBITDA and Operating EBITDA

The Company defines Adjusted EBITDA as GAAP net income of the

Company adjusted to add (i) corporate interest expense,

consolidated income taxes and consolidated depreciation and

amortization expense, (ii) adjust for the effect of purchase

accounting, (iii) adjust for non-cash fair value adjustments, and

(iv) any significant non-recurring expenses. Operating EBITDA

represents Adjusted EBITDA plus stock based compensation expense,

less realized and unrealized gains and losses and less third party

non-controlling interests. Operating EBITDA and Adjusted EBITDA are

not measurements of financial performance or liquidity under GAAP

and should not be considered as an alternative or substitute for

GAAP net income.

($ in millions)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

Net income (loss) attributable to Common

Stockholders

$

4.2

$

0.1

$

18.4

$

23.9

Add: net (loss) income attributable to

noncontrolling interests

0.4

0.4

1.7

6.0

Less: net income from discontinued

operations

—

9.3

—

43.8

Income (loss) from continuing

operations

$

4.6

$

(8.8

)

$

20.1

$

(13.9

)

Corporate debt related interest

expense(1)

4.8

4.9

19.7

18.2

Consolidated income tax expense

(benefit)

5.3

(4.4

)

9.0

(5.9

)

Depreciation and amortization

expense(2)

3.6

3.4

13.1

11.6

Non-cash fair value adjustments(3)

(0.7

)

(0.5

)

(3.1

)

(0.4

)

Non-recurring expenses(4)

1.7

0.3

4.2

2.4

Adjusted EBITDA from continuing

operations

$

19.3

$

(5.1

)

$

63.0

$

12.0

Add: Stock based compensation expense

1.9

2.9

6.4

6.7

Add: Vessel depreciation, net of capital

expenditures

1.0

0.9

2.9

0.9

Less: Realized and unrealized gains

(losses)(5)

1.1

(18.1

)

8.6

(34.7

)

Less: Third party non-controlling

interests(6)

0.1

0.2

0.1

—

Operating EBITDA from continuing

operations

$

21.0

$

16.6

$

63.6

$

54.3

Income (loss) from discontinued

operations

$

—

$

9.3

$

—

$

43.8

Consolidated income tax expense

(benefit)

—

1.4

—

13.7

Non-cash fair value adjustments (3)

—

—

—

(40.7

)

Adjusted EBITDA from discontinued

operations

$

—

$

10.7

$

—

$

16.8

Less: Realized and unrealized gains

(losses) (5)

—

10.7

—

16.2

Operating EBITDA from discontinued

operations

$

—

$

—

$

—

$

0.6

Total Adjusted EBITDA

$

19.3

$

5.6

$

63.0

$

28.8

Total Operating EBITDA

$

21.0

$

16.6

$

63.6

$

54.9

(1)

Corporate debt interest expense includes

interest expense from secured corporate credit agreements, junior

subordinated notes and preferred trust securities. Interest expense

associated with asset-specific debt in Tiptree Insurance and

Tiptree Capital is not added-back for Adjusted EBITDA and Operating

EBITDA.

(2)

Represents total depreciation and

amortization expense less purchase accounting amortization related

adjustments at our insurance companies. Following the purchase

accounting adjustments, current period expenses associated with

deferred costs were more favorably stated and current period income

associated with deferred revenues were less favorably stated. Thus,

the purchase accounting effect related to our insurance companies

increased EBITDA above what the historical basis of accounting

would have generated.

(3)

For our insurance operations, depreciation

and amortization on senior living real estate that is within net

investment income is added back to Adjusted EBITDA. For Care

(Discontinued Operations), the reduction in EBITDA is related to

accumulated depreciation and amortization, and certain operating

expenses, which were previously included in Adjusted EBITDA in

prior periods.

(4)

Acquisition, start-up and disposition

costs, including debt extinguishment, legal, taxes, banker fees and

other costs. In 2018, includes payments pursuant to a separation

agreement, dated November 10, 2015.

(5)

Adjustment excludes Mortgage realized and

unrealized gains and losses - Performing and NPLs, as those are

recurring in nature and align with those business models.

(6)

Removes the Operating EBITDA associated

with third party non-controlling interests. Does not remove the

non-controlling interests related to employee based shares.

Non-GAAP Financial Measures — Adjusted

EBITDA and Operating EBITDA

The tables below present Adjusted EBITDA and Operating EBITDA by

business component.

Three Months Ended December

31, 2019

($ in millions)

Specialty Insurance

Tiptree Capital

Corporate Expenses

Total

Pre-tax income/(loss) from continuing

operations

$

12.6

$

4.8

$

(7.5

)

$

9.9

Adjustments:

Corporate debt related interest

expense(2)

3.3

—

1.5

4.8

Depreciation and amortization

expenses(3)

2.1

1.3

0.2

3.6

Non-cash fair value adjustments(4)

—

(0.7

)

—

(0.7

)

Non-recurring expenses(5)

2.0

—

(0.3

)

1.7

Adjusted EBITDA

$

20.0

$

5.4

$

(6.1

)

$

19.3

Add: Stock-based compensation expense

1.1

—

0.8

1.9

Add: Vessel depreciation, net of capital

expenditures

—

1.0

—

1.0

Less: Realized and unrealized gain

(loss)(6)

2.3

(1.2

)

—

1.1

Less: Third party non-controlling

interests(7)

—

0.1

—

0.1

Operating EBITDA

$

18.8

$

7.5

$

(5.3

)

$

21.0

Year Ended December 31,

2019

($ in millions)

Tiptree Insurance

Tiptree Capital

Corporate Expenses

Total

Pre-tax income/(loss) from continuing

operations

$

41.0

$

21.0

$

(32.9

)

$

29.1

Adjustments:

Corporate debt related interest

expense(2)

13.4

—

6.3

19.7

Depreciation and amortization

expense(3)

8.6

3.8

0.7

13.1

Non-cash fair value adjustments(4)

—

(3.1

)

—

(3.1

)

Non-recurring expenses(5)

3.7

0.2

0.3

4.2

Adjusted EBITDA

$

66.7

$

21.9

$

(25.6

)

$

63.0

Add: Stock based compensation expense

3.1

0.2

3.1

6.4

Add: Vessel depreciation, net of capital

expenditures

—

2.9

—

2.9

Less: Realized and unrealized gains

(losses)(6)

6.5

2.1

—

8.6

Less: Third party non-controlling

interests(7)

—

0.1

—

0.1

Operating EBITDA

$

63.3

$

22.8

$

(22.5

)

$

63.6

Three Months Ended December

31, 2018

($ in millions)

Specialty Insurance

Tiptree Capital

Corporate Expenses

Total

Pre-tax income/(loss) from continuing

operations

$

2.8

$

(6.6

)

$

(9.4

)

$

(13.2

)

Pre-tax income/(loss) from discontinued

operations(1)

—

10.7

—

10.7

Adjustments:

Corporate debt related interest

expense(2)

3.2

—

1.7

4.9

Depreciation and amortization

expenses(3)

2.2

1.1

0.1

3.4

Non-cash fair value adjustments(4)

—

(0.5

)

—

(0.5

)

Non-recurring expenses(5)

0.3

(1.5

)

1.5

0.3

Adjusted EBITDA

$

8.5

$

3.2

$

(6.1

)

$

5.6

Add: Stock-based compensation expense

1.9

—

1.0

2.9

Add: Vessel depreciation, net of capital

expenditures

—

0.9

—

0.9

Less: Realized and unrealized gain

(loss)(6)

(9.0

)

1.6

—

(7.4

)

Less: Third party non-controlling

interests(7)

—

0.2

—

0.2

Operating EBITDA

$

19.4

$

2.3

$

(5.1

)

$

16.6

Year Ended December 31,

2018

($ in millions)

Tiptree Insurance

Tiptree Capital

Corporate Expenses

Total

Pre-tax income/(loss) from continuing

operations

$

18.6

$

(7.8

)

$

(30.6

)

$

(19.8

)

Pre-tax income/(loss) from discontinued

operations(1)

—

57.5

—

57.5

Adjustments:

Corporate debt related interest

expense(2)

13.2

—

5.0

18.2

Depreciation and amortization

expenses(3)

9.8

1.6

0.2

11.6

Non-cash fair value adjustments(4)

—

(41.1

)

—

(41.1

)

Non-recurring expenses(5)

3.1

—

(0.7

)

2.4

Adjusted EBITDA

$

44.7

$

10.2

$

(26.1

)

$

28.8

Add: Stock based compensation expense

3.8

0.1

2.8

6.7

Add: Vessel depreciation, net of capital

expenditures

—

0.9

—

0.9

Less: Realized and unrealized gains

(losses)(6)

(16.0

)

(2.5

)

—

(18.5

)

Less: Third party non-controlling

interests(7)

—

—

—

—

Operating EBITDA

$

64.5

$

13.7

$

(23.3

)

$

54.9

The footnotes below correspond to the tables above, under

“—Adjusted EBITDA and Operating EBITDA - Non-GAAP”

(1)

Includes discontinued operations related

to Care. For more information, see “Note—(3) Dispositions, Assets

Held for Sale & Discontinued Operations” in our Form 10-K for

the year ended December 31, 2019.

(2)

Corporate debt interest expense includes

interest expense from secured corporate credit agreements, junior

subordinated notes and preferred trust securities. Interest expense

associated with asset-specific debt in Tiptree Insurance and

Tiptree Capital is not added-back for Adjusted EBITDA and Operating

EBITDA.

(3)

Represents total depreciation and

amortization expense less purchase accounting amortization related

adjustments at our insurance companies. Following the purchase

accounting adjustments, current period expenses associated with

deferred costs were more favorably stated and current period income

associated with deferred revenues were less favorably stated. Thus,

the purchase accounting effect related to our insurance companies

increased EBITDA above what the historical basis of accounting

would have generated.

(4)

For our insurance operations, depreciation

and amortization on senior living real estate that is within net

investment income is added back to Adjusted EBITDA. For Care

(Discontinued Operations), the reduction in EBITDA is related to

accumulated depreciation and amortization, and certain operating

expenses, which were previously included in Adjusted EBITDA in

prior periods.

(5)

Acquisition, start-up and disposition

costs, including debt extinguishment, legal, taxes, banker fees and

other costs. In 2018, includes payments pursuant to a separation

agreement, dated November 10, 2015.

(6)

Adjustment excludes Mortgage realized and

unrealized gains and losses - Performing and NPLs, as those are

recurring in nature and align with those business models.

(7)

Removes the Operating EBITDA associated

with third party non-controlling interests. Does not remove the

non-controlling interests related to employee based shares.

Non-GAAP Financial Measures — Book

value per share

Management believes the use of this financial measure provides

supplemental information useful to investors as book value is

frequently used by the financial community to analyze company

growth on a relative per share basis. The following table provides

a reconciliation between total stockholders’ equity and total

shares outstanding, net of treasury shares.

($ in millions, except per share

information)

As of December 31,

2019

2018

Total stockholders’ equity

$

411.5

$

399.3

Less non-controlling interests - other

13.4

12.2

Total stockholders’ equity, net of

non-controlling interests - other

$

398.1

$

387.1

Total Common Shares outstanding

34.6

35.9

Book value per share

$

11.52

$

10.79

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200311005774/en/

Tiptree Inc. Investor Relations, 212-446-1400

ir@tiptreeinc.com

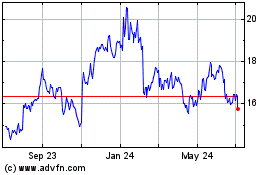

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

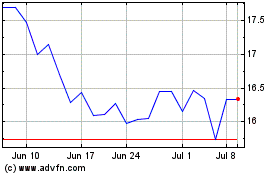

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

From Apr 2023 to Apr 2024