Costco Sales Surge on Fears Over Illness -- WSJ

March 06 2020 - 3:02AM

Dow Jones News

Wholesale club works to keep peanut butter, toilet paper, water

and other staples in stock

By Sarah Nassauer and Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 6, 2020).

Sales at Costco Wholesale Corp. stores rose and some items were

in short supply as shoppers stocked up on bulk quantities of

everyday goods amid the new coronavirus outbreak.

The warehouse club operator reported Thursday a 12.1% jump in

comparable sales in the month of February, noting an increase in

demand in the final week of the month as concerns about the virus

mounted in the U.S.

It could have been even higher. But the retailer has struggled

to keep peanut butter, toilet paper, bottled water and other

staples in stock in some markets. Long lines have been common

around the country and the hashtag #CostcoPanicBuying has

circulated on Twitter in recent days.

"We're getting deliveries daily, but still not enough given the

increased levels of demand on certain key items," Chief Financial

Officer Richard Galanti said on an earnings call Thursday. "It's

been a little crazy this past week in terms of outside shopping

frequency and sales levels and not only in the United States."

On Wednesday, Michael LaPayower headed to Costco to buy baby

wipes for his 22-month-old daughter.

"They were completely sold out. They usually have two brands,"

said the 39-year-old software analyst who lives in Staten Island,

N.Y. The store had limited bottled-water purchases to five cases

per customer. Many employees wore latex gloves, he said.

"I just couldn't believe it," he said. "I have been to Costco

before snow storms and they are fully stocked." Instead of baby

wipes, he picked up diapers, toilet paper, water and granola

bars.

Mr. Galanti said Costco was placing purchase limits on certain

items depending on supply, but the number of people visiting its

warehouse clubs has surged in recent days.

"We had a huge pickup in traffic" starting last week and

continuing this week, he said. "Are some of them putting it in

their basements for another day? Some of it related to the fact

that people aren't eating out as much? I think it's a combination

of those factors."

He said the company and others have been unable to keep certain

items, such as sanitizing items, in stock. "Whatever limited

amounts we get is gone pretty quickly," he said. "I would assume

that over the next few weeks or several weeks that will abate. But

it depends what else happens with the virus itself."

Target Corp., Amazon.com Inc. and other retailers have said

demand for many items is high and some are limiting purchase

quantities for certain items or penalizing online sellers for price

gouging.

For the quarter ended Feb. 16, Costco reported comparable sales.

Those from stores or digital operations open for at least 12 months

rose 8.9% during the quarter and 7.9% when excluding the impact of

gasoline prices and currency fluctuations.

Net income was $931 million, up from $889 million a year ago.

Total revenue rose 11% to $39.07 billion in the quarter and the

retailer's e-commerce sales increased 28.4%.

Costco also reported strong sales over the holiday buying season

when other retailers, including Target, Macy's Inc. and Walmart

Inc., faltered, citing weak sales of some categories such as toys

and electronics.

Managing through the demand surge is challenging for retailers.

Large companies that sell consumer staples and attract more middle-

and high-income shoppers are better placed to gain from the

increase in demand, said some analysts. Wealthier shoppers can

spend more to stock up.

Mr. Galanti said supply-chain issues in China are improving as

more factories ramp up production and transportation bottlenecks

ease. "There were not only product issues but also trucking and

port issues. These are also abating with port capacity in China

improving each day," he said.

The February sales increase fueled by coronavirus concerns

boosted total and comparable sales by about 3 percentage points,

Mr. Galanti said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

March 06, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

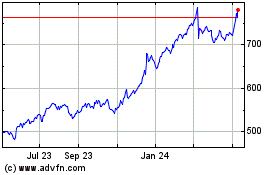

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

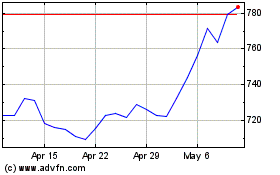

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024