National Beverage Corp. Reports on ‘Stimulus’ Action Results

March 05 2020 - 4:45PM

Business Wire

National Beverage Corp. (NASDAQ: FIZZ) today announced progress

of its recently adopted ‘Stimulus’ action plan and released

financial results for its third quarter ended January 25, 2020:

- Net sales were $223 million, an increase of 1% from the prior

year;

- Gross margin was 36.8% of sales, also improved from the prior

year;

- Earnings per share was $ .57, an increase of 7% from the prior

year; and

Cash was $262 million, an increase of $105 million for the nine

months.

Stimulus Action Results:

“The numbers reflect the effects of a strategy that generated

increased momentum of brand LaCroix. LaCroix has returned to

positive growth in a much different sparkling water category that

existed prior to October 2018, when litigation slowed the growth of

LaCroix, which also affected the growth of the total sparkling

water category.

These third quarter financial results clearly state that LaCroix

retained its distinction as the leader of the premium sparkling

water category in North America. While sparkling water category

growth has slowed from October 2018, the vitality of LaCroix as the

masthead of the sparkling water category remains ‘authentic’.

Components of our Stimulus Action:

- Volume

- Operating Margin

- Capacity

- Innovation

- Cash Flow

- Healthy Functionality

Recent Information:

- February 19, 2020 – LaCroix Victorious in Litigation . . .

Claims Retracted

http://ir.nationalbeverage.com/static-files/921b1264-8d34-4859-ad6a-995f3443119e

- March 4, 2020 – LaCroix’s Spring Taste Is . . . UP!!

http://ir.nationalbeverage.com/static-files/439dcdbf-9f79-4b71-9a4d-69ec321e1d42

Our stimulus action is producing similar positive results all

across our brands of carbonated soft drinks, juices and sparkling

waters. Two new LaCroix flavors, LimonCello and Pastèque

(Watermelon), are currently being launched nationwide. We are

excited about these two new flavors and, according to early

indications, so are our consumers. We remain extremely passionate

about our future and strongly believe progress is rapidly advancing

toward innovative growth opportunities for functional, healthier,

hydration beverages,” stated a company spokesperson.

National Beverage Corp. Consolidated Results for the

Periods Ended January 25, 2020 and January 26, 2019

(in thousands, except per share amounts)

Three Months Ended

Nine Months Ended

Jan. 25, 2020 Jan. 26, 2019 Jan. 25, 2020

Jan. 26, 2019 Net Sales

$

222,814

$

220,891

$

737,993

$

774,190

Net Income

$

26,563

$

24,809

$

93,759

$

114,717

Earnings Per Common Share Basic

$

.57

$

.53

$

2.01

$

2.46

Diluted

$

.57

$

.53

$

2.00

$

2.44

Average Common Shares Outstanding Basic

46,600

46,638

46,633

46,628

Diluted

46,802

46,934

46,853

46,927

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995.Forward-looking statements involve risks,

uncertainties and other factors described in the Company's

Securities and ExchangeCommission filings which may cause actual

results or achievements to differ from the results or achievements

expressed or implied bysuch statements. The Company disclaims an

obligation to update or announce revisions to any forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200305005854/en/

Office of the Chairman Grace Keene 877-NBC-FIZZ

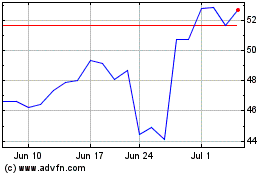

National Beverage (NASDAQ:FIZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

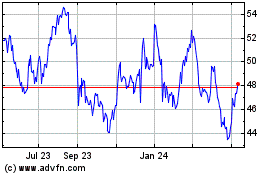

National Beverage (NASDAQ:FIZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024