The

information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement

is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED MARCH 2, 2020

As

filed pursuant to Rule 424(b)(5)

Registration No. 333-221735

PRELIMINARY

PROSPECTUS SUPPLEMENT

(to Prospectus dated December 1, 2017)

Aytu BioScience, Inc.

Shares of 11% Series I Cumulative Redeemable Preferred Stock

$17.50 Per Share

Liquidation Preference $17.50 Per Share

We are offering shares

of our 11% Series I Cumulative Redeemable Perpetual Preferred Stock, which we refer to in this prospectus supplement as the “Series

I Preferred Stock.”

Dividends on the Series I Preferred Stock

offered hereby are cumulative from the date of issuance, and will be payable monthly in arrears on the fifteenth day of each month,

when, as and if declared by our Board of Directors. Dividends will be payable out of amounts legally available therefor at a rate

equal to 11.0% per annum per $17.50 of stated liquidation preference per share, or $1.925 per share of Series I Preferred Stock

per year.

Commencing on and after ,

2025 we may redeem, at our option, the Series I Preferred Stock, in whole or in part, at a cash redemption price of $

per share, plus all accrued and unpaid dividends to, but not including, the redemption date. The Series I Preferred Stock has no

stated maturity, will not be subject to any sinking fund or other mandatory redemption, and will not be convertible into or exchangeable

for any of our other securities.

Holders

of the Series I Preferred Stock generally will have no voting rights except for limited voting.

We

are subject to General Instruction I.B.6 of Form S-3, which limits the amounts that we may sell under the registration statement

of which this prospectus supplement forms a part. The aggregate market value of our common stock held by non-affiliates pursuant

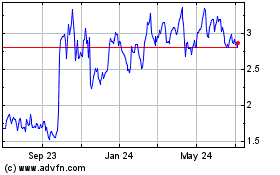

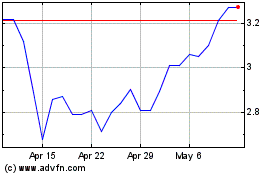

to General Instruction I.B.6 of Form S-3 is approximately $17.6 million, which was calculated based on 16,929,440 shares of our

outstanding common stock held by non-affiliates on February 28, 2020 at a price of $1.04 per share, the closing price of our common

stock on January 2, 2019. During the 12 calendar months prior to, and including, the date of this prospectus supplement, we have

not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3.

Prior

to this offering, there has been no public market for our Series I Preferred Stock. We have filed an application to list the Series

I Preferred Stock on The NASDAQ Capital Market (“NASDAQ”) under the symbol “AYTUP.” If the application

is approved, we expect trading of the Series I Preferred Stock on NASDAQ to commence on or shortly after the initial date of issuance.

Our common stock is traded on NASDAQ under the symbol “AYTU.”

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” beginning on page S-10 of this prospectus supplement and page 6 of the accompanying

prospectus, as well as the risks and uncertainties described under the heading “Risk Factors” contained in our annual

report on Form 10-K for the year ended June 30, 2019, before investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

|

|

|

PER

SHARE

|

|

|

TOTAL

|

|

|

Public Offering Price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

(1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

|

(1)

|

The

underwriters will receive compensation in addition to the discounts and commissions.

See “Underwriting” for a description of compensation payable to the underwriters.

|

We

have granted the representative of the underwriters an option to purchase up to an additional shares of Series I Preferred

Stock from us at the public offering price, less the underwriting discounts and commissions, within 45 days from the date of this

prospectus supplement to cover over-allotments, if any. If the representative of the underwriters exercises the option in full

the total underwriting discounts and commissions payable will be $

and the total proceeds to us, before expenses, will

be $

.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is , 2020

TABLE

OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and accompanying prospectus relates to the offering of our securities. Before buying any of the securities

that we are offering, we urge you to carefully read this prospectus supplement, the accompanying prospectus, any free writing

prospectus that we have authorized for use in connection with this offering, and the information incorporated by reference as

described under the headings “Where You Can Find More Information” and “Information Incorporated by Reference”

in this prospectus supplement. These documents contain important information that you should consider when making your investment

decision.

This

document is comprised of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering

and also adds to, and updates information contained in, the accompanying prospectus and the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, including the documents

incorporated by reference into the accompanying prospectus, provides more general information, some of which may not apply to

this offering. Generally, when we refer to this prospectus, we are referring to the combined document consisting of this prospectus

supplement and the accompanying prospectus. In this prospectus supplement, as permitted by law, we “incorporate by reference”

information from other documents that we file with the Securities and Exchange Commission, or the SEC. This means that we can

disclose important information to you by referring to those documents. The information incorporated by reference is considered

to be a part of this prospectus supplement and the accompanying prospectus and should be read with the same care. When we make

future filings with the SEC to update the information contained in documents that have been incorporated by reference, the information

included or incorporated by reference in this prospectus supplement is considered to be automatically updated and superseded.

In other words, in case of a conflict or inconsistency between information contained in this prospectus supplement and information

in the accompanying prospectus or incorporated by reference into this prospectus supplement, you should rely on the information

contained in the document that was filed later.

This

prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed on November

22, 2017 with the SEC using a “shelf” registration process with respect to up to $100,000,000 in securities that may

be sold thereunder. The shelf registration statement was declared effective by the SEC on December 1, 2017.

Under

the shelf registration process, we may offer and sell any combination of securities described in the accompanying prospectus in

one or more offerings. The purpose of this prospectus supplement is to provide supplemental information regarding us in connection

with this offering of securities.

You

should rely only on the information contained in, or incorporated by reference into, this prospectus supplement, the accompanying

prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering. We have not authorized

any other person to provide you with different information. We are not making an offer to sell or soliciting an offer to buy our

securities in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or

solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume

that the information appearing in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for

use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial condition,

results of operations, and prospects may have changed since those dates.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary description about us and our business highlights selected information contained elsewhere in this prospectus supplement

or the accompanying prospectus, or incorporated in this prospectus supplement or the accompanying prospectus by reference. This

summary does not contain all of the information you should consider before buying securities in this offering. You should carefully

read this entire prospectus supplement and the accompanying prospectus, including each of the documents incorporated herein or

therein by reference, before making an investment decision. Unless the context otherwise requires, the terms “Aytu,”

“the Company,” “we,” “us” and “our” in this prospectus supplement and accompanying

prospectus refer to Aytu Bioscience, Inc., and its subsidiaries.

Recent

Developments

On February 27, 2020, the Company issued a promissory note to

an unrelated third-party investor in which the investor loaned gross proceeds of $800,000 to the Company. The unsecured,

nonconvertible note has an OID of $160,000 and the Company received net proceeds of $640,000. The note will be repaid

by the Company with eight consecutive monthly payments to the investor in the amount of $100,000, beginning April 1, 2020.

On

February 14, 2020 we completed the acquisition of Innovus Pharmaceuticals. Through this acquisition, Aytu expands into the $40

billion consumer healthcare market with a portfolio of over thirty-five consumer products competing in large therapeutic categories

including diabetes, men’s health, sexual wellness and respiratory health. This expanded product line broadens Aytu’s portfolio

beyond its $20 million prescription therapeutic portfolio to enable wider revenue distribution and consumer reach, reduced seasonality

associated with Aytu’s seasonal antitussive product line, and higher revenue from an expanded base of proprietary products.

Combined,

Aytu and Innovus generated approximately $43 million in revenue over the preceding four quarters ended December 31, 2019 when

accounting for the Innovus business and the recently expanded Rx portfolio following the acquisition of nine pediatric primary

care products from Cerecor, Inc.

This

business combination provides increased scale and enables operational synergies that can be leveraged to accelerate the combined

company’s growth and path to profitability. Initially, the company expects to operate the commercial aspects of the Innovus consumer

business separately from Aytu’s prescription business, while rationalizing general and administrative expenses through the removal

of Innovus’ public company costs and redundant administrative and operational processes, along with the reduction in overhead,

administrative and facilities costs.

The

prescription product portfolio will continue to be primarily commercialized through the existing Aytu sales force, while the consumer

health products will continue to be primarily commercialized via Innovus’ proprietary Beyond Human® marketing platform. However,

we expect both lines of business to benefit from opportunistic cross-selling such that some consumer products may be marketed

in the professional market by Aytu’s Rx commercial team, while the marketing of the prescription products may be bolstered through

various online and direct-to-consumer marketing initiatives.

Overview

We

are a specialty pharmaceutical company focused on commercializing novel products that address significant patient needs such as

hypogonadism (low testosterone), cough and upper respiratory symptoms, insomnia, male infertility, and various pediatric conditions

and we plan to expand opportunistically into other therapeutic areas as we continue to execute on our growth plans. We commercialize

our products through our internal commercial infrastructure and nationwide direct sales force.

We

have been historically focused on commercialization of the following products (i) Natesto®, a testosterone replacement therapy,

or TRT, (ii) ZolpiMist™, a short-term insomnia treatment, and (iii) Tuzistra® XR, a codeine–based antitussive.

Additionally,

we completed an Asset Purchase Agreement (the “Purchase Agreement”) with Cerecor, Inc (“Cerecor”) on November

1, 2019, acquiring six products, (i) AcipHex® Sprinkle™, (ii) Cefaclor for Oral Suspension, (iii) Karbinal® ER,

(iv) Flexichamber™, (v) Poly-Vi-Flor® and Tri-Vi-Flor™ (the “Pediatric Portfolio”). We immediately

began to include these acquired Pediatric Portfolio in our commercialization efforts in order to leverage our internal commercial

infrastructure and national sales force.

Finally,

on February 14, 2020 we successfully completed the acquisition of Innovus Pharmaceuticals, Inc., resulting in our entrance into

the approximately $40 billion consumer healthcare market with a portfolio of over thirty-five consumer products.

In

the future we will seek to acquire additional commercial-stage or near-market products, including existing products we believe

can offer distinct clinical advantages and patient benefits over existing other marketed products. Our management team’s

prior experience has involved identifying both clinical-stage and commercial-stage assets that can be launched or re-launched

to increase value, with a focused commercial infrastructure specializing in novel, niche products.

Key

Product Highlights

Primary

Care Rx Portfolio

Prior

to November 1, 2020, we were focused on the commercial development of the following three primary care focused products:

|

|

●

|

Natesto®

– In 2016 We acquired exclusive U.S. rights to Natesto® (testosterone)

nasal gel, a novel formulation of testosterone delivered via a discreet, easy-to-use

nasal gel. Natesto is approved by the U.S. Food and Drug Administration, or FDA, for

the treatment of hypogonadism (low testosterone) in men and is the only testosterone

replacement therapy, or TRT, delivered via a nasal gel. Natesto offers multiple advantages

over currently available TRTs and competes in a $1.7 billion market accounting for nearly

7 million prescriptions annually. Importantly, as Natesto is delivered via the nasal

mucosa and not the skin, there is no risk of testosterone transference to others, a known

potential side effect and black box warning associated with all other topically applied

TRTs, including the market leader AndroGel®.

|

|

|

●

|

ZolpiMist™

– In June 2018 we acquired an exclusive U.S. license to ZolpiMist™. ZolpiMist

is an FDA-approved prescription product that is indicated for the short-term treatment

of insomnia, and is the only oral spray formulation of zolpidem tartrate - the most widely

prescribed prescription sleep aid in the U.S. ZolpiMist is commercially available and

competes in the non-benzodiazepine prescription sleep aid category, a $1.8 billion prescription

drug category with over 43 million prescriptions written annually. Thirty million prescriptions

of zolpidem tartrate (Ambien®, Ambien® CR, Intermezzo®, Edluar®, ZolpiMist™,

and generic forms of immediate-release, controlled release, and orally dissolving tablet

formulations) are written each year in the U.S., representing almost 70% of the non-benzodiazepine

sleep aid category. Approximately 2.5 million prescriptions are written for novel formulations

of zolpidem tartrate products (controlled release and sublingual tablets). We intend

to integrate ZolpiMist into our sales force’s promotional efforts as an adjunct

product to Natesto as there is substantial overlap of physician prescribers of both testosterone

and prescription sleep aids.

|

|

|

●

|

Tuzistra®

XR – In November 2018 we acquired Tuzistra XR, the only FDA-approved 12-hour

codeine-based antitussive. Tuzistra XR is a prescription antitussive consisting of codeine

polistirex and chlorpheniramine polistirex in an extended-release oral suspension. Tuzistra

XR is a patented combination of codeine, an opiate agonist antitussive, and chlorpheniramine,

a histamine-1 receptor antagonist, indicated for relief of cough and symptoms associated

with upper respiratory allergies or a common cold in adults aged 18 years and older.

Tuzistra XR is protected by two Orange Book-listed patents extending to 2031 and multiple

pending patents. According to MediMedia, the US cough cold prescription market is worth

in excess of $3 billion at current brand pricing, with 30-35 million annual prescriptions.

This market is dominated by short-acting treatments, which require dosing 4-6 times a

day. Tuzistra XR was developed using Tris Pharma’s liquid sustained release technology,

LiquiXR®, which allows for extended drug delivery throughout a 12-hour dosing period.

|

The

Pediatric Rx Portfolio

In

November 2019 we acquired a portfolio of pediatric primary care products (the “Commercial Portfolio”) from

Cerecor, Inc. in order to expand our portfolio of commercial-stage products and further leverage our commercial

infrastructure and sales force. Through this acquisition the Company now commercializes nine prescription products and

sells directly to pediatric and primary care physicians throughout the U.S.

The

Commercial Portfolio contains established prescription products competing in markets exceeding $8 billion in annual U.S. sales.

Each product has distinct clinical features and patient-friendly benefits and are indicated to treat common pediatric and primary

care conditions.

|

|

●

|

AcipHex®

Sprinkle™ (rabeprazole sodium) – AcipHex Sprinkle is a granule formulation

of rabeprazole sodium, a commonly prescribed proton pump inhibitor. AcipHex Sprinkle

is indicated for the treatment of gastroesophageal reflux disease (GERD) in pediatric

patients 1 to 11 years of age for up to 12 weeks.

|

|

|

●

|

Cefaclor

(cefaclor oral suspension) – Cefaclor for oral suspension is a second-generation

cephalosporin antibiotic suspension and is indicated for the treatment of numerous common

infections caused by Streptococcus pneumoniae, Haemophilus influenzae,

staphylococci, and Streptococcus pyogenes, and others.

|

|

|

●

|

Flexichamber®

– Flexichamber is an anti-static, valved collapsible holding chamber intended

to be used by patients to administer aerosolized medication from most pressurized metered

dose inhalers (MDIs) such as commonly used asthma medications.

|

|

|

●

|

Karbinal®

ER (carbinoxamine maleate extended-release oral suspension) – Karbinal ER is

an H1 receptor antagonist (antihistamine) indicated to treat various allergic conditions

including seasonal and perennial allergic rhinitis, vasomotor rhinitis, and other common

allergic conditions.

|

|

|

●

|

Poly-Vi-Flor®

and Tri-Vi-Flor® – Poly-Vi-Flor and Tri-Vi-Flor are two complementary prescription

fluoride-based supplement product lines containing combinations of vitamins and fluoride

in various oral formulations. These prescription supplements are prescribed for infants

and children to treat or prevent fluoride deficiency due to poor diet or low levels of

fluoride in drinking water and other sources.

|

Innovus

Merger (Consumer Portfolio)

Upon

the February 14, 2020 acquisition of Innovus Pharmaceuticals, Inc., we now market and sell over 35 products in the U.S. and

more than 10 in multiple countries around the world through 5 international commercial partners. The following

represents the core products:

|

|

●

|

Vesele®

|

|

|

●

|

UriVarx®

|

|

|

●

|

FlutiCare®

|

|

|

●

|

Apeaz®

|

|

|

●

|

Diabasens®

|

|

|

●

|

Prostagorx®

|

|

|

●

|

Sensum+®

|

|

|

●

|

Trexar®

|

In

addition, we currently expect to launch in the U.S. the following products in 2020, subject to the applicable regulatory approvals,

if required:

|

|

●

|

Musclin®

is a proprietary supplement made of two FDA Generally Recognized As Safe (GRAS) approved ingredients designed to increase

muscle mass, endurance and activity (first half of 2020). The main ingredient in Musclin® is a natural activator

of the transient receptor potential cation channel, subfamily V, member 3 (TRPV3) channels on muscle fibers responsible to

increase fibers width resulting in larger muscles;

|

|

|

|

|

|

|

●

|

Regenerum™

is a proprietary product containing two natural molecules: the first is an activator of the TRPV3 channels resulting in the

increase of muscle fiber width, and the second targets a different unknown receptor to build the muscle’s capacity for energy

production and increases physical endurance, allowing longer and more intense exercise. Regenerum™ is being developed

for patients suffering from muscle wasting. We currently expect to launch this product in 2020 pending successful clinical

trials in patients with muscle wasting or cachexia;

|

|

|

●

|

Octiq™

is an expected FDA ophthalmic OTC monograph compliant product for the treatment of eye redness and eye lubrication (early

2020); and

|

|

|

|

|

|

|

●

|

Regoxidine™

is an ANDA approved 5% Minoxidil foam for men and women for hair growth on the top of the scalp (first half 2020).

|

We

have extensive experience across a wide range of business development activities and have in-licensed or acquired products from

large, mid-sized, and small enterprises in the United States and abroad. Through an assertive product and business development

approach, we expect that we will continue to build a substantial portfolio of complementary products.

Our

Strategy

In

the near-term, we expect to create value for shareholders by implementing a focused strategy of increasing sales of our prescription

therapeutics while leveraging our commercial infrastructure. Further, we expect to increase sales of our newly acquired consumer

healthcare product portfolio following the closing of our acquisition of Innovus Pharmaceuticals, Additionally, we expect to expand

both our Rx and consumer health product portfolios through continuous business and product development. Finally, we expect to

identify operational efficiencies identified through our recent transactions and implement expense reductions accordingly,

Corporate

Information

Our

principal executive offices are located at 373 Inverness Parkway, Suite 206, Englewood, Colorado 80112, and our phone number is

(720) 437-6580. Our corporate website address is http://www.aytubio.com. The information contained on, connected to or that can

be accessed via our website is not part of this prospectus. We have included our website address in this prospectus as an inactive

textual reference only and not as an active hyperlink.

THE

OFFERING

|

Securities

offered by us pursuant to this prospectus supplement

|

|

shares

of 11% Series I Cumulative Redeemable Perpetual Preferred Stock (the “Series I Preferred Stock), assuming no exercise

by the underwriters of their over-allotment option

|

|

|

|

|

|

Series

I Preferred Stock to be outstanding after this offering if the maximum number of shares are sold

|

|

shares

of Series I Preferred Stock, assuming no exercise by the underwriters of their over-allotment option.

|

|

|

|

|

|

Offering

Price

|

|

$17.50

per share of Series I Preferred Stock

|

|

|

|

|

|

Dividends

|

|

Holders

of the Series I Preferred Stock will be entitled to receive cumulative cash dividends

at a rate of 11% per annum of the $17.50 per share liquidation preference (equivalent

to $1.925 per annum per share).

Cumulative

dividends on the Series I Preferred Stock will accrue daily connecting on the date of issuance and will be payable monthly

in arrears on the 15th day of each month

Any

dividend payable on the Series I Preferred Stock, including dividends payable for any partial dividend period, will be

computed on the basis of a 360-day year consisting of twelve 30-day months.

|

|

|

|

|

|

No Maturity,

Sinking Fund or Mandatory Redemption

|

|

The

Series I Preferred Stock has no stated maturity and will not be subject to any sinking

fund or mandatory redemption. Shares of the Series I Preferred Stock will remain outstanding

indefinitely unless we decide to redeem or otherwise repurchase them. We are not required

to set aside funds to redeem the Series I Preferred Stock.

|

|

|

|

|

|

Optional

Redemption

|

|

The

Series I Preferred Stock is not redeemable by us prior to , 2025, except

as described below under “Special Optional Redemption.” On and after such date, we may, at our option, redeem the

Series I Preferred Stock, in whole or in part, at any time or from time to time, for cash at a redemption price equal to $17.50 per

share, plus any accumulated and unpaid dividends to, but not including, the redemption date. Please see the section entitled “Description

of the Series I Preferred Stock—Redemption—Optional Redemption.”

|

|

Special

Optional Redemption

|

|

Upon

the occurrence of a Change of Control, we may, at our option, redeem the Series I Preferred Stock, in whole or in part, within

120 days after the first date on which such Change of Control occurred, for cash at a redemption price of $17.50 per

share, plus any accumulated and unpaid dividends to, but not including, the redemption date.

A

“Change of Control” is deemed to occur when the following have occurred and are continuing:

the

acquisition by any person, including any syndicate or group deemed to be a “person” under Section 13(d)(3)

of the Securities Exchange Act of 1934, as amended, or the Exchange Act, of beneficial ownership, directly or indirectly,

through a purchase, merger or other acquisition transaction or series of purchases, mergers or other acquisition transactions

of our stock entitling that person to exercise more than 50% of the total voting power of all our stock entitled to vote

generally in the election of our directors (except that such person will be deemed to have beneficial ownership of all

securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only

upon the occurrence of a subsequent condition); and following the closing of any transaction referred to above, neither

we nor the acquiring or surviving entity has a class of common securities (or American Depositary Receipts representing

such securities) listed on the NYSE, the NYSE American or NASDAQ or listed or quoted on an exchange or quotation system

that is a successor to the NYSE, the NYSE American or NASDAQ.

|

|

|

|

|

|

Liquidation

Preference

|

|

If

we liquidate, dissolve or wind up, holders of the Series I Preferred Stock will have the right to receive $17.50 per share,

plus any accumulated and unpaid dividends to, but not including, the date of payment, before any payment is made to the holders

of our common stock. Please see the section entitled “Description of the Series I Preferred Stock—Liquidation

Preference.”

|

|

|

|

|

|

Ranking

|

|

The

Series I Preferred Stock will rank, with respect to rights to the payment of dividends and the distribution of assets upon

our liquidation, dissolution or winding up, (1) senior to all classes or series of our common stock and to all other equity

securities issued by us other than equity securities referred to in clauses (2) and (3); (2) on a parity with all equity securities

issued by us with terms specifically providing that those equity securities rank on a parity with the Series I Preferred Stock

with respect to rights to the payment of dividends and the distribution of assets upon our liquidation, dissolution or winding

up; (3) junior to all equity securities issued by us with terms specifically providing that those equity securities rank senior

to the Series I Preferred Stock with respect to rights to the payment of dividends and the distribution of assets upon our

liquidation, dissolution or winding up; and (4) effectively junior to all of our existing and future indebtedness (including

indebtedness convertible into our common stock or preferred stock) and to the indebtedness and other liabilities of (as well

as any preferred equity interests held by others in) our existing subsidiaries and any future subsidiaries. Please see the

section entitled “Description of the Series I Preferred Stock–Ranking.”

|

|

Limited

Voting Rights

|

|

Holders

of Series I Preferred Stock will generally have no voting rights. However, the affirmative vote of the holders of at least

two-thirds of the outstanding shares of Series I Preferred Stock (voting together as a class with all other series of parity

preferred stock we may issue upon which like voting rights have been conferred and are exercisable) is required at any time

for us to authorize or issue any class or series of our capital stock ranking senior to the Series I Preferred Stock with

respect to the payment of dividends or the distribution of assets on liquidation, dissolution or winding up, to amend any

provision of our certificate of incorporation or the Series I Preferred Stock Certificate of Designations so as to materially

and adversely affect any rights of the Series I Preferred Stock or to take certain other actions. Please see the section entitled

“Description of the Series I Preferred Stock—Voting Rights.”

|

|

|

|

|

|

Information

Rights

|

|

During

any period in which we are not subject to Section 13 or 15(d) of the Exchange Act and any shares of Series I Preferred Stock

are outstanding, we will use our best efforts to (i) make available on our website copies of the Annual Reports on Form 10-K

and Quarterly Reports on Form 10-Q that we would have been required to file with the SEC pursuant to Section 13 or 15(d) of

the Exchange Act if we were subject thereto (other than any exhibits that would have been required) and (ii) promptly, upon

request, supply copies of such reports to any holders or prospective holder of Series I Preferred Stock, subject to certain

exceptions described in this prospectus. We will use our best efforts to mail (or otherwise provide) the information to the

holders of the Series I Preferred Stock within 15 days after the respective dates by which a periodic report on Form 10-K

or Form 10-Q, as the case may be, in respect of such information would have been required to be filed with the SEC, if we

were subject to Section 13 or 15(d) of the Exchange Act, in each case, based on the dates on which we would be required to

file such periodic reports if we were a “non-accelerated filer” within the meaning of the Exchange Act.

|

|

Listing

|

|

We

have filed an application to list our Series I Preferred Stock on The NASDAQ Capital Market under the symbol “AYTUP”

|

|

|

|

|

|

Use

of Proceeds

|

|

We

intend to use the net proceeds from this offering for general corporate purposes, including working capital. See “Use

of Proceeds” on page S-16.

|

|

|

|

|

|

Risk

Factors

|

|

Investing

in our securities involves significant risks. You should read the “Risk Factors” section beginning on page S-10

of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement and accompanying

prospectus, including the risk factors described under the section entitled “Risk Factors” contained in our Annual

Report on Form 10-K for the fiscal year ended June 30, 2019, for a discussion of factors to consider before deciding

to purchase our securities.

|

|

|

|

|

|

Transfer

Agent

|

|

The

registrar, transfer agent and dividend and redemption price disbursing agent in respect

of the Series I Preferred Stock will be I Direct Transfer, LLC, subsidiary of Issuer

Direct Corporation, located at One Glenwood Avenue, Suite 1001 Raleigh, NC, 27603.

|

|

|

|

|

|

Certain U.S.

Federal Income Tax Considerations

|

|

For

a discussion of the federal income tax consequences of purchasing, owning and disposing

of the Series I Preferred Stock, please see the section entitled “Certain Material U.S.

Federal Income Tax Considerations.” You should consult your tax advisor with respect

to the U.S. federal income tax consequences of owning the Series I Preferred Stock in

light of your own particular situation and with respect to any tax consequences arising

under the laws of any state, local, foreign or other taxing jurisdiction.

|

|

|

|

|

|

Book Entry

and Form

|

|

The

Series I Preferred Stock will be represented by one or more global certificates in definitive, fully registered form deposited

with a custodian for, and registered in the name of, a nominee of The Depository Trust Company (“DTC”).

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you

should carefully consider the specific factors discussed below, the risk factors beginning on page 6 of the accompanying

prospectus, as well as the risk factors discussed under the section entitled “Risk Factors” contained in our Annual

Report on Form 10-K for the fiscal year ended June 30, 2019 as updated by our subsequent filings under the Exchange Act,

each of which is incorporated by reference in this prospectus supplement and accompanying prospectus in their entirety, together

with all of the other information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus,

the documents incorporated by reference herein and therein, and any related free writing prospectus. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently

deem immaterial may also affect our operations. These risks might cause you to lose all or part of your investment in the offered

securities.

Risks

Related to our Operations

Our

cash position is low relative to our anticipated cash needs.

As

of February 28, 2020, we had a cash balance of approximately $2.4 million. This is substantially less than our projected short-term

cash requirements (including fixed costs and projected future costs). There can be no guaranty that we can raise additional funds

from sales of our equity or debt securities on terms that are acceptable to us or otherwise generate sufficient revenue to maintain

our operations. Our inability to obtain such funds would have a material adverse effect on the Company’s financial condition

and operations.

Risks

Related to our Bylaws

Our

Amended and Restated Bylaws provides that the Court of Chancery of the State of Delaware is the exclusive forum for certain litigation

that may be initiated by our stockholders, including claims under the Securities Act, which could limit our stockholders’

ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees.

Our

Amended and Restated Bylaws provides that the Court of Chancery of the State of Delaware shall, to the fullest extent permitted

by law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting

a claim for breach of a fiduciary duty owed by any of our directors, officers, employees or agents to us or our stockholders,

(iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law, our certificate

of incorporation or our bylaws or (iv) any action asserting a claim governed by the internal affairs doctrine. The choice of forum

provision may limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with

us or our directors, officers, employees or agents, which may discourage such lawsuits against us and our directors, officers,

employees and agents. Stockholders who do bring a claim in the Court of Chancery could face additional litigation costs in pursuing

any such claim, particularly if they do not reside in or near the State of Delaware. The Court of Chancery may also reach different

judgments or results than would other courts, including courts where a stockholder considering an action may be located or would

otherwise choose to bring the action, and such judgments or results may be more favorable to us than to our stockholders. Alternatively,

if a court were to find the choice of forum provision contained in our certificate of incorporation to be inapplicable or unenforceable

in an action, we may incur additional costs associated with resolving such action in other jurisdictions, which could adversely

affect our business and financial condition. Notwithstanding the foregoing, the exclusive provision shall not preclude or contract

the scope of exclusive federal or concurrent jurisdiction for actions brought under the Exchange Act, or the Securities Act of

1933, as amended, or the Securities Act, or the respective rules and regulations promulgated thereunder.

Risks

Related to this Offering

Our

management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not

yield a significant return.

Our

management will have broad discretion over the use of proceeds from this offering. We will use the net proceeds from this offering

primarily for working capital and general corporate purposes. Our management will have considerable discretion in the application

of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used appropriately. We may use the net proceeds for corporate purposes that do not increase our operating results or

enhance the value of our preferred stock. The failure of our management to use these funds effectively could have a material adverse

effect on our business, cause the market price of our preferred stock to decline and potentially impair the operation and expansion

of our business. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing

instruments and U.S. government securities. These investments may not yield a favorable return to our stockholders.

Our

Series I Preferred Stock is subordinate to our existing and future debt, and your interests could be diluted by the issuance of

additional preferred shares and by other transactions.

The

Series I Preferred Stock will rank junior to all of our existing and future debt and to other non-equity claims on us and our

assets available to satisfy claims against us, including claims in bankruptcy, liquidation or similar proceedings. Our future

debt may include restrictions on our ability to pay distributions to preferred stockholders. The issuance of additional shares

of Series I Preferred Stock or another series of preferred stock designated as ranking on parity with the Series I Preferred Stock

would dilute the interests of the holders of shares of the Series I Preferred Stock, and the issuance of shares of any class or

series of our capital stock expressly designated as ranking senior to the Series I Preferred Stock or the incurrence of additional

indebtedness could affect our ability to pay distributions on, redeem or pay the liquidation preference on the Series I Preferred

Stock. The Series I Preferred Stock do not contain any terms relating to or limiting our indebtedness or affording the holders

of shares of the Series I Preferred Stock protection in the event of a highly leveraged or other transaction, including a merger

or the sale, lease or conveyance of all or substantially all our assets, that might adversely affect the holders of shares of

the Series I Preferred Stock, so long as the rights, preferences, privileges or voting power of the Series I Preferred Stock or

the holders thereof are not materially and adversely affected, and so long as such transaction does not involve the authorization

or creation, or increasing the authorized or issued amount of, any class or series of capital stock ranking senior to the Series

I Preferred Stock with respect to payment of dividends or the distribution of assets upon liquidation

The

Series I Preferred Stock has not been rated.

Our

Series I Preferred Stock has not been rated by any nationally recognized statistical rating organization, which may negatively

affect their market value and your ability to sell such shares. No assurance can be given, however, that one or more rating agencies

might not independently determine to issue such a rating or that such a rating, if issued, would not adversely affect the market

price of our Series I Preferred Stock. In addition, we may elect in the future to obtain a rating of our Series I Preferred Stock,

which could adversely impact the market price of our Series I Preferred Stock. Ratings only reflect the views of the rating agency

or agencies issuing the ratings and such ratings could be revised downward or withdrawn entirely at the discretion of the issuing

rating agency if, in its judgment, circumstances so warrant. Any such downward revision or withdrawal of a rating could have an

adverse effect on the market price of our Series I Preferred Stock.

As

a holder of shares of the Series I Preferred Stock, you have extremely limited voting rights.

Your

voting rights as a holder of shares of the Series I Preferred Stock will be limited. Our shares of common stock are the only class

of our securities carrying full voting rights. Voting rights for holders of shares of the Series I Preferred Stock exist primarily

with respect to adverse changes in the terms of the Series I Preferred Stock and the creation of additional classes or series

of preferred shares that are senior to the Series I Preferred Stock. Other than these limited voting rights described in this

prospectus supplement, holders of shares of the Series I Preferred Stock will not have any voting rights. See “Description

of the Series I Preferred Stock—Voting Rights” in this prospectus supplement.

Our

cash available for distributions may not be sufficient to pay distributions on the Series I Preferred Stock at expected levels,

and we cannot assure you of our ability to pay distributions in the future. We may use borrowed funds or funds from other sources

to pay distributions, which may adversely impact our operations.

We

intend to pay regular monthly distributions to holders of our Series I Preferred Stock. Distributions declared by us will be authorized

by our Board of Directors in its sole discretion out of assets legally available for distribution and will depend upon a number

of factors, including our earnings, our financial condition, restrictions under applicable law, our need to comply with the terms

of our existing financing arrangements, the capital requirements of our company and other factors as our Board of Directors may

deem relevant from time to time. We may be required to fund distributions from working capital, proceeds of this offering or a

sale of assets to the extent distributions exceed earnings or cash flows from operations. Funding distributions from working capital

would restrict our operations. If we are required to sell assets to fund distributions, such asset sales may occur at a time or

in a manner that is not consistent with our disposition strategy. If we borrow to fund distributions, our leverage ratios and

future interest costs would increase, thereby reducing our earnings and cash available for distribution from what they otherwise

would have been. We may not be able to pay distributions in the future. In addition, some of our distributions may be considered

a return of capital for income tax purposes. If we decide to make distributions in excess of our current and accumulated earnings

and profits, such distributions would generally be considered a return of capital for federal income tax purposes to the extent

of the holder’s adjusted tax basis in its shares. A return of capital is not taxable, but it has the effect of reducing

the holder’s adjusted tax basis in its investment. If distributions exceed the adjusted tax basis of a holder’s shares,

they will be treated as gain from the sale or exchange of such stock.

We

could be prevented from paying cash dividends on the Series I Preferred Stock due to prescribed legal requirements.

Holders

of shares of Series I Preferred Stock do not have a right to dividends on such shares unless declared or set aside for payment

by our Board of Directors. Under Delaware law, cash dividends on capital stock may only be paid from “surplus” or,

if there is no “surplus,” from the corporation’s net profits for the then-current or the preceding fiscal year.

Unless we operate profitably, our ability to pay cash dividends on the Series I Preferred Stock would require the availability

of adequate “surplus,” which is defined as the excess, if any, of net assets (total assets less total liabilities)

over capital. Our business may not generate sufficient cash flow from operations to enable us to pay dividends on the Series I

Preferred Stock when payable. Further, even if adequate surplus is available to pay cash dividends on the Series I Preferred Stock,

we may not have sufficient cash to pay dividends on the Series I Preferred Stock.

Furthermore,

no dividends on Series I Preferred Stock shall be authorized by our Board of Directors or paid, declared or set aside for payment

by us at any time when the authorization, payment, declaration or setting aside for payment would be unlawful under Delaware law

or any other applicable law. See “Description of the Series I Preferred Stock — Dividends.”

We

may redeem the Series I Preferred Stock and you may not receive dividends that you anticipate if we do redeem the Series I.

On

or after , 2025 we may,

at our option, redeem the Series I Preferred Stock, in whole or in part, at any time or from time to time. Also, upon the occurrence

of a Change of Control, we may, at our option, redeem the Series I Preferred Stock, in whole or in part, within 120 days after

the first date on which such Change of Control occurred. We may have an incentive to redeem the Series I Preferred Stock voluntarily

if market conditions allow us to issue other preferred stock or debt securities at a rate that is lower than the dividend rate

on the Series I Preferred Stock. If we redeem the Series I Preferred Stock, then from and after the redemption date, dividends

will cease to accrue on shares of Series I Preferred Stock, the shares of Series I Preferred Stock shall no longer be deemed outstanding

and all rights as a holder of those shares will terminate, except the right to receive the redemption price plus accumulated and

unpaid dividends, if any, payable upon redemption.

Holders

of shares of the Series I Preferred Stock should not expect us to redeem the Series I Preferred Stock on or after the date they

become redeemable at our option.

The

Series I Preferred Stock will be a perpetual equity security. This means that it will have no maturity or mandatory redemption

date and will not be redeemable at the option of the holders. The Series I Preferred Stock may be redeemed by us at our option

either in whole or in part, from time to time, at any time on or after

, 2025, or upon the occurrence of a Change of Control. Any decision we may make at any time to propose a redemption of the Series

I Preferred Stock will depend upon, among other things, our evaluation of our capital position, the composition of our stockholders’

equity and general market conditions at that time.

The

Series I Preferred Stock is not convertible, and investors will not realize a corresponding upside if the price of the common

stock increases.

The

Series I Preferred Stock is not convertible into shares of our common stock and earns dividends at a fixed rate. Accordingly,

an increase in market price of our common stock will not necessarily result in an increase in the market price of our Series I

Preferred Stock. The market value of the Series I Preferred Stock may depend more on dividend and interest rates for other preferred

stock, commercial paper and other investment alternatives and our actual and perceived ability to pay dividends on, and in the

event of dissolution satisfy the liquidation preference with respect to, the Series I Preferred Stock.

The

Change of Control right may make it more difficult for a party to acquire us or discourage a party from acquiring us.

The

Change of Control right (as defined under “Description of the Series I Preferred Stock — Special Optional Redemption”)

may have the effect of discouraging a third party from making an acquisition proposal for us or of delaying, deferring or preventing

certain of our change of control transactions under circumstances that otherwise could provide the holders of our Series I Preferred

Stock with the opportunity to realize a premium over the then-current market price of such equity securities or that stockholders

may otherwise believe is in their best interests.

There

is no established trading market for the Series I Preferred Stock, listing on NASDAQ does not guarantee a market for the Series

I Preferred Stock and the market price and trading volume of the Series I Preferred Stock may fluctuate significantly.

The

Series I Preferred Stock is a new issue of securities with no trading market. We have filed an application to list the Series

I Preferred Stock on NASDAQ. However, an active and liquid trading market to sell the Series I Preferred Stock may not develop

after the issuance of the Series I Preferred Stock offered hereby or, even if it develops, may not be sustained. Because the Series

I Preferred Stock has no stated maturity date, investors seeking liquidity may be limited to selling their shares in the secondary

market. If an active trading market does not develop, the market price and liquidity of the Series I Preferred Stock may be adversely

affected. Even if an active public market does develop, the market price for the Series I Preferred Stock may not equal or exceed

the price you pay for your Series I Preferred Stock.

The

market determines the trading price for the Series I Preferred Stock and may be influenced by many factors, including our history

of paying distributions on the Series I Preferred Stock, variations in our financial results, the market for similar securities,

investors’ perception of us, our issuance of additional preferred equity or indebtedness and general economic, industry,

interest rate and market conditions. Because the Series I Preferred Stock carries a fixed distribution rate, its value in the

secondary market will be influenced by changes in interest rates and will tend to move inversely to such changes. In particular,

an increase in market interest rates may result in higher yields on other financial instruments and may lead purchasers of Series

I Preferred Stock to demand a higher yield on the price paid for the Series I Preferred Stock, which could adversely affect the

market price of the Series I Preferred Stock.

If

the Series I Preferred Stock is delisted, the ability to transfer or sell shares of the Series I Preferred Stock may be limited

and the market value of the Series I Preferred Stock will likely be materially adversely affected.

The

Series I Preferred Stock does not contain provisions that are intended to protect investors if the Series I Preferred Stock is

delisted from NASDAQ. If the Series I Preferred Stock is delisted from NASDAQ, investors’ ability to transfer or sell shares

of the Series I Preferred Stock will be limited and the market value of the Series I Preferred Stock will likely be materially

adversely affected. Moreover, since the Series I Preferred Stock has no stated maturity date, investors may be forced to hold

shares of the Series I Preferred Stock indefinitely while receiving stated dividends thereon when, as and if authorized by our

Board of Directors and paid by us with no assurance as to ever receiving the liquidation value thereof.

Market

interest rates may have an effect on the value of the Series I Preferred Stock.

One

of the factors that will influence the price of the Series I Preferred Stock will be the distribution yield on the Series I Preferred

Stock (as a percentage of the market price of the Series I Preferred Stock) relative to market interest rates. An increase in

market interest rates, which are currently at low levels relative to historical rates, may lead prospective purchasers of the

Series I Preferred Stock to expect a higher distribution yield (and higher interest rates would likely increase our borrowing

costs and potentially decrease funds available for distribution payments). Thus, higher market interest rates could cause the

market price of the Series I Preferred Stock to decrease and reduce the amount of funds that are available and may be used to

make distribution payments.

In

the event of a liquidation, you may not receive the full amount of your liquidation preference.

In

the event of our liquidation of the Company, the proceeds will be used first to repay indebtedness and then to pay holders of

shares of the Series I Preferred Stock and any other class or series of our capital stock ranking senior to or on parity with

the Series I Preferred Stock as to liquidation the amount of each holder’s liquidation preference and accrued and unpaid

distributions through the date of payment. In the event we have insufficient funds to make payments in full to holders of the

shares of the Series I Preferred Stock and any other class or series of our capital stock ranking senior to or on parity with

the Series I Preferred Stock as to liquidation, such funds will be distributed ratably among such holders and such holders may

not realize the full amount of their liquidation preference.

The

market price of the Series I Preferred Stock could be substantially affected by various factors.

The

market price of the Series I Preferred Stock could be subject to wide fluctuations in response to numerous factors. The price

of the Series I Preferred Stock that will prevail in the market after this offering may be higher or lower than the offering price

depending on many factors, some of which are beyond our control and may not be directly related to our operating performance.

These

factors include, but are not limited to, the following:

|

|

●

|

prevailing interest

rates, increases in which may have an adverse effect on the market price of the Series I Preferred Stock;

|

|

|

●

|

trading prices of

similar securities;

|

|

|

●

|

our history of timely

dividend payments;

|

|

|

●

|

the annual yield

from dividends on the Series I Preferred Stock as compared to yields on other financial instruments;

|

|

|

●

|

general economic

and financial market conditions;

|

|

|

●

|

government action

or regulation;

|

|

|

●

|

the financial condition,

performance and prospects of us and our competitors;

|

|

|

●

|

changes in financial

estimates or recommendations by securities analysts with respect to us or our competitors in our industry;

|

|

|

●

|

our issuance of

additional preferred equity or debt securities; and

|

|

|

●

|

actual or anticipated

variations in quarterly operating results of us and our competitors.

|

As

a result of these and other factors, investors who purchase the Series I Preferred Stock in this offering may experience a decrease,

which could be substantial and rapid, in the market price of the Series I Preferred Stock, including decreases unrelated to our

operating performance or prospects.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference

in this prospectus supplement and accompanying prospectus and any free writing prospectus that we have authorized for use in connection

with this offering contain “forward-looking statements” within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, concerning our business, operations and financial performance and condition. In some

cases, you can identify forward-looking statements by terminology such as “anticipate,” “assume,” believe,”

“contemplate,” “continue,” “could,” “due,” “estimate,” “expect,”

“goal,” “intend,” “may,” “objective,” “plan,” “predict,”

“potential,” “positioned,” “seek,” “should,” “target,” “will,”

“would” and other similar expressions that are predictions of or indicate future events and future trends, or the

negative of these terms or other comparable terminology.

These

forward-looking statements are subject to a number of risks, uncertainties and assumptions, including without limitation the risks

described in “Risk Factors” in this prospectus supplement, the accompanying prospectus and the documents incorporated

by reference herein. These risks are not exhaustive. Moreover, we operate in a very competitive and rapidly changing environment.

We

believe that it is important to communicate our future expectations to our investors. However, there may be events in the future

that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations

we describe in our forward-looking statements. These forward-looking statements are based on management’s current expectations,

estimates, forecasts and projections about our business and the industry in which we operate and management’s beliefs and assumptions

and are not guarantees of future performance or developments and involve known and unknown risks, uncertainties and other factors

that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this prospectus supplement,

the accompanying prospectus, the documents we have filed with the SEC that are incorporated by reference in this prospectus supplement

and accompanying prospectus, and any free writing prospectus that we have authorized for use in connection with this offering

may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among

other things, those listed under the heading “Risk Factors” beginning on page S-10 of this prospectus

supplement and elsewhere in the accompanying prospectus and those included in our Annual Report on Form 10-K for the fiscal

year ended June 30, 2019 (as supplemented by our Quarterly Reports on form 10-Q) and other documents we periodically file with

the SEC that are incorporated by reference in this prospectus supplement and accompanying prospectus. We urge you to consider

these factors carefully in evaluating the forward-looking statements. We assume no obligation to update or revise these forward-looking

statements for any reason, even if new information becomes available in the future, except as may be required under applicable

law.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance

or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any

other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus supplement to conform these

statements to actual results or to changes in our expectations.

You

should read this prospectus supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated

by reference in this prospectus supplement and accompanying prospectus and any free writing prospectus that we have authorized

for use in connection with this offering completely and with the understanding that our actual future results, levels of activity,

performance and events and circumstances may be materially different from what we expect. We qualify all of the forward-looking

statements in the foregoing documents by these cautionary statements.

USE

OF PROCEEDS

We

estimate that the net proceeds from the sale of the Series I Preferred Stock in this offering after deducting the underwriting

discount and estimated offering costs and expenses payable by us, will be approximately $ million (or $ million

if the underwriters fully exercise their option to purchase additional shares). We intend to use the net proceeds, if any, from

this offering for working capital and other general corporate purposes.

We

have not allocated any specific portion of the net proceeds to any particular purpose, and our management will have the discretion

to allocate the proceeds as it determines. Furthermore, the amount and timing of our actual expenditures will depend on numerous

factors, including the cash used in or generated by our operations, the pace of the integration of acquired businesses, the level

of our sales and marketing activities and the attractiveness of any additional acquisitions or investments. See “Risk Factors

– Our management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways

which may not yield a significant return.” on page S-10.

CAPITALIZATION

The table below sets forth our cash and

cash equivalents and capitalization as of December 31, 2019 on:

|

|

●

|

an actual basis;

|

|

|

|

|

|

|

●

|

on an pro forma as adjusted basis

to reflect the issuance of the Series I Preferred Stock in this offering, and receipt of the estimated $ million net

proceeds therefrom.

|

You should consider this table in conjunction

with “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and our financial statements and related notes incorporated by reference into this prospectus supplement and the other financial

information included elsewhere in this prospectus supplement or incorporated by reference in this prospectus supplement and the

accompanying prospectus.

|

|

|

As of December 31, 2019

|

|

|

|

|

Actual

|

|

|

Pro

Forma(*)

|

|

|

Pro Forma

As Adjusted

|

|

|

|

|

(in thousands, except share data)

|

|

|

Cash and cash equivalents

|

|

|

5,511

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total long-term liabilities

|

|

|

41,438

|

|

|

|

—

|

|

|

|

41,438

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, $0.001 par value: 50,000,000 shares authorized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Preferred Stock, Series D – 400,000 shares issued and outstanding at December 31, 2019 (unaudited)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Convertible Preferred Stock, Series F – 10,000 shares issued and outstanding at December 31, 2019 (Unaudited)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Convertible Preferred Stock, Series G - 9,805,845 shares issued and outstanding at December 31, 2019 (unaudited)

|

|

|

1

|

|

|

|

—

|

|

|

|

1

|

|

|

Preferred Stock, Series I – no shares issued and outstanding, actual, shares outstanding, pro forma and pro forma as adjusted

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

Common Stock, par value $.0001; 100,000,000 shares authorized; shares issued and outstanding 20,733,052 as of December 31, 2019 (unaudited)

|

|

|

2

|

|

|

|

—

|

|

|

|

2

|

|

|

Additional paid-in capital (unaudited)

|

|

|

128,620

|

|

|

|

—

|

|

|

|

128,620

|

|

|

Accumulated deficit (unaudited)

|

|

|

(111,533

|

)

|

|

|

—

|

|

|

|

(111,533

|

)

|

|

Total stockholders’ equity

|

|

|

17,090

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

|

58,528

|

|

|

|

|

|

|

|

|

|

|

(*)

|

Capitalization table assumes an estimated approximately

$ million, net of offering costs, raised from the Series I Preferred Stock offering and may not reflect actual net amounts

raised from this transaction.

|

Based on 20,733,052 shares of our common

stock outstanding as of December 31, 2019, and excludes as of that date:

|

|

●

|

1,482

shares of our common Stock issuable upon exercise of outstanding stock options under

our 2015 Stock Option and Incentive Plan at a weighted average exercise price of $328.00

per share, of which 1,482 are exercisable;

|

|

|

|

|

|

|

●

|

26,459,663

shares of our Common Stock issuable upon exercise of outstanding warrants with a weighted

average exercise price of $3.06 per share; and

|

DIVIDEND

POLICY

We

have never declared or paid cash dividends on our common stock, and we currently do not plan to declare dividends on shares of

our common stock in the foreseeable future. We expect to retain all future earnings, if any, for use in the operation and expansion

of our business. The payment of cash dividends in the future, if any, will be at the discretion of our Board of Directors and

will depend upon such factors as any other factors our board deems relevant. Holders of Series I Preferred Stock will have certain

dividend rights. See “Description of the Series I Preferred Stock.”

DESCRIPTION

OF THE SERIES I PREFERRED STOCK

The

description of certain terms of the 11% Series I Cumulative Redeemable Perpetual Preferred Stock (“Series I Preferred

Stock”) in this prospectus and the accompanying prospectus does not purport to be complete and is in all respects subject

to, and qualified in its entirety by references to the relevant provisions of our certificate of incorporation, the certificate

of designations establishing the terms of our Series I Preferred Stock, our bylaws and Delaware corporate law. Copies of our certificate

of incorporation, certificate of designations, bylaws and all amendments thereto, are available from us upon request.

General

Pursuant to our certificate of

incorporation, as amended, we are currently authorized to designate and issue up to 50,000,000 shares of preferred stock, par

value $0.001 per share, in one or more classes or series and, subject to the limitations prescribed by our certificate of

incorporation, as amended, and Delaware corporate law, with such rights, preferences, privileges and restrictions of each

class or series of preferred stock, including dividend rights, voting rights, terms of redemption, liquidation preferences

and the number of shares constituting any class or series as our Board of Directors may determine, without any vote or action

by our shareholders. As of February 28, 2020, we had 12,213,747 shares of preferred stock outstanding. Assuming all of the

shares of Series I Preferred Stock offered hereunder are issued, we will have available for issuance shares of Series I

Preferred Stock and an additional shares authorized but undesignated and unissued shares of preferred stock. The Series

I Preferred Stock offered hereby, when issued, delivered and paid for in accordance with the terms of the underwriting

agreement, will be fully paid and nonassessable. Our Board of Directors may, without the approval of holders of the Series I

Preferred Stock or our common stock, designate additional series of authorized preferred stock ranking junior to or on parity

with the Series I Preferred Stock or designate additional shares of the Series I Preferred Stock and authorize the issuance

of such shares. Designation of preferred stock ranking senior to the Series I Preferred Stock will require approval of the

holders of Series I Preferred Stock, as described below in “Voting Rights.”

The

registrar, transfer agent and dividend and redemption price disbursing agent in respect of the Series I Preferred Stock is Direct

Transfer, LLC, subsidiary of Issuer Direct Corporation, located at One Glenwood Avenue, Suite 1001 Raleigh, NC, 27603.

Listing

We

have applied to list our Series I Preferred Stock on The Nasdaq Capital Market under the symbol “AYTUP.”

No

Maturity, Sinking Fund or Mandatory Redemption

The

Series I Preferred Stock has no stated maturity and will not be subject to any sinking fund or mandatory redemption. Shares of

the Series I Preferred Stock will remain outstanding indefinitely unless we decide to redeem or otherwise repurchase them. We

are not required to set aside funds to redeem the Series I Preferred Stock.

Ranking

The

Series I Preferred Stock will rank, with respect to rights to the payment of dividends and the distribution of assets upon our

liquidation, dissolution or winding up:

|

|

(1)

|

senior

to all classes or series of our common stock and to all other equity

securities issued by us including, as of March 2, 2020 our outstanding Series F Preferred Stock and Series G Preferred and any

shares of Series H Stock that may be issued other than equity securities referred to in clauses (2) and (3) below;

|

|

|

|

|

|

|

(2)

|

on

a parity with all equity securities issued by us with terms specifically providing that those equity securities rank on a

parity with the Series I Preferred Stock with respect to rights to the payment of dividends and the distribution of assets

upon our liquidation, dissolution or winding up;

|

|

|

|

|

|

|

(3)

|

junior

to all equity securities issued by us with terms specifically providing that those equity securities rank senior to the Series

I Preferred Stock with respect to rights to the payment of dividends and the distribution of assets upon our liquidation,

dissolution or winding up (please see the section entitled “—Voting Rights” below); and

|

|

|

|

|

|

|

(4)

|

effectively

junior to all of our existing and future indebtedness (including indebtedness convertible to our common stock or preferred

stock) and to any indebtedness and other liabilities of (as well as any preferred equity interests held by others in) our

subsidiaries.

|

Holders

of shares of the Series I Preferred Stock are entitled to receive, when, as and if declared by the Board of Directors, out of

our funds legally available for the payment of dividends, cumulative cash dividends at the rate of 11% per annum on the

$17.50 per share liquidation preference of the Series I Preferred Stock (equivalent to $1.925 per annum per share).

Cumulative dividends on the Series I Preferred Stock will accrue daily commencing on the date of issuance and will be payable