Current Report Filing (8-k)

March 02 2020 - 7:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

and Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 26, 2020

GBT TECHNOLOGIES INC.

(Exact name of registrant as specified in its

charter)

|

Nevada

|

000-54530

|

27-0603137

|

|

(State or other jurisdiction of incorporation )

|

Commission File Number

|

(I.R.S. Employer Identification No.)

|

2500 Broadway, Suite F-125, Santa Monica,

CA 90404

(Address of principal executive offices) (Zip

code)

Registrant’s telephone number including

area code: 424-238-4589

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

/_/ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

/_/ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

/_/ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

/_/ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 3.02

|

Unregitered Sale of Equity Securities

|

GBT Technologies Inc. (the

“Company”) entered into a series of loan agreements with Stanley Hills LLC (“Stanley”) pursuant to which

it received more than $1,000,000 in loans (the “Debt”) since May 2019 up to December 2019. On February 26, 2020, in

order to induce Stanley to continue to provide funding, the Company and Stanley entered into a letter agreement providing that

the Debt may be converted into shares of common stock of the Company at a conversion price equal to 85% multiplied by the lowest

one trading price for the common stock during the 20 trading day period ending on the latest complete trading day prior to the

conversion date. Stanley has agreed to restrict its ability to convert the Debt and receive shares of common stock such that

the number of shares of common stock held by it and its affiliates after such conversion or exercise does

not exceed 4.99% of the then issued and outstanding shares of common stock.

On February 27,

2019, the Company issued Iliad Research and Trading, L.P. a Promissory Note in the principal amount of $2,325,000 (the “Iliad

Note”), due in one year. On February 27, 2020, the Company and Iliad entered to an Amendment to the Iliad Note pursuant to

which the maturity date of the Iliad Note was extended to August 27, 2020, provided that the Debt may be converted into shares

of common stock of the Company at a conversion price equal to 80% multiplied by the lowest trading daily VWAP for the common stock

during the 20 trading day period ending on the latest complete trading day prior to the conversion date, provided for the payment

by the Company to Iliad of an extension fee equal to 7.5% of the outstanding balance of the Iliad Note resulting in a new balance

of the Iliad Note of $2,765,983 and provided that the Company’s failure to deliver shares of common stock within three trading

days of a conversion would result in an event of default. Iliad has agreed to restrict its ability to convert the Iliad Note

and receive shares of common stock such that the number of shares of common stock held by it and its affiliates

after such conversion or exercise does not exceed 9.99% of the then issued and outstanding shares of common stock.

The

offer, sale and issuance of the above securities was made to an accredited investor and the Company relied upon the exemptions

contained in Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Rule 506 of Regulation D promulgated there under

with regard to the sale. No advertising or general solicitation was employed in offering the securities. The offer and sales were

made to an accredited investor and transfer of the common stock will be restricted by the Company in accordance with the requirements

of the Securities Act of 1933, as amended.

The foregoing description

of the terms of the above transactions do not purport to be complete and are qualified in their entirety by reference to the provisions

of such agreements, the forms of which are filed as exhibits to this Current Report on Form 8-K.

On

February 27, 2020 GBT Technologies, S.A., as successor in interest to Hermes Roll, LLC had notified the Company that it was in

default on its Amended and Restated Territorial License Agreement (“ARTLA”) dated June 15, 2015 and that the ARTLA

had been cancelled and rescinded;

On January 31, 2020, in

the arbitration, GBT Technologies Inc. (k/n/a Gopher Protocol, Inc. v. Discover Growth Fund, LLC (“Discover”) (JAMS

Ref. No. 1260005395), the Company was informed that a final award was entered (the “Final Award”). The Final Award

affirms that certain sections of the Senior Secured Redeemable Convertible Debenture (the “Debenture”) constitute

unenforceable liquidated damages penalties and were stricken. Further, it was determined that neither Discover nor John Kirkland,

President and General Partner of Discover, were entitled to recovery of their attorneys fees. Consequently, and consistent with

the expectations of the Company, the arbitrator awarded Discover an award of $4,034,444.46 plus interest of 7.25% accrued from

May 15, 2019 and costs in the amount of $55,613.00.

On February 18, 2020, the

Company filed a motion with the United States District Court District of Nevada (the “Nevada Court”) to confirm the

Final Award and a motion to consolidate Discover’s application to confirm the Final Award filed in the U.S. District Court

of the Virgin Islands (Case No: 3 :20-cv-00012-CVG-RM) (the “Virgin Island Court”). On February 27, 2020, the Nevada

Court denied the Company’s motion to confirm the Final Award and motion to consolidate and further decided that the confirmation

of the Final Award should be litigated in the Virgin Island Court.

As such, on February 27,

2020, the Company filed a Notice of Entry of Order as well as a Motion to Confirm the Arbitration Award; Address the Outstanding

issue regarding whether Discover’s rights are subordinated to other creditors and, thereafter, oversee a commercially reasonable

foreclosure sale (Case No: 3 :20-cv-00012-CVG-RM). It is the Company’s position that the Final Award must first be confirmed

and all questions regarding the rights of Discover relative to those of other creditors must be determined before any foreclosure

sale can proceed. It is further the position of the Company that the previously disclosed foreclosure sale scheduled by Discover

is being conducted in a commercially unreasonable manner and that if Discover proceeded forward with the foreclosure sale it did

so at its own risk.

Nevertheless, on February

28, 2020, Discover advised that it conducted a sale of the Company’s assets.

|

|

Item

|

9.01 Financial Statements and Exhibits

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act 1934, the registrant haly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

GBT TECHNOLOGIES INC.

By:/s/ Douglas

Davis

-----------------------------------------

Name: Douglas

Davis

Title: Chief Executive Officer

Date: March 2, 2020

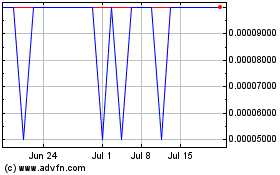

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

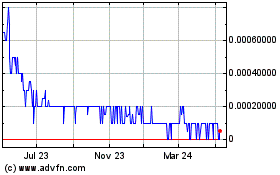

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Apr 2023 to Apr 2024