SEC Charges South Carolina Companies, Executives in Failed Nuclear Project Case -- Update

February 28 2020 - 11:00AM

Dow Jones News

By Mengqi Sun

Two South Carolina companies and two former top executives face

civil fraud charges in relation to a failed nuclear power plant

expansion project, the Securities and Exchange Commission said

Thursday.

Scana Corp. and two of its former senior executives allegedly

repeatedly made false and misleading statements to investors,

regulators and consumers between 2015 and 2017 about the status of

the $9 billion nuclear project that ultimately failed, the SEC said

in a complaint filed in a federal court in South Carolina.

The charges came after Cayce, S.C.-based Scana, the primary

owner of the Virgil C. Summer power plant, abandoned the project of

building two nuclear reactors in July 2017 after close to a decade

of planning and construction, citing high construction costs and

delays.

The SEC also charged a Scana subsidiary, South Carolina Electric

& Gas Co., which is now known as Dominion Energy South Carolina

Inc.

Dominion Energy Inc. acquired Scana in January 2019.

"This is a disappointing development related to a long-standing

investigation by the SEC regarding pre-merger activities," the

company said in a statement. "Dominion Energy has been fully

cooperating with the SEC in this investigation. That cooperation

began prior to completion of our merger. We are taking this matter

very seriously, and are reviewing the complaint to determine our

next steps."

The defendants claimed the project was on track even though they

knew it was significantly delayed and wouldn't be completed on time

by Jan. 1, 2021, to qualify for $1.4 billion of federal tax

credits, the securities regulator alleged.

Scana touted the progress of the project in its regulatory

filings, earnings calls and press releases, according to the

complaint. The statements helped bolster the company's stock price,

sell $1 billion of corporate debt at favorable rates and obtain

approval from utility regulators to charge its customers higher

rates, the SEC said.

The SEC also charged Kevin Marsh, Scana's former chief executive

and chairman, and Stephen Byrne, Scana's former executive vice

president with responsibilities of overseeing all nuclear

operations at Scana. The SEC alleged that the two former executives

were at the center of the fraud.

The SEC charged all defendants with violations of the antifraud

provisions of the federal securities laws, and charged Scana,

SCE&G and Mr. Marsh with reporting violations. The SEC is also

seeking return of allegedly ill-gotten gains, financial penalties

from all defendants and a bar against Messrs. Marsh and Byrne

serving as officers or directors of public companies.

Mr. Marsh didn't immediately respond to a request for comment. A

lawyer for Mr. Byrne had no immediate comment on the charges.

"We just received the complaint this evening, and we're

reviewing it," said Matthew Martens of the law firm Wilmer Cutler

Pickering Hale and Dorr LLP, who is representing Mr. Byrne. "We'll

respond in an appropriate time."

Billions of dollars in cost overruns connected to the failed

expansion of the nuclear station in Jenkinsville, S.C., helped

drive the lead contractor on the project, Westinghouse Electric

Co., to file for chapter 11 bankruptcy in March 2017.

Scana announced months after the bankruptcy filing it was

abandoning the project, which was one of the largest and most

expensive in the history of South Carolina, the SEC said.

Meanwhile, Westinghouse was acquired the following year by

Brookfield Business Partners LP.

A Westinghouse spokeswoman declined to comment.

--Jonathan Randles contributed to this article.

Write to Mengqi Sun at mengqi.sun@wsj.com

(END) Dow Jones Newswires

February 28, 2020 10:45 ET (15:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

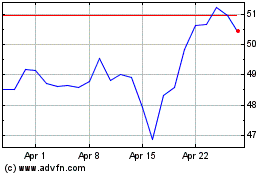

Dominion Energy (NYSE:D)

Historical Stock Chart

From Mar 2024 to Apr 2024

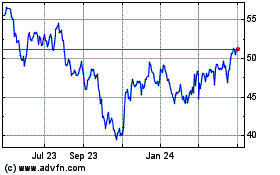

Dominion Energy (NYSE:D)

Historical Stock Chart

From Apr 2023 to Apr 2024