Current Report Filing (8-k)

February 27 2020 - 5:56PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): February 27, 2020

|

CO-DIAGNOSTICS,

INC.

|

|

(Exact

name of small business issuer as specified in its charter)

|

|

Utah

|

|

1-38148

|

|

46-2609363

|

(State

or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification Number)

|

2401

S. Foothill Drive, Suite D, Salt Lake City, Utah 84109

(Address

of principal executive offices)

(801)

438-1036

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of exchange on which registered

|

|

Common

Stock, par value $0.001 per share

|

|

CODX

|

|

NASDAQ

Capital Market

|

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

February 27, 2020, Co-Diagnostics, Inc. (the “Company”) entered into Securities Purchase Agreements (the “Purchase

Agreement”) with certain institutional investors (the “Investors”) for the sale by the Company of

470,000 shares (the “Common Shares”) of the Company’s common stock, par value $0.001 per share (the “Common

Stock”), at a purchase price of $9.00 per share in a registered direct offering priced at-the-market under the Nasdaq

rules. The aggregate gross proceeds for the sale of the Common Shares is expected to be approximately $4,230,000. The closing

of the offering is expected to occur on or about March 2, 2020, subject to the satisfaction of customary closing conditions.

H.C.

Wainwright & Co. LLC, is acting as the exclusive lead placement agent in connection with the offering and Maxim Group LLC

is acting as co-placement agent in connection with the offering. The Company has agreed to pay the placement agents an aggregate

fee equal to 7.0% of the gross proceeds received by the Company from the sale of the securities in the offering. The Company also

agreed to pay the lead placement agent $15,000 for non-accountable expenses and $12,900 for clearing expenses.

The

net proceeds to the Company from the offering, after deducting the placement agents’ fees and offering expenses, are expected

to be approximately $3,965,220. The Company intends to use the net proceeds from this offering for acquisition of PCR (polymerase

chain reaction) equipment and raw materials to be used in connection with sale of tests used to diagnose infectious disease, including

strains and mutations of coronavirus, as well as research and development costs associated with test development for additional

pathogens and test menu expansion, and for working capital and other general corporate purposes.

The

Common Shares sold in the offering were offered and sold by the Company pursuant to an effective shelf registration statement

on Form S-3, that was originally filed on August 14, 2018 and declared effective by the Securities and Exchange Commission (“SEC”)

on September 7, 2018, and the base prospectus contained therein (File No. 333-226835) (the “Registration Statement”).

The Company will file a final prospectus supplement and the accompanying prospectus with the SEC in connection with the sale of

the securities.

The

representations, warranties and covenants contained in the Purchase Agreement were made solely for the benefit of the parties

to the Purchase Agreement. In addition, such representations, warranties and covenants (i) are intended as a way of allocating

the risk between the parties to the Purchase Agreement and not as statements of fact, and (ii) may apply standards of materiality

in a way that is different from what may be viewed as material by stockholders of, or other investors in, the Company. Accordingly,

the Purchase Agreement is included with this filing only to provide investors with information regarding the terms of transaction,

and not to provide investors with any other factual information regarding the Company. Moreover, information concerning the subject

matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information

may or may not be fully reflected in public disclosures. The form of the Purchase Agreement is filed as Exhibit 10.1 to this Current

Report on Form 8-K. The foregoing summaries of the terms of the Purchase Agreement is subject to, and qualified in their entirety

by, such agreement, which is incorporated herein by reference.

The

legal opinion and consent of Carmel, Milazzo & DiChiara LLP relating to the securities is filed as Exhibit 5.1 to this Current

Report on Form 8-K and is incorporated herein by reference.

Item

8.01. Other Events.

On

February 27, 2020, the Company issued a press release announcing the sale of the Common Stock described above under Item 1.01

of this Current Report on Form 8-K.

The

information in this Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed

“filed” for purposes of Section 18 of the United States Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the United States Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in

such a filing.

Item

9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

CO-DIAGNOSTICS,

INC.

|

|

|

|

|

|

By:

|

/s/

Dwight H. Egan

|

|

|

Name:

|

Dwight

H. Egan

|

|

|

Title:

|

Chief

Executive Officer

|

Date:

February 27, 2020

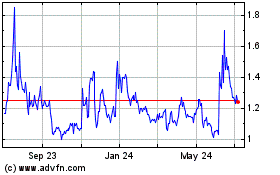

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Mar 2024 to Apr 2024

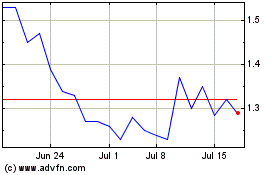

Co Diagnostics (NASDAQ:CODX)

Historical Stock Chart

From Apr 2023 to Apr 2024