By Alistair MacDonald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 27, 2020).

Two of the world's largest investment funds have begun selling

down stakes in coal miners citing environmental concerns, leaving

shares of some of the companies concentrated in the hands of a few

large U.S. investors.

As big fund managers amend what they call their ethical

investment policies, analysts say more selling could follow.

In recent weeks, Norway's trillion-dollar sovereign-wealth fund,

Norges Bank, and French giant BNP Paribas Asset Management have

sold shares in companies that mine thermal coal, including Anglo

American PLC. A few large funds, including Vanguard Group and

Dimensional Fund Managers, now have outsize holdings in many

smaller coal-mining companies.

Other large investors are assessing their own policies for

thermal coal or extending current ones. Thermal coal is considered

one of the biggest contributors to climate change by many

scientists.

"Even if funds don't have these restrictions today, do they want

to have these problems going forward?" said Ben Davis, a mining

analyst at Liberum.

Norges Bank won't invest in companies that extract more than 20

million metric tons of thermal coal a year or maintain coal-power

capacity of more than 10,000 megawatts. On Monday, it sold another

large slice of Anglo's shares, reducing its stake to 1.38% from

2.42% at the end of last year, according to FactSet.

BNP Paribas Asset Management, which has more than $490 billion

under management, recently began selling shares in companies that

derive more than 10% of their revenue from mining thermal coal, a

spokesman said.

BlackRock Inc., by virtue of being the world's largest money

manager, is a major investor in thermal-coal miners and utility

companies. Larry Fink, its chief executive, said the company's

actively managed debt-and-equity portfolios will move away from

thermal coal this year as the sector's exposure to increased

regulation makes it less economically viable.

BlackRock also said it would closely scrutinize other businesses

that are heavily reliant on thermal coal as an input.

Still, the impact will be muted. BlackRock's index-tracking

funds can still hold such stocks, and its smaller active-management

business will only exit companies that generate more than 25% of

their revenue from thermal-coal production.

Diversified giants such as Anglo and Glencore PLC should be

exempt from the firm's limitations. Coal miners such as Arch Coal

Inc. and Whitehaven Coal Ltd. -- of which BlackRock owns 7.4% and

5%, respectively -- are less secure.

BlackRock also isn't divesting shares of coal-powered utilities.

It owns stakes of more than 5% in American Electric Power Co., Duke

Energy Corp. and Southern Co.

An ongoing danger for miners and utilities, analysts say, is

that fund managers with no current restrictions on coal won't want

to risk owning such companies in case their firm's environmental,

social and governance policies change.

U.K.-based Aviva PLC has already sold its shares in 17 companies

that drew more than 30% of their revenue from thermal-coal power

generation or mining. But the fund is looking at going further by

focusing on how much coal companies mine or use, rather than just

portion of revenue, according to a spokesman.

A handful of funds hold outsize positions in certain coal miners

and utilities. Vanguard, BlackRock and Dimensional together own

almost 24% of the share capital of Arch Coal, for instance. A unit

of Invesco, another fund that cites its environmental credentials,

owns a further 21% of the St. Louis-based miner.

A spokeswoman for Invesco said the company supports the move

away from carbon-based fuels to more sustainable forms of energy

but declined to comment further.

"Vanguard is deeply concerned about the long-term impacts of

sustainability risks, such as thermal coal producers," a

spokeswoman for the fund said.

A spokesman for Dimensional said that some of its funds take

into account environmental factors such as climate change.

For Vanguard and BlackRock, it isn't clear how much of their

holdings in coal companies are in index trackers.

Coal miner Peabody Energy Corp. estimates that much of the

nearly 12% stake these funds own in the company is in index

trackers.

Dimensional owns a further 5.3% of Peabody, while activist

investor Elliott Management Corp. owns 30%.

For every fund selling stock citing environmental reasons, there

are many others willing to invest, said Vic Svec, a spokesman for

Peabody. Because demand for coal remains, policy-driven divestment

risks shifting its production and use from transparent public

companies with so-called ESG standards to unlisted ones without

such concerns, he said.

Some fund managers say they prefer engaging with the companies

they own, rather than simply exiting them. Aberdeen Standard owns

large stakes in miners Anglo, Glencore and BHP Group Ltd., as well

as Enel SpA and RWE AG, two European utilities that generate some

of their energy through coal.

"We were vocal in pushing both [utilities] to be as proactive as

possible in phasing out their coal-powered generation," said a

spokeswoman for Aberdeen Standard. RWE recently bought several

large renewable-energy businesses.

Shares in coal miners and utilities have been under pressure for

years. Peabody has fallen 85% since June 2018 and Arch Coal has

dropped about 40% over a similar period -- and they took another

hit Wednesday after U.S. regulators rejected their plan to combine

some of their operations.

Shares in Anglo and Glencore have underperformed their peers,

with analysts often citing thermal coal as one of several

reasons.

Anglo and BHP have both said they would gradually dispose of

their thermal-coal assets. But selling them isn't easy, given that

few Western-based miners want to bulk up in coal. BHP hired banks

to sell its thermal-coal assets last summer, and they remain

unsold.

Glencore says it is keeping its coal. Coal still accounts for

27% of all energy used world-wide and 38% of electricity

generation, according to the International Energy Agency. "The

world still needs coal," CEO Ivan Glasenberg said on a recent

conference call.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

February 27, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

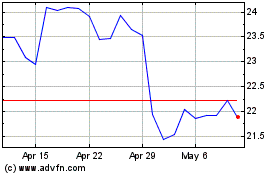

Peabody Energy (NYSE:BTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

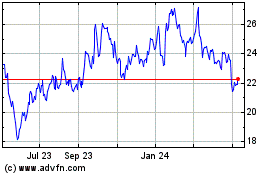

Peabody Energy (NYSE:BTU)

Historical Stock Chart

From Apr 2023 to Apr 2024