Marriott Predicts Coronavirus Will Hurt Fee Revenue

February 26 2020 - 5:56PM

Dow Jones News

By Dave Sebastian

Marriott International Inc. expects the coronavirus epidemic to

weigh on its fee revenue in 2020, as the pathogen's spread outside

of China stokes fears and disrupts travel.

The world's largest hotel company said Wednesday that it could

have about $25 million less in fee revenue per month this year,

compared with its outlook, assuming current low occupancy rates in

the Asia-Pacific region continue.

Excluding the epidemic's effect, Marriott predicted 2020

comparable systemwide revenue per available room, an industry

metric that measures performance, on a constant-currency basis to

be flat to up 2% world-wide, with its rise in North America to be

in the middle of the range. The company expects global room growth

of 5% to 5.25%, and gross fee revenue to rise 4% to 6%, compared

with 2019.

The Bethesda, Md.-based company, which has roughly 7,200

properties, expects earnings of $6.30 a share to $6.53 a share for

the year, on gross fee revenue of $3.96 billion to $4.04

billion.

Companies with high exposure to travel and tourism have borne

the brunt of the epidemic, with hotels closing some operations,

airlines canceling flights, cruise ships becoming incubators for

the pathogen and casinos closed off for two weeks in the gaming

enclave of Macau.

Originating in the central Chinese city of Wuhan, the epidemic

has widened globally, with cases recently surging in South Korea

and Italy and new infections diagnosed in Brazil, Spain, Germany

and Switzerland.

(END) Dow Jones Newswires

February 26, 2020 17:41 ET (22:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

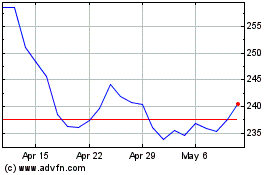

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

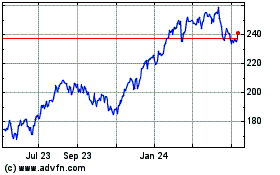

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Apr 2023 to Apr 2024