By Jon Emont

Thousands of Amazon sellers who built their businesses using

China's cheap and efficient manufacturers are on the spot as the

coronavirus shuts factories there.

Sellers say Amazon's ranking algorithm demotes products that are

out of stock. To avoid that painful fate, many are raising prices

to slow sales, and attempting to shift production to other

countries.

Larger corporations like Apple Inc. also face difficulties in

getting goods made on time in China. But merchants say that as

small buyers they'll be low on the list for merchandise when

production eventually revives. And once stock is replenished, they

say they'll need to spend big on advertising to regain their Amazon

rankings, which make products appear higher in site searches.

"I don't think the Amazon platform has seen such a massive

amount of inventory problems as we are about to see," said Patrick

Maioho, a Michigan seller of kitchen products who also advises

others on manufacturing in China.

Mr. Maioho said a supplier in southern China warned him that

even if the local government allows its factory to reopen, it will

be short-staffed for weeks while workers from other provinces

self-quarantine. He recently ran out of two products that account

for 30% of his monthly revenue, and said his product rankings are

dropping on Amazon.

"There's not much you can do," he said, adding that it would be

difficult to move production elsewhere.

There is some good news, though: One supplier had excess

inventory from his last order, which Mr. Maioho said will keep him

in stock for that product for a few weeks longer.

The third-party marketplace accounts for more than half of

Amazon's retail sales, and a growing share of sellers are based in

China, according to Marketplace Pulse, a data research firm.

Amazon said it had already worked with suppliers to secure

additional inventory and provided sellers with guidance on

protecting the health of their accounts on the platform. It said

product availability is just one of many factors it considers when

displaying shopping results for customers on its website.

Chris Davey, a British seller of audio products based in

Shenzhen, generates more than $1 million in annual revenue via

Amazon. He said he's checking in with his suppliers

regularly--mainly to see how they are coping with the public-health

emergency. The hope is that when production restarts, "they

remember who we are and that we're the people that asked how is

your family, not where are our orders," he said.

Some Amazon merchants are approaching smaller competitors to see

if they'll part with extra inventory. Others are seeking out U.S.

wholesalers with excess stock. That is costlier than buying

directly from factories, but may be cheaper than selling out and

having to effectively relaunch products later.

To preserve stock, many sellers are pulling online advertising

campaigns as well as raising prices.

"The worst thing that can happen in a product business is you

run out of stock," said Michael Michelini, a partner at Alpha Rock

Capital, which manages around 10 brands on Amazon. "You're never

really sure your ranking will come back the way it was."

Mr. Michelini said his company has been raising some prices.

Though it bought large quantities of many bestselling items ahead

of the Lunar New Year, he said, some office-supply and

shoe-accessory products could sell out within weeks.

"March will be breaking people," he said.

It can be difficult for small companies with specialist products

to quickly move manufacturing out of China, said Nathan Resnick,

chief executive of Sourcify, which helps businesses find

manufacturers in Asia. He has helped connect Amazon sellers with

alternative suppliers in India and Vietnam, he said, but

manufacturing costs outside China can be much higher, and factories

in Vietnam often won't accept small orders from Amazon sellers.

Garland Sullivan, whose Jacksonville, Fla.-based Amazon business

sells an average of $350,000 a month in multiple categories, with

many products made in China, said he could be out of some goods as

soon as early March. In a last-ditch bid to prevent that, he began

making one product in India this month and is in talks to have

others made there as well. In the future, he says he'll try to be

less dependent on China.

"It's a big wake-up call right now," he said.

Some sellers are already starting to worry about inventory for

the holiday season--the most-important few months of the

year--which requires a long lead time.

"Fourth-quarter planning usually happens now," said Eddie

Levine, president of Hub Dub Ltd., which sells toys and housewares

under its own and other brands. "With a big unknown on China,

everyone is on edge."

Dana Mattioli contributed to this article.

(END) Dow Jones Newswires

February 26, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

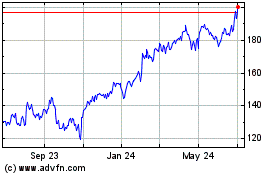

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

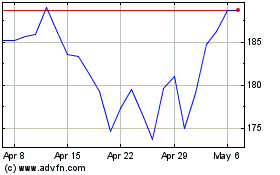

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024