Salesforce Co-CEO Steps Down -- WSJ

February 26 2020 - 3:02AM

Dow Jones News

Business-software provider says results swung to a net loss in

latest quarter

By Sarah E. Needleman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 26, 2020).

Salesforce.com Inc. said its Co-Chief Executive Keith Block is

stepping down from his role, just 18 months after taking the job,

ending for now a brief experiment with dual CEOs and leaving Marc

Benioff in charge of the business-software provider.

Mr. Block, a former Oracle Corp. executive, joined Salesforce in

2013 as president and vice chairman. He became co-CEO in 2018 in an

unusual setup that paired him with Mr. Benioff, a Salesforce

co-founder with a wide array of outside interests that now include

ownership of Time magazine.

Mr. Block had oversight of day-to-day operations while Mr.

Benioff led Salesforce's vision and innovation, among other

areas.

"Keith is an incredible leader and close friend who has helped

position us as a global leader and deeply strengthened our

company," Mr. Benioff said on a conference call with analysts. Mr.

Block will serve as an adviser to the CEO.

Salesforce said its revenue more than quadrupled over Mr.

Block's time at the company to more than $17 billion in the year

ended Jan. 31.

The move, which surprised some Wall Street analysts, came as the

company posted stronger-than-expected revenue in the latest quarter

and adjusted earnings above analysts' forecasts. Its shares fell

more than 3% in after-hours trading.

Founded in 1999, San Francisco-based Salesforce has evolved to

become one of the largest providers of software products for

businesses. Though its roots are in customer-relationship

management software, Salesforce has bolstered its offerings over

the years as enterprises have increased spending to digitize key

business tasks. Salesforce's stock-market capitalization of more

than $160 billion is close to rival Oracle despite being launched

more than 20 years later.

In recent years, Salesforce has been looking to boost revenue

through acquisitions. The company's more than $15 billion deal for

data analytics provider Tableau Software, which closed last year,

was the largest in its history.

The executive change at Salesforce came as the company reported

swinging to a fourth-quarter loss of $248 million from a profit of

$548 million a year earlier. Excluding items such as stock-based

compensation, Salesforce posted a profit of 66 cents a share, which

was stronger than Wall Street had expected, but lower than the 70

cents a share generated a year earlier.

Sales in the quarter increased 35% to $4.85 billion, compared

with the $4.76 billion that analysts surveyed by FactSet had

expected.

Salesforce's closely watched anticipated billings for the coming

months from its subscription-based revenue model rose 26% year over

year. It previously promised growth of about 21%.

Salesforce also Tuesday named Gavin Patterson, a former chief of

BT Group PLC, as president and chief of Salesforce International.

Mr. Patterson was most recently Salesforce's chair of Europe, the

Middle East and Africa. The company said he now oversees its

largest markets outside the U.S.

The twin-CEO structure has had a mixed record at the small

number of companies that have tried it over the years.

Oracle abandoned its dual-CEO structure after the death of Mark

Hurd last year, leaving Safra Catz as the database provider's sole

chief executive. German rival SAP SE adopted a co-CEO leadership

team last year.

A leadership duo at Deutsche Bank AG struggled after a series of

financial missteps and regulatory penalties led both co-CEOs to

resign in 2015.

Write to Sarah E. Needleman at sarah.needleman@wsj.com

(END) Dow Jones Newswires

February 26, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

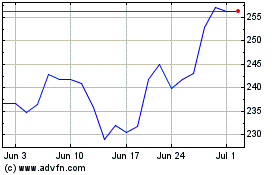

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024