Mastercard's Next CEO to Continue Company's Push Beyond Cards--2nd Update

February 25 2020 - 7:57PM

Dow Jones News

By AnnaMaria Andriotis

Mastercard Inc.'s pick for its next chief executive puts more

muscle behind the company's effort to expand beyond its legacy

cards business.

The company said Tuesday that Ajay Banga, its chief for nearly a

decade, will be replaced by Chief Product Officer Michael Miebach

effective Jan. 1. Mr. Banga will become executive chairman of the

board. Current Chairman Richard Haythornthwaite will retire.

For decades, Mastercard primarily provided the rails for debit-

and credit-card payments. But Mastercard and rivals like Visa Inc.

are facing competition from new payments companies and trying to

navigate changing consumer habits, while also developing technology

to play a bigger role in business-to-business payments. Mr. Banga,

the longest-tenured CEO of a major U.S. card network, has focused

on transforming Mastercard from largely cards-based payments to a

range of payment technologies.

New competitors that let consumers bypass cards have been a

driving factor. In Asia, for example, mobile wallets like WeChat

Pay and Alipay have grown rapidly, allowing consumers to shop with

money moving directly from their deposit account to the merchant.

More broadly, the payments sector is undergoing big changes as tech

giants including Apple Inc., Amazon.com Inc. and Alphabet Inc.s'

Google aim to grab a bigger piece of the market, raising the

prospect that cards could play a smaller role in payments in the

future.

"Everything's changing and what we've tried to do inside the

company, rather than be in a foxhole, I'd rather go out there and

embrace the change and try to drive it," Mr. Banga said in an

interview. Shares fell 6.7% Tuesday, an off day for the

markets.

The company has tried to break away from being branded a card

firm. Last year, it said it was removing its name from its logo in

most contexts, leaving just the familiar red and yellow circles to

represent the brand on cards, advertising and elsewhere.

"We aren't really just a card company," Mr. Banga said. "We are

a payments and technology organization that enables the movement of

money [between] account[s]. That's who we are and that's why I

don't like that we are called a card company."

Mastercard is the second-largest card network in the U.S. behind

Visa.

Before Mr. Banga took over in 2010, card-based transactions

accounted for about 80% of the company's revenue. That has since

declined to just over 50%, the company said.

Another revenue stream the company has grown involves selling

consumers' spending data to governments, banks, merchants and other

companies. Mastercard says the data is anonymized and that it

doesn't sell individual transaction data.

The focus on shifting the company beyond cards will continue

with Mr. Miebach, whose expertise includes digital and real-time

payments. Mr. Miebach has played a crucial role in the company's

empire building, leading the deals to acquire Vocalink, a

payment-technology firm that allows payments to move between bank

accounts, and Nets, a Danish payment-services provider. The Nets

deal, which is in the process of closing, would be its biggest.

Last year, Mastercard bought Vyze, a technology company that

enables point-of-sale lending, where loans are offered to consumers

at checkout. That type of lending has threatened to take away

purchase volume from cards.

Mr. Miebach also led a push to enable Mastercard payments in

emerging markets and was president of Mastercard's Middle East and

Africa operations between 2010 and 2015.

Mastercard stands to benefit from a trade deal the U.S. signed

with China last month, which could clear some of the obstacles that

prevented it and other U.S. financial-services companies from

having a bigger presence in China.

--Micah Maidenberg contributed to this article.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

February 25, 2020 19:42 ET (00:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

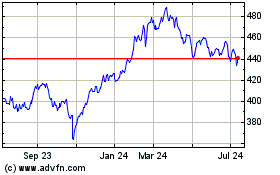

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

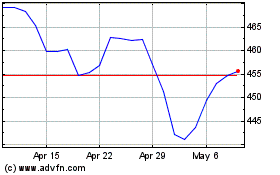

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024