As filed with the Securities and Exchange Commission on February

25, 2020

Registration No.

333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

___________________

EDESA BIOTECH, INC.

(Exact

name of registrant as specified in its charter)

___________________

|

British

Columbia, Canada

|

2836

|

N/A

|

|

(State or other

jurisdiction of incorporation or

organization)

|

(Primary Standard

IndustrialClassification Code Number)

|

(I.R.S.

EmployerIdentification No.)

|

100 Spy Court

Markham, ON L3R 5H6 Canada

(289) 800-9600

(Address,

including zip code, and telephone number, including area code, of

registrant’s principal executive offices)

___________________

Kathi Niffenegger

Chief Financial Officer

Edesa Biotech, Inc.

100 Spy Court

Markham, ON L3R 5H6 Canada

(289) 800-9600

(Name,

address, including zip code, and telephone number, including area

code, of agent for service)

___________________

Copies to:

|

Jonathan Friedman

Stubbs Alderton & Markiles, LLP

15260 Ventura Boulevard, 20th Floor

Sherman Oaks, California 91403

(818) 444-4500

|

___________________

Approximate date of commencement of proposed sale to the public: As

soon as practicable after this registration statement becomes

effective.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box:

☒

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

If this

Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier

effective registration statement for the same offering.

☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated

filer ☐

|

Accelerated filer

☐

|

|

Non-accelerated

filer ☒

|

Smaller reporting

company ☒

|

|

|

Emerging growth

company ☒

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☒

___________________

CALCULATION OF REGISTRATION FEE

|

Title of Each

Class ofSecurities to be Registered(1)

|

|

Proposed Maximum

Offering Price Per Share

|

Proposed Maximum

Aggregate Offering Price

|

Amount of

Registration Fee

|

|

Common shares, no

par value

|

1,016,036(2)

|

$4.80(3)

|

$4,876,972.80(3)

|

$633.03

|

|

Common shares, no

par value

|

677,358(2)

|

$4.00(3)

|

$2,709,432.00(3)

|

$351.68

|

|

Common shares, no

par value

|

12,364(2)

|

$3.20(3)

|

$39,564.80(3)

|

$5.14

|

|

Common shares, no

par value

|

1,897,030

|

$3.58(4)

|

$6,791,367.40(4)

|

$881.52

|

|

Total

|

3,602,788

|

|

$14,417,337.00

|

$1,871.37

|

(1)

Pursuant

to Rule 416 under the Securities Act, the securities being

registered hereunder include such indeterminate number of

additional common shares as may be issued after the date hereof as

a result of stock splits, stock dividends or similar

transactions.

(2)

Represents

Common Shares issuable upon the exercise of warrants by the selling

shareholders named herein.

(3)

Estimated

solely for the purpose of calculating the registration fee in

accordance with Rule 457(o) under the Securities Act of 1933, as

amended, based on the price at which the warrants may be

exercised.

(4)

Estimated solely for the purpose of computing the amount of the

registration fee. In accordance with Rule 457(c) under the

Securities Act of 1933, as amended, the maximum price per share and

maximum aggregate offering price are based on the average of the

$3.6535 (high) and $3.50 (low) sale price of the registrant’s

Common Shares as reported on The Nasdaq Capital Market on February

21, 2020, which date is within five business days prior to filing

this Registration Statement.

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of

1933 or until the registration statement shall become effective on

such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in this prospectus is not complete and may be

changed. The selling

shareholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not

permitted.

Subject to Completion, Dated February 25, 2020

Edesa Biotech, Inc.

PRELIMINARY PROSPECTUS

3,602,788 Common Shares

We are registering an aggregate of 3,602,788 common shares, no par

value (“Common Shares”), for resale by certain of our

shareholders identified in this prospectus. The 3,602,788 Common

Shares include (i) 1,016,036

Common Shares underlying outstanding

Class A Purchase Warrants exercisable at $4.80 per share (subject

to customary adjustments for share splits and dividends),

(ii) 677,358

Common Shares underlying outstanding

Class B Purchase Warrants exercisable at $4.00 per share (subject

to customary adjustments for share splits and dividends) and (iii)

12,364 Common Shares underlying outstanding warrants issued to

representatives of a Placement Agent,

exercisable at $3.20 per share

(subject to customary adjustments for share splits and

dividends)(the “Placement Agent Warrants”), which Class

A Purchase Warrants, Class B Purchase Warrants and Placement Agent

Warrants were acquired from us on January 8, 2020.

The

remaining 1,897,030 Common Shares being registered for resale by

certain of the selling shareholders were acquired from us on June

7, 2019 upon the completion of our business combination with Edesa

Biotech Research, Inc., a company organized under the laws of the

province of Ontario. We are not selling any

securities under this prospectus and we will not receive any

proceeds from the resale of the Common Shares by the selling shareholders. Any proceeds received

by us from the exercise of the warrants will be used for general

corporate purposes.

The selling shareholders may offer our Common Shares from time to

time in a number of different methods and at varying prices. For

more information on possible methods of offer and sale by the

selling shareholders, please see the section entitled “Plan

of Distribution” beginning on page 25 of this

prospectus.

We have agreed to bear all of the expenses incurred in connection

with the registration of these shares. The selling shareholders

will pay or assume discounts, commissions, fees of underwriters,

selling brokers or dealer managers, if any, incurred for the resale

of our Common Shares.

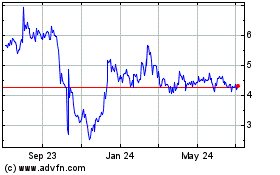

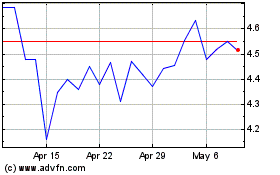

Our Common Shares are listed on the Nasdaq Capital Market under the

symbol “EDSA.” The last reported sale price of our

Common Shares on February 21, 2020 was $3.60 per

share.

We are an “emerging growth company” as that term is

used in the Jumpstart Our Business Startups Act of 2012 and, as

such, we have elected to comply with certain reduced public company

reporting requirements for this prospectus and future filings. See

“Prospectus Summary – Implications of Being an Emerging

Growth Company.”

You should read this prospectus, together with additional

information described under the headings “Incorporation of

Certain Information by Reference” and “Where You Can

Find More Information,” carefully before you invest in our

securities.

Investing in our securities involves a high degree of risk. These

risks are described in the “Risk Factors” section on

page 6 of this prospectus. You should also consider the risk

factors described or referred to in any documents incorporated by

reference in this prospectus, and in an applicable prospectus

supplement, before investing in our securities.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal

offense.

The date of this prospectus is 2020.

TABLE OF CONTENTS

|

|

Page

|

|

PROSPECTUS

SUMMARY

|

1

|

|

THE

OFFERING

|

3

|

|

RISK

FACTORS

|

6

|

|

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

|

7

|

|

USE OF

PROCEEDS

|

8

|

|

SELLING

SHAREHOLDERS

|

8

|

|

CERTAIN TAX

MATTERS

|

17

|

|

PLAN

OF DISTRIBUTION

|

25

|

|

DESCRIPTION OF

SECURITIES

|

27

|

|

LEGAL

MATTERS

|

31

|

|

EXPERTS

|

31

|

|

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

|

31

|

|

INCORPORATION BY

REFERENCE OF CERTAIN DOCUMENTS

|

32

|

______________

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this

prospectus or in any related free writing prospectus filed by us

with the Securities and Exchange Commission, or the SEC. We have

not authorized anyone to provide you with any information or to

make any representation not contained in this prospectus or

incorporated by reference. We do not take any responsibility for,

and can provide no assurance as to the reliability of, any

information that others may provide to you. This prospectus is not

an offer to sell or an offer to buy securities in any jurisdiction

where offers and sales are not permitted. The information in this

prospectus is accurate only as of its date, regardless of the time

of delivery of this prospectus or any sale of Common Shares. You

should not assume that the information contained in this prospectus

or any prospectus supplement or free writing prospectus is accurate

as of any date other than the date on the front cover of those

documents, or that the information contained in any document

incorporated by reference is accurate as of any date other than the

date of the document incorporated by reference, regardless of the

time of delivery of this prospectus or any sale of a security. Our

business, financial condition, results of operations and prospects

may have changed since those dates.

We have not done anything that would permit a public offering of

the Common Shares or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required,

other than in the United States. Persons outside the United States

who come into possession of this prospectus must inform themselves

about, and observe any restrictions relating to, the offering of

Common Shares and the distribution of this prospectus outside of

the United States.

It is

important for you to read and consider all of the information

contained in this prospectus in making your investment decision. To

understand the offering fully and for a more complete description

of the offering you should read this entire document

carefully.

|

|

|

|

|

|

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere or

incorporated by reference in this prospectus and does not contain

all of the information you should consider in making your

investment decision. You should read this summary together with the

more detailed information, including our financial statements and

the related notes, contained or incorporated by reference in this

prospectus. You should carefully consider, among other things, the

matters discussed in “Risk Factors” included elsewhere

in this prospectus, the sections titled “Risk Factors”

and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our financial

statements and related notes, each included in our Annual Report on

Form 10-K for the year ended September 30, 2019, filed with the SEC

on December 12, 2019, which is incorporated by reference herein,

and the section entitled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations”

and our unaudited consolidated interim financial statements and

related notes, each included in our Quarterly Report on Form 10-Q

filed with the SEC on February 13, 2020, which is incorporated by

reference herein, before making an investment decision. You should

also read and consider the information in the documents to which we

have referred you in “Where You Can Find Additional

Information” and “Incorporation of Certain Information

by Reference.” As used in this prospectus,

“Edesa,” “the Company,” “we,”

“us,” and “our” refer to Edesa Biotech,

Inc. and our consolidated subsidiaries, except where the context

otherwise requires.

Business Overview

We are a biopharmaceutical company focused on

acquiring, developing and commercializing clinical-stage drugs for

dermatological and gastrointestinal indications with clear unmet

medical needs. Our lead product candidate, EB01, is an

sPLA2

inhibitor for the topical treatment of

chronic allergic contact dermatitis (ACD), a common, potentially

debilitating condition and occupational illness. EB01 employs a

novel, non-steroidal mechanism of action and in two clinical

studies has demonstrated statistically significant improvement of

multiple symptoms in ACD patients. Our investigational new

drug (IND) application for EB01 was accepted by the U.S. Food and

Drug Administration (FDA) in November 2018 and we initiated patient

enrollment for a Phase 2B clinical study evaluating EB01 in October

2019.

We also intend to expand the utility of our

sPLA2

inhibitor technology, which forms the

basis for EB01, across multiple indications. For example, in

September 2019, we received approval from Health Canada to

begin a proof-of-concept clinical study of EB02, an

sPLA2

inhibitor, as a potential treatment

for patients with hemorrhoids disease (HD). In addition to EB01 and

EB02, we plan to expand our portfolio with drug candidates to treat

other skin and gastrointestinal conditions.

Competitive Strengths

We

believe that we possess a number of competitive strengths that

position us to become a leading biopharmaceutical company focused

on dermatological and gastrointestinal diseases,

including:

●

Novel pipeline addressing

large underserved markets. Our

product candidates are novel clinical-stage compounds that have

significant scientific rationale for effectiveness. By initially

targeting large markets that have significant unmet medical needs,

we believe that we can drive adoption of new products and improve

our competitive position. For example, we believe that the novel,

non-steroidal mode of action of our lead product candidates will be

an appealing alternative for managing the symptoms of ACD and HD.

These diseases impact millions of people in the United States and

Canada, and can have significant effects on patients’ quality

of life and, in the case of many chronic ACD patients and their

employers, significant workplace-related costs and

limitations.

●

Intellectual property

protection and market exclusivity. We have opportunities to develop our competitive

position through patents, trade secrets, technical know-how and

continuing technological innovation. We have exclusive license

rights in our target indications to multiple patents and pending

patent applications in the United States and in various foreign

jurisdictions. In addition to patent protection, we intend to

utilize trade secrets and market exclusivity afforded to a New

Chemical Entity, where applicable, to enhance or maintain our

competitive position.

●

Experienced management and

drug development capabilities. Our leadership team possesses core capabilities in

dermatology, gastrointestinal medicine, drug development and

commercialization, chemistry, manufacturing and controls, public

company management and finance. Our founder and Chief Executive

Officer, Pardeep Nijhawan, MD, FRCPC, AGAF, is a board-certified

gastroenterologist and hepatologist with a successful track record

of building life science businesses, including Medical Futures,

Inc., which was sold to Tribute Pharmaceuticals in 2015. In

addition to our internal capabilities, we have also established a

network of key opinion leaders, contract research organizations,

contract manufacturing organizations and consultants. As a result,

we believe we are well positioned to efficiently develop novel

dermatological and gastrointestinal treatments.

|

|

|

|

|

|

|

|

|

|

|

|

Our

business strategy is to develop and commercialize innovative drug

products that address unmet medical needs for large, underserved

markets where there is limited competition. Key elements of our

strategy include:

●

Establish EB01 as the leading

treatment for chronic ACD. Our

primary goal is to obtain regulatory approval for EB01 and

commercialize EB01 for use in the treatment of ACD. Based on

promising clinical trial results in which patients treated with

EB01 experienced statistically significant improvements of their

symptoms with minimal side effects, we initiated a Phase 2B

clinical study evaluating EB01 in the United

States.

●

Selectively targeting

additional indications within the areas of dermatology and

gastroenterology. In addition

to our ACD program, we plan to efficiently generate

proof-of-concept data for other programs where the inhibition of

sPLA2

activity may have a therapeutic

benefit. For example, given sufficient funding, we are planning a

clinical study to evaluate EB02 for internal

hemorrhoids.

●

In-license promising product

candidates. We are applying our

cost-effective development approach to advance and expand our

pipeline. Our current product candidates are in-licensed from

academic institutions or other pharmaceutical companies, and we

plan to continue to identify, evaluate and potentially obtain

rights to and develop additional assets. Our objective is to

maintain a well-balanced portfolio with product candidates across

various stages of development. In general, we seek to identify

product candidates and technology that represent a novel

therapeutic approach to dermatological and gastrointestinal

diseases, are supported by compelling science, target an unmet

medical need, and provide a meaningful commercial opportunity. We

do not currently intend to invest significant capital in basic

research, which can be expensive and

time-consuming.

●

Capture the full commercial

potential of our product candidates. If our product candidates are successfully

developed and approved, we may build commercial infrastructure

capable of directly marketing the products in North America and

potentially other major geographies of strategic interest. We also

plan to evaluate strategic licensing arrangements with

pharmaceutical companies for the commercialization of our drugs,

where applicable, such as in territories where a partner may

contribute additional resources, infrastructure and

expertise.

Corporate Information

We were incorporated in

the Province of British Columbia, Canada in 2007 and we operate

through our wholly-owned subsidiaries, Edesa Biotech Research,

Inc., an Ontario corporation incorporated in 2015, formerly known

as Edesa Biotech Inc., which we acquired on

June 7, 2019, and Stellar Biotechnologies, Inc., a California

corporation organized September 9, 1999 and acquired on April 12,

2010. Our Common Shares are traded on The Nasdaq Capital Market

under the symbol “EDSA”. Our executive offices are

located at 100 Spy Court, Markham, Ontario L3R 5H6 Canada and our

telephone number at this location is (289) 800-9600. Our website address

is www.edesabiotech.com. The information contained on, or that can

be accessed through, our website is not a part of this prospectus.

Our trademarks and trade names include, but may not be limited to,

“Edesa Biotech,” and the Edesa

logo.

|

|

|

|

|

|

|

|

|

|

|

|

THE

OFFERING

The following summary contains basic information about the offering

and the securities the selling shareholders are offering and is not

intended to be complete. It does not contain all the information

that is important to you. For a more complete understanding of the

securities the selling shareholders are offering, please refer to

the section of this prospectus titled “Description of

Securities.”

|

|

|

|

Common

Shares being offered by the selling shareholders

|

|

|

The selling shareholders are offering up to 3,602,788 Common

Shares, including (i) 1,016,036 Common Shares underlying outstanding Class A

Purchase Warrants exercisable at $4.80 per share (subject to

customary adjustments for share splits and dividends), (ii) 677,358

Common Shares underlying outstanding Class B Purchase Warrants

exercisable at $4.00 per share (subject to customary adjustments

for share splits and dividends) and (iii) 12,364 Common Shares

underlying outstanding warrants issued to representatives of

Brookline

Capital Markets, a division of Arcadia Securities, LLC,

exercisable at $3.20 per share

(subject to customary adjustments for share splits and

dividends)(the “Placement Agent Warrants”).

The

remaining 1,897,030 Common Shares being registered for resale by

certain of the selling shareholders were acquired from us on June

7, 2019 upon the completion of our business combination with Edesa

Biotech Research, Inc.

|

|

|

|

|

|

|

|

|

|

|

Warrant

exercisability and expiration

|

|

|

The Class A Purchase Warrants will be exercisable at any time on or

after July 8, 2020 (the “Class A Purchase Warrant Initial

Exercise Date”), at an exercise price of $4.80 per share and

will expire on the third anniversary of the Class A Purchase

Warrant Initial Exercise Date. The Class B Purchase Warrants will

be exercisable at any time on or after July 8, 2020 (the

“Class B Purchase Warrant Initial Exercise Date”), at

an exercise price of $4.00 per share and will expire on the four

month anniversary of the Class B Purchase Warrant Initial Exercise

Date. The Placement Agent Warrants will be exercisable at any time

on or after July 6, 2020 (the “Placement Agent Warrant

Initial Exercise Date”), at an exercise price of $3.20 per

share and will expire on the fifth anniversary of the Placement

Agent Warrant Initial Exercise Date.

|

|

|

|

|

|

|

|

|

|

|

Common

shares outstanding prior to this offering

|

|

|

8,859,159

shares

|

|

|

|

|

|

|

|

|

|

|

Common shares to be outstanding after this offering

|

|

|

10,564,917

shares

|

|

|

|

|

|

|

|

|

|

|

Use of

Proceeds

|

|

|

All proceeds from the sale of the Common Shares under this

prospectus will be for the account of the selling shareholders. We

will not receive any proceeds from the sale of our Common Shares

offered pursuant to this prospectus. Any proceeds received by us

from the exercise of the warrants will be used for general

corporate purposes, which may include working capital, capital

expenditures and research and development expenses. See the section

entitled “Use of Proceeds” in this

prospectus.

|

|

|

|

|

|

|

|

|

|

|

Nasdaq Capital Market trading symbol

|

|

|

“EDSA”

|

|

|

|

|

|

|

|

|

|

|

Listing

|

|

|

Our Common Shares are listed for trading on the Nasdaq Capital

Market. There is no established trading market for the warrants and

we do not intend to list the warrants on any exchange or other

trading or quotation system.

|

|

|

|

|

|

|

|

|

|

|

Risk Factors

|

|

|

See “Risk Factors” on page 6 of this prospectus to read

about factors you should consider before buying Common

Shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

number of our Common Shares to be outstanding after the offering is

based on 8,859,159 of our Common Shares outstanding as of February

21, 2020 and excludes:

●

671,891

of our Common Shares issuable upon exercise of outstanding options

granted under our equity incentive plans at a weighted average

exercise price of $3.27 per share;

●

481,256 of

our Common Shares available for issuance or future grant pursuant

to our equity incentive plan; and

●

48,914

of our Common Shares issuable upon exercise of outstanding warrants

at a weighted average exercise price of $11.19 per

share.

Implications of Being an Emerging Growth Company

As

a company with less than $1.07 billion in revenue during our

last fiscal year, we qualify as an “emerging growth

company” as defined in the Jumpstart Our Business Startups

Act, or JOBS Act, enacted in April 2012. An “emerging

growth company” may take advantage of reduced reporting

requirements that are otherwise applicable to public companies.

These provisions include, but are not limited to:

●

not

being required to comply with the auditor attestation requirements

of Section 404(b) of the Sarbanes-Oxley Act;

●

reduced

disclosure obligations regarding executive compensation in our

periodic reports, proxy statements and registration statements;

and

●

exemptions

from the requirements of holding a nonbinding advisory vote on

executive compensation and shareholder approval of any golden

parachute payments not previously approved.

We

may take advantage of these provisions until September 30, 2021.

However, if certain events occur prior to September 30, 2021,

including if we become a “large accelerated filer,” our

annual gross revenues exceed $1.07 billion or we issue more

than $1.0 billion of non-convertible debt in any three-year

period, we will cease to be an emerging growth company before such

date.

We

have elected to take advantage of certain of the reduced disclosure

obligations and may elect to take advantage of other reduced

reporting requirements in future filings. As a result, the

information that we provide to our shareholders may be different

than the information you might receive from other public reporting

companies in which you hold equity interests.

Description of Business Combination Transaction

On

June 7, 2019, we completed a business combination with Edesa

Biotech Research, Inc., formerly known as Edesa Biotech Inc.

(“Edesa Research”), a company organized under the laws

of the province of Ontario, in accordance with the terms of a Share

Exchange Agreement, dated March 7, 2019, by and among us, Edesa

Research and the shareholders of Edesa Research. At the closing of

the transaction, we acquired the entire issued share capital of

Edesa Research, with Edesa Research becoming a wholly owned

subsidiary of ours. Also on June 7, 2019, in connection with and

following the completion of the business combination, we effected a

1-for-6 reverse split of our Common Shares and changed our name to

“Edesa Biotech, Inc.” At the closing of the

transaction, the Edesa Research shareholders exchanged their shares

for 88% of our outstanding shares on a fully diluted

basis.

At

the closing of the transaction, the Edesa Research shareholders

received 6,249,780 of our Common Shares in exchange for the capital

shares of Edesa Research and the holders of unexercised Edesa

Research share options immediately prior to the closing of the

transaction were issued replacement share options

(“Replacement Options”) to purchase an aggregate of

297,422 of our Common Shares. On July 26, 2019, pursuant to

the post-closing adjustment contemplated by the Share Exchange

Agreement, we issued an additional 366,234 of our Common Shares to

the Edesa Research shareholders and the holders of unexercised

Edesa Research stock options immediately prior to the closing of

the transaction were issued 17,701 additional Replacement Options

to purchase our Common Shares. Following the completion of the

transactions contemplated by the Share Exchange Agreement and the

reverse split, there were approximately 7,504,468, of our Common

Shares issued and outstanding and approximately 7,876,292 of our

Common Shares outstanding on a fully-diluted basis, and the former

Edesa Research shareholders and option holders owned approximately

6,931,137 of our Common Shares on a fully-diluted basis, or 88% of

our Common Shares on a fully-diluted basis, and our shareholders

and option holders prior to the transactions contemplated by the

Share Exchange Agreement owned approximately 945,155 of our Common

Shares on a fully-diluted basis, or 12% of our Common Shares on a

fully-diluted basis. 1,897,030 Common Shares acquired by the Edesa

Research shareholders in the business combination transaction are

being registered for resale under this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

Description of Offering and Private Placement with Selling

Shareholders

On

January 6, 2020, we entered into a Securities Purchase Agreement

(the “Securities Purchase Agreement”) with certain

United States resident investors and Subscription Agreements (the

“Subscription Agreements”) with certain non-U.S.

investors providing for the issuance and sale by us of an

aggregate of 1,354,961 of our Common Shares, in a registered direct

offering (the “Offering”). In a concurrent private

placement (the “Private Placement”), we agreed to sell

to such investors (i) Class A Purchase Warrants to purchase an

aggregate of up to 1,016,036 Common Shares, or 0.75 of a Common

Share for each Common Share purchased in the Offering (the

“Class A Purchase Warrants”), and (ii) Class B Purchase

Warrants to purchase an aggregate of up to 677,358 Common Shares,

or 0.50 of a Common Share for each Common Share purchased in the

offering (the “Class B Purchase Warrants,” and together

with the Class A Purchase Warrants, the “Purchase

Warrants”). The price per Common Share and associated

Purchase Warrants was (i) $3.20 for investors other than investors

that are officers, directors, employees or consultants of the

company and (ii) $4.11 for each investor that is an officer,

director, employee or consultant of the company. The closing of the

Offering and concurrent Private Placement occurred on January 8,

2020. The Class A Purchase Warrants and Class B Purchase Warrants

will be exercisable as described in the table above. The exercise

price and number of Common Shares issuable upon the exercise of the

Purchase Warrants will be subject to adjustment in the event of any

share dividends and splits, reverse share split, recapitalization,

reorganization or similar transaction. Subject to limited

exceptions, a holder of Purchase Warrants will not have the right

to exercise any portion of its Purchase Warrants if the holder,

together with its affiliates, would beneficially own in excess of

9.99% of the number of Common Shares outstanding immediately after

giving effect to such exercise (the “Beneficial Ownership

Limitation”); provided, however, that upon 61 days’

prior notice to us, the holder may increase the Beneficial

Ownership Limitation, provided that in no event shall the

Beneficial Ownership Limitation exceed 9.99%.

Brookline

Capital Markets, a division of Arcadia Securities, LLC

(“Brookline”), acted as placement agent in the United

States in connection with the Offering and Private Placement

pursuant to a Financial Advisory Agreement between us and Brookline

dated November 5, 2019, as amended. Upon the closing of the

Offering and Private Placement, Brookline received a placement

agent fee of $207,475, which equals 6.5% of the gross proceeds from

sales arranged by Brookline (or 3.5% in the case of sales to

investors introduced by the company). Brookline did not receive any

cash placement fee with respect to non-U.S. investors. As

additional compensation, we issued to Brookline the Placement Agent

Warrants to purchase 12,364 Common Shares, which equals 1.25% of

the number of Common Shares sold in the Offering to investors

introduced by Brookline. Brookline did not receive any warrant

compensation for securities issued to non-U.S investors. The

company also reimbursed Brookline $55,000 for certain expenses

incurred by Brookline in connection with the Offering.

The

Financial Advisory Agreement provides that, for a period of nine

(9) months from the closing date of the Offering, Brookline has a

right of first refusal to act as a co-manager for any financing of

the company by means of a fully marketed public offering, with no

less than 20% of the total fees paid to the

underwriters.

We

received gross proceeds of approximately $4.36 million from

the sale of these securities, before deducting placement agent fees

and offering expenses, and excluding the exercise of any

warrants.

For

a detailed description of the transactions contemplated by the

Share Exchange Agreement, Financial Advisory Agreement, Securities

Purchase Agreement, Subscription Agreements, Purchase Warrants and

Placement Agent Warrants with the selling shareholders and the

securities issued or issuable pursuant thereto, see the section

captioned “Selling Shareholders” in this

prospectus.

We

filed the registration statement on Form S-1, of which this

prospectus forms a part, (i) to fulfill our contractual

obligations under the Securities Purchase Agreement, Subscription

Agreements and Placement Agent Warrants with the selling

shareholders to provide for the resale by the selling shareholders

of the Common Shares underlying the Purchase Warrants and Placement

Agent Warrants and (ii) to provide liquidity to certain

shareholders of the company that acquired Common Shares in our

business combination transaction with Edesa Research.

|

|

|

|

|

|

RISK FACTORS

Investing in our Common Shares involves a high degree of

risk. Investors should carefully consider the risks

described in the filings incorporated by reference in this

prospectus and any prospectus supplement, including our Annual

Report on Form 10-K for the transition period from January 1, 2019

to September 30, 2019 filed with the SEC, before deciding whether

to invest in our securities. We expect to update the risk factors

from time to time in the periodic and current reports that we file

with the SEC after the date of this prospectus. These updated risk

factors will be incorporated by reference in this prospectus. The

risks described in our filings incorporated by reference are not

the only ones we face. Our business,

financial condition and results of operations could be materially

and adversely affected by any or all of these risks or by

additional risks and uncertainties not presently known to us or

that we currently deem immaterial that may adversely affect us in

the future. In such case, the trading price of our Common

Shares could decline and you could lose all or part of your

investment. Our actual results could differ materially from those

anticipated in the forward-looking statements made throughout this

prospectus and in the documents incorporated by reference as a

result of different factors, including the risks we face described

in the filings incorporated by reference.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this

prospectus contain certain statements that constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, or Securities Act, and Section

21E of the Securities Exchange Act of 1934, as amended, or Exchange

Act. These statements involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performances or achievements expressed or

implied by the forward looking statements. These forward looking

statements include, but are not limited to, those concerning the

following:

●

our ability to fund

our planned operations and implement our business

plan;

●

the scope, number,

progress, duration, cost, results and timing of clinical trials and

nonclinical studies of our current or future product

candidates;

●

our ability to

raise sufficient funds to support the development and potential

commercialization of our product candidates;

●

the outcomes and

timing of regulatory reviews, approvals or other

actions;

●

our ability to

obtain marketing approval for our product candidates and otherwise

execute our business plan;

●

our ability to

establish and maintain licensing, collaboration or similar

arrangements on favorable terms and whether and to what extent we

retain development or commercialization responsibilities under any

new licensing, collaboration or similar arrangement;

●

the success of any

other business, product or technology that we acquire or in which

we invest;

●

our ability to

maintain, expand and defend the scope of our intellectual property

portfolio;

●

our ability to

manufacture any approved products on commercially reasonable

terms;

●

our ability to

establish a sales and marketing organization or suitable

third-party alternatives for any approved product;

●

the number and

characteristics of product candidates and programs that we

pursue;

●

the attraction and

retention of qualified employees and personnel;

●

future acquisitions

or investments in complementary companies or technologies;

and

●

our ability to

comply with evolving legal standards and regulations pertaining to

our industry.

In some cases, you can identify forward-looking statements by terms

such as “anticipates,” “believes”,

“could”, “estimates”,

“expects”, “intends”, “may”,

“plans”, “potential”,

“predicts”, “projects”,

“should”, “will”, “would” as

well as similar expressions. Forward-looking statements reflect our

current views with respect to future events, are based on

assumptions and are subject to risks, uncertainties and other

important factors. We discuss many of these risks, uncertainties

and other important factors in greater detail under the heading

“Risk Factors” contained in this prospectus and in our

most recent annual report on Form 10-K, as well as any amendments

thereto reflected in subsequent filings with the SEC. Given these

risks, uncertainties and other important factors, you should not

place undue reliance on these forward-looking statements. Also,

these forward-looking statements represent our estimates and

assumptions only as of the date such forward-looking statements are

made. Except as required by law, we assume no obligation to update

any forward-looking statements publicly, or to reflect facts and

circumstances after the date of this prospectus. Before deciding to

purchase our securities, you should carefully read this prospectus,

together with the information incorporated herein by reference as

described under the heading “Incorporation by Reference

of

Certain Documents,” completely and with the

understanding that our actual future results may be materially

different from what we expect.

This

prospectus and the documents incorporated by reference in this prospectus also refer to estimates

and other statistical data made by independent parties and by us

relating to market size and growth and other data about our

industry. This data involves a number of assumptions and

limitations, and you are cautioned not to give undue weight to such

estimates. In addition, projections, assumptions and estimates of

our future performance and the future performance of the markets in

which we operate are necessarily subject to a high degree of

uncertainty and risk.

USE OF PROCEEDS

We will not receive any proceeds from the resale of our Common

Shares by the selling shareholders. We cannot predict when or if

the Purchase Warrants or Placement Agent Warrants will be

exercised, and it is possible that the Purchase Warrants and/or

Placement Agent Warrants may expire and never be exercised. Any

proceeds received by us from the exercise of such warrants will be

used for general corporate purposes, which may include working

capital, capital expenditures, and research and development

expenses.

We have not yet determined the amount of net proceeds to be used

specifically for any of the foregoing purposes. Accordingly, our

management will have significant discretion and flexibility in

applying the net proceeds from the exercise of the Purchase

Warrants and/or Placement Agent Warrants. Pending any use, as

described above, we intend to invest the net proceeds in

high-quality, short-term, interest-bearing securities.

The selling shareholders will pay any discounts, commissions, fees

of underwriters, selling brokers or dealer managers and expenses

incurred by the selling shareholders for brokerage, accounting, tax

or legal services or any other expenses incurred by the selling

shareholders in disposing of the shares. We will bear all other

costs, fees and expenses incurred in effecting the registration of

the shares covered by this prospectus, including, without

limitation, all registration and filing fees, printing fees, Nasdaq

listing fees and fees and expenses of our counsel and our

accountants.

SELLING SHAREHOLDERS

Description of Transactions with Selling Shareholders

Description of Business Combination Transaction

On June 7, 2019, we completed a business combination with Edesa

Biotech Research, Inc., formerly known as Edesa Biotech Inc.

(“Edesa Research”), a company organized under the laws

of the province of Ontario, in accordance with the terms of a Share

Exchange Agreement, dated March 7, 2019, by and among us, Edesa

Research and the shareholders of Edesa Research. At the closing of

the transaction, we acquired the entire issued share capital of

Edesa Research, with Edesa Research becoming a wholly owned

subsidiary of ours. Also on June 7, 2019, in connection with and

following the completion of the business combination, we effected a

1-for-6 reverse split of our Common Shares and changed our name to

“Edesa Biotech, Inc.” At the closing of the

transaction, the Edesa Research shareholders exchanged their shares

for 88% of our outstanding shares on a fully diluted

basis.

At the closing of the transaction, the Edesa Research shareholders

received 6,249,780 of our Common Shares in exchange for the capital

shares of Edesa Research and the holders of unexercised Edesa

Research share options immediately prior to the closing of the

transaction were issued replacement share options

(“Replacement Options”) to purchase an aggregate of

297,422 of our Common Shares. On July 26, 2019, pursuant to

the post-closing adjustment contemplated by the Share Exchange

Agreement, we issued an additional 366,234 of our Common Shares to

the Edesa Research shareholders and the holders of unexercised

Edesa Research stock options immediately prior to the closing of

the transaction were issued 17,701 additional Replacement Options

to purchase our Common Shares. Following the completion of the

transactions contemplated by the Share Exchange Agreement and the

reverse split, there were approximately 7,504,468, of our Common

Shares issued and outstanding and approximately 7,876,292 of our

Common Shares outstanding on a fully-diluted basis, and the former

Edesa Research shareholders and option holders owned approximately

6,931,137 of our Common Shares on a fully-diluted basis, or 88% of

our Common Shares on a fully-diluted basis, and our shareholders

and option holders prior to the transactions contemplated by the

Share Exchange Agreement owned approximately 945,155 of our Common

Shares on a fully-diluted basis, or 12% of our Common Shares on a

fully-diluted basis. 1,897,030 Common Shares acquired by the Edesa

Research shareholders in the business combination transaction are

being registered for resale under this prospectus.

Description of Offering and Private Placement with Selling

Shareholders

On January 6, 2020, we entered into a Securities Purchase Agreement

(the “Securities Purchase Agreement”) with certain

United States resident investors and Subscription Agreements (the

“Subscription Agreements”) with certain non-U.S.

investors providing for the issuance and sale by us of an

aggregate of 1,354,961 of our Common Shares, in a registered direct

offering (the “Offering”). In a concurrent private

placement (the “Private Placement”), we agreed to sell

to such investors (i) Class A Purchase Warrants to purchase an

aggregate of up to 1,016,036 Common Shares, or 0.75 of a Common

Share for each Common Share purchased in the Offering (the

“Class A Purchase Warrants”), and (ii) Class B Purchase

Warrants to purchase an aggregate of up to 677,358 Common Shares,

or 0.50 of a Common Share for each Common Share purchased in the

offering (the “Class B Purchase Warrants,” and together

with the Class A Purchase Warrants, the “Purchase

Warrants”). The price per Common Share and associated

Purchase Warrants was (i) $3.20 for investors other than investors

that are officers, directors, employees or consultants of the

company and (ii) $4.11 for each investor that is an officer,

director, employee or consultant of the company. The closing of the

Offering and concurrent Private Placement occurred on January 8,

2020. The Class A Purchase Warrants and Class B Purchase Warrants

will be exercisable as described under the heading

“The Offering” on page 3. The exercise

price and number of Common Shares issuable upon the exercise of the

Purchase Warrants will be subject to adjustment in the event of any

share dividends and splits, reverse share split, recapitalization,

reorganization or similar transaction. Subject to limited

exceptions, a holder of Purchase Warrants will not have the right

to exercise any portion of its Purchase Warrants if the holder,

together with its affiliates, would beneficially own in excess of

9.99% of the number of Common Shares outstanding immediately after

giving effect to such exercise (the “Beneficial Ownership

Limitation”); provided, however, that upon 61 days’

prior notice to us, the holder may increase the Beneficial

Ownership Limitation, provided that in no event shall the

Beneficial Ownership Limitation exceed 9.99%.

Brookline Capital Markets, a division of Arcadia Securities, LLC

(“Brookline”), acted as placement agent in the United

States in connection with the Offering and Private Placement

pursuant to a Financial Advisory Agreement between us and Brookline

dated November 5, 2019, as amended. Upon the closing of the

Offering and Private Placement, Brookline received a placement

agent fee of $207,475, which equals 6.5% of the gross proceeds from

sales arranged by Brookline (or 3.5% in the case of sales to

investors introduced by the company). Brookline did not receive any

cash placement fee with respect to non-U.S. investors. As

additional compensation, we issued to Brookline the Placement Agent

Warrants to purchase 12,364 Common Shares, which equals 1.25% of

the number of Common Shares sold in the Offering and concurrent

Private Placement to investors introduced by Brookline. Brookline

did not receive any warrant compensation for securities issued to

non-U.S investors. The company also reimbursed Brookline $55,000

for certain expenses incurred by Brookline in connection with the

Offering.

The Financial Advisory Agreement provides that, for a period of

nine (9) months from the closing date of the Offering, Brookline

has a right of first refusal to act as a co-manager for any

financing of the company by means of a fully marketed public

offering, with no less than 20% of the total fees paid to the

underwriters.

We received gross proceeds of approximately $4.36 million from

the sale of these securities, before deducting placement agent fees

and offering expenses, and excluding the exercise of any

warrants.

We filed the registration statement on Form S-1, of which this

prospectus forms a part, (i) to fulfill our contractual

obligations under the Securities Purchase Agreement, Subscription

Agreements and Placement Agent Warrants with the selling

shareholders to provide for the resale by the selling shareholders

of the Common Shares underlying the Purchase Warrants and Placement

Agent Warrants and (ii) to provide liquidity to certain

shareholders of the company that acquired Common Shares in our

business combination transaction with Edesa Research.

The resale registration statement, of which this prospectus is a

part, when declared effective by the SEC, permits the resale into

the market from time to time over an extended period of the Common

Shares underlying the Purchase Warrants and Placement Agent

Warrants and the resale of a portion of the Common Shares held by

certain of the selling shareholders that were acquired in our

business combination transaction with Edesa Research.

When we refer to the selling shareholders in this prospectus, we

mean those persons listed in the table below, as well as the

permitted transferees, pledgees, donees, assignees, successors and

others who later come to hold any of the selling

shareholders’ interests other than through a public

sale.

The selling shareholders may from time to time offer and sell

pursuant to this prospectus any or all of the Common Shares set

forth in the following table. There is no requirement for the

selling shareholders to sell their shares, and we do not know when,

or if, or in what amount the selling shareholders may offer the

Common Shares for sale pursuant to this prospectus.

The table below has been prepared based on the information

furnished to us by the selling shareholders as of February 7, 2020.

The selling shareholders identified below may have sold,

transferred or otherwise disposed of some or all of their shares

since the date on which the information in the following table is

presented in transactions exempt from or not subject to the

registration requirements of the Securities Act. Information

concerning the selling shareholders may change from time to time

and, if necessary, we will supplement this prospectus accordingly.

We are unable to confirm whether the selling shareholders will in

fact sell any or all of their Common Shares.

To our knowledge and except as noted below, none of the selling

shareholders has, or within the past three years has had, any

material relationships with us or any of our affiliates. Each

selling shareholder who is also an affiliate of a broker dealer, as

noted below, has represented that: (1) the selling shareholder

purchased in the ordinary course of business and (2) at the time of

purchase of the securities being registered for resale, the selling

shareholder had no agreements or understandings, directly or

indirectly, with any person to distribute the

securities.

Beneficial ownership for the purposes of this table is determined

in accordance with the rules and regulations of the SEC. These

rules generally provide that a person is the beneficial owner

of securities if such person has or shares the power to vote or

direct the voting thereof, or to dispose or direct the disposition

thereof or has the right to acquire such powers within 60 days.

Common Shares subject to options or warrants that are currently

exercisable or exercisable within 60 days of February 21, 2020, are

deemed to be outstanding and beneficially owned by the person

holding the options or warrants. These shares, however, are not

deemed outstanding for the purposes of computing the percentage

ownership of any other person.

Percentage of beneficial ownership is based on 8,859,159 common

shares outstanding as of February 21, 2020.

|

|

Common Shares

Beneficially Owned Prior to Offering

|

|

Common Shares

Beneficially Owned After Offering

|

|

Selling

Shareholders

|

|

|

Number of

Common Shares Being Offered

|

|

|

|

Firstfire Global

Opportunities Fund LLC (1)

|

68,360

|

*

|

68,360

|

-

|

-

|

|

KBB Asset

Management (2)

|

105,470

|

1.2%

|

58,595

|

46,875

|

*

|

|

RRSJ Associates

(3)

|

105,470

|

1.2%

|

58,595

|

46,875

|

*

|

|

Laurence Lytton

(4)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

Warberg WF VII LP

(5)

|

28,125

|

*

|

15,625

|

12,500

|

*

|

|

William Cassano

(6)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Intracoastal

Capital LLC (7)

|

78,125

|

*

|

78,125

|

-

|

-

|

|

Robert Masters

(8)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

AG Family LP

(9)

|

140,625

|

1.6%

|

78,125

|

62,500

|

*

|

|

Pichon Family Trust

(10)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Lagom LLC

(11)

|

140,625

|

1.6%

|

78,125

|

62,500

|

*

|

|

Michael Mullins

(12)

|

10,548

|

*

|

5,860

|

4,688

|

*

|

|

Josiah Austin

(13)

|

70,312

|

*

|

39,062

|

31,250

|

*

|

|

Craig Effron

(14)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Bruce Conway

(15)

|

63,282

|

*

|

35,157

|

28,125

|

*

|

|

Stephen Mut

(16)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Jennifer A.

Duncan’s Inheritors Trust (17)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Nicholas Finegold

(18)

|

105,470

|

1.2%

|

58,595

|

46,875

|

*

|

|

YJP International

Limited (19)

|

56,250

|

*

|

31,250

|

25,000

|

*

|

|

Starlight

Investment Holdings Limited (20)

|

84,375

|

*

|

46,875

|

37,500

|

*

|

|

James Clancey

(21)

|

14,063

|

*

|

7,813

|

6,250

|

*

|

|

John Moore

(22)

|

17,580

|

*

|

9,767

|

7,813

|

*

|

|

Tomsat Investment

& Trading Co. Inc. (23)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

Stanford Ventures

LLC (24)

|

175,782

|

2.0%

|

97,657

|

78,125

|

*

|

|

Bigger Capital

Fund, LP (25)

|

58,595

|

1.2%

|

58,595

|

-

|

-

|

|

Hill Blalock, Jr.

(26)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

VI LLC

(27)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

Catalysis Partners,

LLC (28)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

Lee Revocable Trust

(29)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Joel Levine

(30)

|

17,813

|

*

|

7,813

|

10,000

|

*

|

|

William Nimrod

(31)

|

14,063

|

*

|

7,813

|

6,250

|

*

|

|

The Hewett Fund LP

(32)

|

88,595

|

*

|

58,595

|

30,000

|

*

|

|

Richard Maulit

(33)

|

7,032

|

*

|

3,907

|

3,125

|

*

|

|

Lorin Johnson

(34)

|

23,361

|

*

|

10,655

|

12,706

|

*

|

|

Frank and Dorothy

Oakes Family Trust (35)

|

14,040

|

*

|

1,523

|

12,517

|

*

|

|

Kathi Niffenegger

Trust (36)

|

37,289

|

*

|

1,523

|

35,766

|

*

|

|

Gary Koppenjan

(37)

|

20,219

|

*

|

1,523

|

18,696

|

*

|

|

Lumira Capital II,

L.P. (38)

|

2,154,874

|

23.9%

|

672,208

|

1,482,666

|

14.0%

|

|

Lumira Capital II

(International), L.P. (39)

|

199,262

|

2.2%

|

62,160

|

137,102

|

1.3%

|

|

Jeff McLean

(40)

|

140,625

|

1.6%

|

78,125

|

62,500

|

*

|

|

Bruce and Bonny

Jean MacDonald (41)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

James Gary Paterson

(42)

|

70,313

|

*

|

39,063

|

31,250

|

*

|

|

10379085 Canada

Inc. (43)

|

710,375

|

8.0%

|

222,098

|

488,277

|

4.6%

|

|

2248618 Ontario

Inc. (44)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Caitlin McCain

(45)

|

10,548

|

*

|

5,860

|

4,688

|

*

|

|

K. Jessa Medicine

Prof. Corporation (46)

|

14,063

|

*

|

7,813

|

6,250

|

*

|

|

Michael Brooks

(47)

|

188,227

|

2.1%

|

2,285

|

185,942

|

1.7%

|

|

York-Cav

Enterprises Inc. (48)

|

9,663

|

*

|

3,045

|

6,618

|

*

|

|

Geoffrey Christie

(49)

|

21,467

|

*

|

9,760

|

11,707

|

*

|

|

Paul Pay

(50)

|

38,463

|

*

|

3,045

|

35,418

|

*

|

|

Ronnie Tarter

(51)

|

14,063

|

*

|

7,813

|

6,250

|

*

|

|

Kassum Properties

Canada Limited (52)

|

35,157

|

*

|

19,532

|

15,625

|

*

|

|

Sean

McDonald (53)

|

18,551

|

*

|

4,311

|

14,240

|

*

|

|

Inveready

Innvierte Biotech II, S.C.R. S.A. (54)

|

531,986

|

6.0%

|

159,596

|

372,390

|

3.5%

|

|

Pardeep Nijhawan

Medical Professional Corporation (55)

|

2,127,594

|

24.0%

|

643,601

|

1,483,993

|

14.0%

|

|

Pardeep

Nijhawan (56)

|

580,287

|

6.5%

|

161,194

|

419,093

|

4.0%

|

|

The

Digestive Health Clinic Inc. (57)

|

224,094

|

2.5%

|

67,229

|

156,865

|

1.5%

|

|

1968160

Ontario Inc. (58)

|

371,727

|

4.2%

|

111,519

|

260,208

|

2.5%

|

|

William

Buchanan, Jr. (59)

|

2,312

|

*

|

2,312

|

-

|

-

|

|

Harris

Lydon (60)

|

4,064

|

*

|

4,064

|

-

|

-

|

|

Scott

A. Katzmann (61)

|

2,196

|

*

|

2,196

|

-

|

-

|

|

Graham

Powis (62)

|

1,541

|

*

|

1,541

|

-

|

-

|

|

Andrew

Daniels (63)

|

1,360

|

*

|

1,360

|

-

|

-

|

|

Patrick

Sturgeon (64)

|

205

|

*

|

205

|

-

|

-

|

|

Westley

McGeoghegan (65)

|

293

|

*

|

293

|

-

|

-

|

|

Dan

Weston (66)

|

293

|

*

|

293

|

-

|

-

|

|

Henry

Moore (67)

|

53

|

*

|

53

|

-

|

-

|

|

Matthew

Hoban (68)

|

47

|

|

47

|

-

|

-

|

(1)

Consists of (i)

41,016 Common Shares issuable upon

exercise of Class A Warrants; and (ii) 27,344

Common Shares issuable upon exercise

of Class B Warrants. Eli Fireman, as Managing Member of

Firstfire Global Opportunities Fund LLC, has sole voting and

dispositive

power over all such shares.

(2)

Consists of (i)

46,875 Common Shares; (ii) 35,157 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 23,438 Common Shares issuable upon exercise of

Class B Warrants. Steven Segal, as Managing Member, has sole

control and investment direction over the reported securities that

are held by KBB Asset Management. As a result, Steven Segal may be

deemed to have beneficial ownership over such

securities.

(3)

Consists of (i)

46,875 Common Shares; (ii) 35,157 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 23,438 Common Shares issuable upon exercise of

Class B Warrants. Ralph Finerman, as Partner, has sole voting and

dispositive

power over all such shares.

(4)

Consists of (i)

31,250 Common Shares; (ii) 23,438 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 15,625 Common Shares issuable upon exercise of

Class B Warrants.

(5)

Consists of (i)

12,500 Common Shares; (ii) 9,375 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 6,250 Common Shares issuable upon exercise of

Class B Warrants. Daniel Warsh, as manager, has sole voting and

dispositive

power over all such shares.

(6)

Consists of (i)

15,625 Common Shares; (ii) 11,719 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 7,813 Common Shares issuable upon exercise of

Class B Warrants.

(7)

Consists of (i)

46,875 Common Shares issuable upon

exercise of Class A Warrants; and (ii) 31,250 Common Shares issuable upon exercise of

Class B Warrants. Mitchell P. Kopin and Daniel B. Asher, each of

whom are managers of Intracoastal Capital LLC

(“Intracoastal”), have shared voting and investment

discretion over the securities reported herein that are held by

Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be

deemed to have beneficial ownership (as determined under Section

13(d) of the Securities Exchange Act of 1934, as amended) of the

securities reported herein that are held by

Intracoastal.

(8)

Consists of (i)

31,250 Common Shares; (ii) 23,438 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 15,625 Common Shares issuable upon exercise of

Class B Warrants.

(9)

Consists of (i)

62,500 Common Shares; (ii) 46,875 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 31,250 Common Shares issuable upon exercise of

Class B Warrants. Thomas Satterfield, Jr., as managing partner of

the general partner of AG Family LP, has sole voting and

dispositive

power over all such shares.

(10)

Consists of (i)

15,625 Common Shares; (ii) 11,719 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 7,813 Common Shares issuable upon exercise of

Class B Warrants. Wayne M. Pichon, as trustee of the Pichon Family

Trust, has sole voting and dispositive power over

all such shares.

(11)

Consists of (i)

62,500 Common Shares; (ii) 46,875 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 31,250 Common Shares issuable upon exercise of

Class B Warrants. Ray Nimrod and Marika Lindholm, as managing

members of Lagom, LLC, exercise shared voting and dispositive power over

all such shares.

(12)

Consists of (i)

4,688 Common Shares; (ii) 3,516 Common

Shares issuable upon exercise of Class A Warrants; and (iii)

2,344 Common Shares issuable upon

exercise of Class B Warrants.

(13)

Consists of (i)

31,250 Common Shares; (ii) 23,437 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 15,625 Common Shares issuable upon exercise of

Class B Warrants.

(14)

Consists of (i)

15,625 Common Shares; (ii) 11,719 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 7,813 Common Shares issuable upon exercise of

Class B Warrants.

(15)

Consists of (i)

28,125 Common Shares; (ii) 21,094 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 14,063 Common Shares issuable upon exercise of

Class B Warrants.

(16)

Consists of (i)

15,625 Common Shares; (ii) 11,719 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 7,813 Common Shares issuable upon exercise of

Class B Warrants.

(17)

Consists of (i)

15,625 Common Shares; (ii) 11,719 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 7,813 Common Shares issuable upon exercise of

Class B Warrants. Jennifer Duncan, as trustee, has sole voting and

dispositive

power over all such shares.

(18)

Consists of (i)

46,875 Common Shares; (ii) 35,157 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 23,438 Common Shares issuable upon exercise of

Class B Warrants.

(19)

Consists of (i)

25,000 Common Shares; (ii) 18,750 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 12,500 Common Shares issuable upon exercise of

Class B Warrants. Young Soo Park, as Director of YJP International

Limited, has sole voting and dispositive power over

all such shares.

(20)

Consists of (i)

37,500 Common Shares; (ii) 28,125 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 18,750 Common Shares issuable upon exercise of

Class B Warrants. Nicola Hodge, as Director of Starlight Investment

Holdings Limited, has sole voting and dispositive power over

all such shares.

(21)

Consists of (i)

6,250 Common Shares; (ii) 4,688 Common

Shares issuable upon exercise of Class A Warrants; and (iii)

3,125 Common Shares issuable upon

exercise of Class B Warrants.

(22)

Consists of (i)

7,813 Common Shares; (ii) 5,860 Common

Shares issuable upon exercise of Class A Warrants; and (iii)

3,907 Common Shares issuable upon

exercise of Class B Warrants.

(23)

Consists of (i)

31,250 Common Shares; (ii) 23,438 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 15,625 Common Shares issuable upon exercise of

Class B Warrants. Thomas Satterfield, Jr., as President, has sole

voting and dispositive power over

all such shares.

(24)

Consists of (i)

78,125 Common Shares; (ii) 58,594 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 39,063 Common Shares issuable upon exercise of

Class B Warrants. Hartley Wasko, as VP, has sole voting and

dispositive

power over all such shares.

(25)

Consists of (i)

35,157 Common Shares issuable upon

exercise of Class A Warrants; and (ii) 23,438 Common Shares issuable upon exercise of

Class B Warrants. Michael Bigger, as managing member of the general

partner of Bigger Capital Fund LP, has sole voting and dispositive power over

all such shares.

(26)

Consists of (i)

15,625 Common Shares; (ii) 11,719 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 7,813 Common Shares issuable upon exercise of

Class B Warrants.

(27)

Consists of (i)

31,250 Common Shares; (ii) 23,438 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 15,625 Common Shares issuable upon exercise of

Class B Warrants. Timothy Cohen, as managing member, has sole

voting and dispositive power over

all such shares.

(28)

Consists of (i)

31,250 Common Shares; (ii) 23,438 Common Shares issuable upon exercise of

Class A Warrants; and (iii) 15,625 Common Shares issuable upon exercise of