Current Report Filing (8-k)

February 21 2020 - 9:08AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 21, 2020 (February 20, 2020)

iBio,

Inc.

(Exact name of registrant as specified in

its charter)

Delaware

(State or jurisdiction of incorporation

or organization)

001-35023

(Commission File Number)

26-2797813

(I.R.S. Employer Identification Number)

600 Madison Avenue, Suite 1601,

New York, NY 10022-1737

(Address of principal executive offices

(Zip Code)

Registrant's telephone number: (302) 355-0650

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Ticker symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

IBIO

|

|

NYSE American

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On February 20, 2020, iBio, Inc., a Delaware

corporation (the “Company”), entered into a warrant exchange and amendment agreement (the “Exchange Agreement”)

with certain holders (the “Holders”) of the Company’s Series A warrants (the “Original Series A Warrants”)

to purchase shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) and Series

B warrants (the “Original Series B Warrants”) to purchase shares of Common Stock, each of which were issued in the

Company’s underwritten offering of securities of October 28, 2019.

Pursuant to the Exchange Agreement, the

Holders agreed to exchange Original Series A Warrants and Original Series B Warrants to purchase an aggregate of 15,000,000 shares

of Common Stock for (i) an aggregate of 15,000,000 shares of newly-issued Common Stock and (ii) promissory notes (the “Notes”)

in the aggregate principal amount of $3.3 million. The Holders further agreed to amendments to the remaining, unexchanged Original

Series A Warrants and Original Series B Warrants as described below (as amended, the “New Series A Warrants” and “New

Series B Warrants,” respectively, and collectively, the “New Warrants”). Following the Exchange Agreement, there

will be an aggregate of New Warrants to purchase 9,595,000 shares of Common Stock.

The Notes do not bear interest except in

the case of default and are payable in full on the earlier to occur of (i) August 20, 2020, or (ii) completion of an underwritten

offering of securities by the Company resulting in gross proceeds of at least $10 million.

The New Warrants were amended to remove

all price protection anti-dilution provisions from the Original Series A Warrants and Original Series B Warrants. The New Series

B Warrants were also amended to provide that if there is a registration statement that covers the resale of the shares underlying

the New Series B Warrants and other conditions are satisfied, the Company has the option to “call” for the cancellation

of any or all of the New Series B Warrants, from time to time, by giving a call notice to the holder only after any 20-consecutive

trading day period (the “Measurement Period”) during which the daily weighted average price of the Common Stock is

not less than $1.00 during 10 of such trading days during the Measurement Period and the daily dollar trading volume of our Common

Stock equals or exceeds $50,000 on each trading day during the Measurement Period.

The foregoing descriptions of the terms

of the New Series A Warrants, New Series B Warrants, Notes and Exchange Agreement do not purport to be complete and are subject

to, and qualified in their entirety by reference to, such instruments and agreements, which are filed herewith as Exhibit 4.1,

Exhibit 4.2, Exhibit 4.3 and Exhibit 10.1, respectively, and are incorporated herein by reference.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

Reference is made to the disclosure set

forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The shares of Common Stock and the Notes

issued pursuant to the Exchange Agreement were offered and sold in reliance upon the exemption from registration pursuant to Section

4(a)(2) of the Securities Act. The Company made this determination based on the representations of the Holders which included,

in pertinent part, that each Holder is an “accredited investor” within the meaning of Rule 501 of Regulation D.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

*Filed herewith.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

IBIO INC.

|

|

|

|

|

|

|

|

Date: February 21, 2020

|

By:

|

/s/

Robert B. Kay

|

|

|

|

Robert B. Kay

|

|

|

|

Executive Chairman and CEO

|

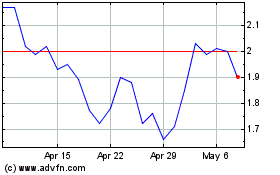

iBio (AMEX:IBIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

iBio (AMEX:IBIO)

Historical Stock Chart

From Apr 2023 to Apr 2024