Current Report Filing (8-k)

February 20 2020 - 6:01AM

Edgar (US Regulatory)

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 16, 2020

MCTC HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

333-146404

|

|

99-0539775

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

520 S. Grand

Ave, Suite 320

|

|

90071

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (310) 986-4929

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbols

|

Name of Exchange on Which Registered

|

|

Common

|

MCTC

|

None

|

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Section 1 - Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On

February 16, 2020, the Registrant entered into a material definitive agreement (“Agreement”) not made in the ordinary

course of its business. The parties to the Agreement are the Registrant and Lelantos Biotech, Inc., a Wyoming corporation (“Lelantos”),

Ma Helen M. Am Is, Inc., a Wyoming corporation (“Helen M.”),

East West Pharma Group, Inc., a Wyoming corporation (“East West”),

and New Horizons Laboratory Services, Inc., a Wyoming corporation (“New Horizons”). There

is no material relationship between the Registrant or its affiliates

and Lelantos, Helen M., East West, New Horizons, or any of their respective affiliates, other than in respect of the material definitive

agreement.

The terms and conditions of

the Agreement require the Registrant to issue 400,000 shares of its common stock to Lelantos, and separately, an aggregate of $500,000

in the form of notes payable as follows: $225,000 to Helen M.; $50,000 to East West, $225,000 to New Horizons. The notes are due

and payable as follows:

(1) The note to Helen M. is

due on June 15, 2020. In the event Registrant defaults on the note, the outstanding amount of principal and interest due converts

into 6.75% of the total issued and outstanding shares of Registrant on the maturity date.

(2) The note to East West is

due on May 31, 2020 with an interest rate 5% per annum. If Registrant defaults on the note, the interest rate increases to 10%.

If Registrant fails to pay by August 30, 2020, the total amount of principal and interest shall be converted into a 1.5% fully

diluted ownership of Registrant’s issued and outstanding common shares.

(3) The note to New Horizons

is due on May 31, 2020 with an interest rate of 15% per annum. If Registrant defaults on the note, the outstanding amount of principal

and interest due converts into 6.75% of the total issued and outstanding shares of Registrant on the maturity date.

In exchange for the foregoing

consideration, the Registrant is obtaining all right, title and interest in certain trade secrets, intellectual property rights

and research and development, in unique hemp infusion technologies, exotic cannabinoids and nano-fibers that may increase bioavailability

and absorption.

Section 9 – Financial Statement

and Exhibits

Item 9.01 Financial Statements and

Exhibits

|

Exhibit No.

|

Document

|

|

Location

|

|

|

|

|

|

|

10.1

|

Lelantos Biotech, Inc. Acquisition Agreement

|

|

Filed Herewith

|

|

10.2

|

Ma Helen M. Am Is, Inc. Acquisition Note

|

|

Filed Herewith

|

|

10.3

|

New Horizons Laboratory Services, Inc. Acquisition Note

|

|

Filed Herewith

|

|

10.4

|

East West Pharma Group, Inc. Acquisition Note

|

|

Filed Herewith

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Dated February 19, 2020

MCTC HOLDINGS, INC.

By: /s/ Arman Tabatabaei

Arman Tabatabaei

(Principal Executive Officer)

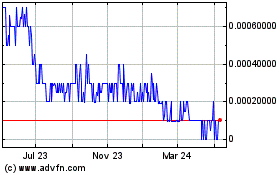

Cannabis Global (PK) (USOTC:CBGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

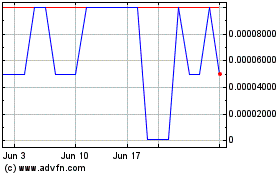

Cannabis Global (PK) (USOTC:CBGL)

Historical Stock Chart

From Apr 2023 to Apr 2024