Maersk Warns of Lower Earnings Amid Coronavirus Hit -- Update

February 20 2020 - 3:58AM

Dow Jones News

--Maersk sees lower earnings in year ahead

--Coronavirus epidemic hitting demand and rates

--Vessel work delayed amid Chinese factory shutdowns

By Dominic Chopping

Danish shipping giant A.P. Moeller-Maersk AS on Thursday

reported weaker-than-expected fourth-quarter results and warned

that earnings this year will be lower than 2019 as coronavirus

dampens demand and hits freight rates.

Fear of the virus and the efforts to prevent its spread will see

increasing pressure on the supply-demand balance and could dampen

2020 volumes, due to the extension of the Chinese New Year holidays

and emergency measures to curb the infection's spread, Maersk

said.

"It is still early days to measure the overall impact, however,

the weekly container vessel calls at key Chinese ports were

significantly down compared with last year during the last weeks of

January and the first weeks of February," the company said.

Freight rates are expected to decrease due to dropping demand

for containerized goods transport, while the epidemic has led to

delays in opening of Chinese shipping yards following the Chinese

New Year holidays, which has delayed yard works planned, including

some planned installations of scrubbers on Maersk vessels.

Maersk swung to an unexpected net loss in the quarter of $72

million from a profit of $46 million in the year-earlier period. A

FactSet analyst poll had expected a net profit of $343 million.

Though it said that figures are materially impacted by implementing

the IFRS 16 accounting standard and 2019 figures aren't comparable

with last year.

Maersk, which is considered a barometer of global trade,

reported a revenue fall of 5.6% to $9.67 billion, missing

expectations of $9.94 billion, as its shipping unit lowered

capacity to adjust to market conditions.

For the full year, Ebitda rose to $5.71 billion, meeting the

company's own guidance of between $5.4 billion and $5.8 billion,

but it expects to report lower Ebitda this year of around $5.5

billion.

The company's main shipping unit saw revenue fall as volumes

dropped 1.8% while freight rates slipped 0.4%. Maersk said it

continued to cut its cost base at the unit while lower fuel prices

also helped offset some of the weakness.

Volumes were hit in both East-West and North-South routes, amid

continued slower growth in the U.S. and front loading of orders in

the same quarter last year ahead of anticipated tariffs, lower

demand in Europe, continued weak demand in Latin America, and

weakened market conditions in West and Central Asia and

Oceania.

Maersk said the outlook and guidance for 2020 is subject to

significant uncertainties and impacted by the coronavirus, which

has significantly lowered visibility on what to expect in 2020.

"As factories in China are closed for longer than usual in

connection with the Chinese New Year and as a result of the

Covid-19, we expect a weak start to the year," the company

said.

The organic-volume growth in its main ocean unit is expected to

be in line with or slightly lower than the estimated 2020 average

market growth of 1% to 3%.

Accumulated gross capex for 2020-21 is still expected to be $3.0

billion-$4.0 billion.

Maersk declared an unchanged full-year dividend of 150 Danish

kroner ($0.14).

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

February 20, 2020 03:43 ET (08:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

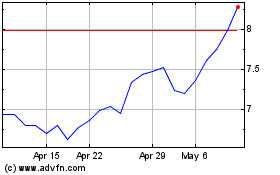

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

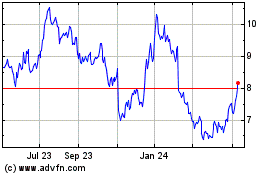

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2023 to Apr 2024