Anglo American Beats Market Views With Flat Net Profits in 2019

February 20 2020 - 2:53AM

Dow Jones News

By Adriano Marchese

Anglo American Plc said Thursday that net profit remained flat

in 2019 but beat analysts' forecasts, benefiting from higher

revenue in the year.

For the year ended Dec. 31, the diversified mining company said

it made a profit of $3.55 billion, unchanged from the prior year's

$3.55 billion. This compares with the consensus estimate of $3.42

billion, compiled from the forecasts of 14 analysts on FactSet.

Underlying earnings before interest, taxes, depreciation and

amortization--Anglo American's preferred metric, which strips out

certain one-off items--rose 9.2% to $10.01 billion, from $9.16

billion. This also beat consensus, compiled from 19 analysts'

forecast on FactSet, which had pegged this figure at $9.84

billion.

Revenue for the year rose 8.2% to $29.87 billion. Consensus for

revenue was $29.29 billion, taken from FactSet based on the

forecasts of 17 analysts.

Underlying Ebitda from Anglo American's majority-owned diamond

business De Beers fell by 55% to $558 million, the company said,

harmed by lower sales volumes and a lower value sales mix.

Moreover, the company said there was a 13% decline in production as

a response to weaker demand.

The company declared a final dividend of 47 cents per share,

bringing to total to $1.09. This compares with last year's dividend

of $1.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

February 20, 2020 02:38 ET (07:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

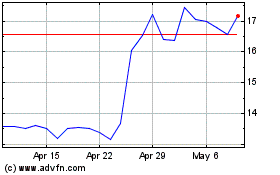

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

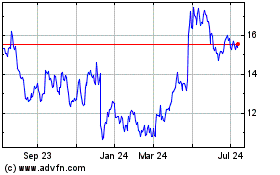

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024