|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On February 18, 2020, i3 Verticals, LLC (“i3 LLC”), a subsidiary of i3 Verticals, Inc. (“i3 Inc.,” and together with i3 LLC, the “Companies”), issued $138 million aggregate principal amount of 1.00% Exchangeable Senior Notes due 2025 (the “Notes”), which includes the full exercise and purchase of $18 million aggregate principal amount of Notes by the Initial Purchasers (as defined below) pursuant to a right to purchase additional Notes. The Notes are guaranteed solely by i3 Inc. The Notes bear interest at a fixed rate of 1.00% per year, payable semiannually in arrears on February 15 and August 15 of each year, beginning on August 15, 2020.

The Notes are exchangeable into cash, shares of i3 Inc.’s Class A common stock, $0.0001 par value per share (“Class A common stock”), or a combination of cash and Class A common stock, at i3 LLC’s election. The Notes mature on February 15, 2025, unless earlier exchanged, redeemed or repurchased. In connection with the offering, i3 LLC and i3 Inc. entered into a Purchase Agreement dated February 12, 2020, with BofA Securities, Inc., as representative of the several initial purchasers named therein (the “Initial Purchasers”). The Notes were sold by the Initial Purchasers to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”).

The net proceeds from the sale of the Notes were approximately $133.1 million (including the proceeds from the Initial Purchasers exercise in full of their right to purchase additional Notes), after deducting discounts and commissions to the Initial Purchasers and other estimated fees and expenses. i3 LLC intends to use a portion of the net proceeds of the offering to pay down outstanding borrowings under its senior secured credit facility in connection with the effectiveness of the operative provisions of the Amendment (as defined below) to the Credit Agreement (as defined below) and to pay the cost of the Note Hedge Transactions (as defined below) (such cost net of the proceeds received by i3 Inc. upon sale of the warrant transactions described below).

Amendment to Senior Credit Facility

Concurrently with the issuance of the Notes, on February 18, 2020, i3 LLC entered into a second amendment (the “Amendment”) to its Amended and Restated Credit Agreement, dated as of May 9, 2019, by and among i3 LLC, as the borrower, i3 Inc. and certain subsidiaries of i3 Inc., as guarantors, the lenders party thereto, and Bank of America, N.A., as administrative agent for the lenders, as theretofore amended (the “Credit Agreement”). The Credit Agreement provides a revolving credit facility (the “Revolving Credit Facility”) in the principal amount of $300 million (prior to the effectiveness of the Amendment) and an option to increase the Revolving Credit Facility and/or obtain incremental term loans in an additional principal amount of up to $50 million in the aggregate (subject to the receipt of additional commitments for any such incremental credit extensions).

Effective upon the issuance of the Notes, the Amendment provides for, among other things:

|

|

1.

|

the amendment of various covenants to permit:

|

|

|

a.

|

the issuance of exchangeable notes, including the Notes;

|

|

|

b.

|

call spread hedging (option and warrant) transactions in connection with the issuance of exchangeable notes, including the Notes, and the exercise of the Companies’ rights and the performance of the Companies’ obligations in connection with those transactions; and

|

|

|

c.

|

the payment and settlement of exchangeable notes, including the Notes, and related call spread hedging (option and warrant) transactions;

|

|

|

2.

|

an increase in the maximum permitted level of i3 Inc.’s consolidated total leverage ratio;

|

|

|

3.

|

replacement of i3 Inc.’s consolidated senior leverage ratio with a consolidated senior secured leverage ratio;

|

|

|

4.

|

a change in the manner of calculation of i3 Inc.’s consolidated interest coverage ratio;

|

|

|

5.

|

a decrease in the maximum amount of the Revolving Credit Facility to $275 million; and

|

|

|

6.

|

certain permitted uses of the proceeds of the Revolving Credit Facility in connection with the Notes.

|

The foregoing description of the Amendment is qualified in its entirety by reference to the Amendment, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

Indenture

i3 LLC issued the Notes pursuant to an Indenture, dated as of February 18, 2020 (the “Indenture”), among i3 LLC, i3 Inc. and U.S. Bank National Association, as trustee.

Prior to August 15, 2024, the Notes will be exchangeable only upon satisfaction of certain conditions and during certain periods described in the Indenture, and thereafter, the Notes are exchangeable at any time until the close of business on the second scheduled trading day immediately preceding the maturity date. The Notes are exchangeable on the terms set forth in the Indenture into cash, shares of Class A common stock, or a combination thereof, at i3 LLC’s election.

The exchange rate is initially 24.4666 shares of Class A common stock per $1,000 principal amount of Notes (equivalent to an initial exchange price of approximately $40.87 per share of Class A common stock). The exchange rate is subject to adjustment in some circumstances as described in the Indenture. In addition, following certain corporate events that occur prior to the maturity date or i3 LLC’s delivery of a notice of redemption, i3 LLC will increase, in certain circumstances, the exchange rate for a holder who elects to exchange its Notes in connection with such a corporate event or notice of redemption, as the case may be. If i3 Inc. or i3 LLC undergoes a fundamental change (as defined in the Indenture), holders may require i3 LLC to repurchase for cash all or part of their Notes at a repurchase price equal to 100% of the principal amount of the Notes to be repurchased, plus accrued and unpaid interest to, but not including, the fundamental change repurchase date.

i3 LLC may not redeem the Notes prior to February 20, 2023. On or after February 20, 2023, and prior to the 47th scheduled trading day immediately preceding the maturity date, if the last reported sale price per share of Class A common stock has been at least 130% of the exchange price for the Notes for at least 20 trading days (whether or not consecutive), i3 LLC may redeem all or any portion of the Notes at a cash redemption price equal to 100% of the principal amount of the Notes to be redeemed plus accrued and unpaid interest on such note to, but not including, the redemption date.

The Notes are general senior unsecured obligations of i3 LLC and the guarantee is i3 Inc.’s senior unsecured obligation and rank senior in right of payment to all of i3 LLC’s and i3 Inc.’s future indebtedness that is expressly subordinated in right of payment to the Notes or the guarantee, as applicable. The Notes and the guarantee rank equally in right of payment with all of i3 LLC’s and i3 Inc.’s existing and future unsecured indebtedness that is not so expressly subordinated in the right of payment to the Notes or the guarantee, as applicable. The Notes and the guarantee are effectively subordinated to any of the Companies’ existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness (including obligations under the Credit Agreement). The Notes and the guarantee will be structurally subordinated to all indebtedness and other liabilities and obligations (including the debt and trade payables) of i3 Inc.’s subsidiaries, other than i3 LLC.

The Indenture provides for customary events of default, all as described in the Indenture.

The foregoing description of the Indenture and the Notes is qualified in its entirety by reference to the text of the Indenture and the form of the Notes, copies of which are filed as Exhibits 4.1 and 4.2 hereto and are incorporated herein by reference.

Registration Rights Agreement

On February 18, 2020, i3 LLC, i3 Inc. and BofA Securities, Inc., on behalf of the Initial Purchasers, entered into a registration rights agreement with respect to the Class A common stock deliverable upon exchange of the Notes (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, i3 Inc. has agreed that it will:

|

|

•

|

file a shelf registration statement to register the resale of the Class A common stock deliverable upon exchange of the Notes;

|

|

|

•

|

use commercially reasonable efforts to cause such shelf registration statement to become effective on or prior to the 365th day after the issue date of the Notes; and

|

|

|

•

|

use commercially reasonable efforts to keep the shelf registration statement continuously effective until the earlier of (i) the 20th trading day immediately following the maturity date of February 15, 2025 and (ii) the date on which there are no longer outstanding any Notes or “restricted” shares (within the meaning of Rule 144 under the Securities Act) of Class A common stock outstanding that have been issued upon exchange of any Notes.

|

During the continuance of certain registration defaults, additional interest will accrue on the Notes at a rate per annum equal to 0.25% of the principal amount of the Notes to, and including, the 90th day following such registration default, and 0.50% of the principal amount of the Notes from, and after, the 91st day following such registration default.

The foregoing description of the Registration Rights Agreement is qualified in its entirety by reference to the Registration Rights Agreement, a copy of which is filed as Exhibit 10.2 hereto and is incorporated herein by reference.

Exchangeable Note Hedge Transactions

On February 12, 2020, concurrently with the pricing of the Notes, and on February 13, 2020, concurrently with the exercise by the Initial Purchasers of their right to purchase additional Notes, i3 LLC entered into exchangeable note hedge transactions with respect to Class A common stock (the “Note Hedge Transactions”) with certain financial institutions (collectively, the “Counterparties”). The Note Hedge Transactions cover, subject to anti-dilution adjustments substantially similar to those applicable to the Notes, the same number of shares of Class A common stock that initially underlie the Notes in the aggregate and are exercisable upon exchange of the Notes. The Note Hedge Transactions are intended to reduce potential dilution to the Class A common stock upon any exchange of the Notes and/or offset any potential cash payments i3 LLC is required to make in excess of the principal amount of exchanged Notes, as the case may be, in the event that the market value per share of Class A common stock, as measured under the Note Hedge Transactions, at the time of exercise is greater than the strike price of the Note Hedge Transactions.

The Note Hedge Transactions will expire upon the maturity of the Notes, if not earlier exercised. The Note Hedge Transactions are separate transactions, entered into by i3 LLC with the Counterparties, and are not part of the terms of the Notes. Holders of the Notes will not have any rights with respect to the Note Hedge Transactions. i3 LLC used approximately $14.0 million of the net proceeds from the offering of the Notes (net of the premiums received for the warrant transactions described below) to pay the cost of the Note Hedge Transactions.

The foregoing description of the Note Hedge Transactions is qualified in its entirety by reference to the form of Exchangeable Note Hedge Transaction Confirmation, a copy of which is filed as Exhibit 10.3 hereto and incorporated herein by reference.

Warrants Transactions

On February 12, 2020, concurrently with the pricing of the Notes, and on February 13, 2020, concurrently with the exercise by the Initial Purchasers of their right to purchase additional Notes, i3 Inc. entered into warrant transactions to sell to the Counterparties warrants (the “Warrants”) to acquire, subject to customary adjustments, up to initially 3,376,391 shares of Class A common stock in the aggregate at an initial exercise price of $62.8800 per share.

i3 Inc. offered and sold the Warrants in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. If the market value per share of Class A common stock, as measured under the Warrants, at the time of exercise exceeds the strike price of the Warrants, the Warrants will have a dilutive effect on the shares of Class A common stock unless, subject to the terms of the Warrants, i3 Inc. elects to cash settle the Warrants. The Warrants will expire over a period beginning on May 15, 2025.

The Warrants are separate transactions, entered into by i3 Inc. with the Counterparties, and are not part of the terms of the Notes. Holders of the Notes will not have any rights with respect to the Warrants.

The foregoing description of the Warrants is qualified in its entirety by reference to the form of Warrant Transaction Confirmation, a copy of which is filed as Exhibit 10.4 hereto and incorporated herein by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information with respect to the Notes and the Indenture set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The information with respect to the Notes, the Indenture and the Warrants set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference. As described in Item 1.01 of this Current Report on Form 8-K, the Notes were sold to the Initial Purchasers in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. The Notes were then sold by the Initial Purchasers to qualified institutional buyers pursuant to Rule 144A under the Securities Act and the Warrants were sold in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act.

The Notes and the underlying Class A common stock deliverable upon exchange of the Notes, if any, have not been registered under the Securities Act, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

The Warrants and the underlying Class A common stock issuable upon exercise of the Warrants, if any, have not been registered under the Securities Act, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

4.1

|

|

|

Indenture, dated February 18, 2020, among i3 Verticals, LLC, i3 Verticals, Inc. as guarantor and U.S. Bank National Association

|

|

|

|

|

|

|

|

|

4.2

|

|

|

Form of 1.00% Exchangeable Senior Notes due 2025 (included in Exhibit 4.1)

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Second Amendment to the Amended and Restated Credit Agreement, dated as of May 9, 2019, by and among i3 Verticals, LLC, as the borrower, i3 Verticals, Inc. and certain Subsidiaries of i3 Verticals, Inc., as guarantors, the lenders party thereto, and Bank of America, N.A., as administrative agent for the lenders*

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Registration Rights Agreement, dated February 18, 2020, among i3 Verticals, Inc. and BofA Securities, Inc.

|

|

|

|

|

|

|

|

|

10.3

|

|

|

Form of Exchangeable Note Hedge Transaction Confirmation

|

|

|

|

|

|

|

|

|

10.4

|

|

|

Form of Warrant Transaction Confirmation

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the inline XBRL document).

|

|

*

|

Schedules and exhibits have been omitted pursuant to Item 601 of Regulation S-K. i3 Verticals, Inc. hereby undertakes to furnish supplementally a copy of any of the omitted schedules and exhibits upon request by the Securities and Exchange Commission.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 18, 2020

|

|

|

|

|

i3 Verticals, Inc.

|

|

|

|

|

|

By:

|

|

/s/ Clay Whitson

|

|

Name:

|

|

Clay Whitson

|

|

Title:

|

|

Chief Financial Officer

|

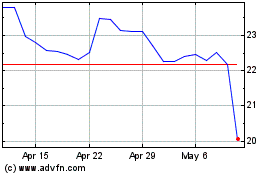

i3 Verticals (NASDAQ:IIIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

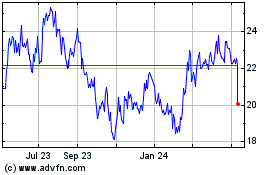

i3 Verticals (NASDAQ:IIIV)

Historical Stock Chart

From Apr 2023 to Apr 2024