Intesa Sanpaolo Makes EUR4.86 Billion Offer to Buy UBI Banca

February 17 2020 - 10:29PM

Dow Jones News

By P.R. Venkat

Intesa Sanpaolo S.p.A. has made an voluntary offer to acquire

Unione di Banche Italiane S.p.A., or UBI Banca, in a deal valued at

4.86 billion euros ($5.27 billion).

Under the proposed offer, UBI Banca shareholders will get 17

newly issued shares of Intesa Sanpaolo for every 10 UBI Banca

shares held, Intesa said in a statement.

The share offer values UBI stock at EUR4.254 apiece. UBI Banca

shares closed 5.5% higher at EUR3.49 on Monday, while Intesa shares

closed 1.3% higher at EUR2.54.

"The prospect of the financial and banking sector in the coming

years is characterized by a consolidation in which the main

operators will be champions both in Europe and outside Europe,"

Intesa said in a statement late Monday, adding that the combined

entity could generate consolidated profits higher than EUR6 billion

starting in 2022.

Intesa said the finalization of the transaction is expected to

take place by the end of this year and is subject to the receipt of

regulatory authorizations.

Once the deal is completed, Intesa plans to delist UBI Banca,

the fourth-largest banking group in Italy by number of branches,

with a market share of about 7%.

"The combined group will have over EUR1,100 billion in customer

financial assets with around three million UBI Banca customers, who

hold around EUR200 billion in financial assets," according to the

statement.

Intesa Sanpaolo is one of the top banking groups in Europe with

a market capitalization of EUR44.43 billion. The Italian bank

provides retail, corporate and wealth management services with a

network of about 3,800 branches. It has a market share of 12% in

most Italian regions, according to its website.

Write to P.R. Venkat at venkat.pr@wsj.com

(END) Dow Jones Newswires

February 17, 2020 22:14 ET (03:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

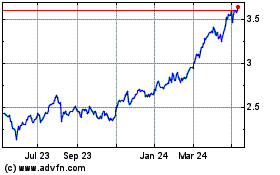

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Apr 2024

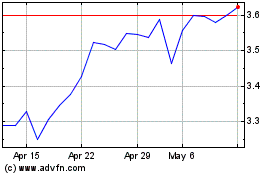

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2023 to Apr 2024